🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

Plus: Activist investors push for another rail merger, Florida's U-turn crash sparks tighter driver scrutiny from shippers, the top 10 freight brokerages flex their market grip, and more.

Good Monday morning. We're decoding retailer earnings and commentary in today's feature. Consumers are pulling back, inventories are shrinking, and tariff tremors are beginning to take hold. Here's what it means for freight.

Plus,

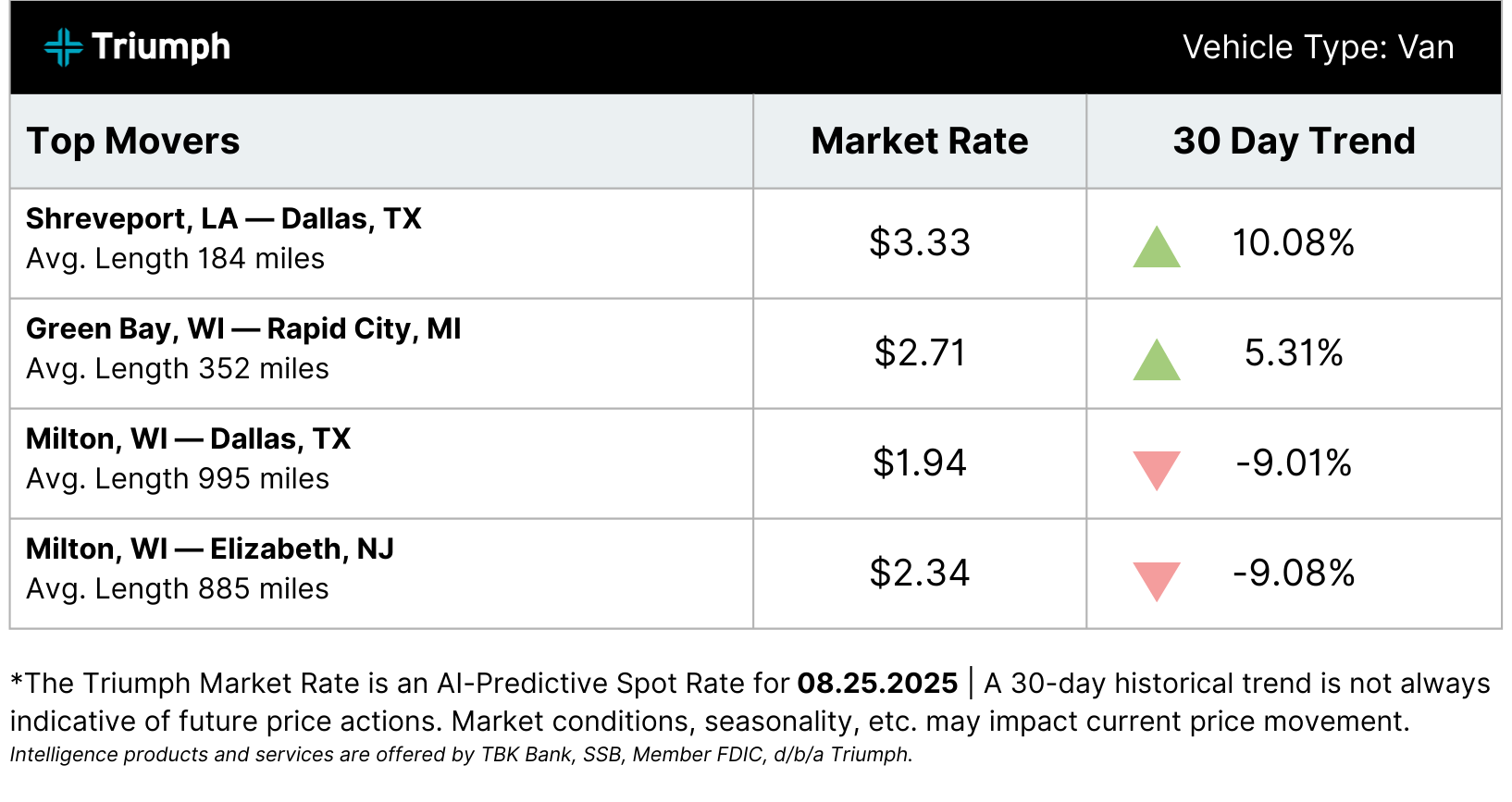

TOP LANE MOVERS POWERED BY TRIUMPH

🚂 Another Rail Merger In The Works? CSX is under pressure from activist investors Toms Capital and Ancora Holdings to pursue consolidation after Union Pacific’s $71.5 billion Norfolk Southern acquisition. Ancora blasted CEO Joe Hinrichs for “anemic shareholder returns” and warned of a proxy fight. Speculation is mounting over a possible BNSF–CSX merger that could create a $200 billion coast-to-coast network. At the same time, CSX and BNSF announced new intermodal services linking Southern California with Charlotte and Jacksonville, Phoenix with Atlanta, and the Port of NY/NJ with Kansas City. With regulators signaling openness to mergers, CSX’s role in the next phase of rail consolidation is pivotal.

🚨 Florida U-Turn Crash Fallout Spurs Tighter Driver Vetting. The August 12 Florida Turnpike crash that killed three now includes the arrest of the driver’s brother, Harneet Singh, who DHS confirmed had previously been released by Border Patrol. Both men remain in federal custody. Industry reactions are surfacing quickly: FreightCaviar subscribers report brokers and shippers are requiring CDL submissions before dispatch, VIN and license uploads on load boards, and stricter identity checks. One commenter said a broker even asked if their driver was a “U.S.-born citizen.” While unverified, the reports suggest a faster-than-expected shift toward tighter vetting as companies look to limit liability due to heightened federal and public scrutiny.

🥇 Top 10 3PLs Dominate as Industry Faces 2025 Headwinds. Armstrong & Associates’ latest ranking shows C.H. Robinson leading U.S. domestic transportation management with $13 billion in revenue, followed by J.B. Hunt ($8 billion) and TQL ($6.8 billion). But 3PLs face ongoing challenges: two years of weak demand and excess capacity have kept rates soft, while shippers continue pushing for cost savings. Tariff volatility, complex technology integration, urban congestion, and tight labor pools further pressure margins. Still, opportunities exist in intermodal growth, AI-driven efficiencies, reverse logistics, and consolidation. Success in 2025 will hinge on how well providers adapt, balancing cost discipline with digital tools to meet shippers’ shifting needs.

Introducing the Trusted Freight Exchange (TFX)

Highway launched today the Trusted Freight Exchange (TFX), the industry’s first secure digital freight exchange, built exclusively for vetted brokers and verified carriers.

At the core of TFX is Highway’s identity engine and powered by Triumph’s market rating, intelligence, payment, and credit capabilities. Together, they embed identity verification, compliance, pricing, and payments in a single platform. The result is a new era of trust, control, and speed for modern freight transactions.

TFX delivers a purpose-built ecosystem where:

Click here to learn more about the Trusted Freight Exchange.

Three Fast Stats

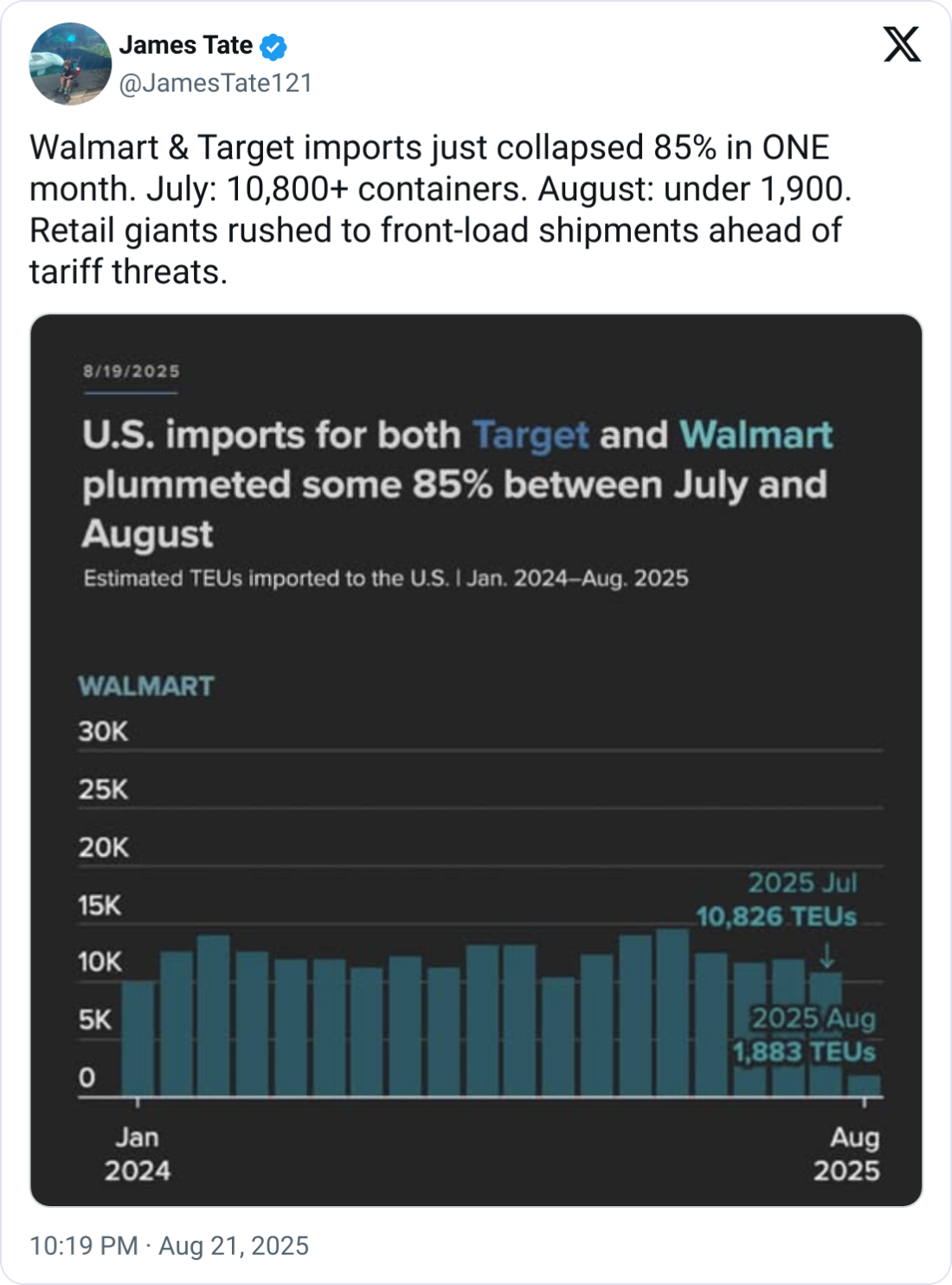

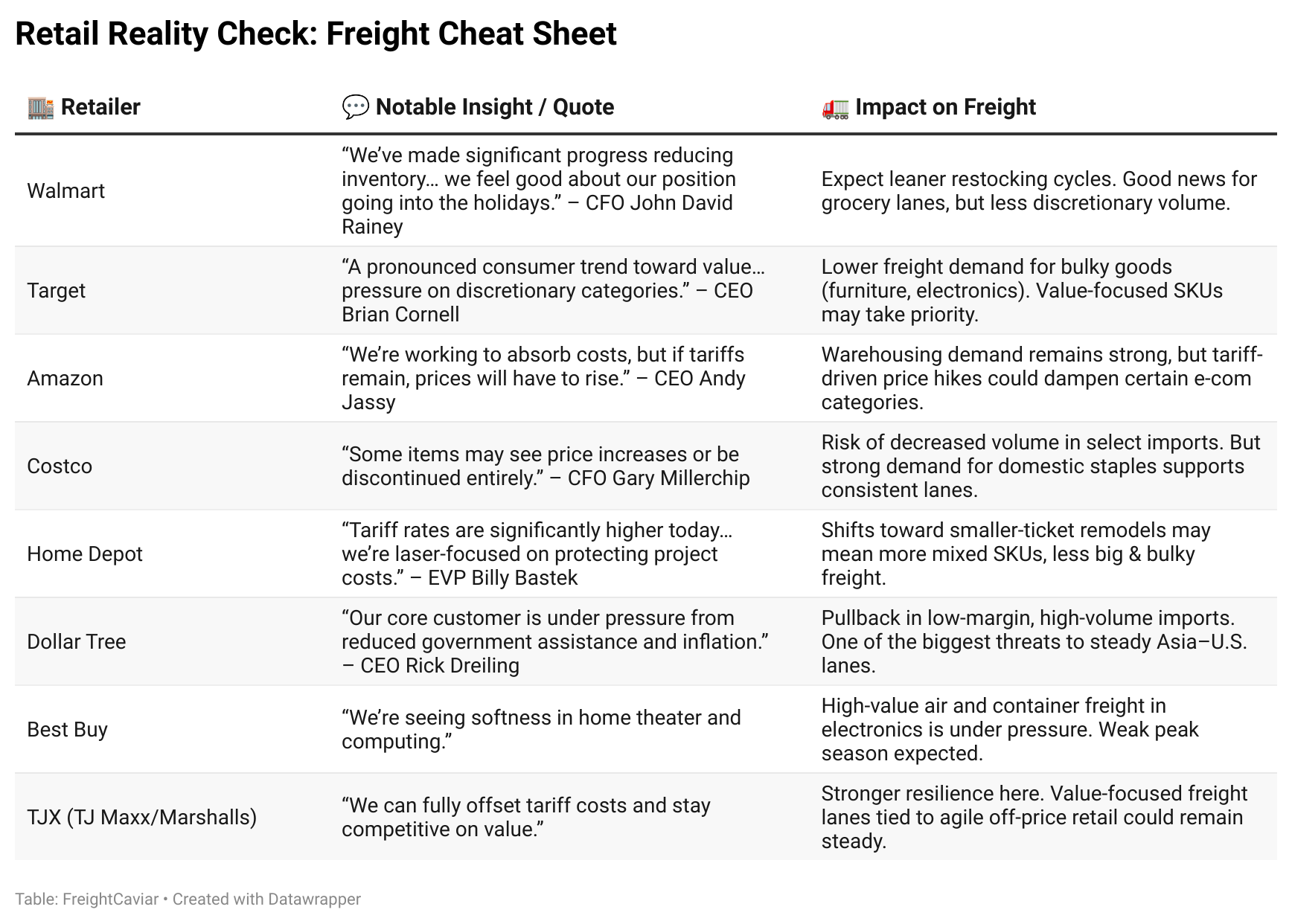

The smoke has cleared from Q2 earnings season. Retailers are warning: consumer demand is cooling, inventories are being surgically trimmed, and freight is directly in the crosshairs. Here's what the major players had to say.

"We are seeing a pronounced consumer trend toward value… with pressure on discretionary categories.” —Brian Cornell, CEO, Target

The Freight Impact: This hits high-margin, bulky freight like electronics, furniture, and home goods. Expect lower import volumes and a muted peak season in these verticals.

“We made significant progress getting inventory down… we’re better positioned for the holidays.” —John David Rainey, CFO, Walmart

“Our customers are feeling the impact of reduced government assistance and higher costs.” —Rick Dreiling, CEO, Dollar Tree

The Freight Impact: These chains move massive volumes of low-cost Asian imports. Weakness here = lower container throughput and LTL loads.

The Freight Impact: Consumer packaged goods (CPG) and reefer lanes are holding strong. If you're moving essentials, Q4 will bring opportunity, even if overall volumes soften.

The consensus from the retail giants is clear: peak season 2025 will not be a blowout. It will be a battle for efficiency. Retailers have spoken: volume will be cautious, lead times shorter, and opportunity strongest in essential goods, not big-ticket items.

Running a successful trucking operation means doing more with less, and CtrlChain makes that possible. With automated systems, carriers can take on more freight without adding staff, scaling volume while keeping overhead low.

🏗️ Pallet Expands Reach. Pallet CEO Sushanth Raman announced the company’s first national TV commercial, three new customers in a day, and CoPallet’s Deep Reasoning AI, designed to manage complex, multi-step logistics workflows.

💰 Oway’s Funding. Oway secured $4 million in funding for its AI-enabled “rideshare freight platform.” The startup aims to match loads with underutilized trucks, improving efficiency in emerging markets.

🏭 Border Job Losses. Mexico’s maquiladoras are shedding jobs as U.S. tariffs bite and wages rise. Trade delegate Marcelo Vázquez warned of a “worrying situation,” with factories squeezed between tariff costs and labor pressures.

🚨 Driver Exploitation Exposed. Canadian Trucking Insider revealed corrupt firms charge immigrants from India up to $40,000 for U.S. driving jobs, exposing a black-market labor pipeline tied to visa exploitation.

📉 Rates Fall Back. Trans-Pacific container spot rates dropped to pre–Red Sea crisis levels, signaling easing supply chain pressures. Analysts are warning that the weaker peak season demand may pressure carriers into new rate wars.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).