🎣 C.H. Robinson

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

Plus: Trucker charged in deadly CA crash, AI deepfakes fuel a surge in freight fraud, shippers stretch payment terms as rates start to shift, and more.

Good morning. Carriers are cashing out and selling their USDOT numbers to scammers for quick cash. We sat down with GenLogs CEO Ryan Joyce to unpack how that fuels freight fraud.

Plus:

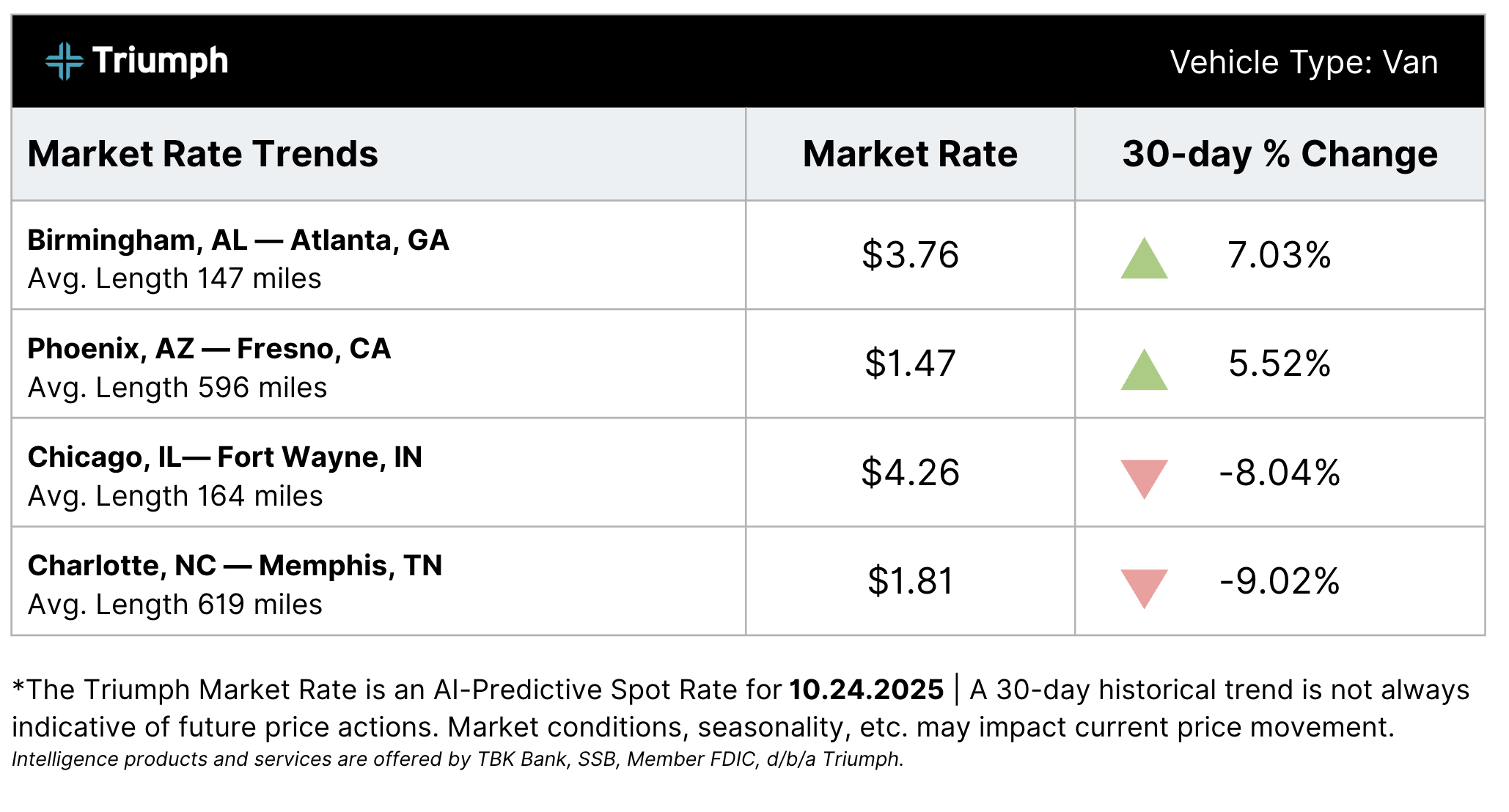

TOP LANE MOVERS POWERED BY TRIUMPH

🚨 21-Year-Old Trucker Charged in Fatal California Crash. Prosecutors charged Jashanpreet Singh, 21, with vehicular manslaughter and DUI after a crash on California’s I-10 that killed three people and injured several others. Investigators say Singh, driving a semi-truck at high speed, failed to brake before plowing into stopped traffic, triggering an eight-vehicle pileup. Federal officials confirmed Singh entered the U.S. illegally in 2022, but later received employment authorization and a CDL. San Bernardino County DA Jason Anderson called the incident “a heinous tragedy that was easily avoidable.” Singh is due to be arraigned on all charges Oct. 24, without bail.

🤖 AI Deepfakes Fuel Freight Crime Wave. Cargo ramps up as criminals deploy AI deepfakes, fake carrier profiles, and social engineering to execute digital heists. Overhaul reports thefts jumped 33% year-over-year in Q2, with California, Texas, and Tennessee leading incidents. Thieves use AI-generated voices to impersonate dispatchers and brokers, while stolen goods are resold through Facebook Marketplace and TikTok Shop. Overhaul’s Danny Ramon calls it a “criminal direct-to-consumer pipeline.” With fraud tactics growing more advanced, education and real-time verification will be the industry’s best defense heading into the holiday season.

💸 Shippers Delay Payments as Market Tightens. Factoring companies are feeling pressure as shippers extend payment terms up to 120 days, Phoenix Capital CEO Bryan Alsobrooks said at FreightWaves’ F3 conference. The slowdown is squeezing cash flow and pushing factoring costs higher, eroding carrier and broker margins already under strain. Meanwhile, Kevin Nolan of Sope Creek noted early 2026 bid data shows large asset-based carriers pricing higher while brokers quote entire RFPs, a sign the market could be nearing a tipping point. Shippers cite expected boosts from tax cuts, tariff relief, and tighter enforcement, hinting at a potential rebound in carrier pricing power.

Running a successful trucking operation means doing more with less, and CtrlChain makes that possible. With automated systems, carriers can take on more freight without adding staff, scaling volume while keeping overhead low.

Every tool works together to make operations leaner, smarter, and more profitable. Let’s build a future where freight moves efficiently and carriers operate with confidence.

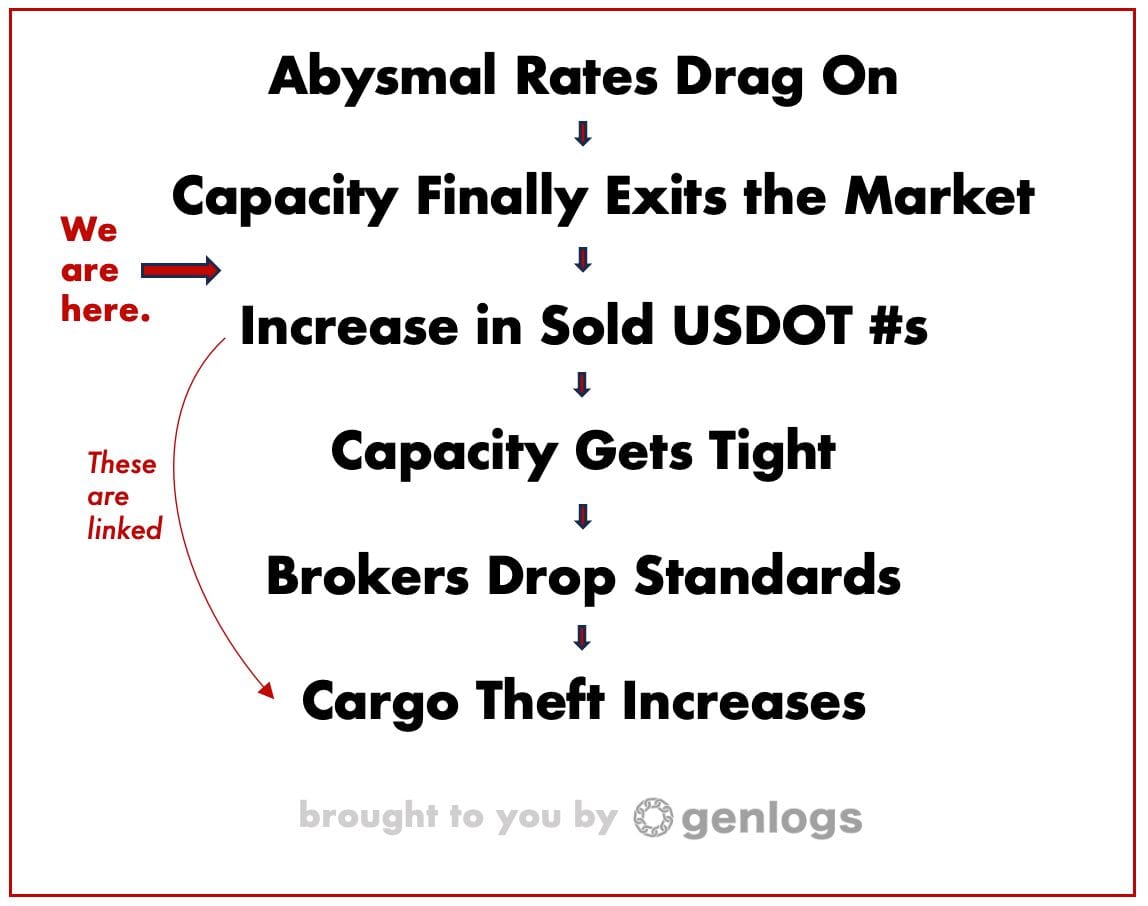

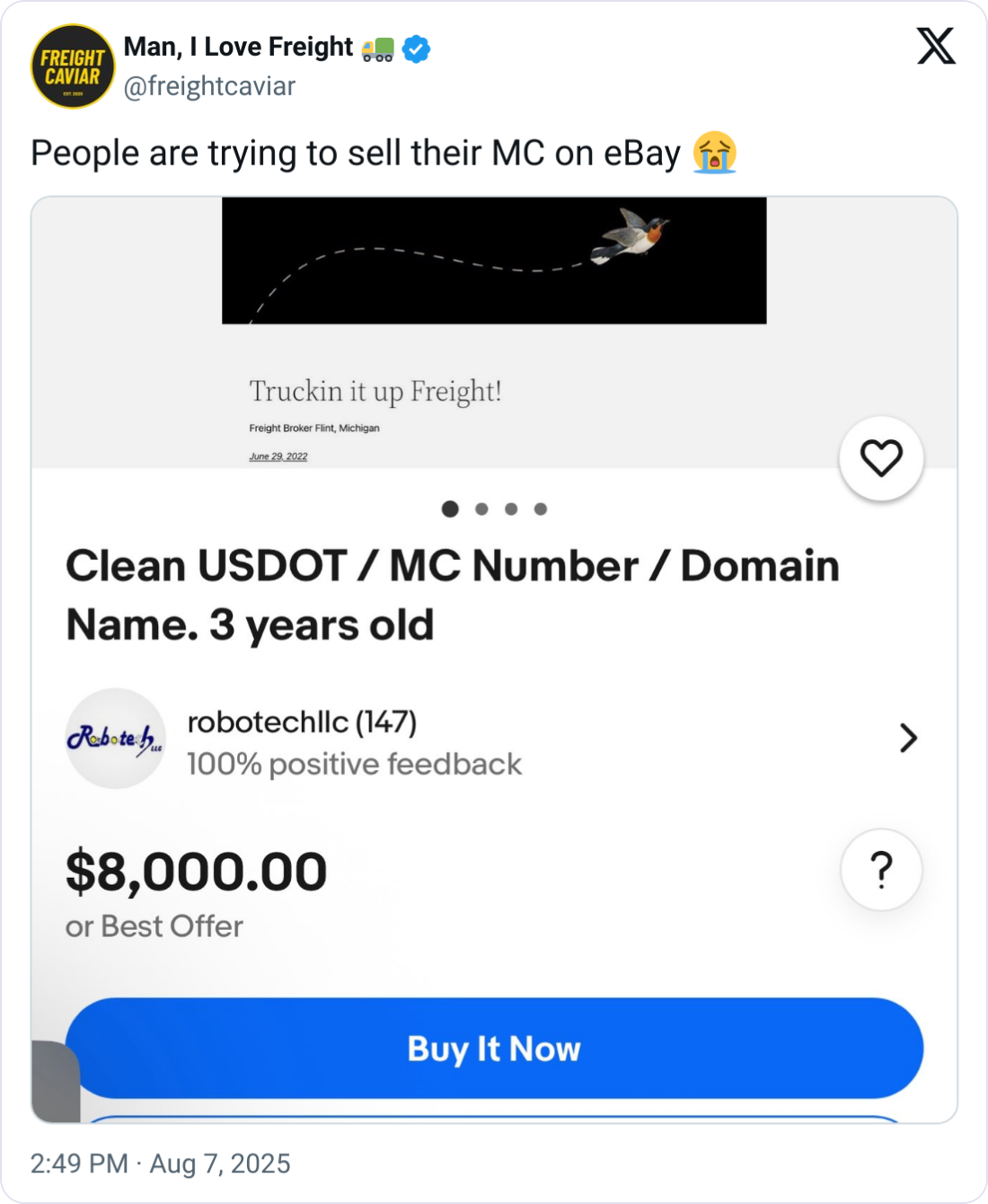

Carriers are bailing out of the market, and some are cashing out in a way that’s fueling a new wave of cargo theft.

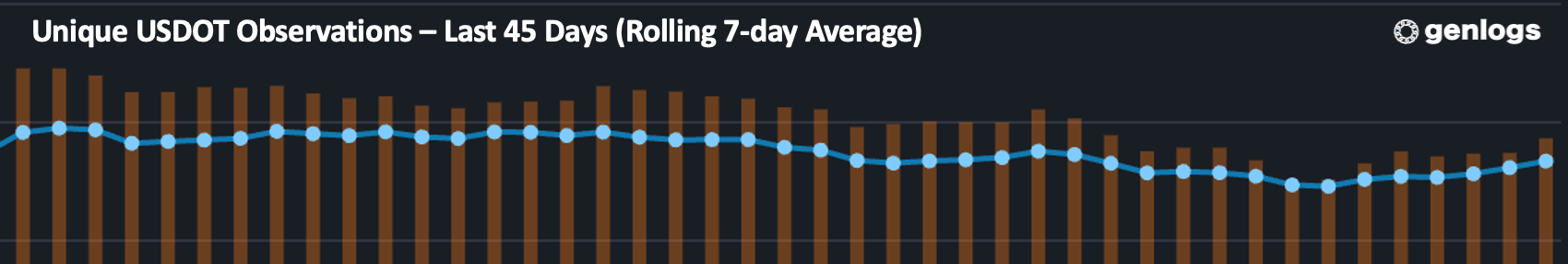

GenLogs CEO Ryan Joyce says his team has tracked a -6.7% drop in unique USDOTs and a -3% drop in unique trucks on U.S. roads since mid-September.

The real problem is what happens next: those USDOT numbers are getting sold to fraudsters on Facebook.

"After holding on for dear life for two years, carriers are starting to exit the market in higher numbers," Joyce told FreightCaviar. "They can make a last and quick $20K by selling their USDOT/MC numbers online. Some even hand over logins and bank account access."

In Facebook groups and Telegram chats, “clean” carrier identities are selling fast.

"In almost all cases we’ve investigated," Joyce said, "theft occurred when a bad actor used one of these recently sold USDOTs. On digital-only vetting platforms, they still look legitimate. But GenLogs had already seen their real operations stop on the roads."

From Sept. 10–Oct. 21, GenLogs observed a -6.7% drop in unique USDOTs and a -3% drop in active trucks.

That aligns with spot-rate spikes tracked by SONAR, some lanes up 42% week-over-week, even though freight demand hasn’t changed.

The company’s earlier research tied the exodus to what it calls a "Compliance Crunch," enforcement actions, ICE inspections, and shutdowns of Mexican carriers operating beyond legal zones.

"We’ve seen 972 Mexican carriers running deep inside the U.S.," Joyce said, "many violating OP-2 limits. Federal enforcement is tightening, which is squeezing supply further."

For now, brokers have relied on digital compliance tools. But Joyce warns those defenses are aging fast.

"Each week, brokers who used digital-only vetting platforms come to us after thefts," he said. "One customer had eight loads stolen in a single month. The thieves have figured out how to beat the system."

GenLogs’ upcoming Compliance Suite aims to change that by automatically checking whether a carrier:

“Thieves can’t create legitimate trucks out of thin air. GenLogs sees all,” Joyce added.

Joyce revealed that GenLogs has been quietly assisting California-based law enforcement on high-value cargo theft cases, including the ongoing Singh Organization investigation.

Investigators used GenLogs’ real-time camera network to track stolen trucks worth millions and secure federal indictments.

"There are more details that we can't share at this time, but other well-known cargo theft rings (some that FreightCaviar has even reported on before) were linked to this broader Singh Organization investigations," Joyce hinted.

Joyce doesn’t see relief coming soon.

"It’s going to get worse before it gets better,” he said. “As capacity tightens and rates rise, brokers will get desperate, and thieves will follow the money."

He expects fraud to rise, not fall, through early 2026.

Email hacks. GPS spoofing. Fake carrier networks.

"Fraud attempts are here to stay," he said. "For brokers not checking the USDOT's physical footprint in GenLogs, they are going to be the most vulnerable."

Want more insights from GenLogs? Check out their Webinar today!

FleetWorks is a AI agent for managing your carrier network.

Fred and Felice talk to carriers over phone, email, and text. They can:

FleetWorks frees broker time to help your customers and carriers with their toughest problems.

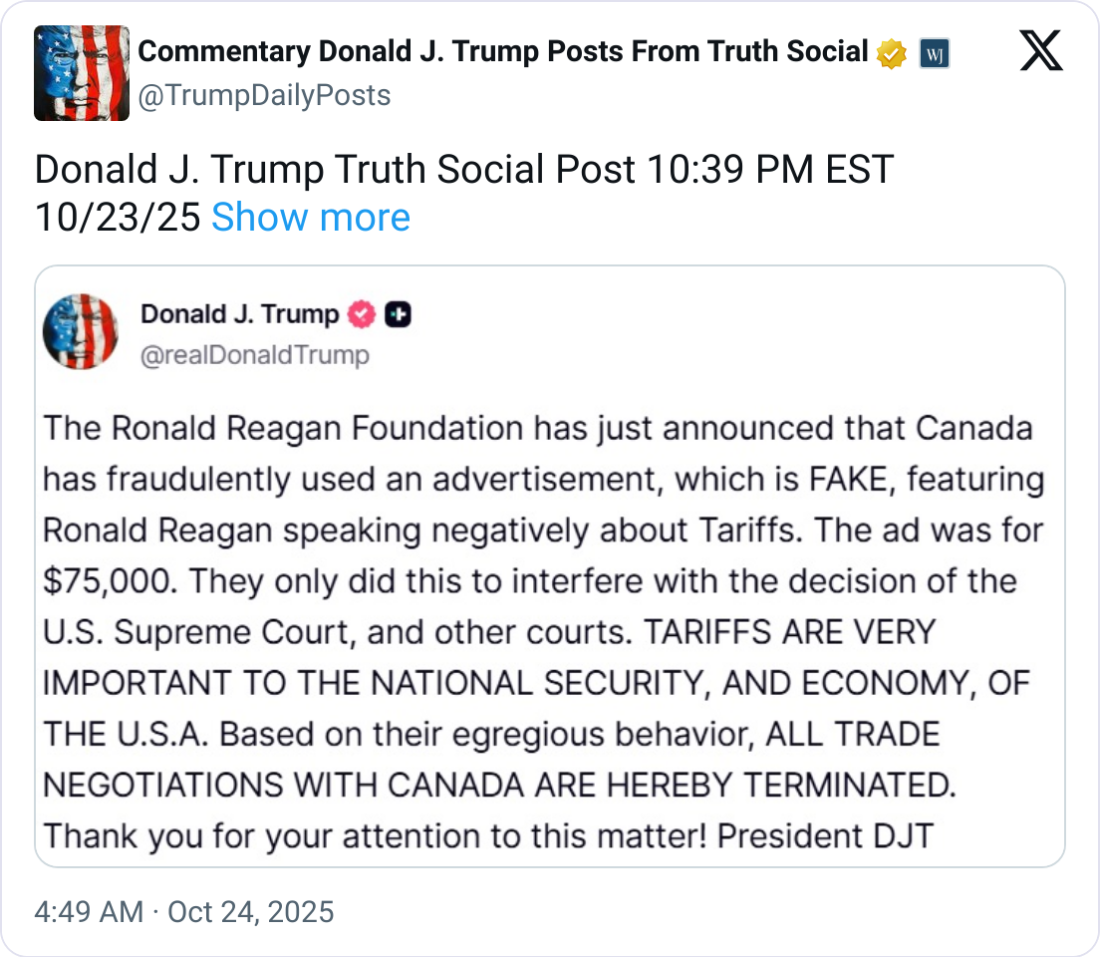

🇨🇦 Canada Trade Talks Terminated. Donald Trump announced on Oct 24 that he is ending all trade negotiations with Canada after a controversial Ontario ad used edited clips of Ronald Reagan to criticise U.S. tariffs.

📊 Shippers See Rate Shift. Early bid season feedback shows large carriers quoting 2026 rates well above brokers, signaling a market tipping point. Drivers cite tax cuts, tariff relief, and tighter enforcement as key factors.

🚔 Cargo Theft Ring Busted. Twelve individuals linked to the so-called “Singh Organization” were indicted in Southern California for using legitimate trucking firms to bid on contracts and divert high-value freight between March 2021 and June 2025, losses run into the millions.

🥩 Beef Prices Stay Elevated. U.S. cattle herds are at their smallest since the 1950s after drought-driven liquidation. High tariffs and limited imports keep supplies tight, leaving consumers facing record beef costs.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).