🎣 Reading Between the Lines

Plus: UPS to cut 30,000 jobs, ATA pushes to extend under-21 driver program, and cargo thieves targeted bigger paydays in 2025.

FedEx earnings take a tariff hit, CVSA wants trackers on trucks, a fresh cyberattack puts Estes in the spotlight, and more.

Happy Friday. We're checking back into Trump's tariffs ahead of the July 9 deadline. Today's feature takes a look at the layoffs, court fights, and warning signs from global markets.

Plus:

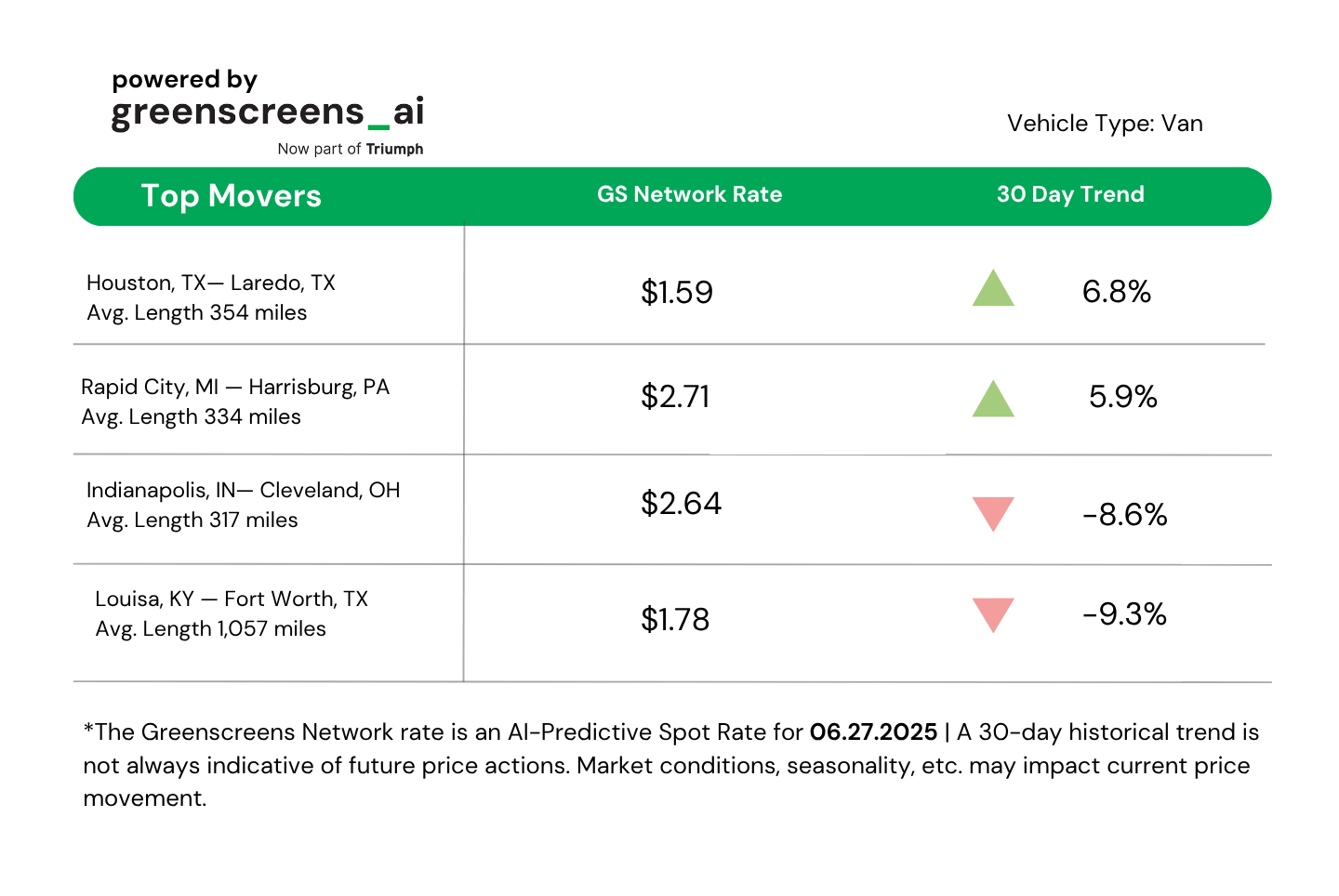

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

🍳 WHAT’S COOKIN’ IN FREIGHT

🛡️ Cyberattack Hits Estes Forwarding Worldwide, Echoes 2023 Incident. Estes Forwarding Worldwide (EFW) confirmed a cyberattack on May 28, though operations were not significantly disrupted. “We want to assure you there was no significant disruption to our business,” CEO Scott Fisher said, crediting “robust cybersecurity protocols, system redundancies, and the swift response” of internal and third-party IT teams. EFW restored systems within hours and is continuing to investigate. Fisher added, “We are grateful for the support of our parent company, Estes Express Lines, throughout this incident.” The attack comes less than two years after Estes Express Lines experienced a major cyber event in 2023 that temporarily shut down digital systems across its LTL network.

📦 FedEx Earnings Reflect Freight Strains Amid Tariff Volatility. FedEx’s Q4 earnings show growing pressures from tariff shifts, weak industrial demand, and restructuring across logistics. CEO Raj Subramaniam cited a steep drop in Asia demand following U.S. tariff changes, prompting a 35% cut in air capacity and accelerated rollout of its Tricolor network redesign. Meanwhile, FedEx Freight reported a 6% drop in operating income as LTL volumes remain soft. FedEx Freight will spin off in 2026, with a new team incoming. Despite AI investments and cost cuts, shares fell 5% on weak guidance and postal losses.

📃 CVSA Renews Push for Universal Truck ID in 2025 Highway Bill. The Commercial Vehicle Safety Alliance is advocating for a Universal Electronic Vehicle Identifier (UEVI) on all newly manufactured commercial trucks. The proposal, once shelved in 2022 amid industry backlash, returns as a top priority in CVSA’s 2025 highway bill agenda. The UEVI would allow enforcement to scan trucks in motion, streamlining inspections, but some believe it will lead to an invasion of privacy. Additional CVSA proposals include grant reform, stricter exemption rules, expanded drug testing methods, and preserving ELD mandates. The bigger goal: standardized, tech-driven safety enforcement across states backed by sustainable Highway Trust Fund support.

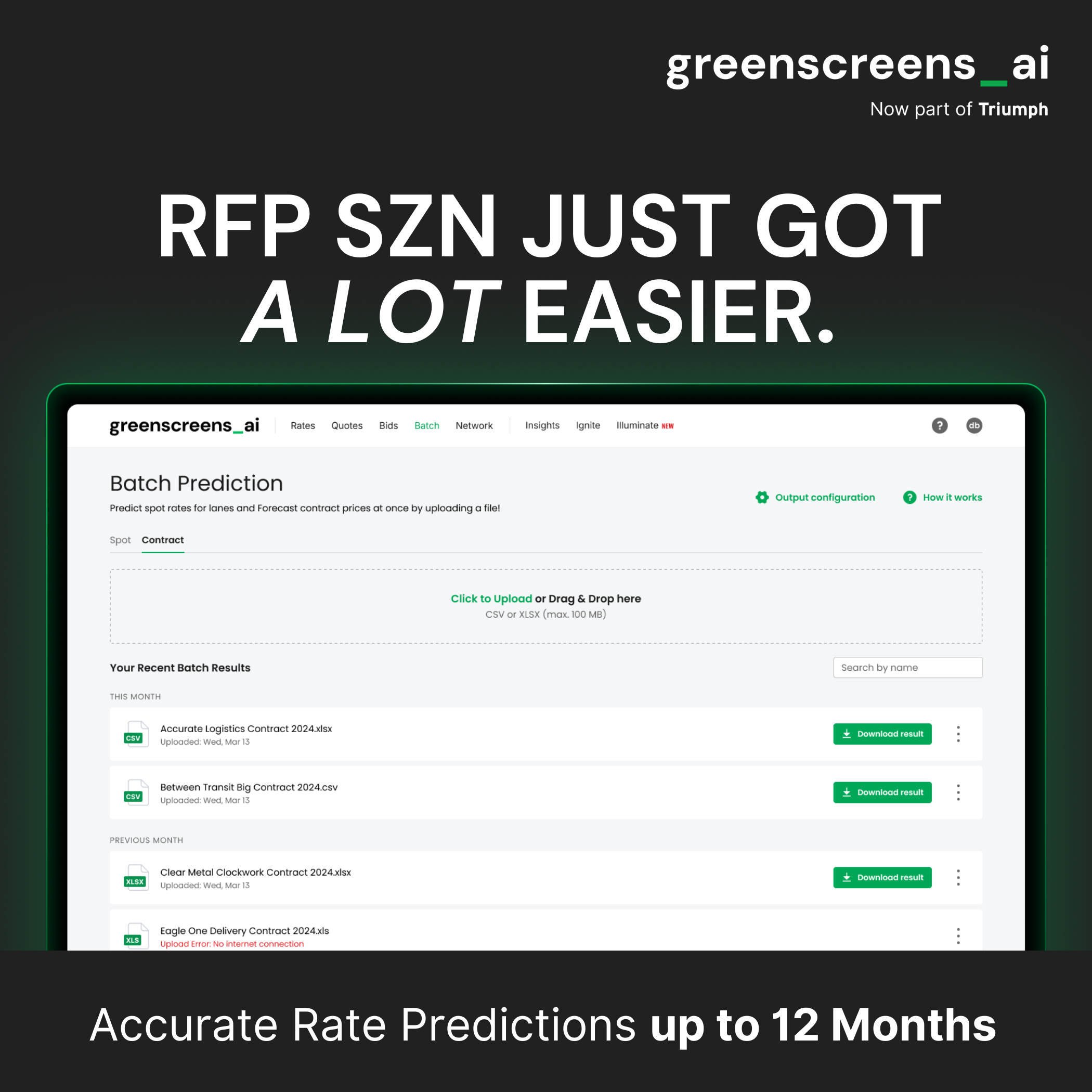

Don’t let RFP season catch you scrambling. Greenscreens' long-term rate prediction tool delivers accurate monthly freight forecasts up to 12 months out — With seamless system integration and support for high volume lane uploads, it improves efficiency, accelerates user adoption, and reduces time to respond to RFPs.

At SMT Automation in Michigan, Elena Morales thought 2025 would be a record year. Instead, she laid off 8 employees and is sitting on an empty new building.

“We had forecast to have a lot of work this year,” Morales told Bloomberg. “Now, most companies are pushing back order times.”

SMT is just one example of how Trump’s tariffs are causing a chain reaction across the U.S. auto supply chain:

"Michigan had the largest jump in layoffs in the US for the week ended May 24, with 3,259 jobs lost, mostly in manufacturing, according to the US Department of Labor." – Bloomberg

Meanwhile, the Trump administration is battling it out in court to keep broad tariff powers alive.

On June 24, the DOJ urged a federal appeals court to overturn a lower ruling that deemed the tariffs unconstitutional. The argument was that Congress gave the president enough authority under national security provisions.

“The president imposed these tariffs… to address what he has determined are grave threats to the United States’s national security and economy,” the Justice Department wrote.

Arguments will be heard July 31, but the next key date is July 9, when many suspended tariffs could come back into force if no deals are struck.

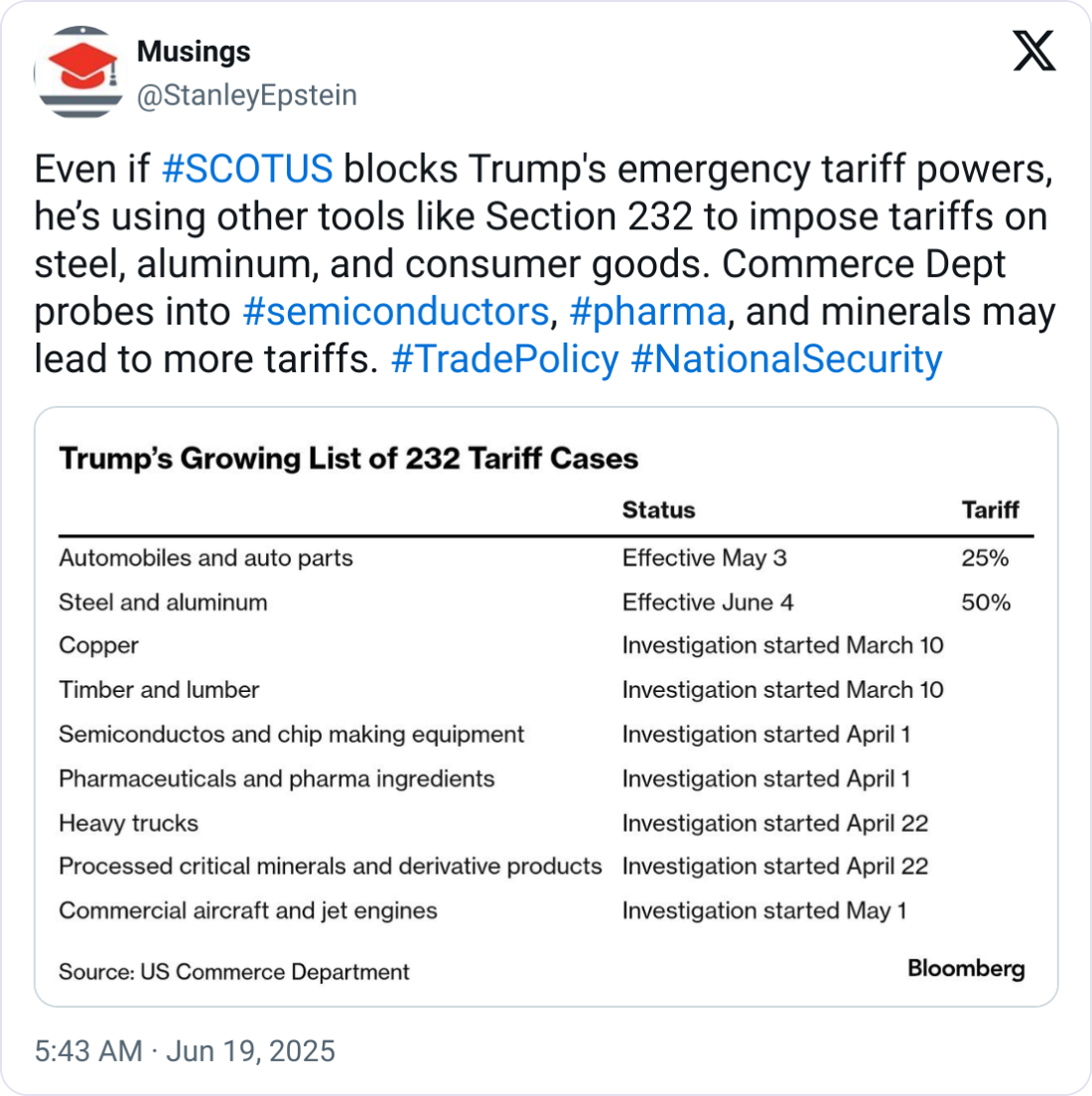

From the EU to Japan to India, nobody wants to sign a deal and get slapped the next day with new “Section 232” tariffs on autos, steel, chips, or drugs.

“The last thing you want is to agree to a deal only to be hammered the next day,” said Deborah Elms of the Hinrich Foundation.

India is pushing for “most favored nation” status. Japan won’t back down on cars. The EU expects only “broad principles” by July 9, with few details resolved.

And in the meantime, the Trump administration is signaling tariffs could be used as bargaining chips for other commercial wins.

“If other countries play ball with us, I would expect that’s an offer we make,” said U.S. Commerce Secretary Howard Lutnick, referencing a British Airways deal to buy $10B in Boeing aircraft.

In May, U.S. exports fell by $9.7B, widening the goods trade deficit to $96.6B.

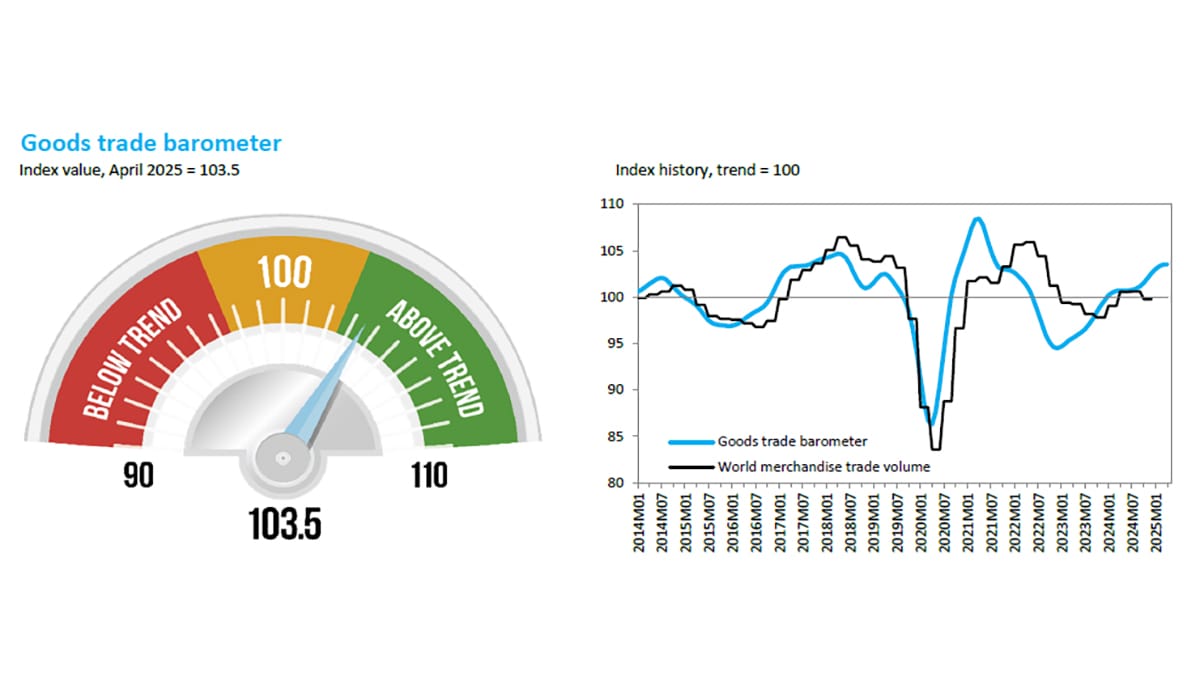

Meanwhile, importers are rushing shipments ahead of July 9 tariff hikes, frontloading inventory to avoid higher costs later.

The WTO Goods Trade Barometer ticked up to 103.5, signaling above-trend activity, but warned the export outlook is falling, with new export orders dipping below trend to 97.9.

This means any freight boost may be short-lived and inventory-driven.

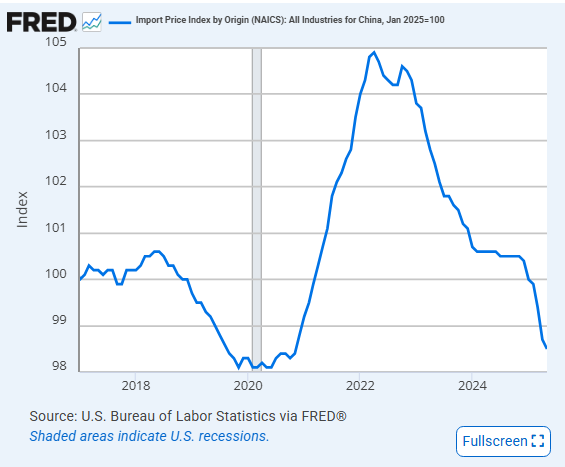

Even the Fed isn’t sure how much of the economic pain is being passed on to consumers.

“The question is, who’s going to pay for the tariffs?” said Fed Chair Jerome Powell on June 25. “And honestly, it’s very hard to predict that in advance.”

Powell signaled the Fed isn't rushing to cut interest rates just yet. Inflation may still spike due to tariffs, but Powell noted the full impact is still unclear and may be masked by lagging data.

As Powell noted, “there’s no new marble,” but there may be a new cliff coming for freight.

Take control of your future with Freight Flex!

Be your own boss without the corporate red tape. Build your business with our cutting-edge tech stack, including paid TMS, DAT, Sylectus, Highway, ZoomInfo, Macropoint, Allianz credit insurance, Triumph Pay, seamless onboarding, and 24/7 support.

Gain access to 10,000+ carriers with rapid customer setup. With 70% commission on margins—you’ll have the freedom to focus on your goals while we handle the rest.

🌎 AROUND THE FREIGHT WEB

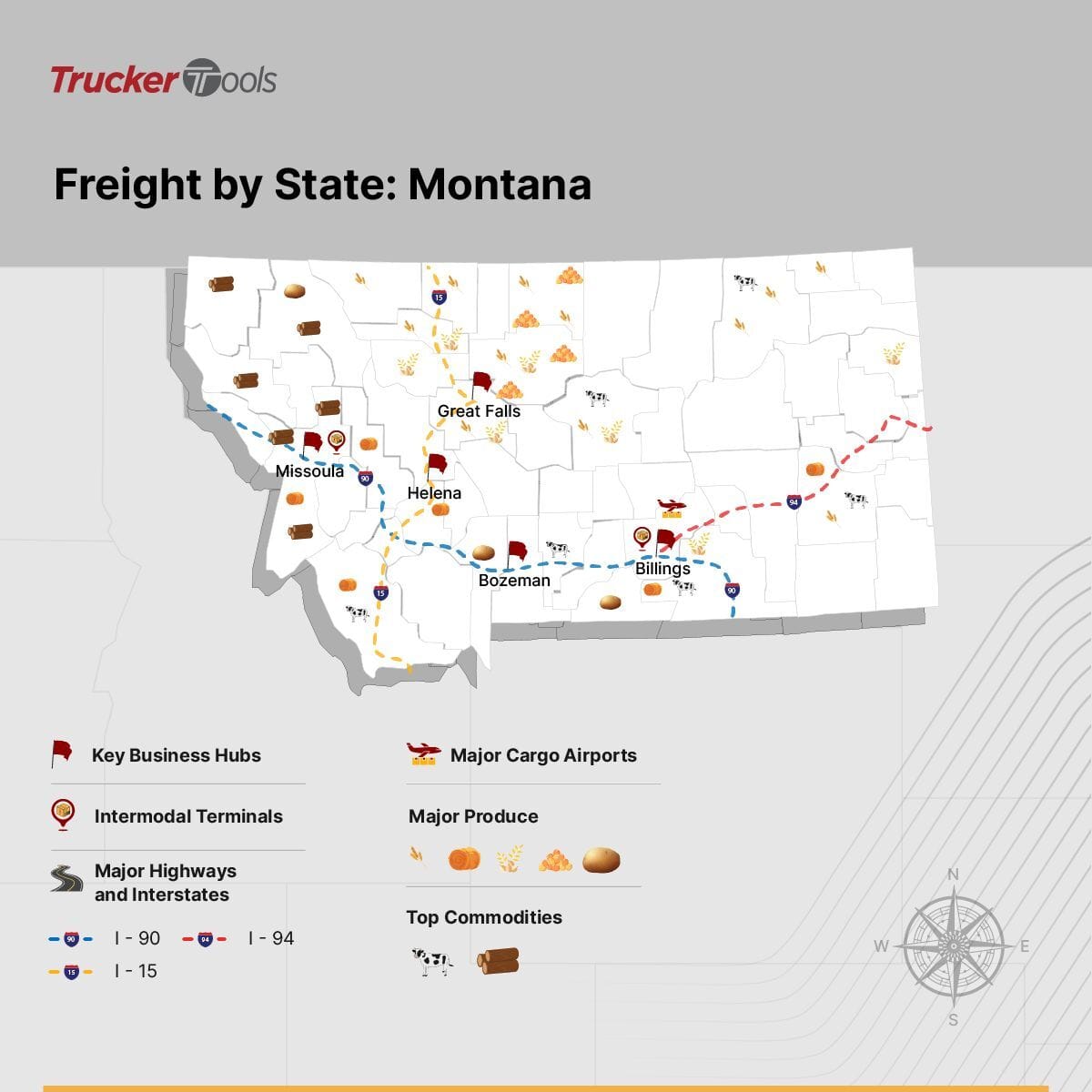

📊 Freight by State. Trucker Tools CEO Kary Jablonski highlights how freight volumes and commodity flows vary widely within Montana. This could present opportunities for some, so take a look at the data and plan accordingly.

🏪 Kroger to Close 60 U.S. Stores. Kroger announced plans to shutter 60 underperforming stores across the U.S. over the next 18 months. Kroger has stated that employees impacted by the closures will be offered jobs at other locations.

🕊️ Former ATA President Passes Away. Bennett Whitlock, former president of the American Trucking Associations, has died at age 97. He worked for ATA for 36 years, helping steer the trucking industry through deregulation.

🚢 Texas Ports See Mixed May. Freight volumes at Texas ports showed mixed results in May, with some facilities seeing growth while others experienced declines. For instance, Houston’s container volume is up 5%, though crude oil shipments dropped 9%.

🗣️ English Skills Linked to CMV Safety. A 2011 Volpe Center report found limited English proficiency among commercial motor vehicle drivers may impact safety performance. This is due to a number of languages other than English being spoken by CMV drivers and other complications.

🤝 Patton’s Acquisitions. Pennsylvania-based logistics company Patton Logistics Group has acquired Milton Transportation and Warehousing and its sister company, BTR Inc. Through the deal, Patton will acquire 40 additional trucks, 300 trailers, two truck maintenance facilities, and a body and alignment shop.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).