🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

FreightCaviar Weekly Recap. From federal pressure on English proficiency enforcement in certain states to a broker grappling with a tight lane and real-time pricing missteps, here are this week’s most talked-about freight stories.

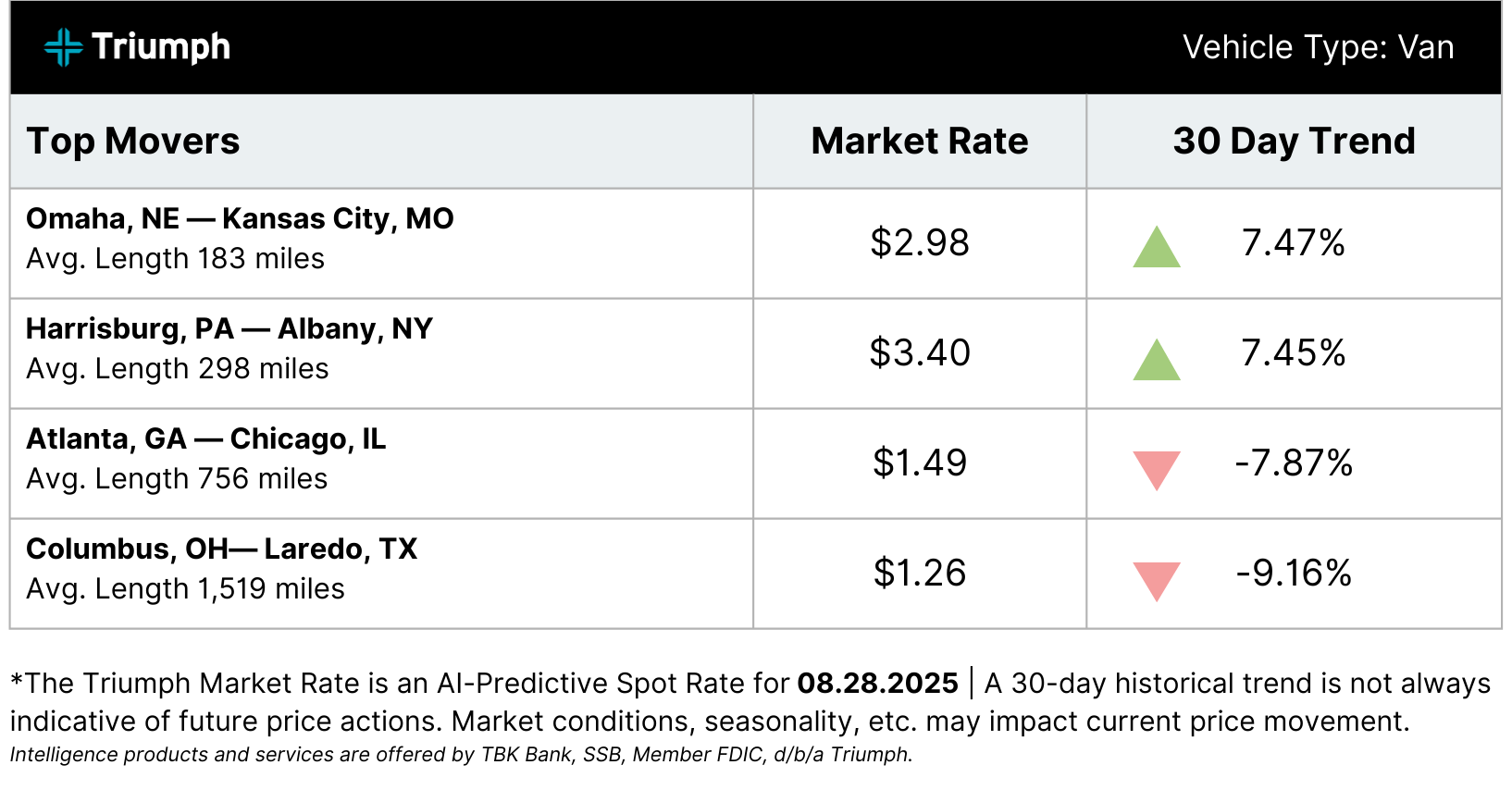

TOP LANE MOVERS BY TRIUMPH

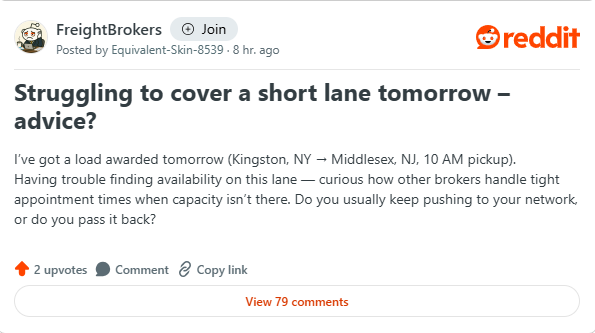

A broker on r/FreightBrokers ran into a common problem: a next-day short-haul load from Kingston, NY to Middlesex, NJ with a tight 10 AM pickup...and no carriers biting. The question was simple: Do you keep pushing your network, or give the load back to the customer?

The replies revealed a blend of tough love and tactical advice:

Tight lanes with fixed appointments aren’t just pricing challenges, they’re planning challenges.

When you’re stuck:

And if you do take the loss? Make sure it’s the last time on that lane. Mistakes are part of the game, but only if you learn from them.

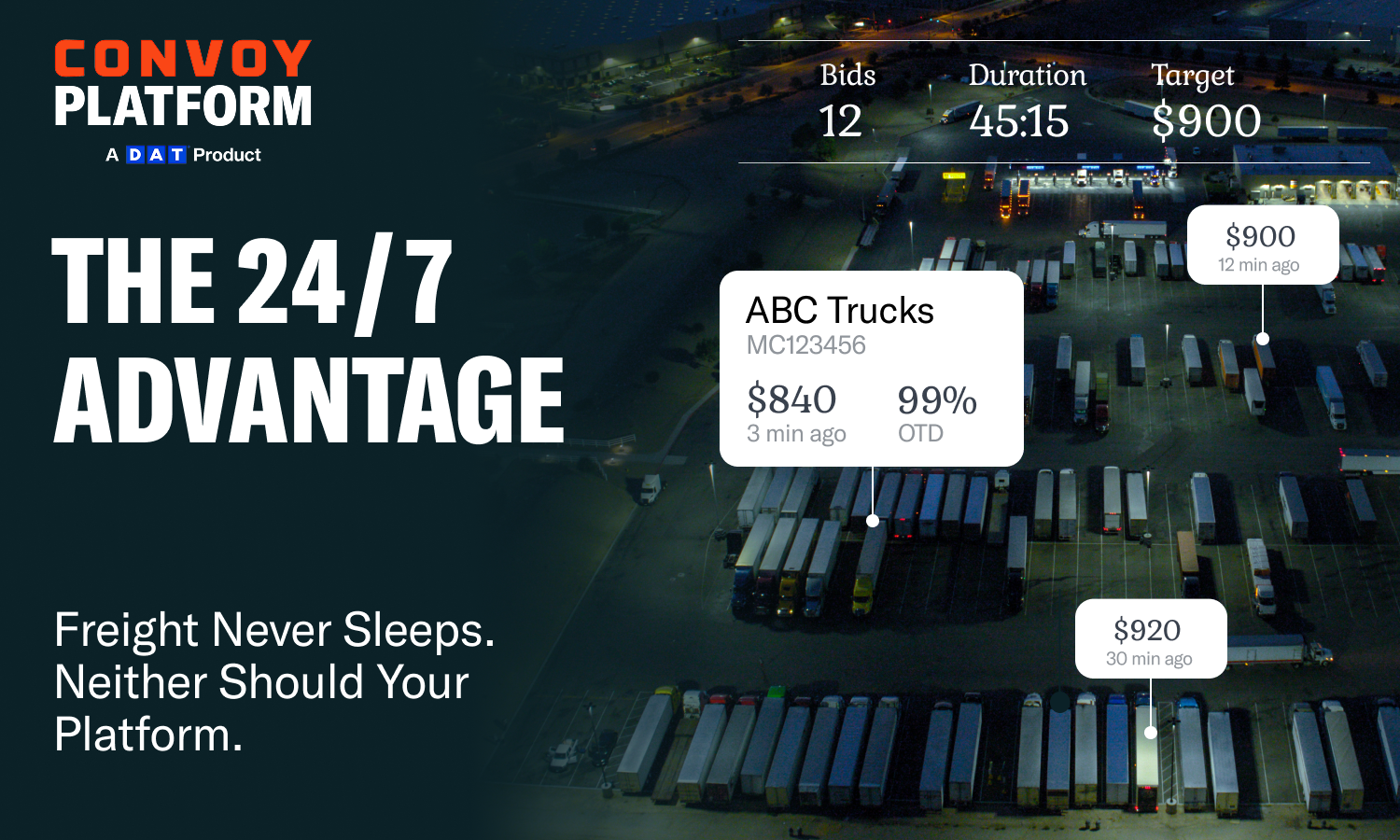

Easily and automatically reach carriers every day, at any time, to make sure you find the right truck for your shipper at the best cost.

The Convoy Platform gives brokers advanced freight automation—covering vetting, booking, tracking, and payments—so you can hit your targets even while you sleep.

And the best part? No upfront costs, only pay once the load is delivered.

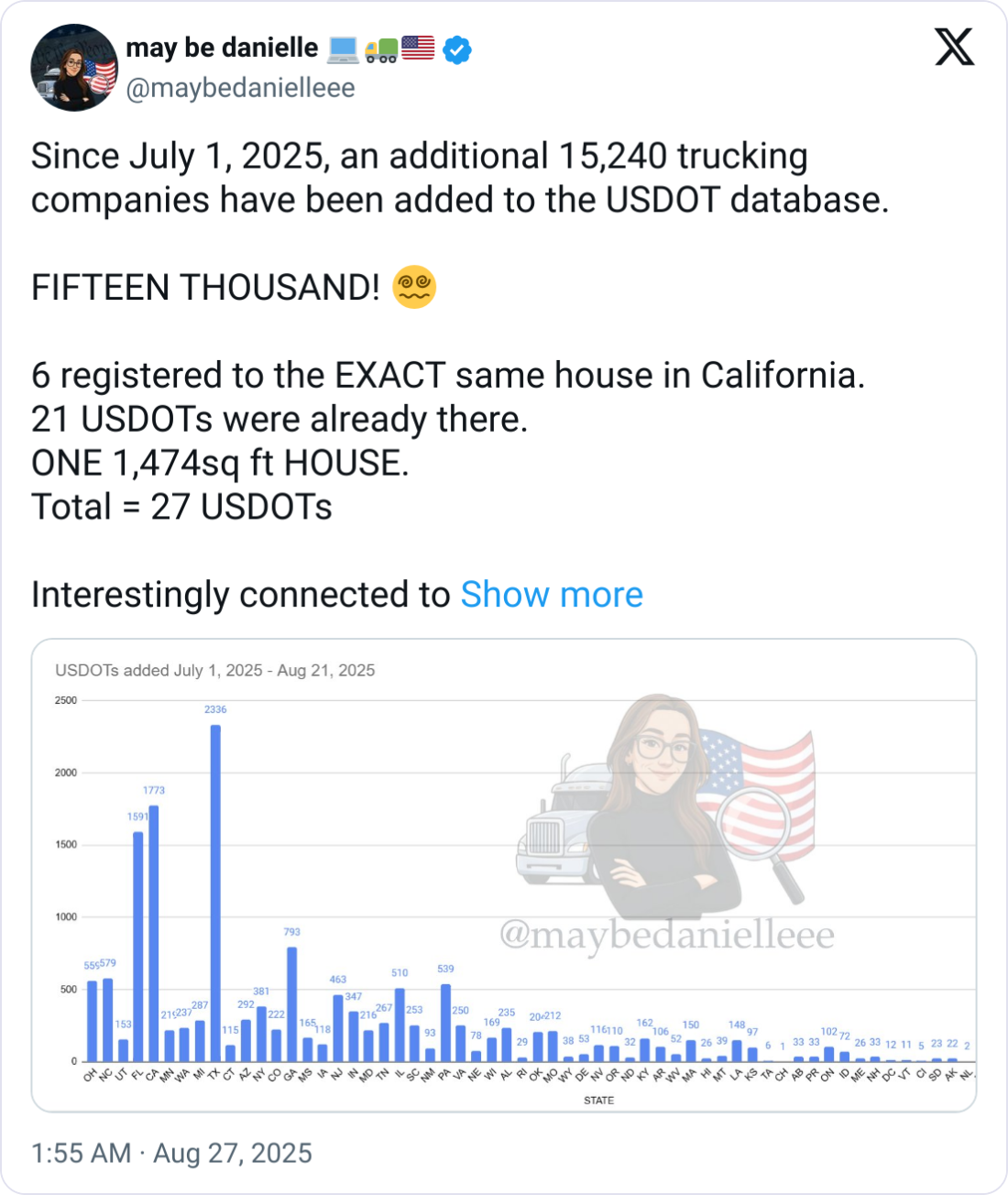

Danielle Chaffin’s latest discovery points to a troubling pattern hidden in plain sight: since July 1, more than 15,000 new trucking companies have been added to the USDOT registry—including dozens linked to the same residential address. The clustering of 27 USDOT numbers at a single 1,474 sq. ft. house in California raises serious questions about ongoing fraud, identity misuse,

Recent reporting reinforces what's behind that surge:

There is a lot more to the story, so it's best to have a look at Danielle's research on this matter, it is rather alarming.

Danielle’s findings have uncovered a disturbing freight fraud trend, bulk USDOT registrations at single addresses raise red flags, especially as fraudsters often buy and manipulate carrier identities. FMCSA’s overhaul aims to counteract this, but the sheer scale of new registrations, especially clustered ones, shows the urgency and sophistication of these schemes.

If you would love even further insight from Danielle, last week we interviewed her on Freight Gong Friday, where we talked about the Florid U-turn crash and the tough debates it has raised in freight, from driver training and carrier liability to immigration and safety standards.

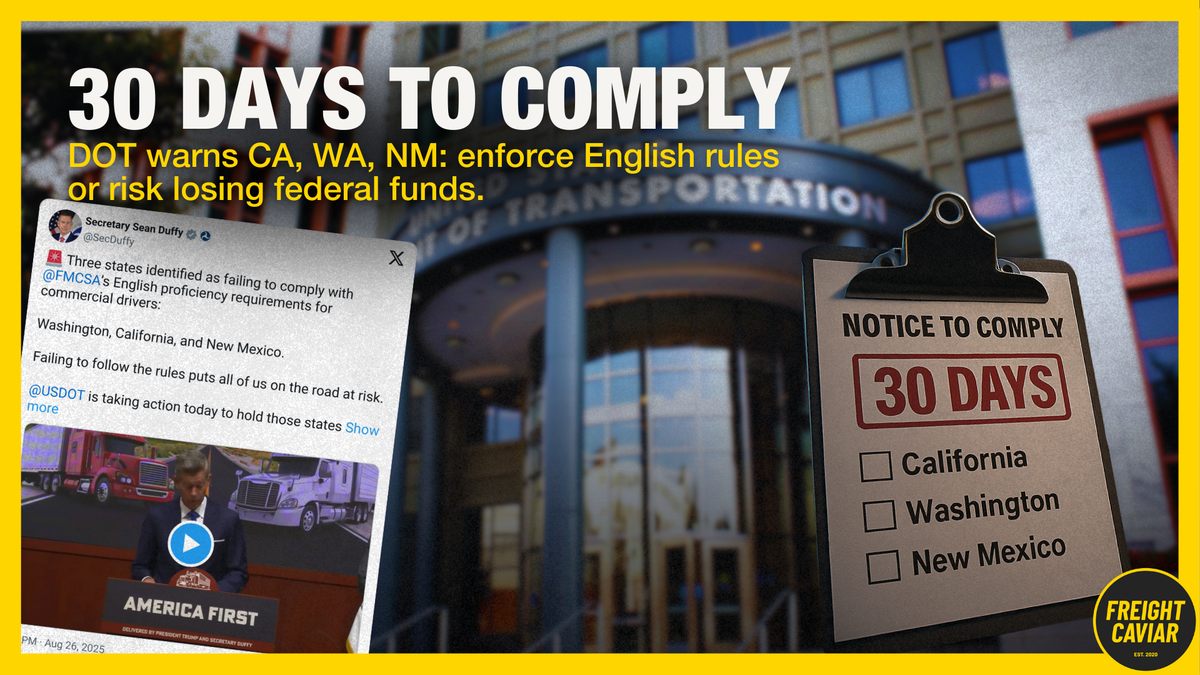

The FreightCaviar Feature of the Week spotlights escalating tensions between the U.S. Department of Transportation and three states: California, Washington, and New Mexico, over enforcement of English Language Proficiency (ELP) requirements for truck drivers. Following recent high-profile crashes and licensing controversies, USDOT is threatening to withhold up to $50 million in federal safety funding if the states fail to demonstrate compliance within 30 days.

Florida, meanwhile, is taking a more aggressive stance, turning weigh stations into de facto immigration checkpoints, drawing both support and backlash. Industry voices, including OOIDA, stress the safety necessity of basic English skills, but the debate risks drifting into concerns about discrimination and enforcement overreach.

This story continues to stir controversy, particularly as it intersects with wider conversations around immigration, enforcement, and trucking’s labor pool.

Read the full feature to explore how regulators, states, and the industry are responding.

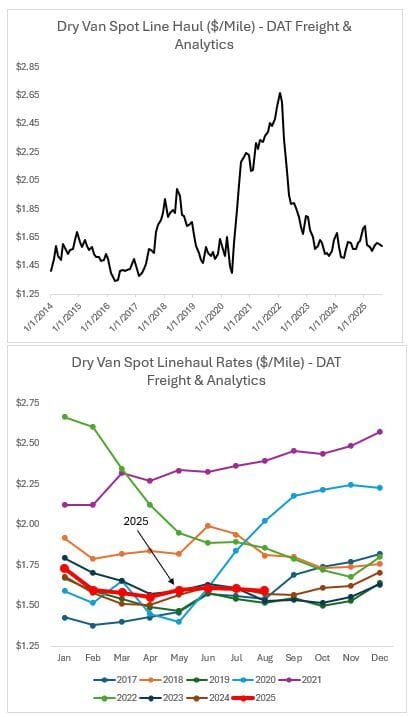

In a recent LinkedIn post, Michigan State’s Jason Miller took aim at what he called the “capacity cliff crowd”, those who predicted that stricter English Language Proficiency (ELP) enforcement would drive spot rates up by pulling thousands of drivers off the road. So far, the data says otherwise.

Miller pointed to DAT’s dry van spot linehaul rates, which have remained flat through August, showing no signs of a capacity squeeze. "2025 looks like 2024," he noted, reinforcing his long-held view that bull markets are driven by demand, not minor supply-side shocks.

The post sparked discussion among industry professionals:

For now, Miller’s argument appears to be holding: regulatory enforcement alone hasn’t been enough to move rates or tighten capacity. Whether that changes with increased audits remains to be seen.

Levity automates high-volume email and phone tasks like quoting, load building, and track & trace, without black-box agents or risky AI experiments.

Designed for teams that need control, transparency, and results they can trust.

🎣 THE FREIGHT CAVIAR CORNER

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).