🎣 C.H. Robinson

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

Plus: Three USDOTs, one apartment draws scrutiny, cargo theft tops $6.6B, lumber and furniture tariffs bite, and more in today’s newsletter.

Good Monday morning. U.S. imports fell 8.4% in September, and small carriers keep dropping out. Learn what it means for capacity in today's feature.

Plus:

🚨 Danielle Chaffin Flags Arizona “New Wave” Freight Setup. Industry researcher Danielle Chaffin shared a post on X cautioning carriers to “be cautious of the freight broker ‘New Wave Global Logistics.’” According to Chaffin’s review of FMCSA data, an Arizona resident, Skyler Pearson, registered three new USDOT authorities on September 8: two trucking companies and a brokerage, all linked to the same residential address. The entities include New Wave Global Logistics, New Wave Global Trucking LLC, and New Wave International Trucking LLC, each listing one truck. Chaffin also noted that court records from 2022 show Pearson faced criminal charges in Las Vegas related to an unrelated medical spa business.

📦 ATRI: Cargo Theft Costs $6.6 Billion a Year, Many Losses Never Reported. A new ATRI report finds U.S. cargo theft costs exceed $6.6 billion a year, or about $18 million daily, with 74% of stolen goods never recovered. The study revealed that over 40% of motor carriers don’t report thefts due to high deductibles and fear of premium hikes. “Unfortunately, we’ve reached a point where cargo theft has become a standard cost of doing business. Something must be done to stop these costly crimes,” said Ben Banks, president of TCW Inc. ATRI recommends stronger state laws, better theft reporting, and creating a national database to coordinate law enforcement and industry response.

📊 Tariffs Hit Lumber, Furniture Imports. Michigan State professor Jason Miller highlighted new Section 232 import duties on timber, lumber, and furniture products, noting lumber tops the list with nearly $4 billion in 2024 imports affected. Canada and Vietnam face the biggest impact, tied to lumber and upholstered furniture tariffs. Miller says these duties make it unlikely production will shift back to the U.S., as financing and competitiveness risks remain too high. The result: reduced product variety, higher consumer costs, and weaker downstream freight demand in sectors moving lumber, furniture, and cabinetry.

Rapido is a top nearshore staffing company providing logistics and supply chain talent to companies in the United States. Based in Guadalajara, Mexico, Rapido offers a unique combination of cost savings and access to a skilled workforce, making it an attractive option for American logistics businesses.

See what makes nearshoring to Mexico an attractive option for scaling a logistics company and how partnering with Rapido Solutions Group simplifies the whole process.

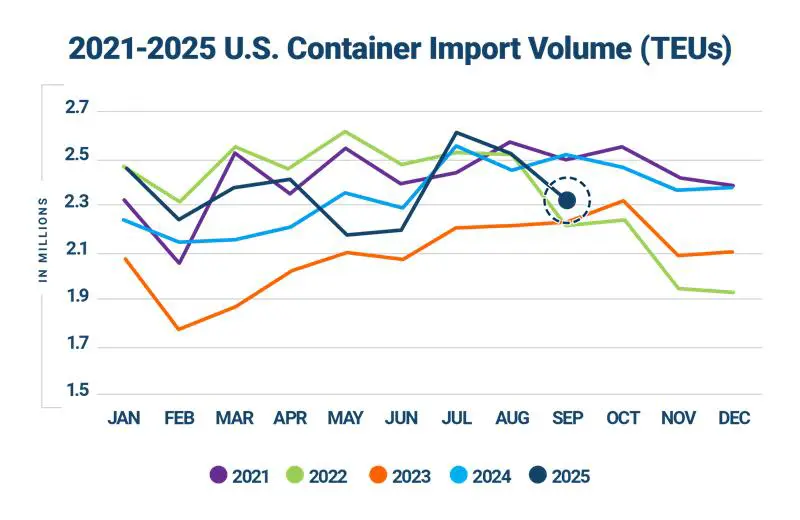

New data from Descartes Systems Group shows U.S. container imports fell 8.4% year-over-year in September to 2.3 million TEUs, the steepest drop of 2025.

Imports from China fell even harder, down 12.3% MoM and 22.9% YoY, as trade tensions, a prolonged federal shutdown, and upcoming tariff deadlines rattled importers.

The 90-day tariff truce between the U.S. and China expires on November 10, adding more uncertainty to Q4 planning.

Ports including Long Beach, Savannah, and New York/New Jersey saw double-digit declines, while Tacoma was the only major gateway to record a small increase.

Despite the fall, total import volume for 2025 remains 1.9% higher year-to-date, a reminder that freight isn’t collapsing, just recalibrating.

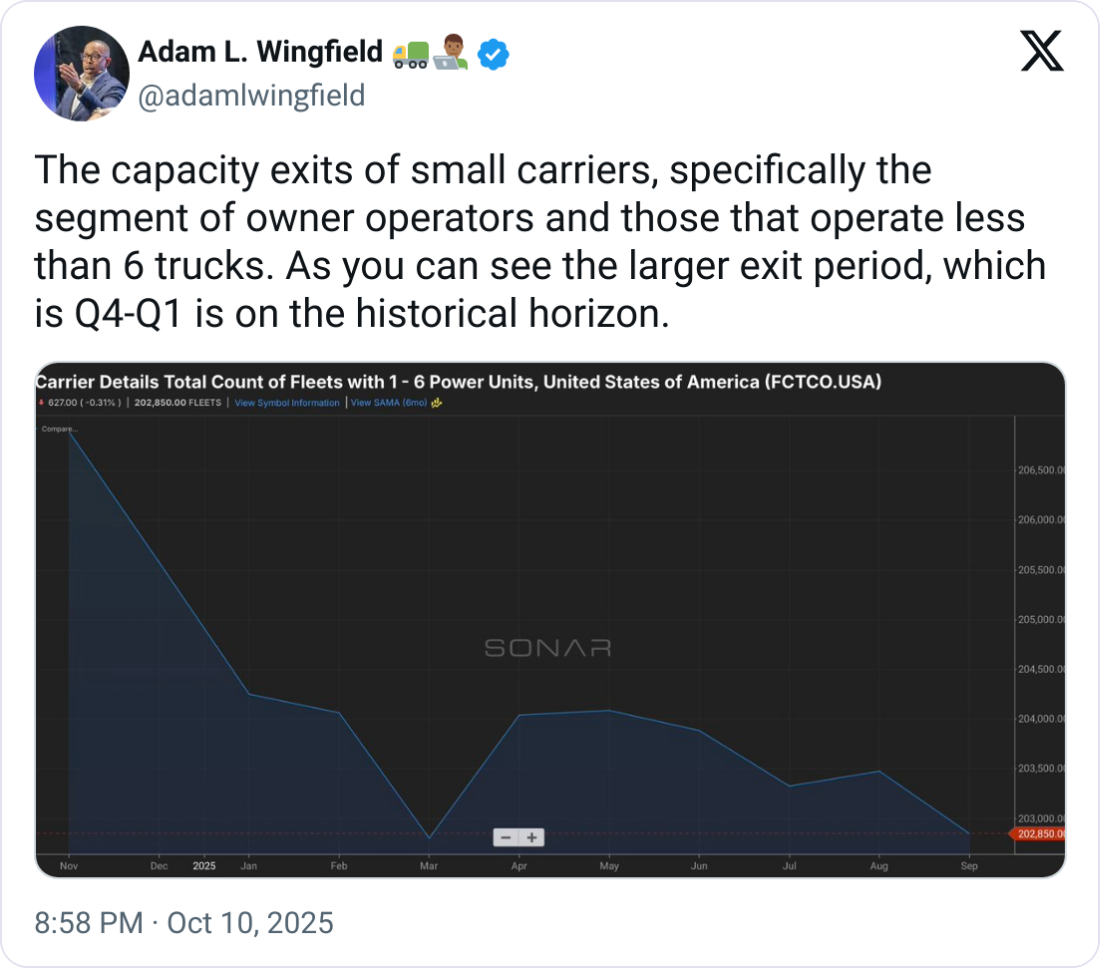

According to a recent TruckingDive analysis of FMCSA operating authority data, in Q3 2025, exits (revocations) outpaced new grants and reinstatements.

What’s happening: small and marginal carriers are bleeding out. In a market where spot might be firming, fewer players mean less buffer.

Combine the two trends and you get a freight market that looks deceptively quiet but is slowly constricting.

We’ve seen this movie before: soft rates for months, then sudden bursts of volatility that catch shippers off guard.

The Convoy Platform connects brokers with trusted carriers to effortlessly match and execute freight, eliminating wasted calls and boosting productivity.

You set the strategy that's right for your business—from pricing to carrier selection—while our automated marketplace covers vetting, tracking, document management, payouts and more, freeing up your team to focus on growing your business and delivering top-tier customer service.

🏁 C.H. Robinson NASCAR Debut. A C.H. Robinson–branded car hit the NASCAR track in Las Vegas, marking the brokerage’s latest brand partnership. The driver, Blane Perkins, placed 27 in the race on Saturday night.

😔 Uber Freight Cuts Jobs. Uber Freight announced job cuts as part of a broader commercial reorganization, streamlining its digital brokerage and enterprise sales teams amid continued margin pressure and shifting freight demand.

💊 Cocaine Seized. CBP officers at the World Trade Bridge in Laredo found $4.4 million in cocaine concealed in a tractor-trailer on October 1. The drugs were hidden within the trailer’s structural beams, and the driver was detained.

🚓 Commercial Dragnets Expand. State and federal agencies are ramping up commercial vehicle dragnets targeting unsafe carriers, fake CDLs, and ELD violations. Officials say the coordinated sweeps are designed to remove high-risk operators from U.S. highways.

🧾 Ontario Blitz Results. Ontario inspectors checked over 500 trucks, placing 31% out of service during the two-day blitz (Oct 7 and 8). Violations included faulty brakes, worn tires, and driver log falsifications.

🎣THE FREIGHT CAVIAR CORNER

This Friday (Oct. 17) at 8AM CST, we’re hosting the Ultimate Freight Meme Competition, powered by Epay Manager. Eight contestants, three judges, one winner — all bracket style. Each matchup gets a random meme template and just 60 seconds to create a freight meme before the judges decide who advances.

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).