🎣 C.H. Robinson

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

Plus: trucking attorney warns carriers and brokers to tighten compliance, tariffs take a toll on U.S. import volumes, semi-truck orders plunge 44%, and more.

Good morning and happy Friday. In today’s feature, we break down what’s happening in the spot market.

Plus:

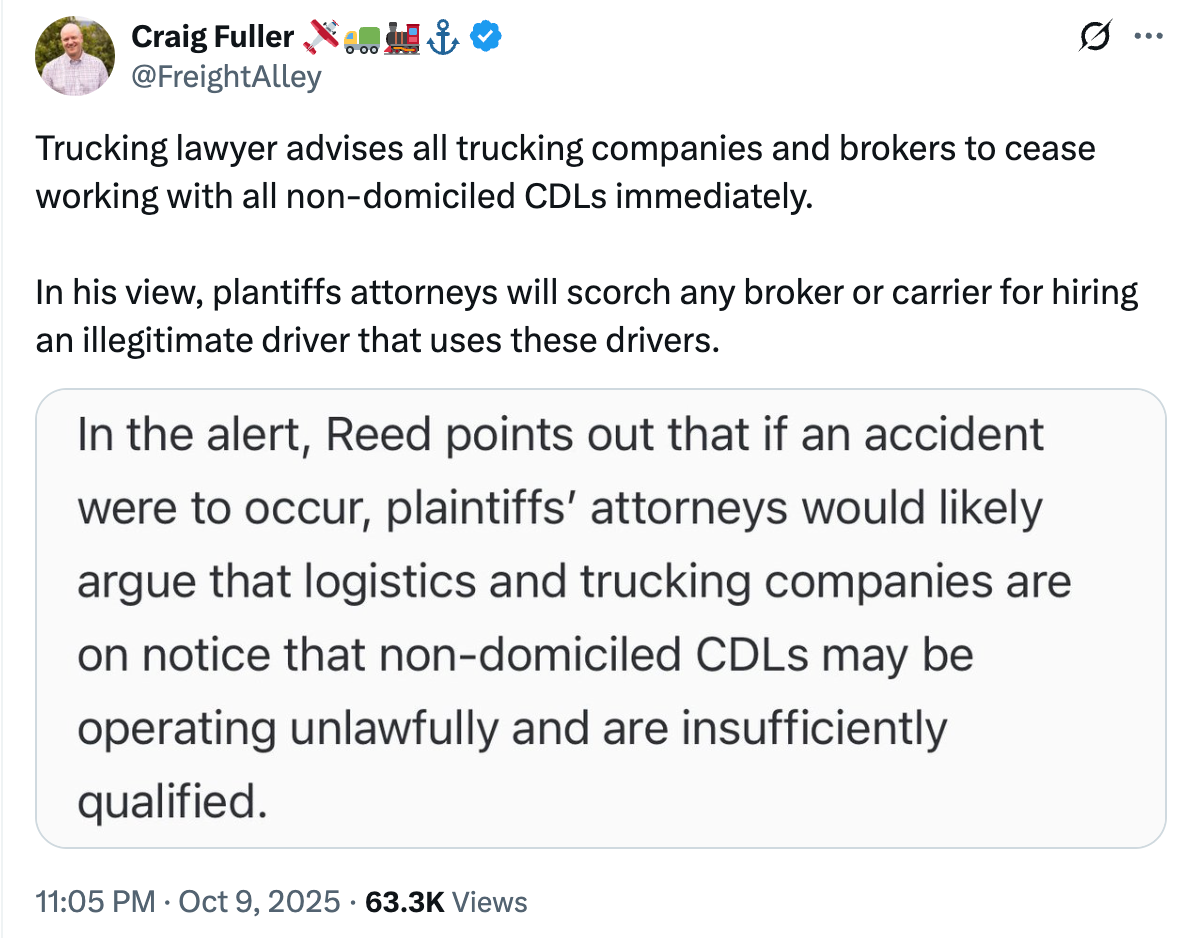

🛡️ Trucking Urged to Audit All Drivers as Non-Domiciled CDL Risk Spikes. Transportation attorney Greg Reed says carriers and brokers should “audit all existing employee or contract drivers” after FMCSA’s September emergency rule cast doubt on non-domiciled CDLs. “Both the regulatory language, and Secretary Duffy’s remarks, cast doubt on the legitimacy of all non-domiciled CDLs,” Reed told FreightWaves, warning plaintiffs will argue companies are now on notice. FMCSA estimates 194,000 of about 200,000 non-domiciled CDL holders could exit over two years (~5% of 3.9 million drivers). Reed advises limiting use of these drivers until credentials are confirmed and tightening contract language on licensing and lawful status. TD Cowen’s Jason Seidl called the capacity hit “likely far more impactful” than ELP enforcement, a “late ’26/early ’27 tailwind,” while noting shippers may “pull forward some bids” as attrition looms.

📦 NRF: Frontloading and Tariffs to Keep U.S. Imports Below 2M TEUs Through Year-End. Retailers pulled peak season forward, leaving monthly volumes projected under 2 million TEUs for the rest of 2025, per NRF/Hackett’s Global Port Tracker. “This year’s peak season has come and gone… due to retailers frontloading imports ahead of reciprocal tariffs,” said NRF’s Jonathan Gold. August handled 2.32 million TEUs (-2.9% from July; +0.1% y/y). Forecasts: September 2.12M (-6.8% y/y), October 1.97M (-12.3%), November 1.75 million (-19.2%), December 1.72 million (-19.4%), the weakest since March 2023. New 25% tariffs on furniture/cabinets hit next week and rise in January; the 90-day tariff pause extension expires Nov. 10 absent a deal. Full-year volume is pegged at 24.79 million TEUs (-2.9% vs. 2024) as Morgan Stanley sees consumer-spending growth slowing to 3.7% in 2025 from 5.7% in 2024.

📉 Semi-Truck Orders Down 44% as Mexico warns $15B at Risk. ACT says September North American semi-truck (Class 8) orders fell 44% y/y amid “the longest for-hire downturn in history,” with freight rates “below inflation,” noted analyst Carter Vieth. Volvo’s Magnus Koeck said OTR sleeper demand is “significantly weaker,” with fleets aging equipment amid uncertainty on tariffs and Phase 3 emissions. FTR flagged the ninth straight below-prior-year month and warned a 25% U.S. tariff on imported heavy trucks, now slated for Nov. 1, will lift prices; “imported Class 8 trucks will face a 25% surcharge,” said FTR’s Dan Moyer. Mexico, which supplies 70% of U.S. heavy-truck imports, says tariffs threaten $15B in exports. “Tariffs on heavy trucks affect $15 billion in exports,” Deputy Minister Luis Rosendo Gutiérrez said, as President Sheinbaum weighs outreach to Trump to avoid the duty.

This $1B+ brokerage is averaging two loads stolen every week despite using a leading digital vetting platform. Digital vetting is not enough. Self-reported data is being manipulated and ELDs are being spoofed. For true protection, you need to bridge the digital & physical divide.

GenLogs literally 'sees' all with a nationwide network of truck-tracking cameras. Loads are only assigned when a carrier has physically been observed recently operating on the lane with the right equipment type. This eliminates stolen carrier identities -- plus, you tap whole-of-market capacity and increase margins by an average of 5%. Say goodbye to the old days of stolen loads.

The spot market seems to have caught some needed heat this week.

BobbyLoads broke down on Instagram certain markets around the country, mentioning Los Angeles, Columbus, Harrisburg, Elizabeth, and giving Green Bay, Chicago, and Charlotte favorable mention as well.

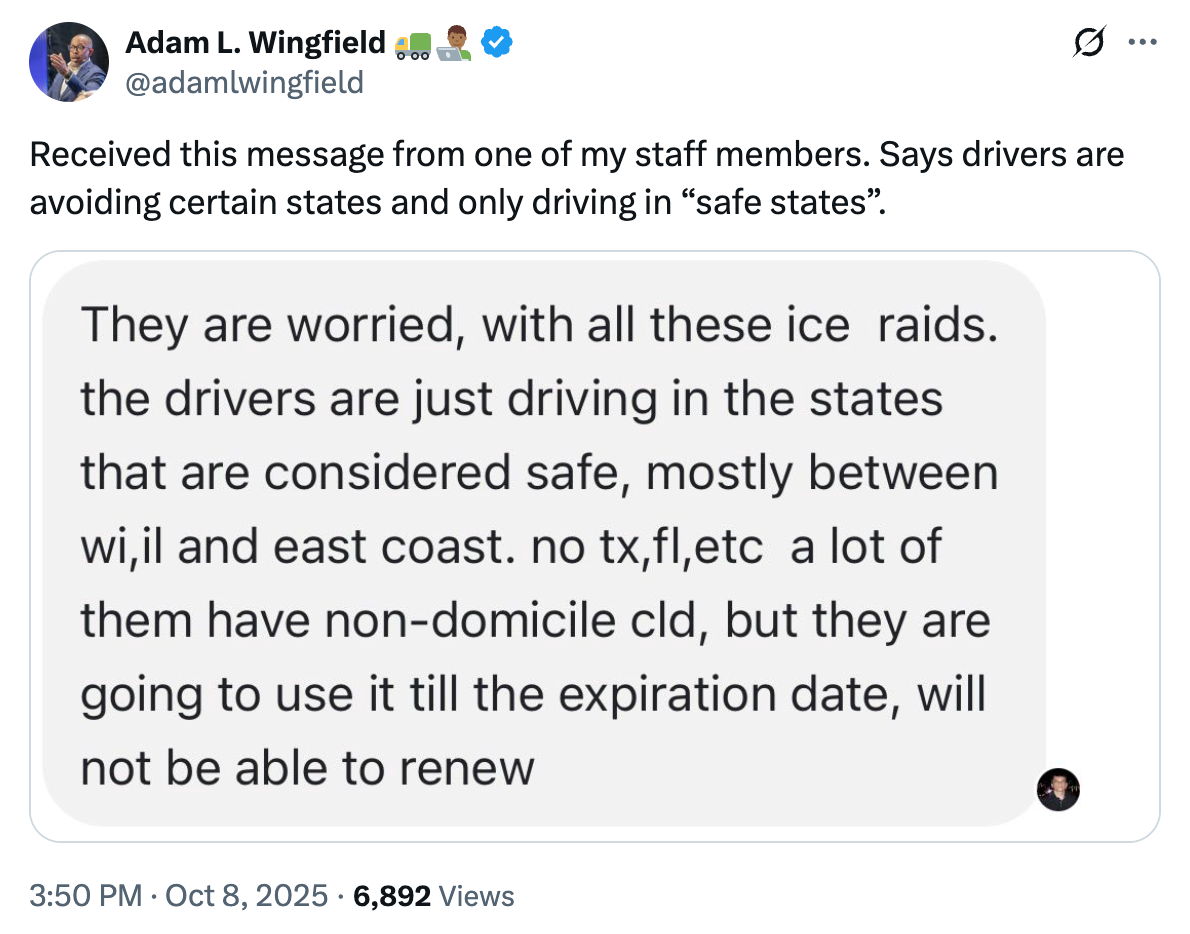

The reason? It seems many non-domiciled drivers are afraid of being on the road. ICE has reportedly been spotted at weigh stations and even at some shippers, causing drivers to avoid “unsafe” states and stick to the Midwest and East Coast.

As Adam Wingfield shared from a message he received:

“They’re worried, with all these ICE raids. The drivers are just driving in the states that are considered safe, mostly between Wisconsin, Illinois, and the East Coast. No Texas, Florida, etc.”

That fear may be tightening capacity in certain lanes.

FreightWaves’ Craig Fuller called the sudden surge “unusual,” noting that tender volumes are flat and rejection rates remain low at 5.5%. “Spot rates are surging without signs of higher demand,” he wrote, suggesting a supply-driven squeeze, not a freight rebound.

Ken Adamo of DAT said the "the market is still very much in a tough spot and these increases are both modest and, in many cases, isolated to certain lanes and markets."

He also noted the bump coincides with End of Month and End of Quarter (EOM/EOQ) effects, which often create short-lived volatility.

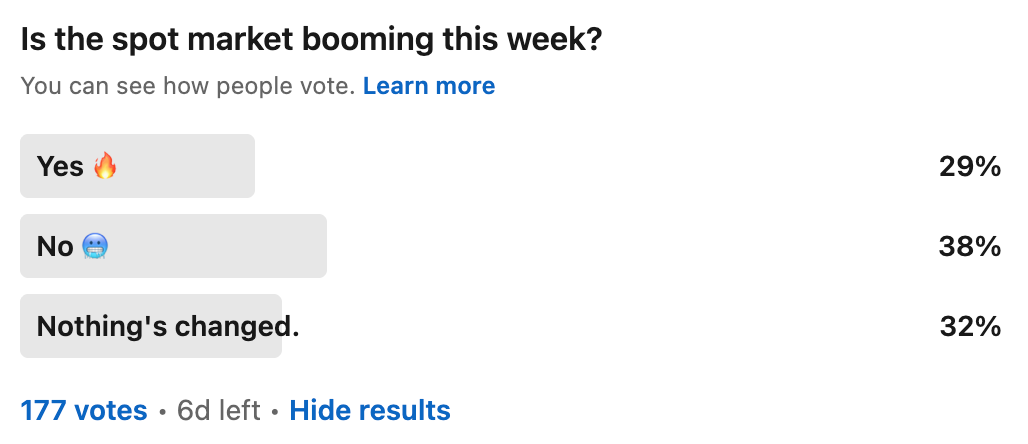

FreightCaviar’s own poll showed a split market: 30% said rates are booming, 38% disagreed, and 32% said nothing’s changed.

As broker John Ferguson put it, “It was booming earlier in the week, but that’s no longer the case. Rates have plunged like bricks in a lake.”

For now, the bump looks less like a freight recovery and more like a reaction to fear on the highways.

Make carrier payments a strength of your back-office with OTR Solutions.

Nurture your broker-carrier relationship with best-in-class payments.

🚛 Flatbed Carrier Shuts Down Overnight. PE-backed Montgomery Transport filed for Chapter 7 bankruptcy, shutting down immediately and leaving 1,000 employees, including 600 drivers, out of work.

🏆 Matt Silver Honored. Matt Silver, founder of Cargado and former Forager CEO, was named to Crain’s 40 Under 40 for 2025. Silver thanked mentors Amanda Lannert and Ty Findley, saying he’s “grateful, humbled, and fired up” to keep supporting Chicago’s freight tech founders.

🚢 Trump Eyes Canal. President Trump said he wants the U.S. to “control or buy back” the Panama Canal, claiming it’s vital to national security and trade as tensions rise with China over global shipping routes. But there's more to the story, and Johnny Harris breaks it all down.

📊 ELP Safety Study. A new study found carriers with ELP violations are significantly more likely to have poor safety ratings, suggesting language gaps directly affect compliance and crash risk.

🩺 Medical Card Extension. FMCSA will allow truckers to use paper medical certificates through January 2026, citing technical issues in the transition to the new National Registry Integration Initiative (NRII) electronic system.

🎭 Fake Beard CDL Scam. A New York DA says a female defendant wore a fake beard to pose as a male test-taker in a CDL cheating ring that led to seven indictments tied to fraud and identity theft.

🎣THE FREIGHT CAVIAR CORNER

Next Friday (Oct. 17) at 8AM CST, we’re hosting the Ultimate Freight Meme Competition, powered by Epay Manager. Eight contestants, three judges, one winner — all bracket style. Each matchup gets a random meme template and just 60 seconds to create a freight meme before the judges decide who advances.

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).