🎣 C.H. Robinson

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

Plus: U.S. imports slow as tariffs bite, Mexico slaps 50% tariffs on Chinese goods, UP–NS defend their $85B merger amidst rival alliances, and more.

TGIF. That viral “ghost truck”? It’s real. China’s cabless Zelos delivery trucks are already running city freight. We break down the China vs. U.S. race on driverless trucks.

Plus,

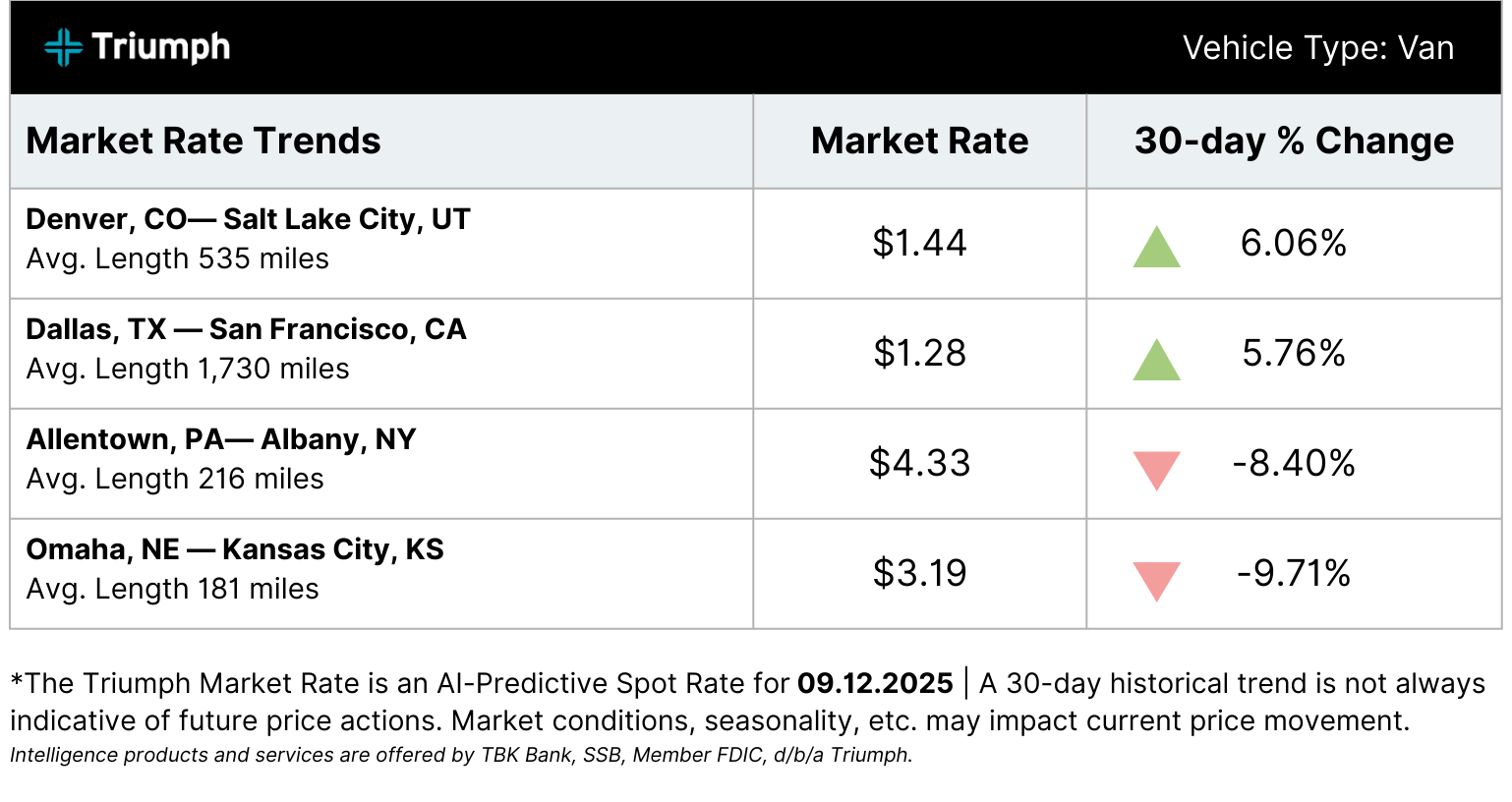

TOP LANE MOVERS POWERED BY TRIUMPH

📦 U.S. Peak Season Imports Falter Amid Tariffs and Early Frontloading. The U.S. peak shipping season has weakened, with container imports from China falling 27% year-over-year for three weeks straight, according to Vizion. Typically running through October, this year’s season peaked in July as retailers frontloaded cargo to avoid tariffs. The Port of Los Angeles set records in July, but blank sailings now dominate schedules. “Normally, we would expect a peak starting … ahead of Golden Week. So far, there are no clear signs,” said Dimerco’s Catherine Chien. With inventories already built, rates rising, and carriers cutting routes, NRF projects import declines through year-end, underscoring tariff-driven volatility in U.S. trade flows.

🇲🇽 Mexico to Impose 50% Tariffs on Chinese Imports. Mexico plans tariffs of up to 50% on Chinese cars, auto parts, steel, and textiles to shield domestic producers. Economy Minister Marcelo Ebrard said the measures “protect jobs” as Chinese auto imports surged 25% in early 2025. President Claudia Sheinbaum framed the plan as a national strategy, while Beijing accused Mexico of yielding to U.S. pressure. Less than 9% of imports are affected, but the policy also extends to South Korea, India, and Turkey to prevent transshipment. Logistics providers are adapting: C.H. Robinson launched a cross-border freight consolidation program in Laredo to cut costs by 40%. The move highlights Mexico’s growing role as both a manufacturing hub and a tariff buffer in North America’s trade realignment.

🚂 UP and NS Defend $85 Billion Merger as Rivals Build Alliances. Union Pacific and Norfolk Southern executives are pitching their proposed $85 billion merger as essential, even as rivals unveil coast-to-coast alliances. BNSF and CSX announced joint intermodal services, while CSX and Canadian National launched a Canada-to-Tennessee interline route. UP CEO Jim Vena argued alliances collapse under strain, saying, “Bottom line is this: A cooperation agreement is completely different than a consolidation.” NS CFO Mark George likened the merger to the Interstate Highway System, calling it transformative. The 4,000-page merger application heads to the Surface Transportation Board after Oct. 29, with executives citing positive feedback from shippers, labor, and the Trump administration.

FleetWorks is a AI agent for managing your carrier network.

Fred and Felice talk to carriers over phone, email, and text. They can:

FleetWorks frees broker time to help your customers and carriers with their toughest problems.

A viral video of a box truck in China with no cab, no steering wheel, and no driver has been bouncing around social media this week. Some claim it has to be AI, but it's actually real.

It's the Zelos line of autonomous, cabless delivery trucks from Juishi Intelligent Technology now being sold for urban freight. They are marketed at ¥39,800–¥89,800 (about $5,500–$12,000 USD) with a subscription for “full self-driving.” They're designed for short-haul moves from distribution centers to neighborhood stations, supermarkets, hospitals, and universities.

China’s freight autonomy push is moving on two fronts:

While public trust in 40-ton semis without drivers will take time, last-mile and suburban freight are already shifting.

“Global autonomous heavy-duty trucking could reach $616 billion by 2035, with China leading more than half that growth.”

On the other side of the Pacific, autonomy is still cab-first:

The U.S. approach is slower, regulation-heavy, and highway-focused. China, meanwhile, is commercializing cabless urban AV fleets today.

There is no coherent federal law yet that explicitly permits commercial autonomous vehicles (Level 4/5) to operate without onboard drivers in all states.

Regulations are a patchwork: 35 states allow some form of autonomous-truck testing or limited deployment, but rules vary widely.

One of the most significant legislative pushes is the AMERICA DRIVES Act: it sets out a federal framework to update FMCSA rules by 2027, and it would exempt autonomous trucks from many human-centric requirements, things like hours-of-service rules, drug testing, and even some CDL/driver-occupant requirements for trucks equipped with Automated Driving Systems.

Regulatory inertia and safety-law legacy rules still bind AV trucking.

For example, existing regulations from decades ago (such as the requirement that a stopped tractor-trailer must place reflective triangles or flares on the road shoulder) have been challenged in court by companies like Aurora, arguing they no longer make sense with modern technology.

Shippers are watching. They want to know which 3PLs are actually making the critical tech investments that will keep their freight safe.

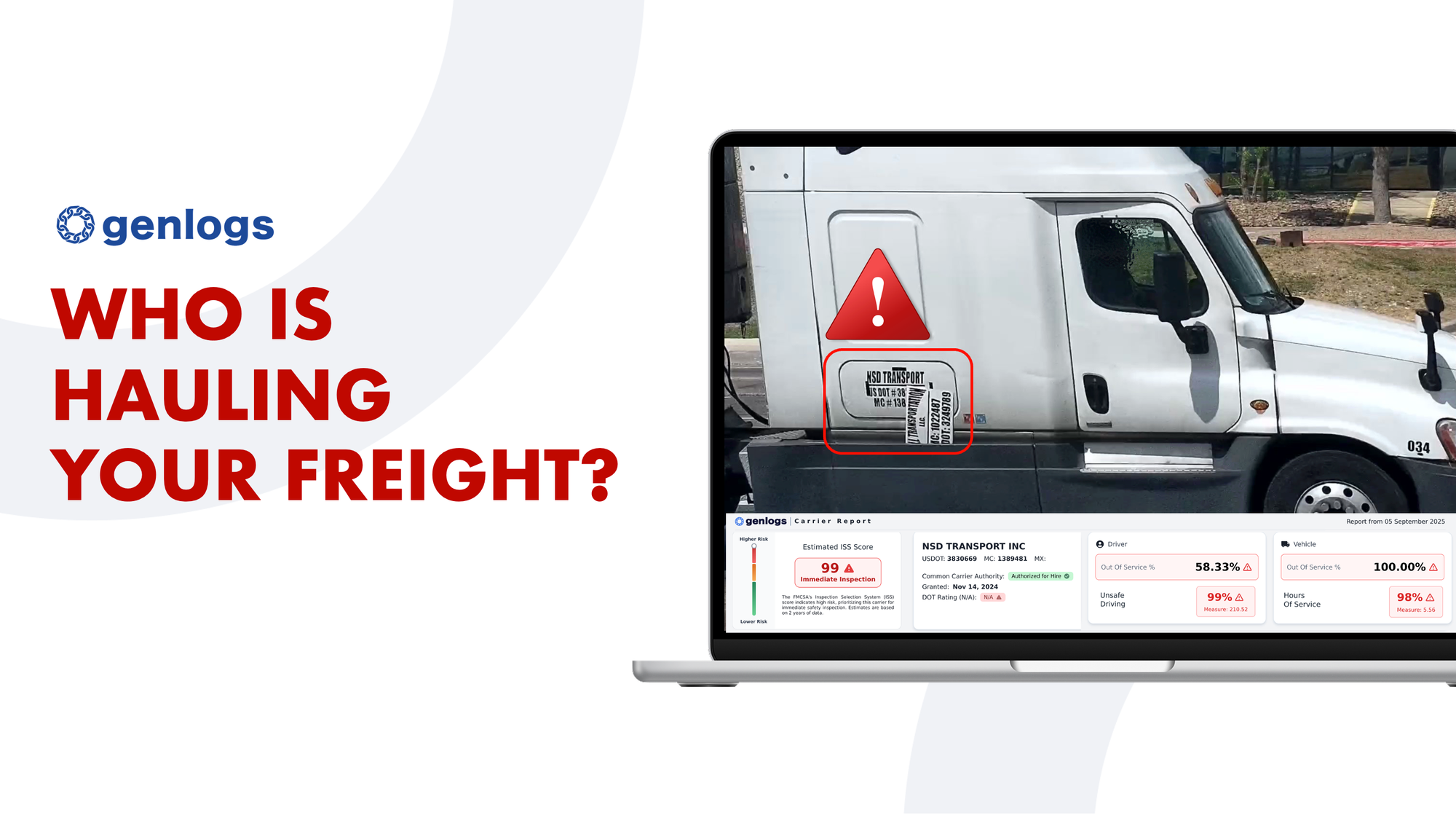

GenLogs is the only platform that offers full visibility and compliance with a nationwide network of cameras that capture all truck traffic and patterns. Brokers using GenLogs have cut theft to near zero* and increased both customer acquisition and satisfaction.

at

⚠️ Gas Tanker Disaster. A fuel tanker crash in Mexico City triggered a fiery explosion that killed 8 and injured around 90 as of latest reports. The blast leveled homes and cars, underscoring fragile hazmat safety.

🚔 NY Trucking Raid. FBI and IRS agents arrested Kingsley McDonald, owner of McDonald Logistics, after seizing drugs and assault rifles during a raid at four different locations.

🤝 Tive-AstraZeneca Partnership. Krenar Komoni, CEO of Tive, announced a partnership with AstraZeneca to equip FluMist® Home, the first at-home flu vaccine service, with Tive Tag sensors. Each shipment will verify proper temperature control for the 2025–2026 flu season.

📊 FMCSA Crash Study. FMCSA announced plans for a new Large Truck Crash Causation Study, the first since 2003, aiming to analyze factors behind fatal crashes and shape future safety regulations.

🐄 Livestock Hauling Bill. A new House bill seeks stricter standards for hauling livestock, addressing animal welfare and safety. Proposals include maximum driving hours, ventilation requirements, and enhanced oversight of haulers.

🛡️ Werner Uses AI. Werner Enterprises deployed AI-driven monitoring tools to detect cargo theft risks, analyzing route data and theft hot spots to help protect high-value shipments across its national network.

⚖️ NFI Settlement. NFI has agreed to pay $5.75 million to settle a New Jersey misclassification case. Hundreds of port truck drivers claimed they were wrongly treated as contractors instead of employees.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).