🎣 RFX and R&R Express Sued

Plus: ELP enforcement isn’t sticking, Amazon eyes LTL, FMCSA warns of phishing scam

DOT Blitz Week is here. We break down inspection data, rate impacts, and why the market feels unusually quiet.

Happy Tuesday!

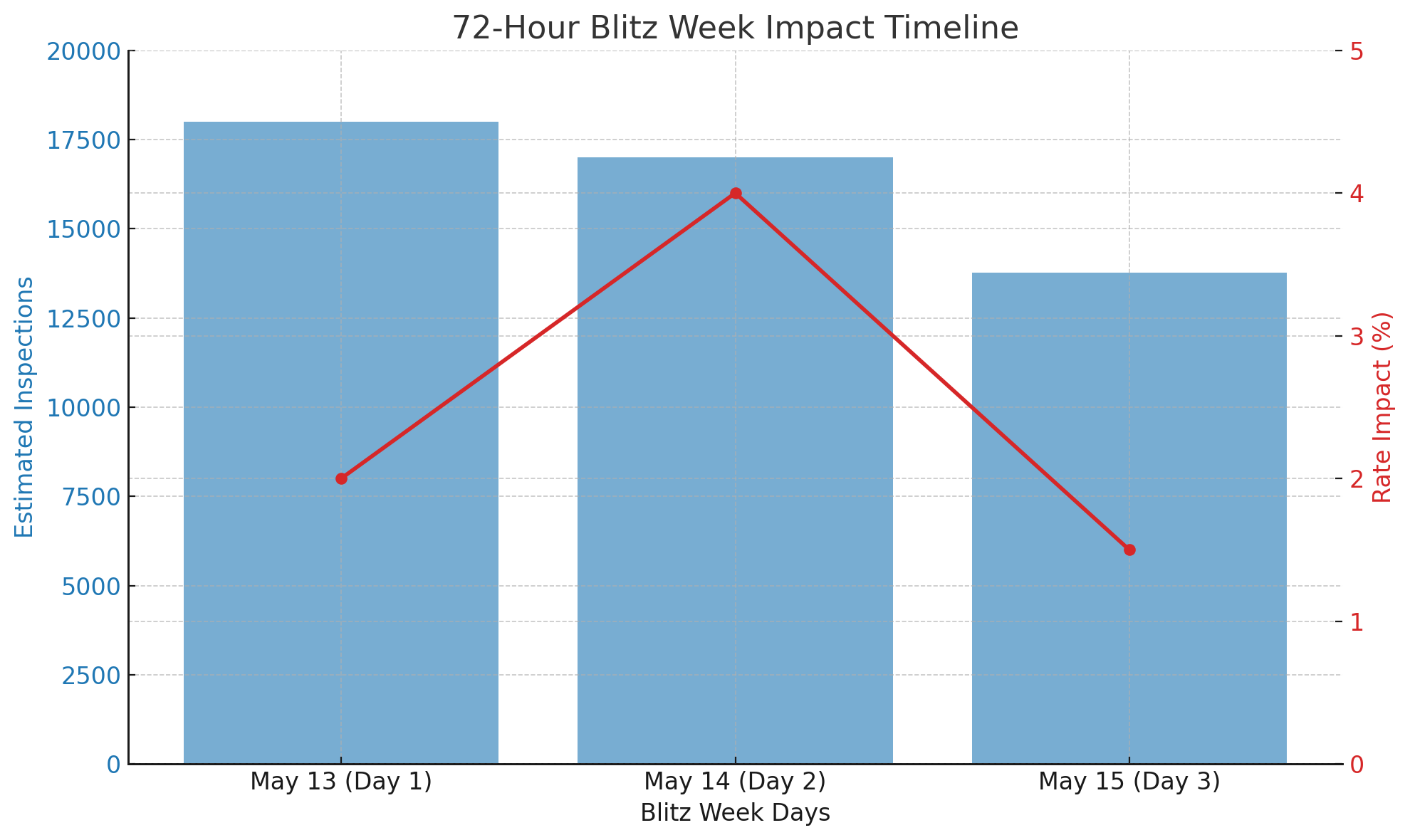

It’s officially DOT Blitz Week—CVSA’s annual 72-hour truck inspection event running from May 13–15 across the U.S., Canada, and Mexico. And while drivers may brace for long waits and roadside checks, the big question for brokers and shippers is: Will it impact freight?

The short answer? Not as much as you might think.

CVSA’s International Roadcheck means thousands of Level I inspections will take place over three days. This year, the focus is on:

Vehicles or drivers with violations may be placed out of service, which has historically prompted some drivers to take time off to avoid the hassle.

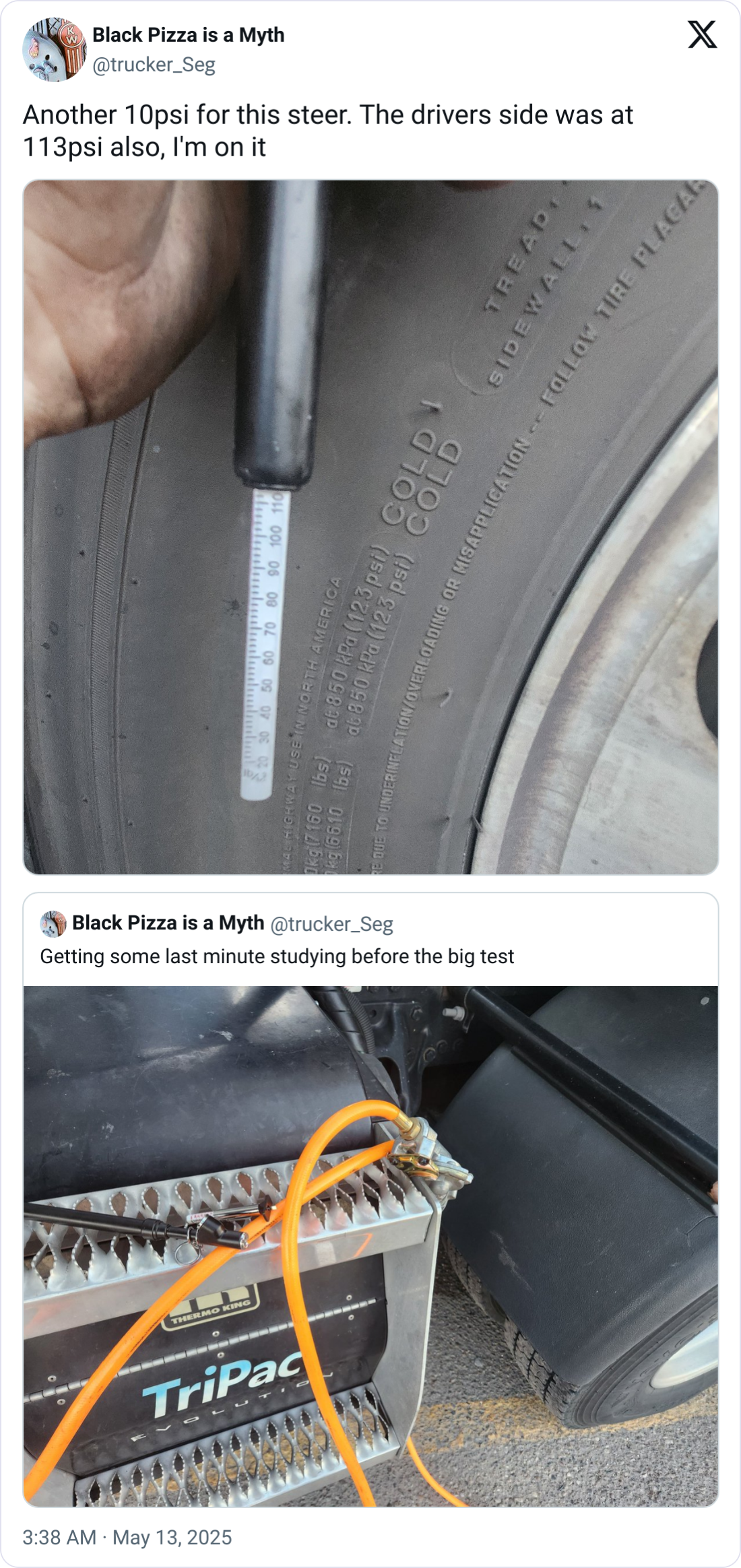

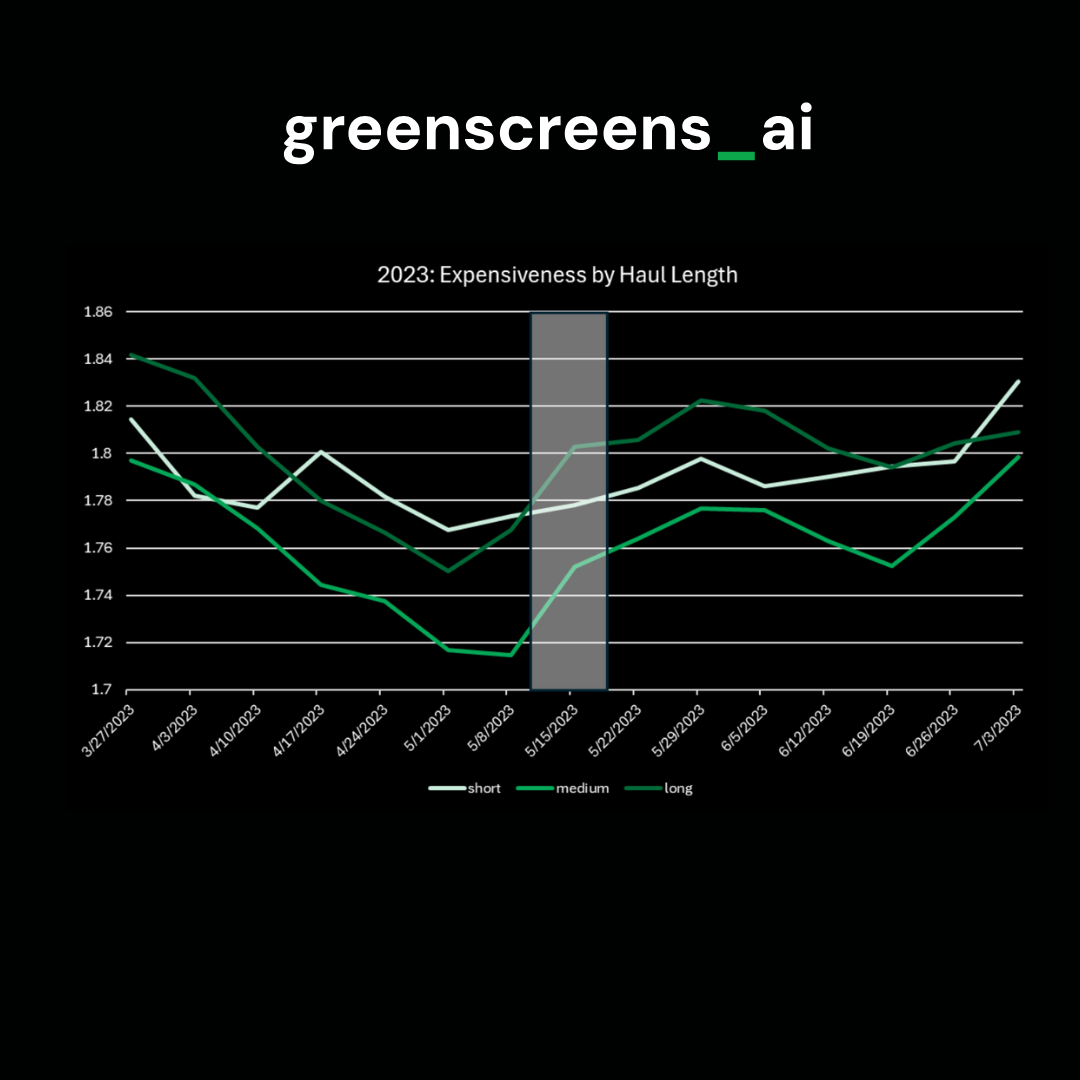

Greenscreens.ai analyzed four years of blitz-week data. Here’s what they found:

"The impact is real—but not dramatic," their team summarized.

This year’s blitz is hitting during one of the softest freight springs in recent memory.

With rates already below 5-year averages, many compliant carriers say they’ll stay on the road, DOT week or not.

There's little incentive to sit out this year. The real shift will come if volumes drop in advance or spike right after.

According to FreightWaves’ Thomas Wasson, dry van and flatbed spot rates actually declined last week:

That’s a pretty muted reaction heading into what’s typically a volatile week.

Take control, centralize your claims process for:

✅ Faster resolutions

✅ Automated tracking & updates

✅ Simplified carrier communication

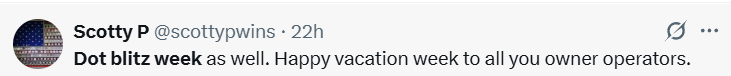

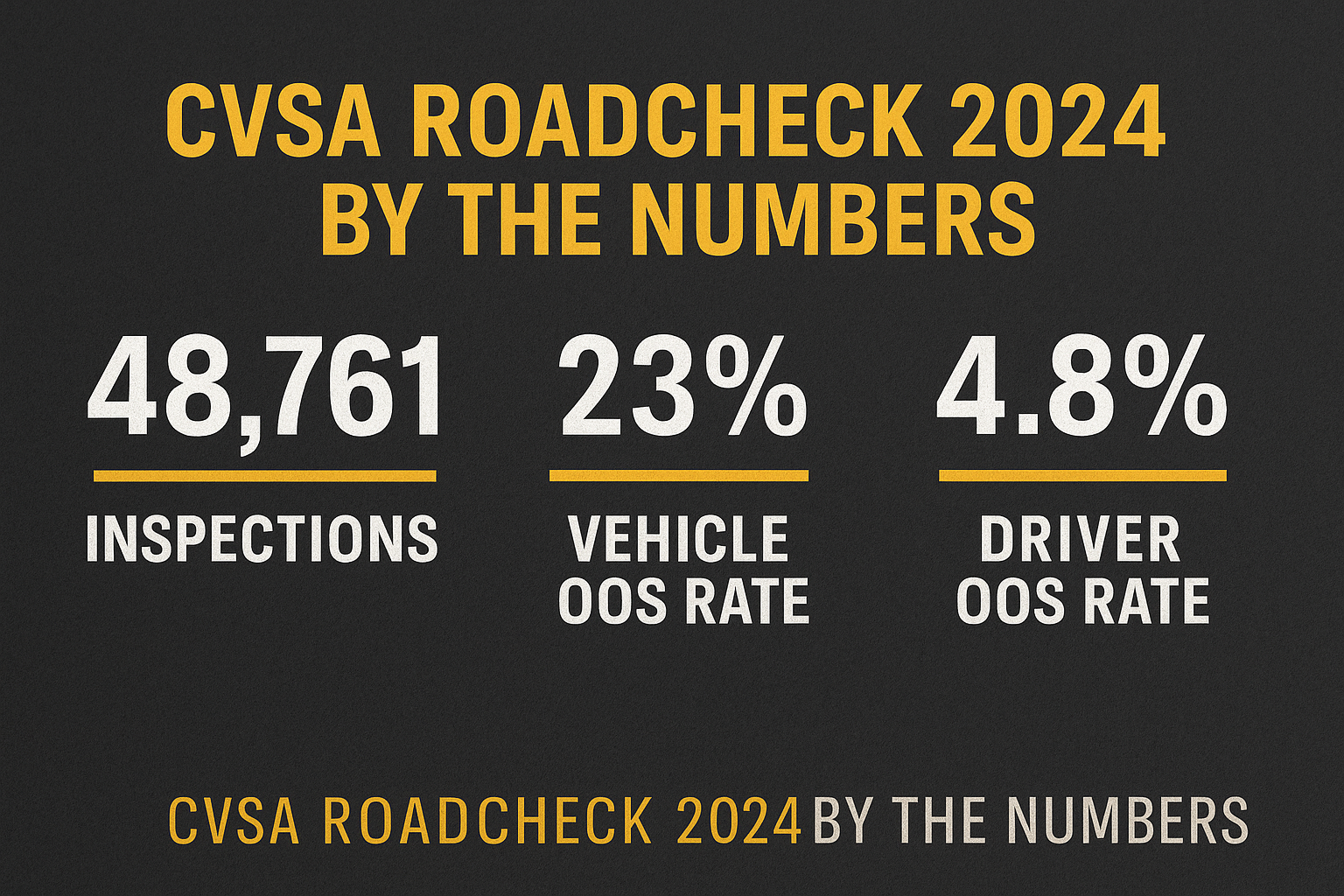

The 2024 International Roadcheck saw 48,761 inspections across North America.

While the majority of vehicles and drivers were in compliance, the vehicle out-of-service rate stood at 23%, and 4.8% of drivers were also placed out of service.

Top Violations:

The U.S. alone accounted for over 42,000 inspections, with nearly 8,000 trucks and 2,151 drivers sidelined. Brakes and HOS violations dominated the charts.

These figures matter because every truck pulled off the road tightens capacity, even if only temporarily. As Greenscreens.ai’s historical data shows, spot rates typically climb by 4-5% during Blitz Week, with freight volume taking a short-term hit of up to 5.6% in years past.

Blitz Week won’t flip the freight market, but it will jostle it.

Expect:

But with rates already bottomed out in many markets, even a brief squeeze could offer a much-needed margin lift for brokers, if they’re quick to act.

For over 20 years, Epay has provided best-in-class automation, invoicing, and payments solutions to freight brokerages.

🎣 THE FREIGHTCAVIAR PODCAST

Mexico is becoming the epicenter of a nearshoring revolution — and Roberto Icaza was years ahead of the curve. In this episode, he shares how he helped build a logistics powerhouse in Guadalajara, why U.S. companies are rushing south, and what it really takes to scale across borders. Check it out on YouTube, Spotify, or Apple Podcasts.

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).