🎣 Honey, Hold My Beer

Here are the Top 500 fleets of 2026. Plus: Sierra snow shuts down I-80, rail targets truckload freight, and ocean rates fall.

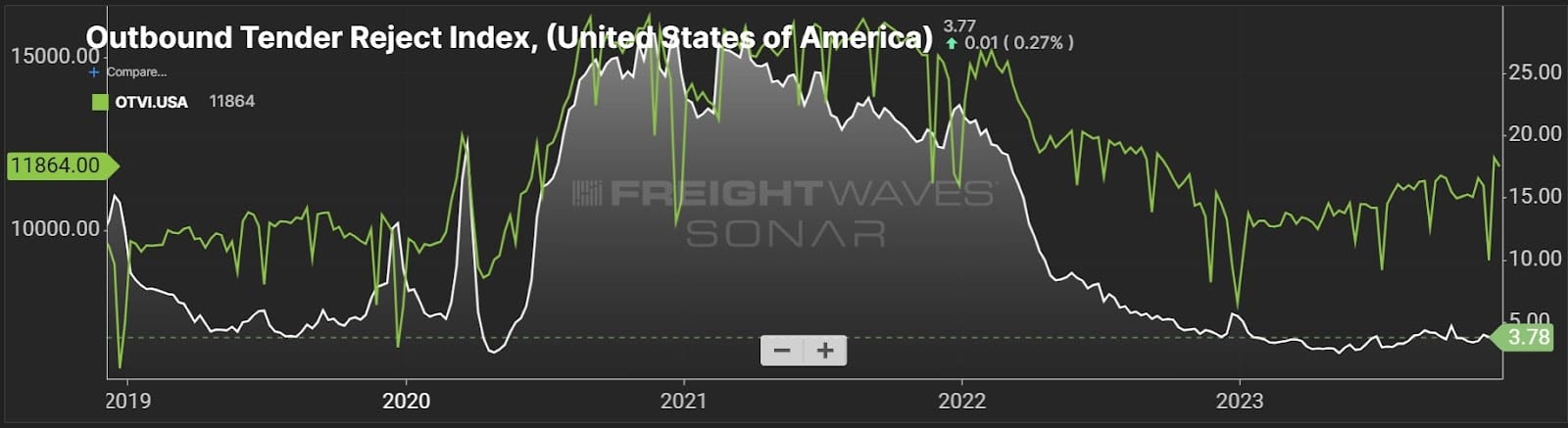

Josh Bouk from TriumphPay forecasts a later freight market rebound by December 2024.

A Different Outlook

Josh Bouk, TriumphPay’s chief partnership officer, offers a unique perspective on the freight market's future. Unlike others predicting a recovery in mid-2024, he anticipates it won't be until December 2024. His viewpoint is grounded in the company's extensive involvement in logistics transactions, amounting to nearly $50 billion annually.

Despite increased retail sales, 2023's market hasn't seen the expected rate rise. Brokers are advised to focus on profitability, with TriumphPay playing a key part in streamlining invoice settlements and fraud prevention.

Bouk notes the recent spike in online spending and its uncertain impact on the trucking sector. For brokers, the next year is crucial for maintaining business efficiency and managing costs effectively.

The company is preparing to unveil new partnerships that promise greater industry insight.

Source: FreightWaves

The majority of respondents to our survey believe that the freight market will rebound in the second half of 2024. What's your take? pic.twitter.com/727pyS4LRq

— Man, I Love Freight 🚛 (@freightcaviar) November 20, 2023

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).