🎣 RFX and R&R Express Sued

Plus: ELP enforcement isn’t sticking, Amazon eyes LTL, FMCSA warns of phishing scam

Ken Oaks, the man behind TQL, is now the richest man in Cincinnati with a net worth of $980M.

Disclaimer: The views expressed in this article are my own and do not represent those of any organizations mentioned. The content is based on personal research and is for informational purposes only. Readers should independently verify any claims. The author assumes no responsibility for errors or potential consequences.

Good morning, FreightCaviar readers.

I hope you enjoyed Tuesday’s feature newsletter where I shared insights from our day with Kevin Nolan and Andrew Silver. Today’s feature dives into one of the most talked-about freight brokerages in our industry: Total Quality Logistics (TQL).

Now, you might be wondering—does TQL pay me to feature them frequently in our memes and newsletters? Absolutely not. I have no affiliation with TQL. The reason I’m writing about them today is simple: their story is interesting. TQL is arguably one of the most controversial freight brokerages, with strong opinions from both carriers and former employees. Some consider them the most disliked brokerage, while others, including carriers who work with them, speak highly of their experience. Many employees have also found significant success at the company.

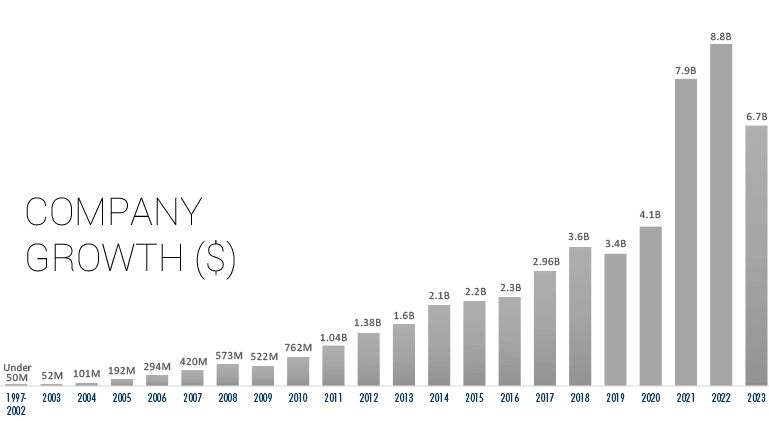

Given their size and impact on the industry, with $6.7 billion in revenue in 2023 and over 9,000 employees, I thought it would be worth exploring their history—covering both their remarkable growth and some of the challenges that come with it.

Before we dive in, I’d appreciate it if you could take a minute to fill out an anonymous survey to help us improve our content. You can find the link here. If you complete the survey and want to let me know, feel free to email me at pbj@freightcaviar.com. One lucky participant will receive a FreightCaviar t-shirt in the mail as a thank you!

TOGETHER WITH ISOMETRIC TECHNOLOGIES (ISO)

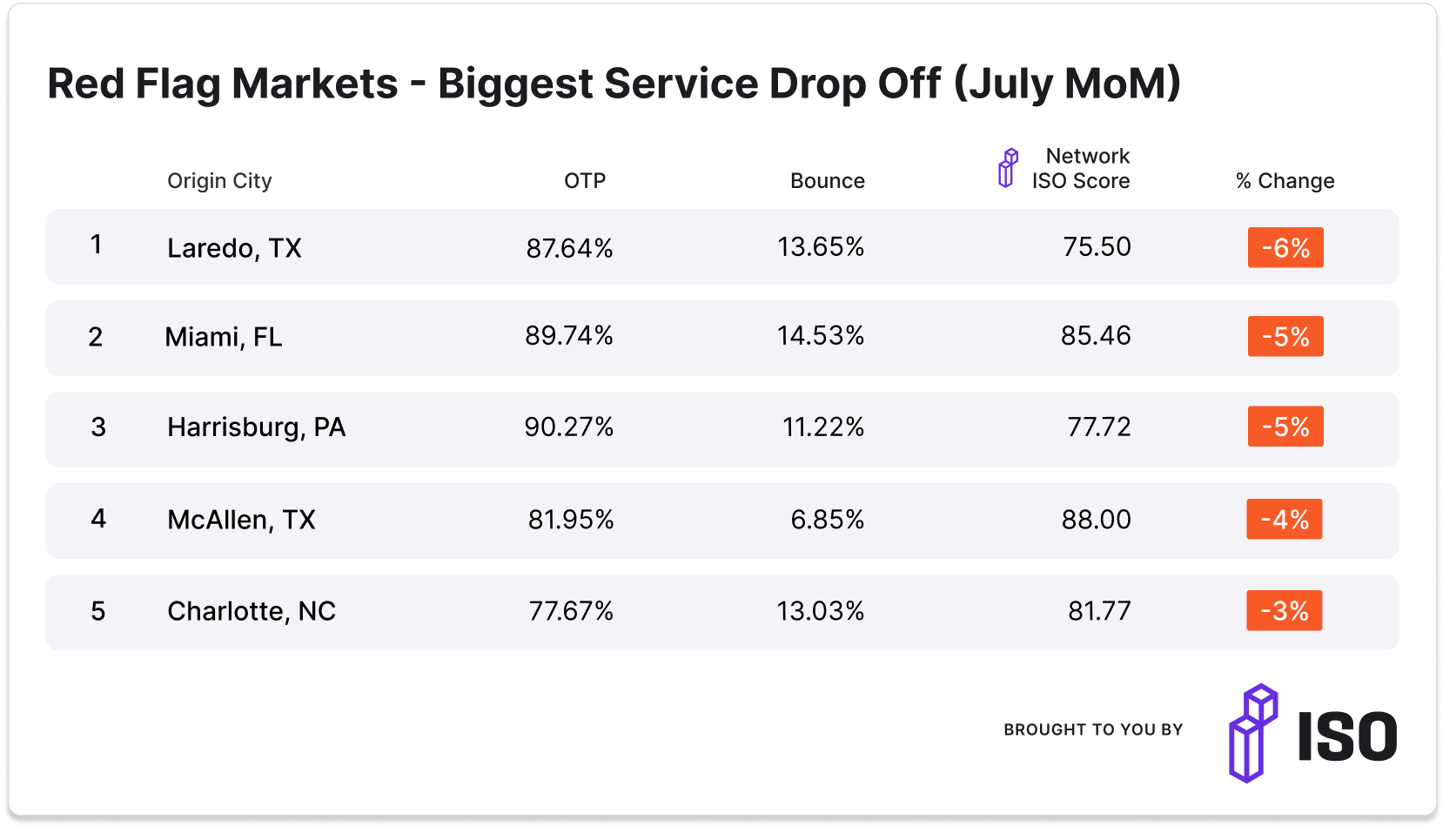

These key markets saw the biggest service drop-offs in July across the ISO* network.

*Isometric Technologies' (ISO) Service Index helps brokers scorecard, benchmark, and source by service level performance across their customer and carrier network. ISO Scores are a composite of OTD, OTP, and Bounce Rates.

Book a demo with ISO today, and keep an eye out for August's Red Flag Markets later this month.

Total Quality Logistics (TQL) was founded in 1997 by Ken Oaks in Cincinnati, Ohio. Before starting TQL, Ken worked as a produce buyer, frequently dealing with freight brokerages. According to TQL’s website:

His frustration at the lack of service and integrity he saw in the industry drove him to start his own company.

Interestingly, C.H. Robinson also began as a produce broker. It seems there’s something about the challenges of shipping perishable goods that drives produce brokers to take logistics into their own hands. In addition to C.H. Robinson and TQL, several other freight brokerages have also evolved from produce brokerage origins.

Now, I may not know exactly how TQL grew from under $50M in revenue to $8.8B by 2023, but here are some insights I’ve gathered from conversations with former employees and others in the industry:

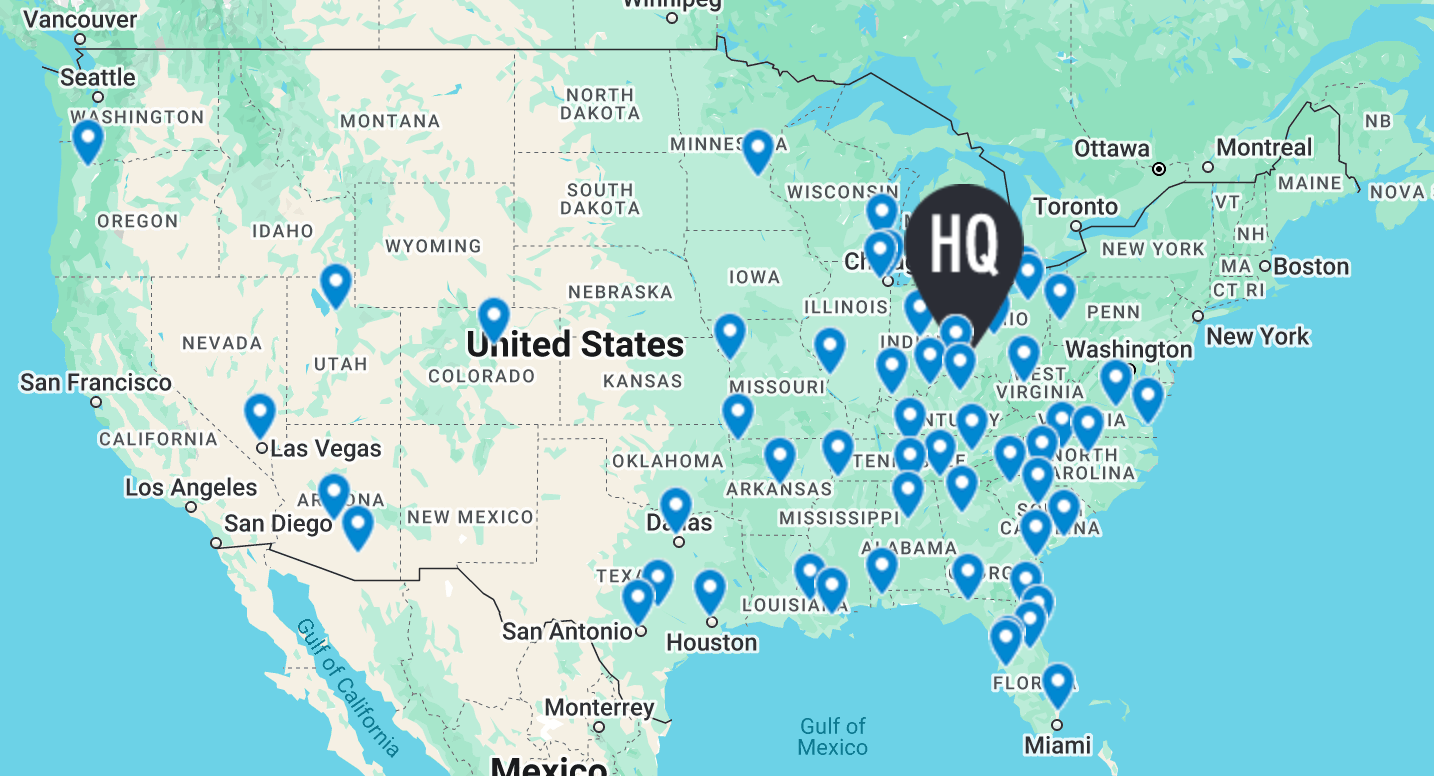

A few years ago, I interviewed Dan Hellmann, a former TQL employee and top performer at their Cincinnati branch. He shared that in 2011, he was tasked with opening TQL's Denver office, which was their westernmost location at the time. TQL frequently offered its top performers the opportunity to relocate and open new offices in strategic locations.

When we interviewed Steve Cox, President of Steam Logistics, whose company experienced massive growth during the pandemic, he shared that he admires Ken Oaks and the way he built TQL. Steve has similarly expanded his own company by rapidly opening offices across the Midwest.

A shipper recently commented the following on one of our Instagram posts:

At logistics conferences, there's often a debate about whether companies should build their own tech or buy from providers. Today, most experts agree it’s more cost-effective to buy, given the range of affordable options available. However, this wasn’t always the case. For example, C.H. Robinson acquired American Backhaulers in 1999, partly for their in-house tech, and UPS did the same with Coyote, which built its own TMS, Bazooka.

Before we continue, a quick ad from our sponsor:

TOGETHER WITH OTR SOLUTIONS

Brokers can utilize customizable working capital solutions from OTR Solutions to bridge the gap between carrier and customer pay dates. Beyond the cash flow advantages, utilizing working capital solutions also drives increased revenue due to Quick Pay adoption – as high as 12% when combined with Epay Manager.

OTR Solutions is a trucking technology and freight factoring company that was founded in 2011. In 2024 OTR acquired Epay Manager, a back-office automation and carrier payments platform that is revolutionizing broker back-offices with its proactive invoicing workflow. Learn more about OTR Solutions and Epay Manager.

What’s incredible to me is that TQL is the largest privately-owned freight brokerage in the United States—and possibly the world.

One of the main reasons many former employees speak negatively about TQL is due to their strict non-compete policy. All new employees are required to sign a one-year non-compete if they leave the company. While non-competes are fairly common in the industry, most companies tend to avoid enforcing them aggressively. TQL, however, is known for being particularly strict. They even pursued legal action against one of their top former sales reps for taking a job as a dispatcher at a trucking company.

Several successful freight brokerages have emerged from TQL. The two that come to mind (though there are likely more) are:

Whenever we post anything about TQL online, we receive a flood of comments—some positive, mostly from TQL employees, and the rest predominantly negative. Here are a few comments from our recent posts last week:

To conclude, TQL has built a massive operation. Some people love them, while many others dislike them. Personally, I’ve never worked with TQL as a carrier or shipper, so I don’t have an opinion either way. I hope you enjoyed today’s feature.

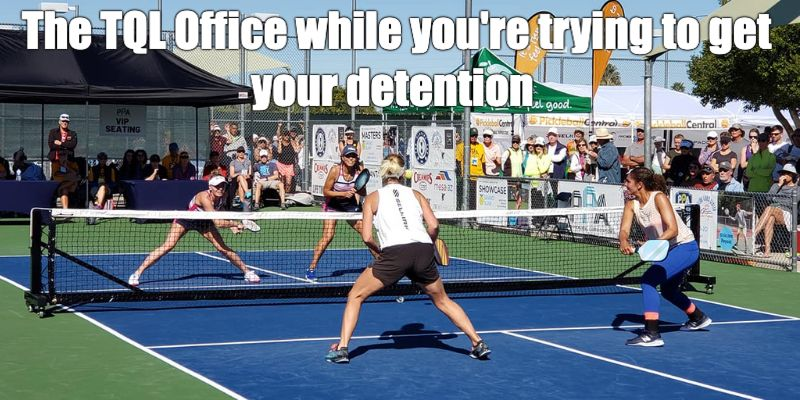

Here’s a meme in light of their new pickleball courts at HQ:

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).