🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

Happy Friday. With Schneider National posting a weak Q4 earnings report, how will they respond in 2026?

Plus:

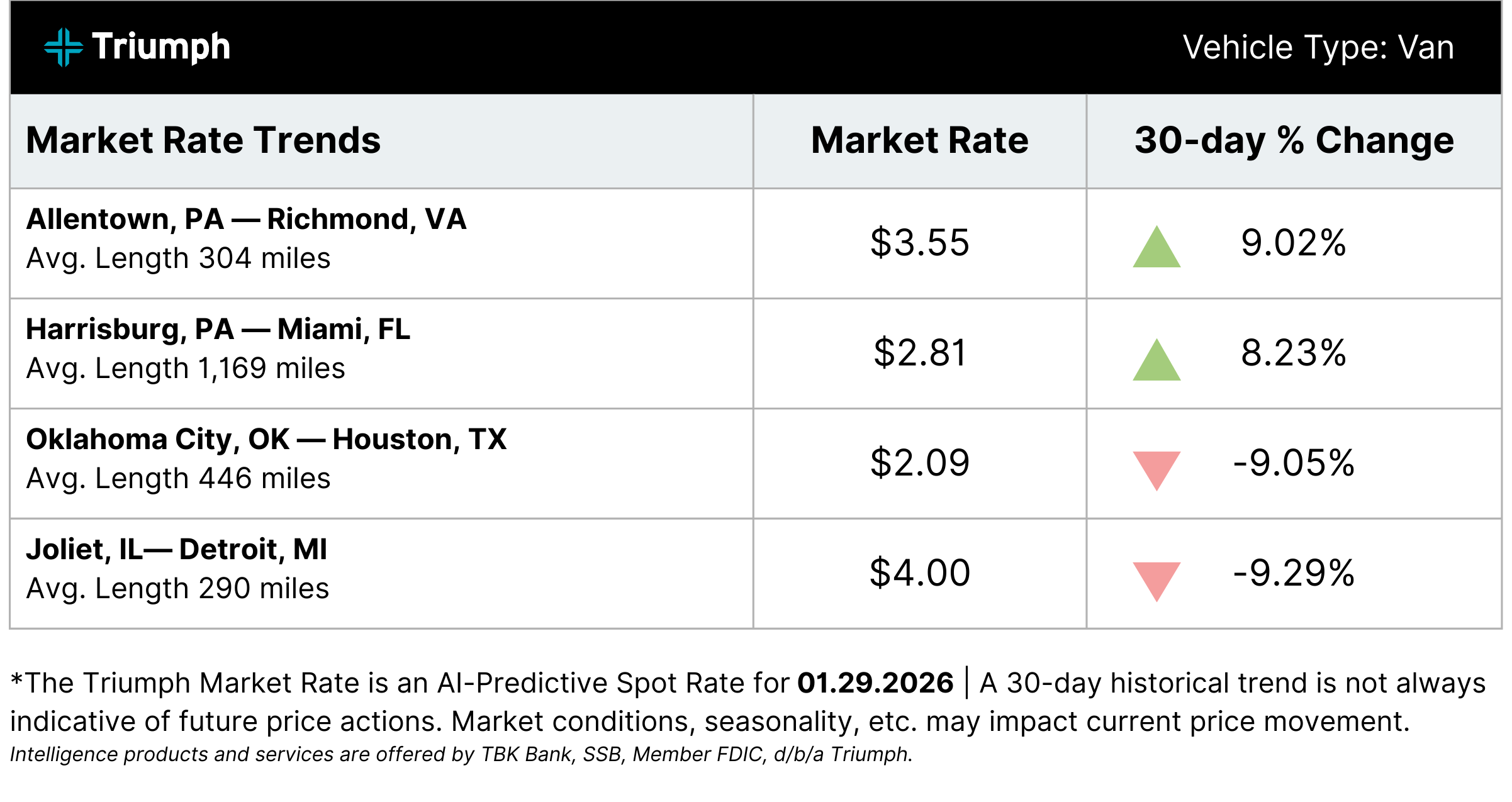

TOP LANE MOVERS POWERED BY TRIUMPH

🍳 What's Cookin' In Freight

😔 AGX Freight Suspends Operations. Florida-based AGX Freight Group has indefinitely suspended operations, citing a dispute with a senior secured lender that blocked access to working capital. President Mike Williams said the company “is not in default” and that the issue is “not liquidity — it is accessibility.” All operations are expected to cease by Jan. 31. Fraud risks followed quickly: Dale Prax, Founder of FreightValidate, warned that scammers began impersonating AGX within 24 hours, urging carriers to reject AGX-related loads and verify all communications.

🤖 Gatik Goes Fully Driverless. Gatik became the first U.S. company to operate fully driverless trucks at a commercial scale, running daily freight deliveries with no driver or safety observer on public roads. The company has logged 60,000 driverless orders without incident since mid-2025 and secured more than $600 million in contracted revenue from Fortune 50 retailers. CEO Gautam Narang said autonomous trucking “is no longer a promise. It’s a business,” as Gatik operates 24/7 routes across Texas, Arizona, and Arkansas and prepares to expand further.

🤝 Werner Buys FirstFleet. Werner Enterprises acquired FirstFleet for $282.8 million in an all-cash deal, adding about 2,400 tractors and 11 properties. The acquisition lifts Werner’s dedicated fleet to nearly 7,400 trucks and boosts dedicated revenue by roughly 50%. CEO Derek Leathers called the timing “ideal,” citing FirstFleet’s four decades of profitable growth and $615 million in annual revenue. Co-owner Paul Wilson said the deal strengthens long-term customer value.

Rapido is a top nearshore staffing company providing logistics and supply chain talent to companies in the United States. Based in Guadalajara, Mexico, Rapido offers a unique combination of cost savings and access to a skilled workforce, making it an attractive option for American logistics businesses.

See what makes nearshoring to Mexico an attractive option for scaling a logistics company and how partnering with Rapido Solutions Group simplifies the whole process.

Schneider National’s fourth-quarter earnings captured the freight market’s late-2025 dynamic in real time.

Capacity tightened. Costs rose faster than revenue. Visibility into 2026 stayed limited.

The market reacted accordingly.

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).