🎣 RFX and R&R Express Sued

Plus: ELP enforcement isn’t sticking, Amazon eyes LTL, FMCSA warns of phishing scam

Plus: 3,000 drivers sidelined over English tests, DOT fraud crackdown follows FMCSA’s data glitch, two TV cargo theft schemes, and more.

TGIF. Freight rates find a floor, imports cool, and fleets pump the brakes. Arrive’s 2025-26 forecast update signals a flat market with quick bursts. We've got the predictions and what they mean for your ops in today's feature.

Plus,

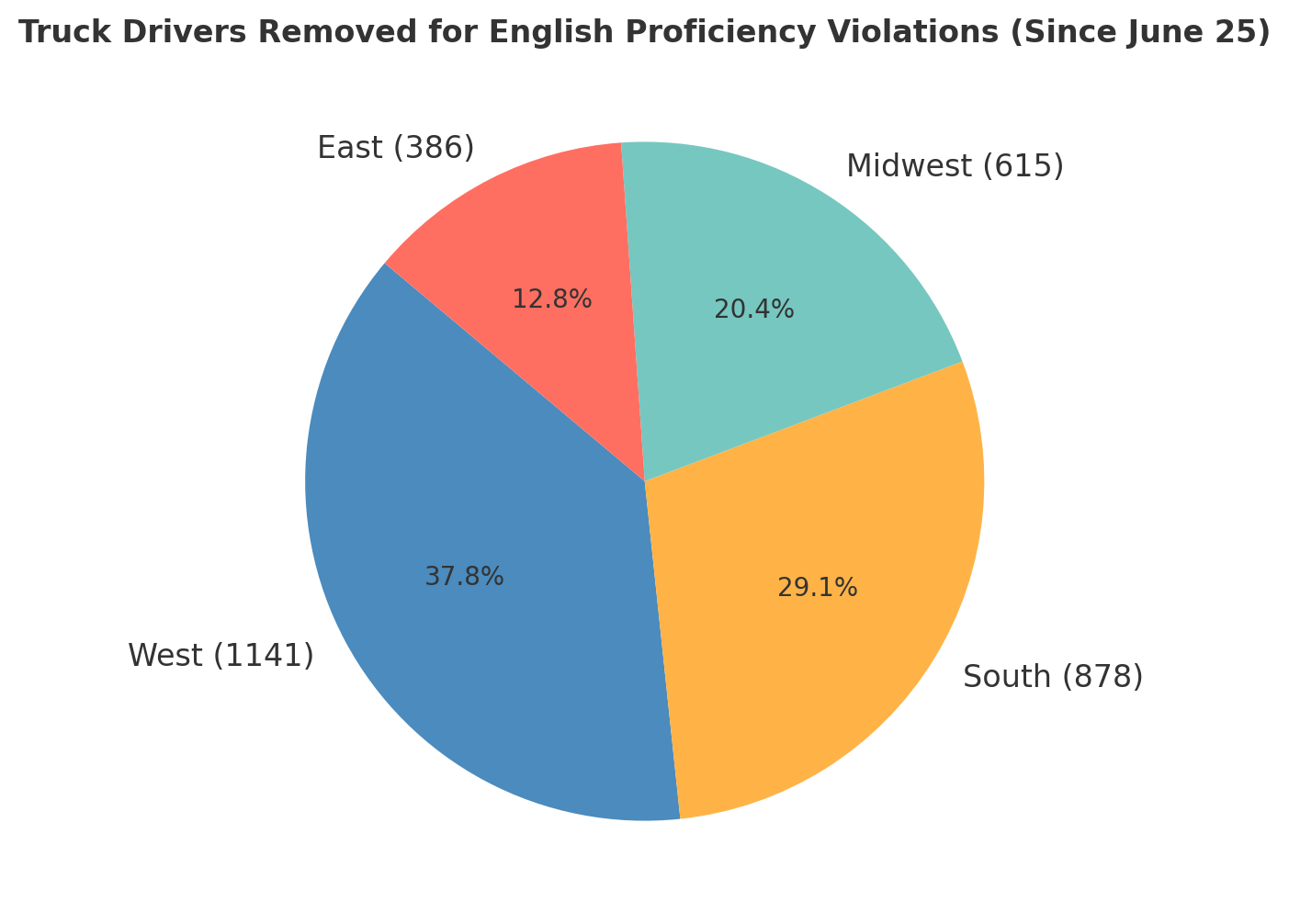

🛑 Over 3,000 Truck Drivers Removed for English Proficiency Violations. More than 3,000 truck drivers have been placed out of service since June 25 for failing federal English Language Proficiency requirements, FMCSA data shows. The Western region accounted for the largest share with 1,141 violations, followed by the South (878), Midwest (615), and East (386). The surge follows a White House order reinstating ELP enforcement, reversing a 2016 FMCSA policy. Transportation Secretary Sean Duffy has tied the stricter oversight to safety concerns raised after the fatal Florida Turnpike crash. With over 3,000 removals in less than three months, carriers now face tighter driver availability and heightened compliance demands.

📊 FMCSA Data Outage Coincides With DOT Cargo Theft Crackdown. FMCSA restored public safety datasets after a Sept. 17 outage briefly cut off access to crash, inspection, and census files, sparking speculation among industry stakeholders. The disruption came as DOT unveiled a new initiative targeting cargo theft, distinguishing between “straight thefts” of trailers and loads and “strategic theft networks” using fraud, cyber tools, or insider collusion. Cargo theft incidents have surged more than 90% since 2021, with average losses topping $200,000. The timing underscores the tension between DOT’s call for expanded reporting and the reliability of federal data infrastructure critical to vetting carriers and combating fraud.

📺 Two Truck Drivers Charged in Separate TV Theft Schemes. Two truck drivers in separate cases have been sentenced or charged in thefts of televisions worth more than $700,000. In Texas, Gurvinder Singh received a year in prison after diverting two loads from a South Carolina warehouse, including 900 TVs valued at $130,000. Investigators also tied him to other thefts. In Indiana, prosecutors charged Lakhwant Singh of Fresno with stealing six shipments of Vizio TVs worth nearly $595,000. Authorities allege he filed forged proof-of-delivery records while the trailers never entered Sam’s Club distribution centers. Phone and license-plate data later placed the shipments in Illinois. Lakhwant Singh faces two Level 5 felonies, with trial set for December. Federal and state investigators are probing related cases, as cargo theft involving high-value electronics continues to rise nationwide.

You’re in control of your back-office with Epay Manager.

For over 20 years, Epay has provided best-in-class automation, invoicing, and payments solutions to freight brokerages.

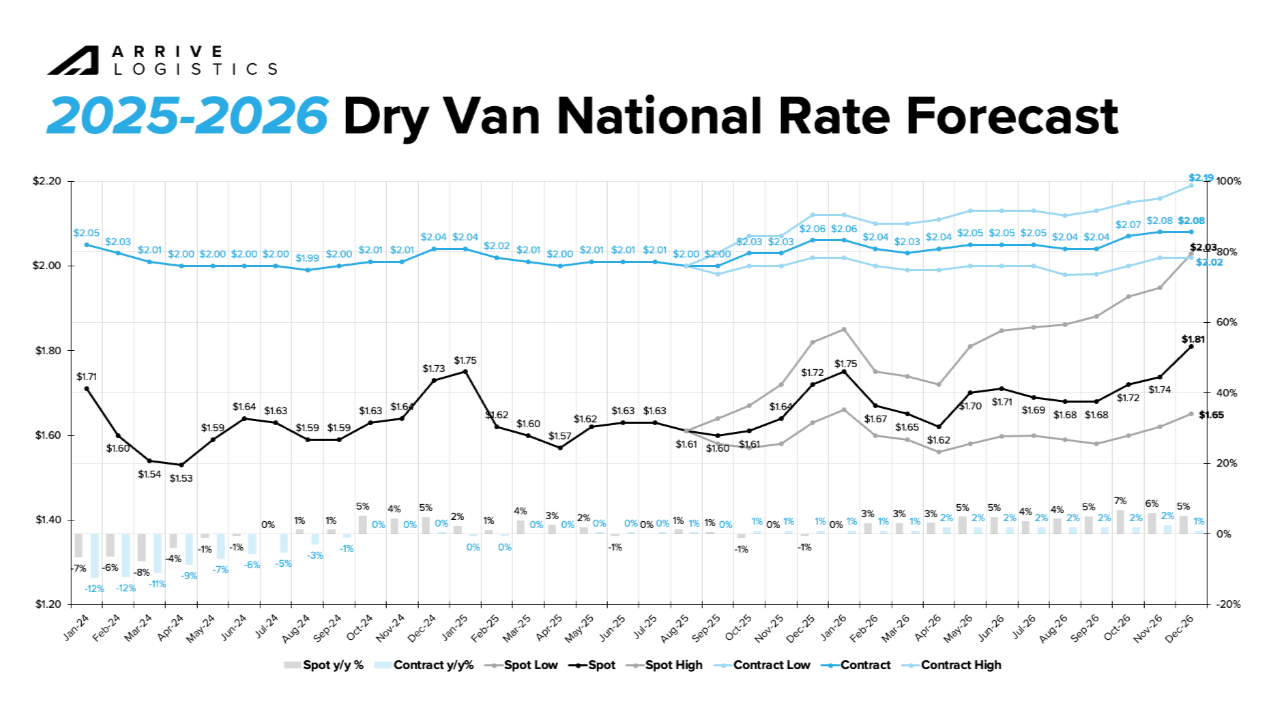

Arrive Logistics' fresh Truckload Freight Rates Forecast Q3 2025 Update points to a market that’s bottomed and likely grinds sideways: spot sits on a floor, contracts stabilize, and volatility shows up in short bursts, not full-on spikes.

Tariffs and front-loaded imports muddy the picture, but the base case is flat to modest rate growth into 2026.

Arrive says the spot market has likely found a floor, with flat-to-modest gains ahead while contract rates stay mostly steady.

Their model peaks in 2026:

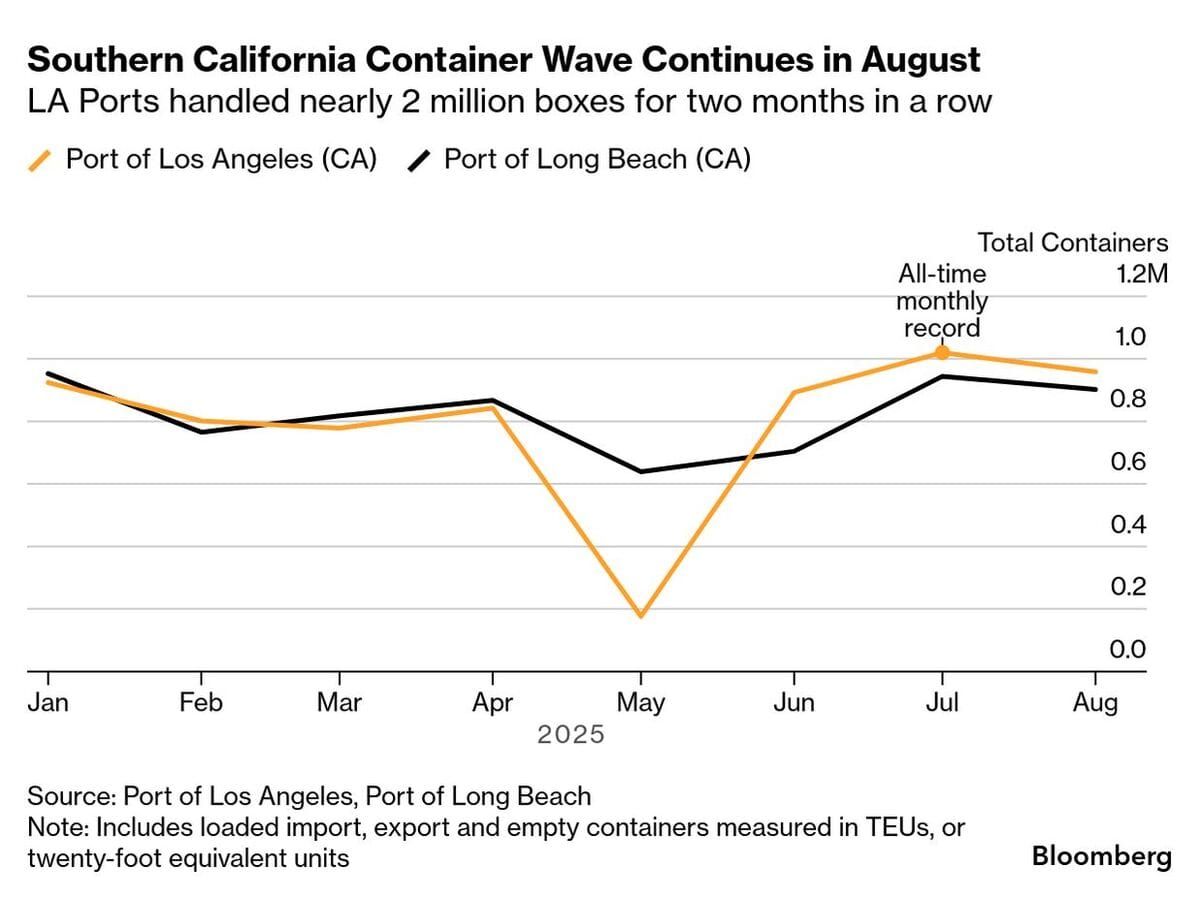

The Southern California import surge has run its course.

August volumes dropped 6.6% from July, and September is expected to be around 850k TEUs, down ~10% y/y as holiday cargo arrived early to beat tariffs.

But, truck dwell at LA/LB improved to 2.73 days in August, down from 2.87 in July, showing faster throughput even as import volumes ease.

Fleets are pulling back on new equipment. Class 8 net orders fell 21% y/y in August to 12,844, while retail sales dropped 13% y/y, signaling carriers are tapping the brakes as demand stays soft.

For brokers and carriers, Arrive’s forecast suggests opportunity comes from tactical moves, not big bets:

Without a major policy shock or demand surge, sideways is the trade. We'll see rate floors, quick snapbacks, and localized spikes as the best opportunities through early 2026.

Running a successful trucking operation means doing more with less, and CtrlChain makes that possible. With automated systems, carriers can take on more freight without adding staff, scaling volume while keeping overhead low.

🚨 AMA Logistics Owner Flagged. Danielle Chaffin highlighted data linking Arturas Pivoras, a Lithuanian national currently in ICE custody, to AMA Logistics Inc. Past records also show convictions for theft, assault, and drugs.

🕒 HOS Pilot Program. FMCSA will allow 512 CDL holders to test hours-of-service flexibility in new pilot programs. The initiative examines alternative driving/rest schedules to assess impacts on safety and driver fatigue.

💼 DAT Expands Categories. DAT One added listings for cargo vans, box trucks, and power-only loads, broadening its freight-matching platform beyond traditional tractor-trailers as operators seek new ways to cover short-haul and niche freight.

🤝 Highway Buys newtrul. Highway acquired newtrul, a freight-matching startup known for digital load board tools. The deal allows newtrul to accomplish its goal of “disrupting the legacy incumbents who have failed to innovate,” according to Ed Stockman, CEO at newtrul.

📜 Truck Leasing Bill. A new federal bill seeks to ban predatory truck leasing, targeting lease-purchase programs critics say trap drivers in debt while misclassifying them as contractors without fair labor protections.

📲 Trucker Tools Alerts. Trucker Tools added an automated “running late” feature, notifying brokers when drivers fall behind schedule, aiming to reduce missed updates and improve visibility in time-sensitive freight moves.

📈 FedEx Earnings Lift. FedEx posted Q1 EPS of $3.83 on $22.24 billion revenue, topping expectations as U.S. volumes rose 6%. Shares climbed 5% despite tariffs. Craig Fuller will discuss the outlook today on Bloomberg TV at 4:20 p.m. ET.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).