🎣 RFX and R&R Express Sued

Plus: ELP enforcement isn’t sticking, Amazon eyes LTL, FMCSA warns of phishing scam

Plus, China-built ship fees are in, Freight X goes viral, sweeping layoffs from Volvo Group, and more.

Good Monday morning. It's earnings season, and the numbers are rolling in. From J.B. Hunt’s intermodal shake-up to Marten’s struggle with rising costs, we're breaking down the latest Q1 2025 freight results.

Plus:

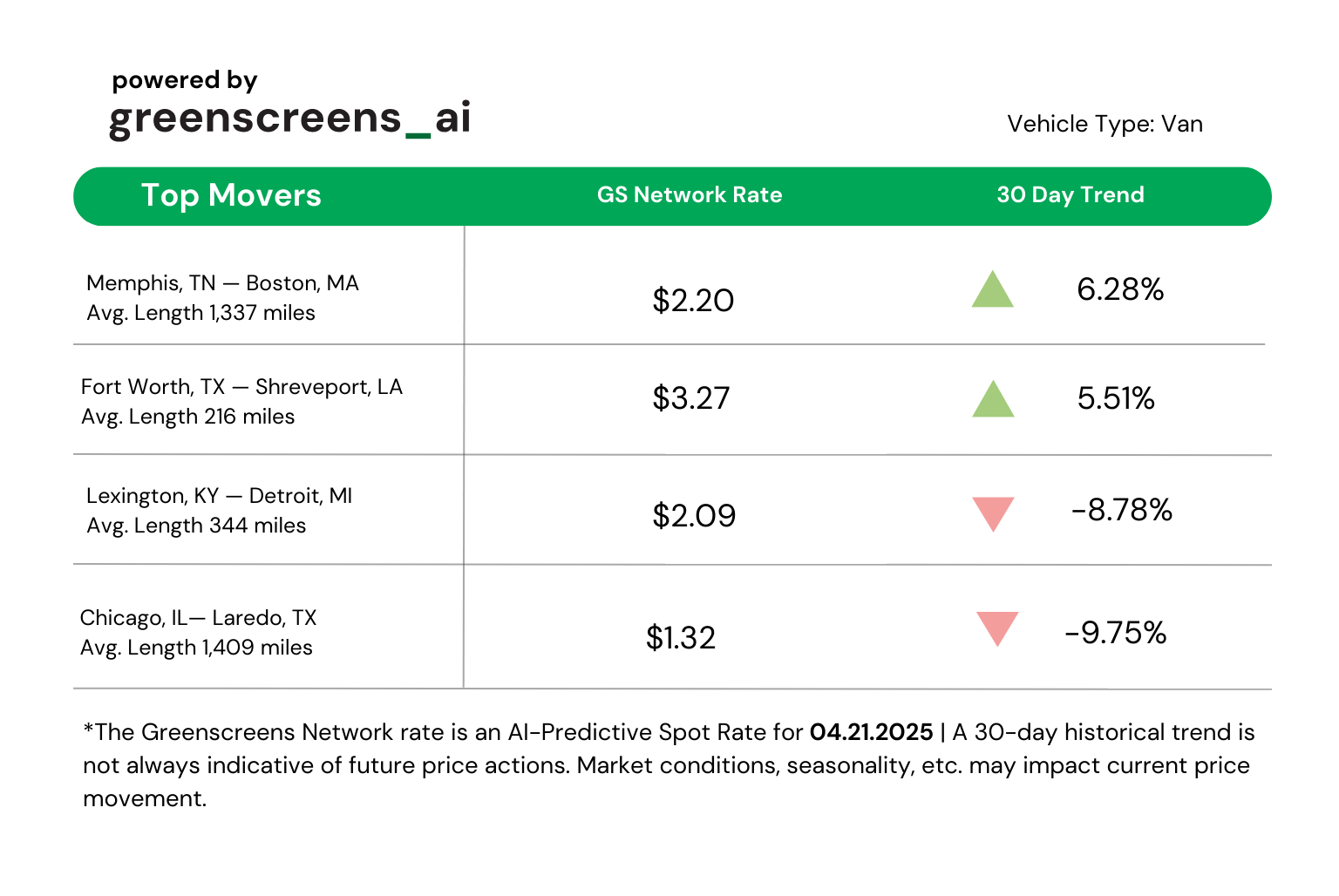

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

🐔 WHAT’S COOKIN’ IN FREIGHT

🚢 U.S. Announces Fees for Chinese-Made Ships. The Trump administration has announced phased fees on Chinese-built ships docking at U.S. ports, following a bipartisan investigation that found China’s dominance, accounting for up to 80% of global shipbuilding, harms U.S. commerce. Fees, reaching up to $1.5 million per voyage, aim to revive domestic shipbuilding and reduce supply chain vulnerabilities. Vessel owners can delay or avoid fees by ordering U.S.-built ships. Exemptions apply to bulk goods, empty vessels, and certain routes. While China has condemned the move, U.S. trade officials argue it signals a commitment to economic security and fair competition in maritime industries.

🧨 Freight X Goes Viral: Fuller vs. Reddit. Over the weekend, some of Craig Fuller’s tweets have been reposted—including one of our own—sparking debates on the current conditions within the freight industry. Some are saying COVID was a better time than now, while others are questioning Trump’s decisions so far, some of which Fuller disapproves of. A user called Fuller out, saying, “Craig is a MAGA guy.” But Fuller pushed back, saying, “I was never MAGA. I did vote for Trump in the last election (not in 2020 or 2016). I thought he would follow a similar playbook to his first administration, but we are getting a more unhinged version.” One Redditor added that Trump’s first term had “checks and balances,” but now, with GOP control of Congress, the freight industry is experiencing the “full Trump experience.” Some say things are sinking. Others say it’s too soon to tell. What’s your take on the current state of freight?

😔 Tariffs, Uncertainty Force Mack Trucks to Cut 450 Jobs. Mack Trucks, part of Volvo Group, will lay off up to 450 workers across its Pennsylvania and Maryland plants, citing market uncertainty and tariffs. The Lehigh Valley facility in Pennsylvania will lose 250–350 jobs within 90 days, while the Hagerstown, Maryland, plant will cut 50–100 positions by May 2, following earlier layoffs. Volvo announced a total of up to 800 layoffs. Company officials blame weak demand for Class 8 trucks, supply chain issues, and global trade tensions. Pennsylvania Rep. Josh Siegel criticized the tariffs, calling them harmful to U.S. industry, saying workers “are being sacrificed at the altar of political theater.” Mack, owned by Volvo Group, remains hopeful production will rebound when the market stabilizes.

Looking for ways to reduce costs of back office operations like invoice processing or load and dispatch planning? Or you need IT experts to improve your systems?

Experience the perfect blend of European work ethic and cost-efficiency, tailored for American transportation companies. Optimize your team, reduce expenses by 45% and more, and drive your logistics business forward with AmeriPol's innovative outsourcing solutions.

A string of Q1 2025 earnings dropped last week, and here's what we're seeing.

One of the largest transportation and logistics companies in North America.

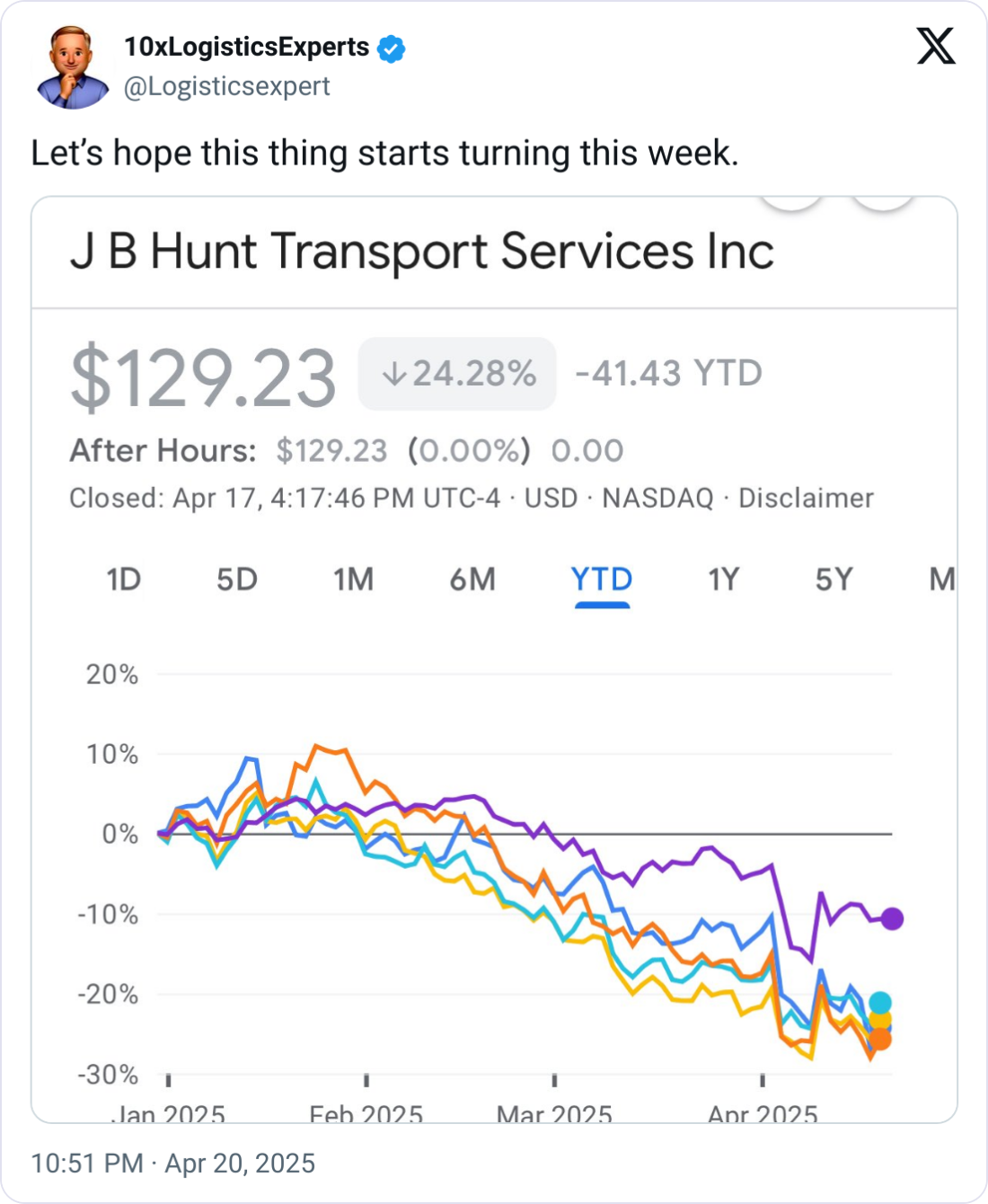

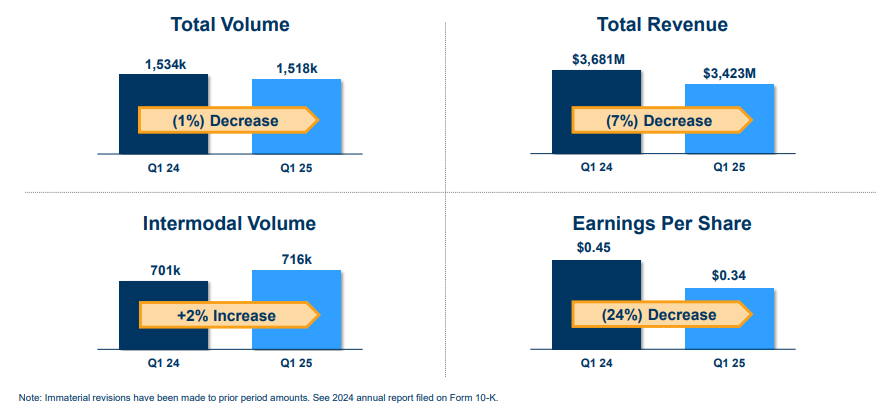

J.B. Hunt (JBHT) reported Q1 earnings of $1.22 per share, down from $1.89 last year, beating expectations.

“Lower insurance and claims expense, lower personnel counts, and fewer cargo claims helped us partially offset weaker yields across most of our segments.” – CFO John Kuhlow

Truckload: Revenue fell 7%, but operating income jumped 66% to $2M, helped by better trailer utilization.

Intermodal: Intermodal revenue fell 11%, driven by lower bid season pricing and equipment imbalances.

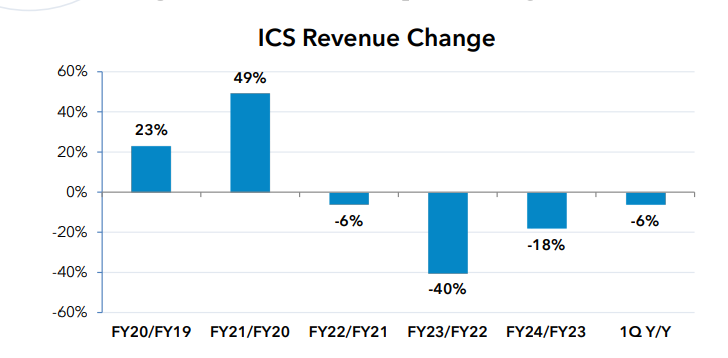

Brokerage:

A national truckload carrier specializing in temperature-sensitive freight.

Q1 2025 was Marten Transport’s sixth straight quarter of year-over-year profit decline, and this time, the outlook was especially grim.

The company’s operating ratio (OR), a measure of cost efficiency, deteriorated across all segments:

He added that the company is trying to weather the storm by playing the long game:

“We remain focused on minimizing the freight market’s impact — and now the impact of the U.S. and global economies with the current trade policy volatility — while investing in and positioning our operations to capitalize on profitable organic growth opportunities.”

What spooked some observers was Marten’s explicit mention of tariff-driven volatility. The freight giant, typically focused on contract freight and premium service, appears rattled by macro factors.

A leading U.S.-based freight railroad company.

CSX's earnings showed how network congestion and crew shortages are still throttling rail freight performance.

CEO Joe Hinrichs:

“We are taking targeted actions to address the network constraints posed by two major ongoing infrastructure projects.”

A financial services firm focused on the freight industry, and the parent company of TriumphPay.

Triumph posted a $0.8M net loss, citing heavy investment costs in new products like LoadPay, as well as Greenscreens.ai acquisition expenses.

CEO Aaron Graft said:

"We will not blame the freight market and trade policy for our results, nor will we let them dissuade us from our strategic vision,”

Prologis, the world's largest industrial real estate investment trust (REIT), stuck with its bullish 2025 forecast despite growing retailer caution and tariff risk.

CFO Tim Arndt:

“Let’s be clear: The range of outcomes is wide. We see potential for a recession, inflation or possibly both. And let’s also not dismiss the potential for a quick resolution.”

Bottom Line: No sugarcoating Q1. Higher costs, shaky demand, and tariff anxiety hit carriers and railroads alike. Most leaders are playing defense and watching Q2 closely.

Brokers can utilize customizable working capital solutions from OTR Solutions to bridge the gap between carrier and customer pay dates. Beyond the cash flow advantages, utilizing working capital solutions also drives increased revenue due to Quick Pay adoption – as high as 12% when combined with Epay Manager.

OTR Solutions is a trucking technology and freight factoring company that was founded in 2011. In 2024 OTR acquired Epay Manager, a back-office automation and carrier payments platform which is revolutionizing broker back-offices with its proactive invoicing workflow.

🌎 AROUND THE FREIGHT WEB

⭐ Aurora’s Review. Aurora invited four Hirschbach drivers to take a ride in their self-driving Aurora Driver-powered trucks. Here's what these million+ milers had to say.

📦 FitzMark Completes Acquisitions. FitzMark has finished its acquisition of logistics firms High Point and PENTONIX Freight. FitzMark Founder and CEO Scott Fitzgerald aims to maintain the company’s “sterling track record” of providing refrigerated, LTL, and managed transportation services.

🚨 Cocaine Bust. CBP officers discovered two duffel bags and four boxes containing 339 pounds of cocaine hidden in a Canada-bound truck at the Ambassador Bridge in Detroit. The truck has been seized, and the driver is facing federal charges.

🏗️ Hyundai, POSCO Teaming Up. Hyundai and POSCO signed a memorandum of understanding to build a U.S.-based steel plant. This comes after Hyundai announced plans to invest $21 billion in the United States last month.

🚗 Toll Moves Ahead. Despite the Trump administration’s Easter Sunday ultimatum, New York's controversial congestion toll plan for Manhattan drivers remains in place and is moving forward. DOT has stated they will “not hesitate” to use every tool at their disposal if the state doesn’t stop the toll.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).