🎣 Honey, Hold My Beer

Here are the Top 500 fleets of 2026. Plus: Sierra snow shuts down I-80, rail targets truckload freight, and ocean rates fall.

Plus: holiday trucking shutdowns, a broker liability bill facing pushback, DOT threatening funding over failed CDL audits, and more in today’s newsletter.

We're Back. But is freight? Rates spiked, but freight still isn’t behaving like a recovery market. Today’s feature breaks down what’s really driving volatility, and what 2026 will actually reward.

Plus:

😔 Standard Forwarding Freight & Queen Transportation Shut Down. Two regional trucking companies abruptly halted operations during the holiday period, leaving hundreds of drivers uncertain about next steps. 91-year-old Standard Forwarding Freight announced it will temporarily suspend daily operations following a strategic review, impacting a fleet of roughly 302 trucks and 277 drivers. While the company framed the move as a pause, the Teamsters say management intends to fully shut down and are pursuing bargaining and possible legal action. Separately, Queen Transportation ceased operations over Christmas, terminating employees immediately. The carrier ran 89 trucks and remains listed as active in FMCSA records.

🏛 Broker Liability Bill Faces Pushback. A House bill introduced by Rep. John Moolenaar would fine freight brokers 10% of cargo value for using carriers with prior DOT violations and allow FMCSA penalties after fatal crashes. The proposal would fine brokers 10% of cargo value and allow FMCSA to impose added restrictions after fatal crashes. Attorney Matthew Leffler warns the bill is overly broad, treating minor paperwork issues like serious safety failures and raising costs without fixing root problems. Dale Prax, Founder of FreightValidate, notes the bill aligns with broker liability questions now before the Supreme Court, a sign that lawmakers see accountability gaps as courts, regulators, and Congress converge on broker responsibility.

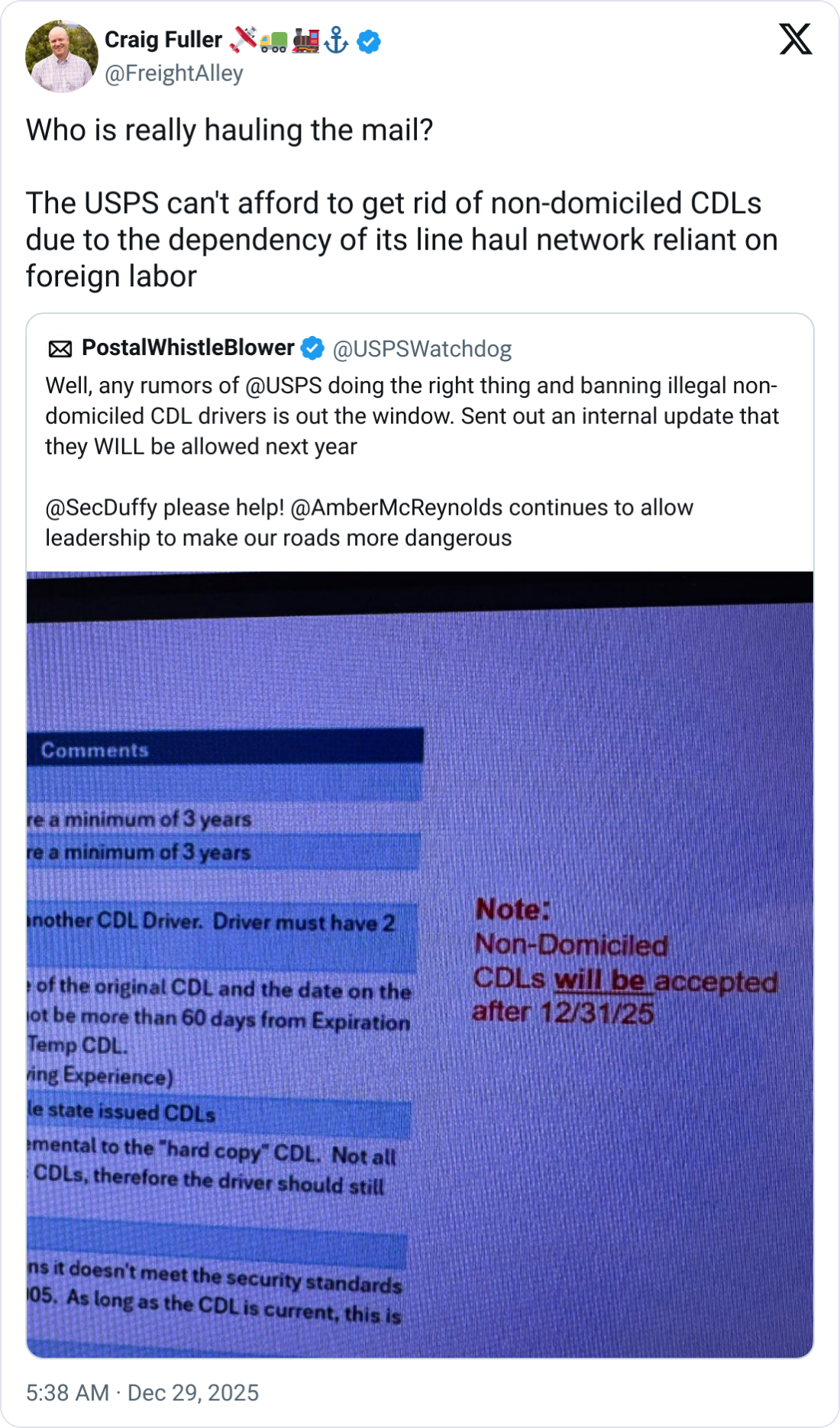

📝 DOT Threatens Funding Over CDL Audits. FMCSA and DOT are threatening to withhold millions in federal grants after 2025 audits found widespread noncompliance in non-domiciled CDL programs, including a 99.5% failure rate in Nevada. Transportation Secretary Sean Duffy said states must “get into compliance now or we’ll pull funding,” while FMCSA Administrator Derek Barrs said, “Compliance and safety is our goal.” Several states paused or ended CDL issuance as courts temporarily blocked enforcement of the interim federal rule. In California, the Sikh Coalition sued the DMV after nearly 20,000 non-domiciled CDLs were slated for cancellation, calling the actions “unlawful” and tied to paperwork errors.

Easily and automatically reach carriers every day, at any time, to make sure you find the right truck for your shipper at the best cost.

The Convoy Platform gives brokers advanced freight automation—covering vetting, booking, tracking, and payments—so you can hit your targets even while you sleep.

And the best part? No upfront costs, only pay once the load is delivered.

By now, you’ve probably read FreightCaviar’s 2026 Freight Market Predictions in our print magazine and online preview.

One theme keeps holding up: this isn’t a clean recovery cycle. It’s a selective one.

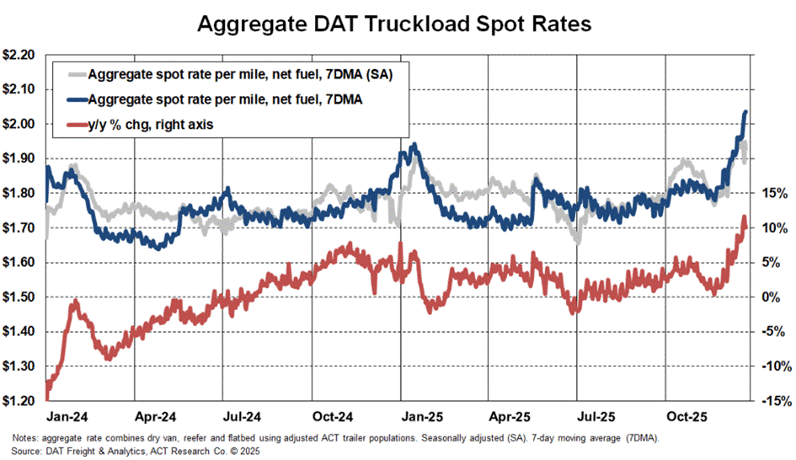

According to ACT Research, spot rates were running about 10% above year-ago levels, rising roughly 8% on a seasonally adjusted basis over the past month.

ACT Research’s Tim Denoyer explains:

"The combination of severe weather and solid holiday freight demand tells us the surge is temporary. Weather will warm, and consumption will fall again after the holidays."

Pricing responded quickly, but timing mattered.

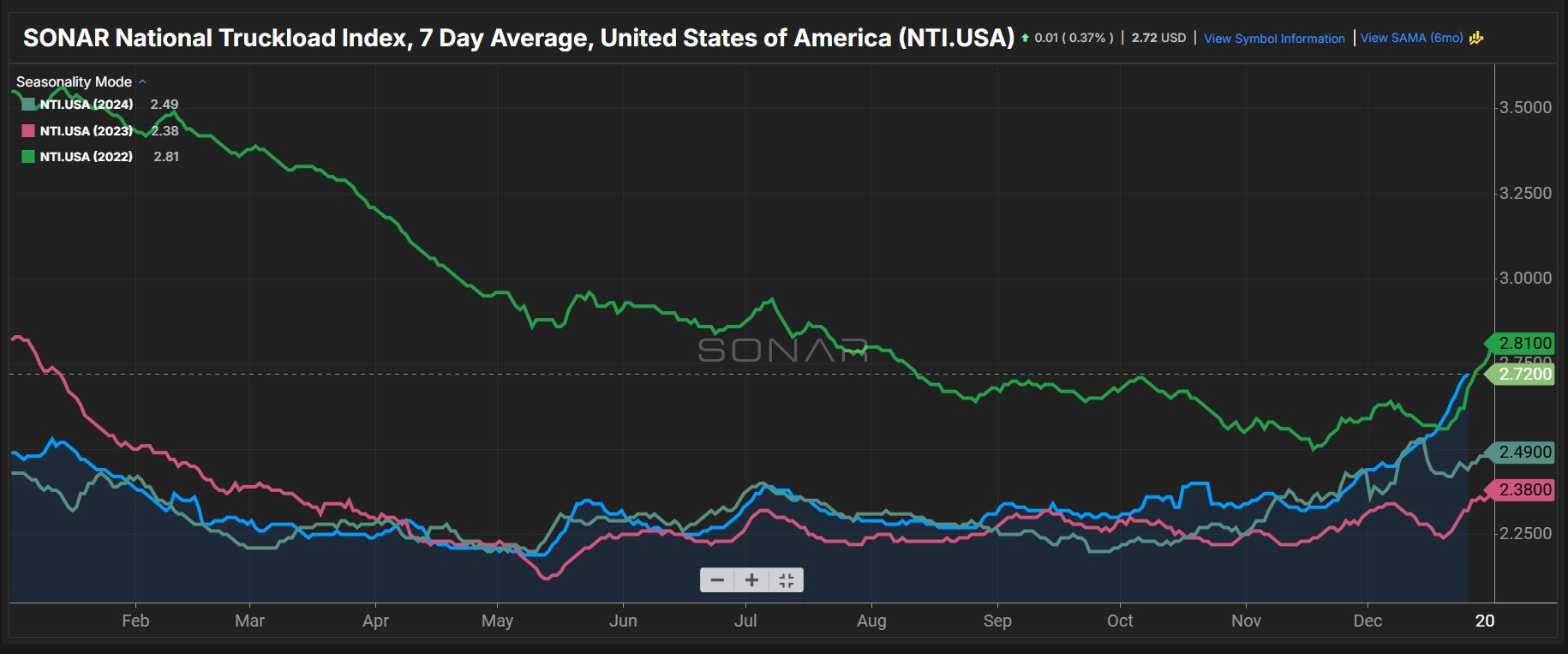

SONAR data shows the National Truckload Index rose 33¢ per mile month over month in December and 26¢ year over year, alongside a sharp rise in tender rejections as drivers took time off over Christmas.

FreightWaves SONAR analyst Thomas Wasson cautions against overinterpreting the signal:

“The rally is seasonal and capacity-driven as drivers head home during Christmas, cratering working tractor percentages.”

In normal weeks, fleets often have 85–95% of tractors working. Over the holidays, that can drop to 30–50%, tightening supply without any meaningful change in demand.

Wasson adds:

“It is premature to place a reliable bet on whether the tide of the Great Freight Recession finally ebbs or whether mid-January will see a seasonal return to spot market declines.”

FreightWaves CEO Craig Fuller has pointed to capacity exits and compliance-driven pressure as reasons rates and rejections are responding:

“The fact that we're seeing further bankruptcies and capacity crackdown due to compliance issues does tell us that the market is ready and primed for a rebound… in terms of tender rejections and rates.”

Fuller pointed out that freight volumes today remain roughly where they were in 2019, suggesting the industry hasn’t regained lost demand, but that it's adjusting to fewer trucks.

Supply Chain Professor Jason Miller challenged a common assumption: Miller says the data doesn't support that retailers will rush to restock after strong holiday sales.

"Sales were flat from January through September on a price and seasonally adjusted basis… This suggests retailers will be cautious about increasing inventories."

Miller added that inventory-to-sales ratios remain elevated versus 2018–2019, and December drawdowns are a normal seasonal pattern, not a trigger for a new freight surge.

Even solid holiday sales don’t trigger a demand rush if inventories were already planned months earlier.

That’s why the smartest forecasts are less about direction and more about flexibility. uShip CEO Sean Wu summed it up cleanly:

"The biggest key to running a successful supply chain in 2026 is designing for adaptability, not certainty."

He also warned that:

"Managing rising costs will focus less on squeezing rates and more on reducing inefficiency."

It's key to keep in mind that freight may not come roaring back, but it is filtering out.

FleetWorks is a AI agent for managing your carrier network.

Fred and Felice talk to carriers over phone, email, and text. They can:

FleetWorks frees broker time to help your customers and carriers with their toughest problems.

📬 USPS Dependency. With USPS continuing to rely on non-domiciled CDL holders in 2026, questions are emerging about who will ultimately haul the mail and whether English proficiency rules will be consistently enforced.

⚡ Nikola Collapse. Nikola’s workforce has shrunk to a single employee as the electric truck maker winds down due to their bankruptcy and asset liquidation, reporting zero sales and revenue in November and a $1.6 million loss.

💰 CDL Funding Boost. USDOT announced $118 million in funding for state and local partners to help strengthen CDL standards, expand enforcement, and support veterans entering trucking through training and credentialing programs.

🖥️ Transfix TMS Opens. Jonathan Salama announced Transfix’s TMS is now available to all brokers and 3PLs, unifying quoting, execution, and settlement in a single operational workflow.

🌍 Kyrgyz Talent Hub. U.S. logistics firms are turning to Kyrgyzstan for dispatch talent and digital tools after CABXPO-2025 drew American carriers recruiting Bishkek-based teams to support U.S. freight operations.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).