🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

Despite a surge in U.S. spending, trucking firms face shutdowns. Can the industry recover from this paradox?

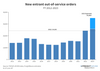

Despite a 4.9% Q3 economic boost in 2023, U.S. truckers struggle. 35,000 new trucking firms closed their doors by Sept. 30.

Matthew James Collins, an Ohio trucker, mirrors the trucking plight. A year ago, he hauled goods for four corporates. Now, only two clients remain. So, what's happening?

What's Driving the Trucking Meltdown?

The Road Ahead

Many believe the only way forward is a significant downsizing in trucking authorities. The current demand can't match the 2021 shopping spree, possibly a once-in-a-lifetime event.

Source: FreightWaves

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).