🎣 RFX and R&R Express Sued

Plus: ELP enforcement isn’t sticking, Amazon eyes LTL, FMCSA warns of phishing scam

Plus, two trucking firms close, harassment claims at TIA conference, a 19.5% week-over-week drop in spot loads, and more.

Happy Friday. Tariffs dominated freight this week—from lawsuits and booking collapses to China’s retaliation. We break down the facts, fallout, and a couple of bright spots. Catch the roundup below.

Plus:

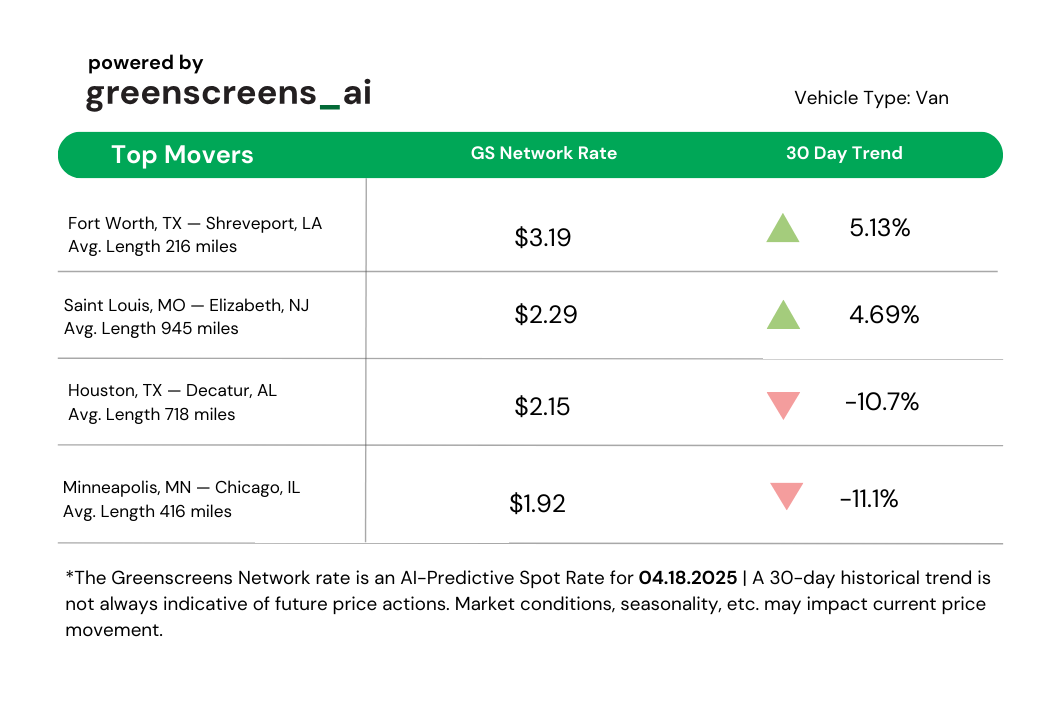

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

🐔 WHAT’S COOKIN’ IN FREIGHT

😔 End of the Road: Two Legacy Trucking Firms Shut Down. Family-run carriers Davis Express (FL) and Wes Olson Trucking (ID) are ceasing operations after decades in business, citing mounting costs, legal pressures, insurance spikes, and a shrinking pool of skilled drivers. With 160 trucks, Davis Express will lay off 146 employees by June 15, after nearly 50 years in refrigerated freight. Wes Olson Trucking, known for ice road hauling and timber transport, ended operations in March. Both owners emphasized how driver shortages and regulatory burdens have made it impossible to remain viable, with Jim Olsen saying, "Good drivers are a dying breed. They’re just not out there.”

🛑 Addressing Harassment in Freight Conferences. At the recent TIA conference, Carrier Assure CEO Cassandra Gaines revealed that two young female associates were harassed—subjected to unwanted comments and physical contact. The troubling incidents are not isolated, highlighting a broader issue of misconduct at industry events. Leaders like Will Jenkins and Jennifer Morris are calling for accountability, urging men to speak up and organizations to take real action. While some male allies did step in, fear of backlash still silences many women. The message is clear: the freight industry must protect and empower women, not just invite them into the room.

📊 Spot Market Shifts as Load Volumes Dip. Posted spot loads on DAT One dropped 19.3% to 2.1 million, yet load movements hit a Week 15 record, signaling active market churn. Truck posts rose 2.8%, reflecting ongoing volatility. Despite the dip, van load posts remained historically high, and van rates held above pre-pandemic levels. Reefer volumes fell 27.3% following a recent surge, and flatbed activity softened, particularly in Texas, where oil-related freight is slowing. Meanwhile, a spike in container ship traffic to Southern California suggests a looming surge in imports, possibly the last before a projected 27% plunge due to U.S.-China trade tensions.

WireBee is an AI-Powered Carrier Communication platform for Freight Brokers

Save time, cut costs, and secure better carriers–faster.

It’s Friday. Which means it’s time to take a breath, reload your email, and try to make sense of this week's tariff whirlwind.

From rare earth retaliation and legal blowback to booking collapses and warehouse demand surges, here’s how the week unfolded—the good, the bad, and the "wait, what now?"

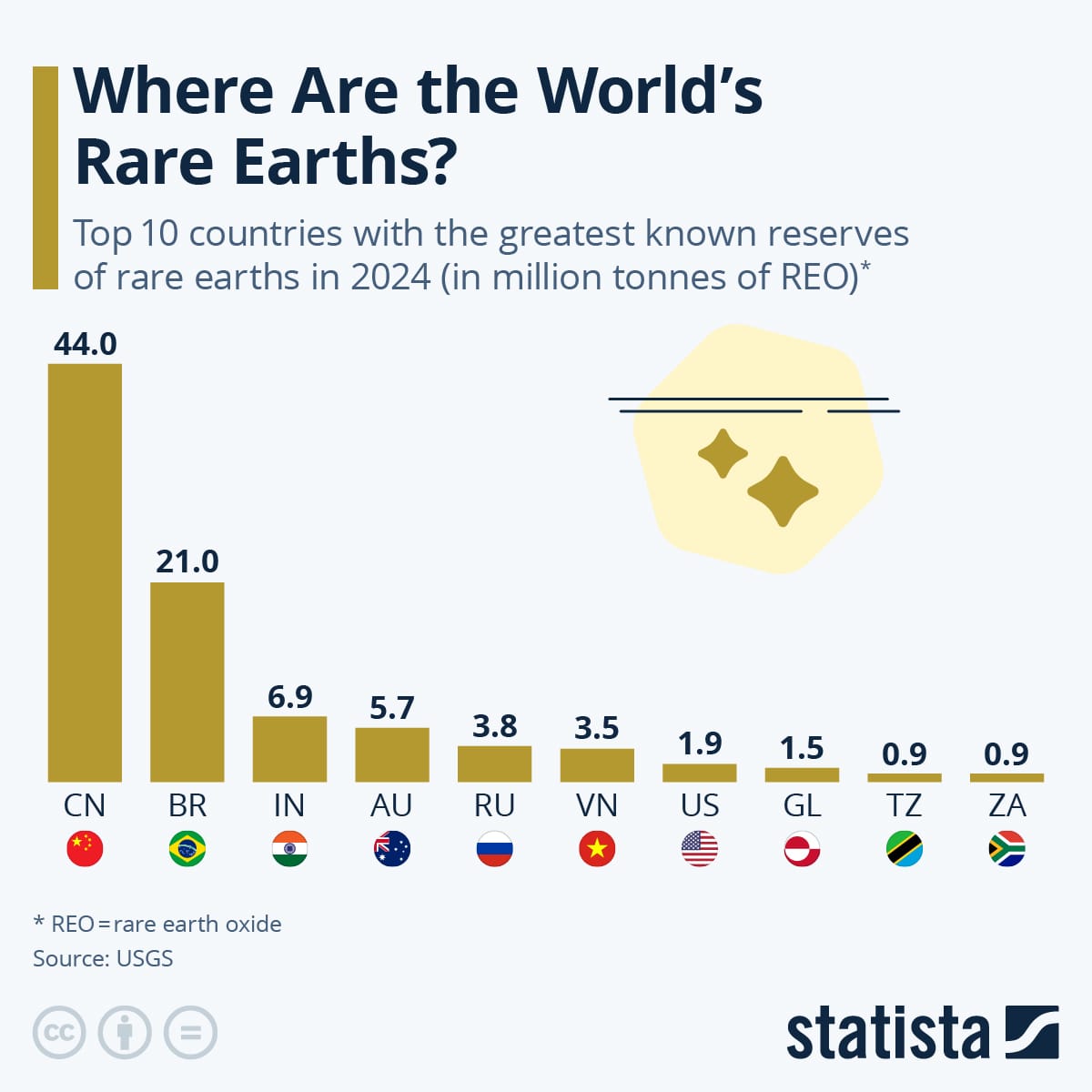

China has moved to curb exports of rare earth metals, a quiet but massive blow to U.S. supply chains that depend on these critical materials for everything from semiconductors to defense systems.

The country controls roughly 70% of global rare earth production, and its latest restrictions are seen as a direct counterstrike to Trump’s April 2 tariff blitz.

"Beginning in the late 20th century, China prioritised the development of its rare earth mining and processing capabilities... This allowed them to undercut global competitors and build a near-monopoly across the entire value chain." – Gavin Harper, a critical materials research fellow at the University of Birmingham.

The economic pain is hitting home fast. This week, California became the first state to sue the Trump administration over the new tariffs, filing a federal complaint on grounds that the policy bypasses congressional authority and harms the state’s economy.

“The President’s chaotic and haphazard implementation of tariffs is not only deeply troubling, it’s illegal. As the fifth largest economy in the world, California understands global trade policy is not just a game." – California Attorney General Rob Bonta.

California's ports take in 40% of imports to the U.S. Check out yesterday's newsletter for more details on their performance.

The lawsuit reflects growing concerns among state governments that the tariff rollout is doing more harm than good and making U.S. ports collateral damage.

Despite industry backlash, President Trump remained steadfast, doubling down during a televised segment on Thursday:

“I’m in no rush...tariffs are making us rich. We were losing a lot of money under Biden."

The administration sees tariffs as a tool to bring manufacturing back to the U.S., but logistics professionals and shippers say it’s causing more chaos than clarity.

Amid the tension, there’s one positive note. The U.S. and Japan announced a second round of trade talks to smooth over friction in key sectors like autos and semiconductors.

“Talks were productive, and both sides expressed a commitment to mutual economic resilience,” said a statement from the Office of the U.S. Trade Representative.

Japan is one of the few top trading partners to avoid steep tariff hikes, possibly offering a model for how trade diplomacy might still function.

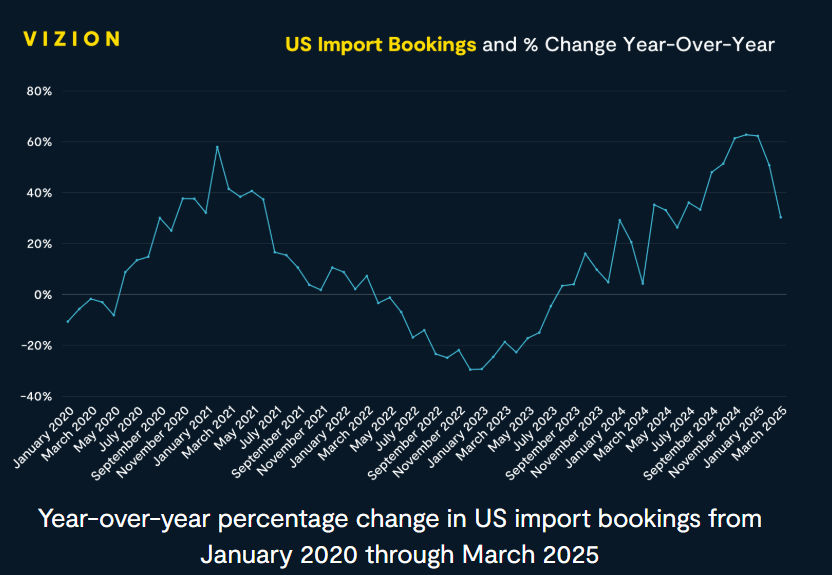

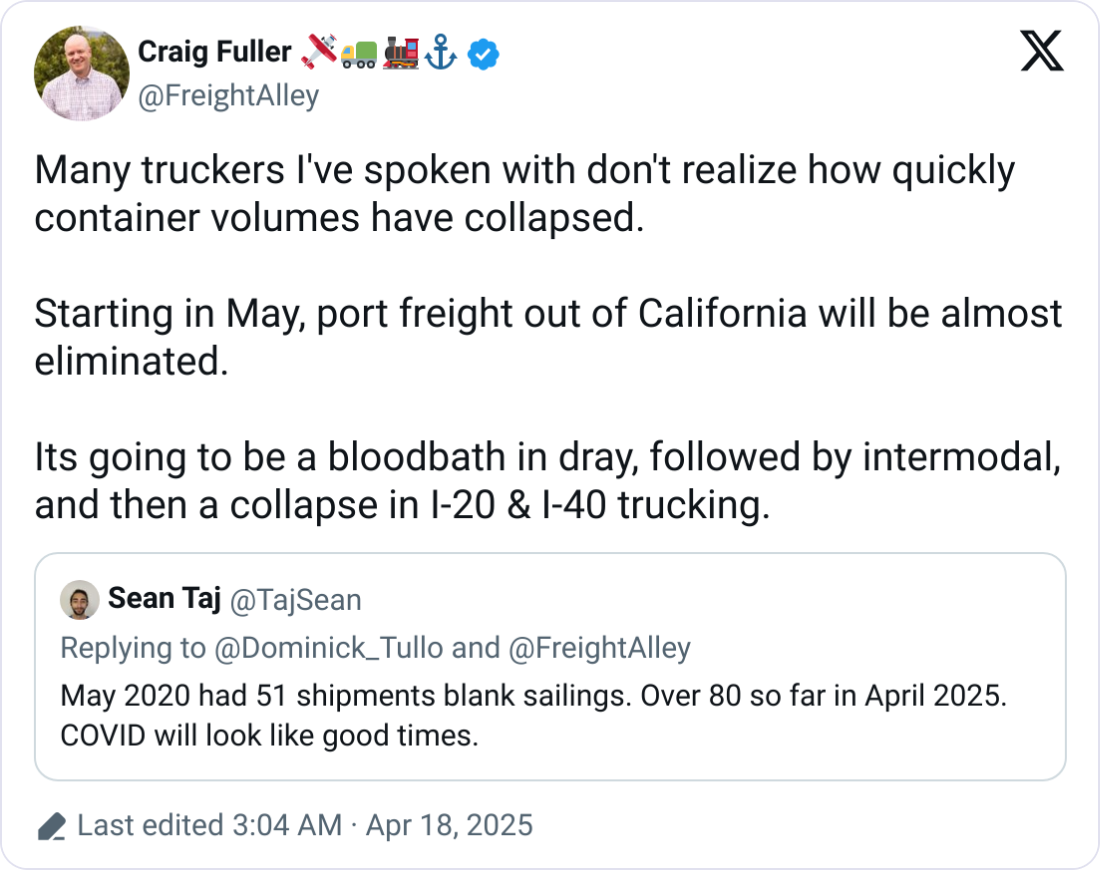

The real-time impact is being felt at sea. As reported by FreightWaves, ocean container bookings from China to the U.S. have “fallen off a cliff” since the tariffs took effect.

"This dramatic drop aligned with two key developments: the April 4th U.S. tariff announcement, followed by China’s retaliatory measures announced on April 5th. The result? A widespread booking freeze, as shippers paused mid-shipment cycle to reassess costs, timelines, and broader trade strategy." – Vizion 2025 U.S. Booking Trends Report

Some shipping lines have blanked sailings, while others are rerouting vessels away from U.S. lanes entirely. Spot rates are whiplashing, and forward visibility is evaporating.

One firm seeing opportunity? Prologis, the logistics real estate giant. In an interview with The Wall Street Journal, they framed the tariff fallout as a catalyst for demand:

“We’re seeing accelerated interest in stateside inventory storage as firms look to reduce cross-border exposure,” a Prologis spokesperson said. “It’s a shift from just-in-time to just-in-case.”

The surge in domestic warehousing signals that while imports may slump, internal repositioning is gaining steam.

This week proved that trade headlines can reshape freight flows overnight. From canceled bookings to warehouse booms, the logistics industry is adapting in real time.

TAB-LLC is a wholly owned subsidiary of Artur Express Inc. Our asset-backed model allows our agents to explore opportunities that would otherwise be unavailable.

At TAB, we provide agents with unmatched support, leading technology, staffing options, and unlimited potential to meet their financial goals and keep the wheels turning.

What we offer:

And much, much more.

🌎 AROUND THE FREIGHT WEB

⌚ Congestion at Bensenville. Ari Ashe reports that CPKC's Bensenville terminal experienced delays due to a gate outage and an unexpected surge in container arrivals. The situation seems to be ongoing currently, but the past reasons may not be the same today.

🤖 C.H. Robinson’s AI Rollout Expands. With over 3 million tasks now automated, CHRW’s generative AI is streamlining quoting and LTL operations.

⚡ Windrose Debuts Electric Sleeper Cab. Windrose’s 420-mile range Class 8 truck is now rolling out in the U.S. with JoyRide Logistics, making it the first fleet to run all-electric sleeper trucks.

🏗️ Amazon’s $15B Logistics Push.

Amazon may add 80 new U.S. logistics sites, from urban hubs to rural towns. Some will include robotic fulfillment centers, part of a major warehouse expansion.

📚 Speak English? A truck driver shared what he experienced at a weigh station checkpoint, where he was asked about his place of birth and his English skills due to the recently passed Arkansas English-proficiency bill. He also gives his advice on what to do and say.

🌄 Life of a Driver. A truck driver shared a piece of his driving stories, ranging from dropping off a shipment in a sketchy location and taking “ice baths” to picking up multiple Amazon loads, one after the other.

🚨 Drug Bust. U.S. Customs and Border Protection officers intercepted over $14.6 million worth of meth concealed in a shipment of cucumbers and fresh bell peppers at the Pharr International Bridge.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).