🎣 RFX and R&R Express Sued

Plus: ELP enforcement isn’t sticking, Amazon eyes LTL, FMCSA warns of phishing scam

Plus, STG Logistics secures $300 million for expansion and guess how much the trucking market has grown since 2020—find out in today's Question of the Day.

Good morning. While still under clean-up and recovery efforts from Hurricane Helene, Florida urges millions of residents to evacuate before Hurricane Milton makes landfall. Meanwhile, trucking capacity continues toward stabilization, FMCSA data shows.

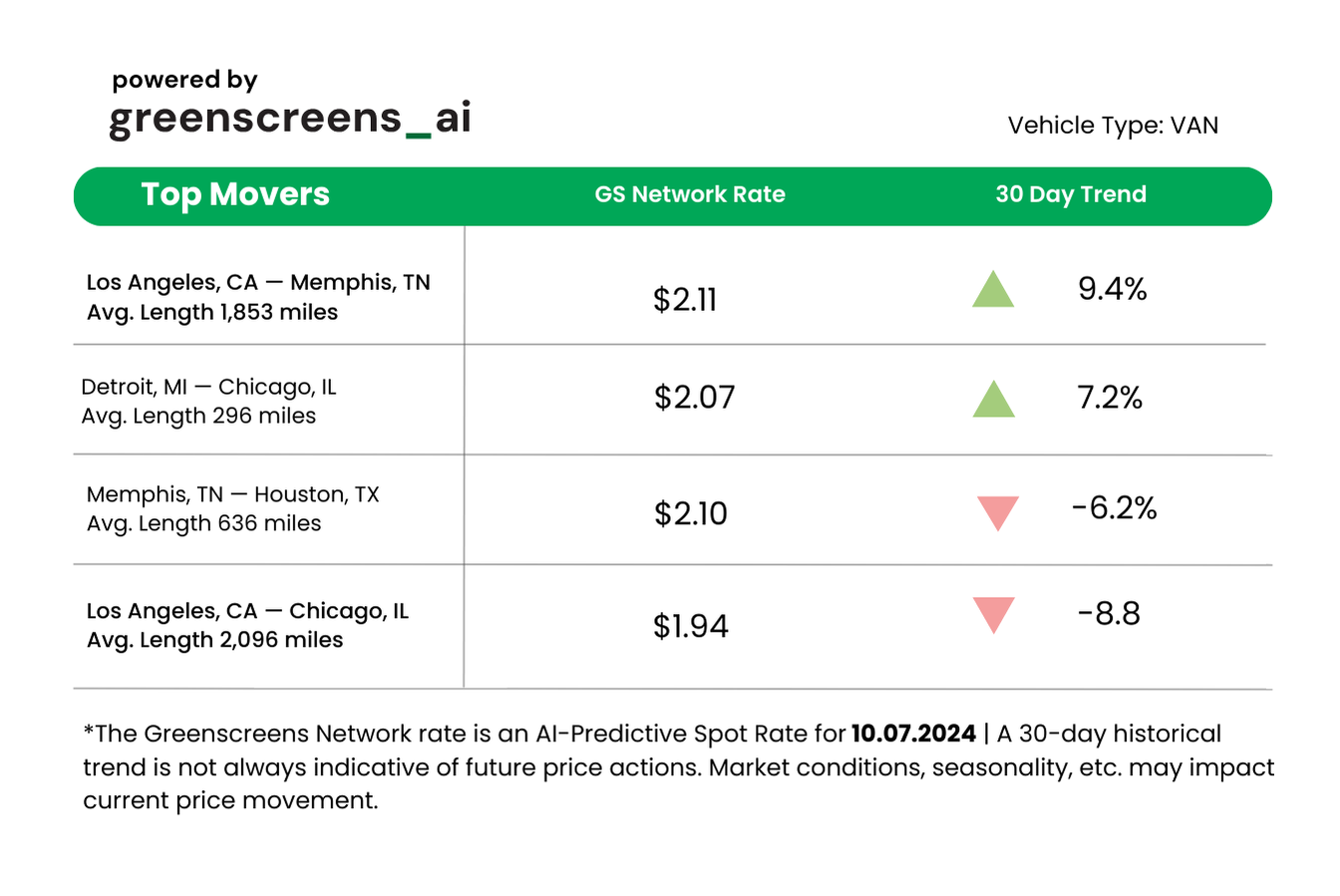

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

*Greenscreens.ai, forecasts real-time truckload buy prices that are suited to each freight brokerage's purchasing power using AI and machine learning. Its engine takes into account over 130 attributes and data points in each rate forecast.

🐔 WHAT’S COOKIN’ IN FREIGHT

🌀 Florida Braces for Hurricane Milton as Helene's Aftermath Lingers. Hurricane Milton rapidly strengthened into a Category 1 storm and is expected to make landfall on Florida’s Gulf Coast as a Category 3 by Wednesday. With winds reaching 120 mph, Milton will bring heavy rainfall, with some areas expecting up to 15 inches. The state is still recovering from Hurricane Helene, which caused widespread destruction just days earlier. Florida officials have declared a state of emergency, urging residents to evacuate – the first time since Hurricane Irma in 2017. Evacuations and storm preparations are underway, with widespread power outages and significant storm surges anticipated. Schools and facilities are being converted into shelters. The impact Milton will have on the freight industry remains at large.

📈 STG Logistics Secures $300M for Expansion and Growth. STG Logistics, a Chicago-based provider of transloading and containerized freight services, closed on a $300 million debt and equity financing package to drive expansion and operational improvements. Backed by private equity sponsors Wind Point Partners, Duration Capital Partners, and Oaktree Capital, the funds will support their growth, including potential future acquisitions. In 2022, STG acquired XPO’s intermodal operations for $710 million. CEO Paul Svindland expressed confidence in overcoming freight market challenges. Last year, STG’s President and COO Geoff Anderman discussed the company’s vision in an interview with Freight Caviar which you can watch here.

🌉 Gulf Ports Oppose Tariffs on Chinese Container Cranes. US Gulf Coast ports are protesting the new 25% tariffs on Chinese-made container cranes, citing higher costs and potential project delays. The cranes, previously scrutinized by the US government over spying concerns, face increased tariffs. Port Houston, which ordered eight cranes for $113 million from Zhenhua Heavy Industries, must pay an additional $28.5 million. These cranes are key to completing Project 11, an expansion of the Houston Ship Channel. Other ports, including Freeport and New Orleans, face similar impacts on major projects. Port officials and industry groups warn the tariffs will hurt efficiency, strain supply chains, and burden the economy, especially with no US manufacturers. Despite some exemptions, ports are still lobbying for relief.

As the RFP season approaches, it’s essential to focus on receiving only relevant bid requests. CtrlChain provides a cost-effective solution that enables carriers to secure more contract freight from reliable shippers. By indicating your preferred routes, availability, and capacity, you can start receiving personalized offers tailored to your needs.

CtrlChain also streamlines daily operations for fleet owners and operators by automating and digitizing manual tasks, such as managing delivery information, updating customers, and providing proof of delivery (POD).

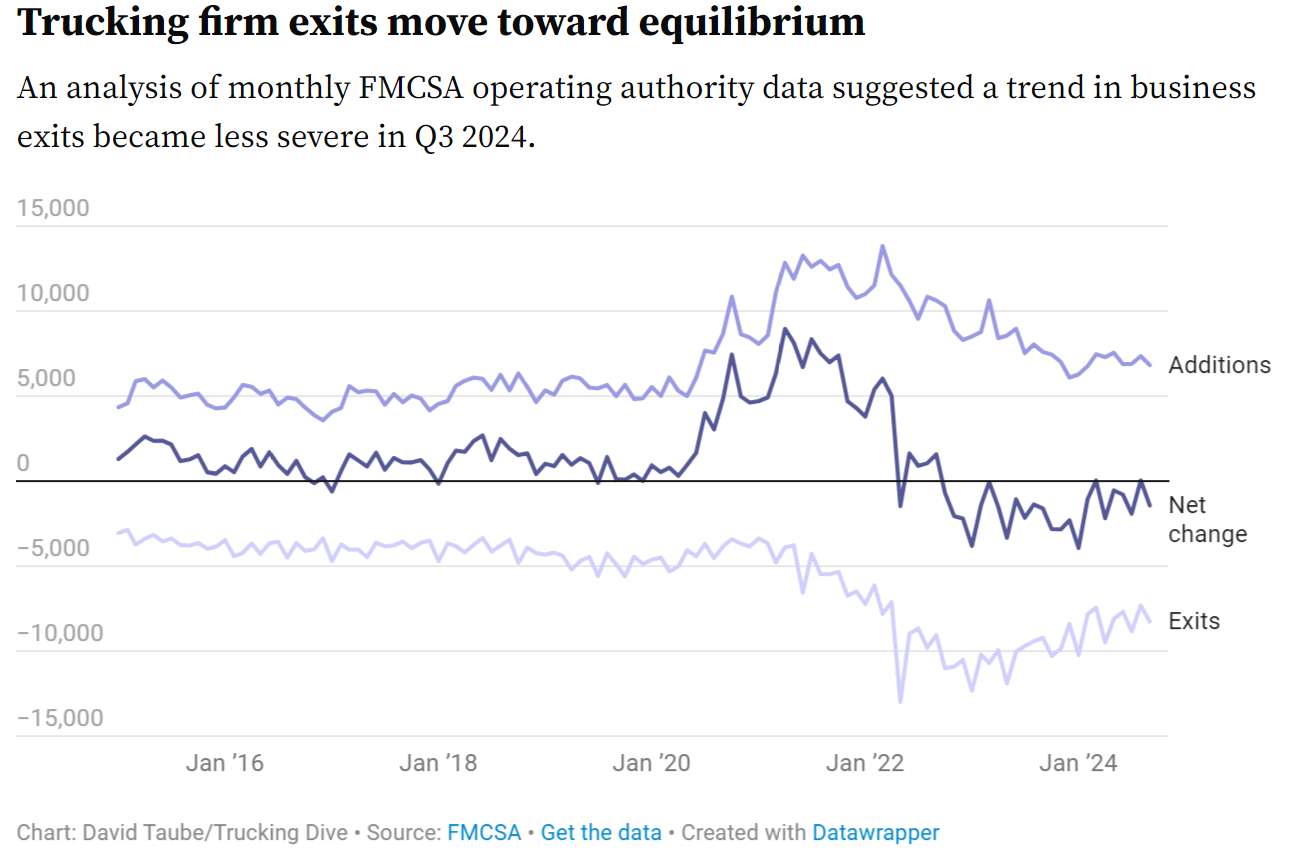

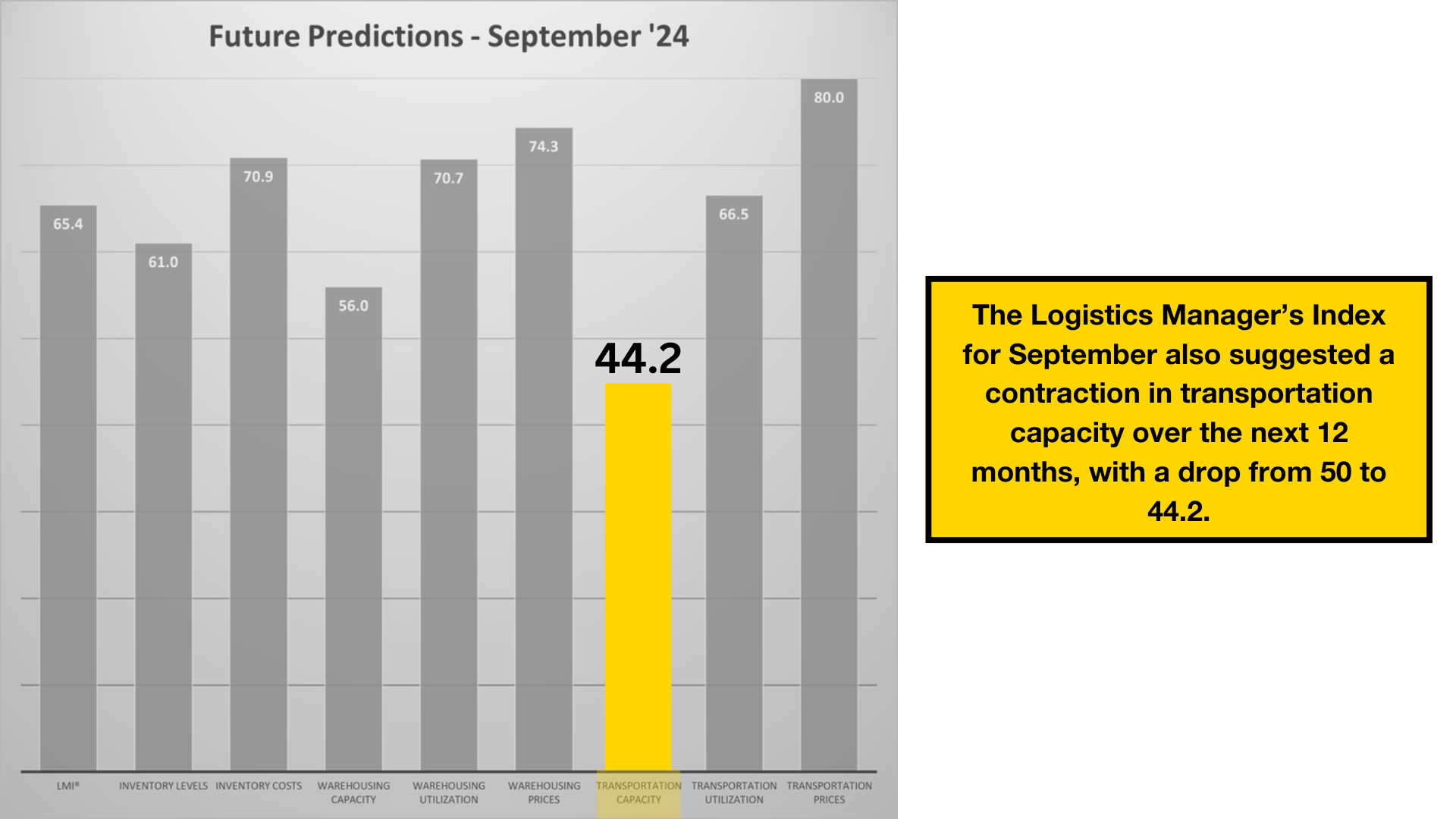

Trucking capacity has been on a winding road as it seeks balance. Recent Q3 data from the FMCSA indicates that the trucking industry's exits are still outpacing new entrants, yet the pace of exits has begun to slow, showing signs of stabilization.

Here’s what you need to know:

The pandemic saw a huge influx of new carriers into the market, and a sizable chunk have managed to stick around. Even though there have been some temporary gains, such as in March and August, these gains haven’t yet led to broader, sustained growth.

With exits rising, trucking jobs are also on a downward trend:

These reductions reflect the ongoing contraction of the industry, suggesting that both trucking companies and their employees are feeling the economic squeeze.

The spot premium ratio remains negative, as highlighted by Chad Kennedy, Group Product Manager at DAT Freight & Analytics. We need to see spot rates rise above contract rates to turn the market.

As Q4 unfolds, all eyes are on the continued exits and job reductions to see if they will finally lead to the long-anticipated rate recovery. The trends now point to a slow but steady capacity correction and a return to a healthier market. However, fewer exits could lessen the likelihood of a major market flip or quick rate rebound.

As Vise suggests, “The current level of carrier population decline could continue for a long time.”

Your Go-To Freight Industry Job Board.

Whether you're looking to hire top talent or land your next role, we’ve got you covered. Click here to sign up.

🌎 AROUND THE FREIGHT WEB

😬 The Brutal Truth About Flexport? Brittain Ladd shares his thoughts after the company announced they will be laying off 2% of their staff.

🚚 AI in Logistics. Pallet raised $18 million in their bid to merge TMS and WMS, using AI to optimize workflows and cut costs.

⚠️ AZ Trucking Company Loophole Exposed. After a fatal crash caused by a meth-impaired driver, an Arizona trucking company rebranded under a new name to bypass a failed safety audit, raising concerns about regulatory loopholes in the trucking industry.

🔪 Mass Tire Slashing at Tennessee Truck Stop. Over 80 semi-trucks had their tires slashed at a TA Travel Center in Madison County, TN.

🤖 Gatik to Expand Driverless Freight in Texas. Autonomous trucking company Gatik plans to launch driverless freight operations in north Texas by early 2025.

🌀 Logistics Support. The logistics industry are rallying after Hurricane Helene to deliver crucial supplies to affected areas.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT MEME OF THE DAY

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).