🎣 RFX and R&R Express Sued

Plus: ELP enforcement isn’t sticking, Amazon eyes LTL, FMCSA warns of phishing scam

Plus: U.S.–EU agree to lower tariffs (but Europe’s not thrilled), brokers brace for the biggest AI wave, and Congress sets the stage for fully driverless trucks.

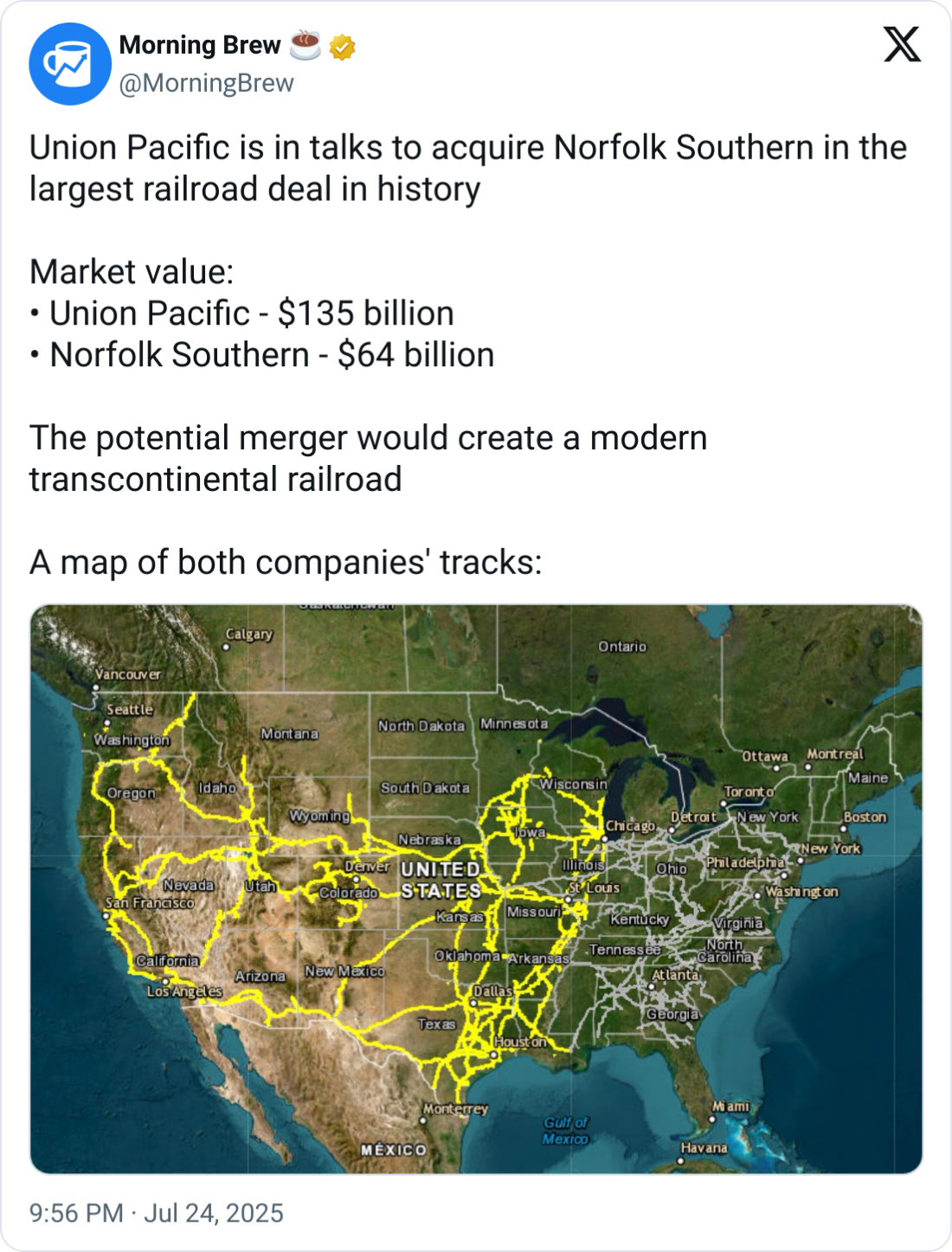

Happy Monday. A $200B rail mega-merger could redraw the freight map. Even if you don’t touch intermodal, the UP–NS deal might shift rates, lanes, and broker leverage.

Plus,

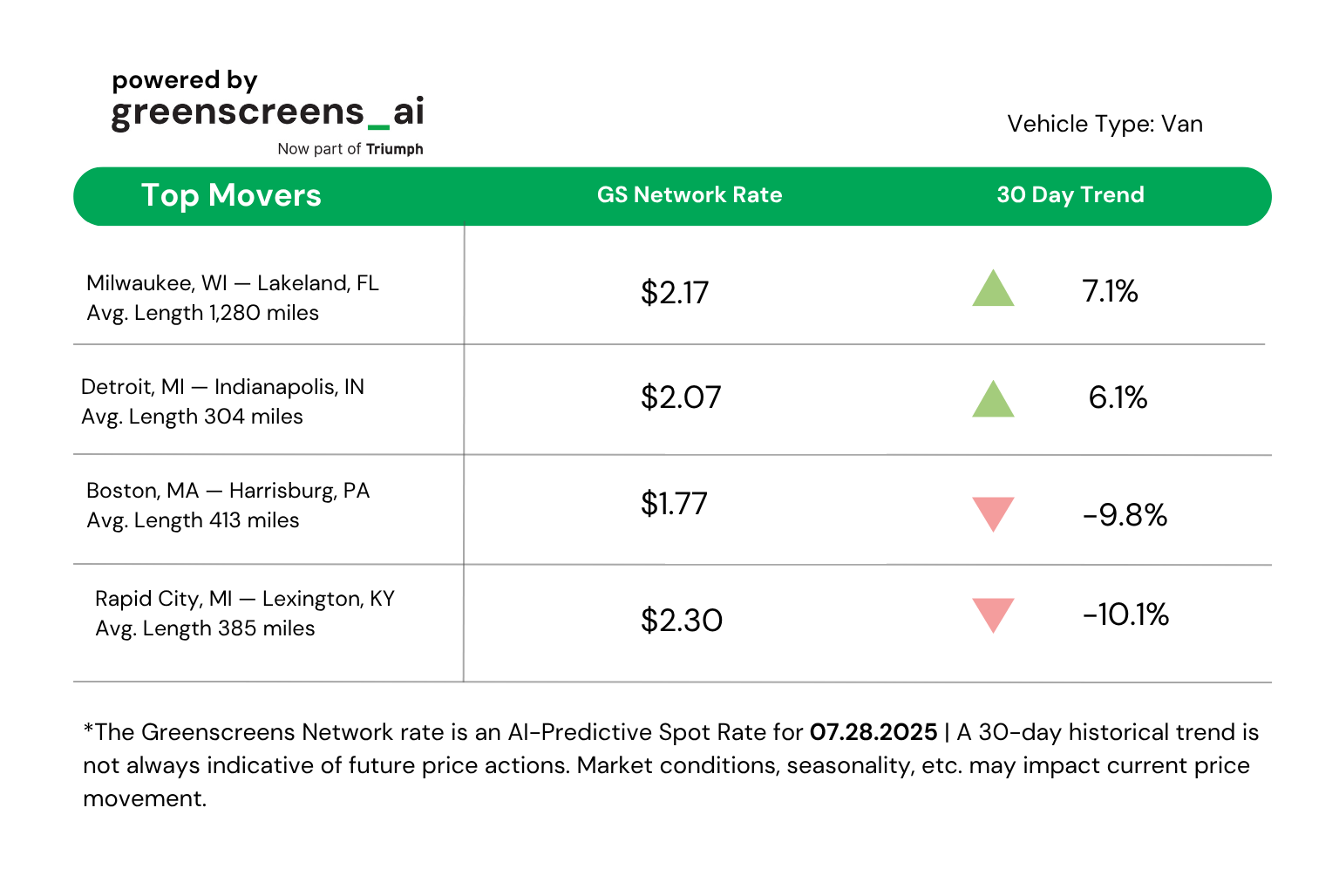

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

🍳 WHAT’S COOKIN’ IN FREIGHT

🌍 U.S. and EU Agree to 15% Tariff Deal, European Leaders Warn of Heavy Costs. The U.S. and European Union reached a deal imposing 15% tariffs on most EU goods, averting a threatened 30% hike. European officials, however, called the agreement “unbalanced,” with Germany’s BDI federation warning of “considerable negative repercussions” for exporters. Cars, pharmaceuticals, and semiconductors face steep new costs, while steel and aluminum remain at 50% tariffs. “It will bring stability. It will bring predictability,” said EU Commission President Ursula von der Leyen, though she admitted, “15% is not to be underestimated.” Economists warn the U.S. gains disproportionately, leaving Europe to absorb the majority of the immediate economic pain.

📊 Tech Reshapes Brokerage: Automation and AI Drive the Future. Freight brokerage is undergoing a technology-driven transformation, according to an analysis by Mindy Long in Transport Topics. Brokers are rapidly adopting automation, AI, and predictive analytics to stay competitive. “Technology in brokerage is and will remain an accelerator,” said Ryan Schreiber of Metafora. Executives from AVRL, Transfix, and Flock Freight emphasized that data-driven decision-making is now critical, with some likening it to “quant trading in a hedge fund.” Industry leaders are stressing that future brokers will be leaner, smarter, and more analytical, with soft skills like critical thinking overtaking traditional load-booking speed as key to long-term success.

🏛 America Drives Act Could Fast-Track Driverless Trucks Nationwide. Congress introduced the America Drives Act, a bill creating a national framework for autonomous trucks. Sponsored by Rep. Vince Fong, the bill would exempt trucks with Level 4 or Level 5 self-driving systems (meaning they can operate without human input) from hours-of-service and drug testing rules, while placing them under DOT oversight by 2027. “This bill would help the United States win the AI race by creating clear, safety‑focused rules for the deployment of autonomous trucks … and end this regulatory fragmentation,” Fong said. Industry leaders, including Aurora’s Gerardo Interiano, say the measure is vital for U.S. competitiveness. Analysts say wide adoption remains 10–15 years away, but regulatory groundwork is advancing.

TrueNorth is The First AI Loadboard built to protect brokers.

As soon as you post your loads, our AI assistant—Loadie—automatically matches those loads to qualified carriers that meet your standards. We then connect you to those carriers that want to haul your freight.

Stop cold calls. Limit fraud risk. Get better carrier relationships, booked faster.

If Union Pacific and Norfolk Southern merge (a $200+ billion deal currently in advanced talks), it would create the first coast-to-coast Class I railroad in U.S. history.

That means fewer interchanges, potentially smoother long-hauls, and a brand-new map for brokers to navigate.

Last week, Bloomberg and Reuters reported that Union Pacific and Norfolk Southern are in advanced talks to merge, with a deal possibly announced as soon as this week.

According to FreightWaves, the combined entity would gain coast-to-coast reach, connecting the West Coast ports of Los Angeles and Oakland to the East Coast hubs of Norfolk and New York.

The Surface Transportation Board (STB), which must approve the merger, is currently short one board member and under legal fire after a Supreme Court decision weakened its rulemaking power. That opens the door for more White House involvement or complete derailment.

Right now, UP and NS compete directly or indirectly through shared interchanges in Chicago, Memphis, Kansas City, and other critical hubs. That competition helps keep intermodal rates reasonable, especially for brokers stitching together capacity on coast-to-coast lanes.

If the merger goes through? That tension disappears. With one transcontinental railroad, brokers lose a key source of leverage.

“Merging the companies could recapture market share from trucking and potentially reinvigorate a subsector that has faced stagnant or declining volumes,” said Stephanie Moore, an analyst at Jefferies.

Large shippers and asset-based players are more likely to secure volume guarantees and high-priority contracts with the merged rail giant. Meanwhile, brokers could get pushed further down the priority list, making service quality less predictable.

This merger, if approved, will redraw the freight map. Like any shake-up, there will be winners and losers. Here's what brokers should be doing now.

Even if you’re not brokering containers out of LA or tracking STB filings, this merger will still touch your business. It may reshape the TL/LTL mix, shift spot rates, and open new doors.

You’re in control of your back-office with Epay Manager.

For over 20 years, Epay has provided best-in-class automation, invoicing, and payments solutions to freight brokerages.

🌎 AROUND THE FREIGHT WEB

🌊 Flash Flood. A truck driver attempted to reverse out of a flooded frontage road near Vado, NM, on July 23. When rising water proved too strong, the current dragged the truck with its flow. Flash flooding has hit the area multiple times this month.

📈 Bullish Tractor Sales. Ryder’s Q2 used vehicle report shows tractor prices rose 3% sequentially (10% in retail sales), even as overall used truck prices fell 10% from Q1. The uptick signals strength in the corner tractor market amid stabilizing supply.

⚡ Nevoya Invests in AI Trucks. Startup Nevoya announced a $9.3 million investment to develop AI-powered electric trucks, aiming to show that zero-emissions trucking can outperform diesel operations environmentally and economically.

🎤 Duffy Speaks with Truckers. Transportation Secretary Sean Duffy spoke directly with truck drivers in order to learn more about the challenges they face everyday. “The best ideas don’t come from Washington, they come from the men and women who do the work and make this country great!” Duffy said on X.

🥶 Miami’s Cold Chain Hub. Miami is cementing itself as a key gateway for perishables with a $141 million cold storage and phytosanitary facility at Miami International Airport. The public-private project with PortMiami will expand handling capacity for fresh produce, seafood, and flowers along the East Coast.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).