2024 Shipper - 3PL Study Details Best Partnerships

Only 49% of shippers are satisfied with 3PL IT capabilities. Good news: 63% are open to working with smaller, specialized, or regional 3PLs.

The 28th Annual Third-Party Logistics Study by Penske, NTT Data, and Penn State provides a comprehensive overview of the current state of the logistics market, focusing on the evolving dynamics between shippers and 3PLs.

This year's study sheds light on several critical aspects, from collaboration trends to reasons for declining RFP opportunities.

Positive Relationships and Outsourcing Trends:

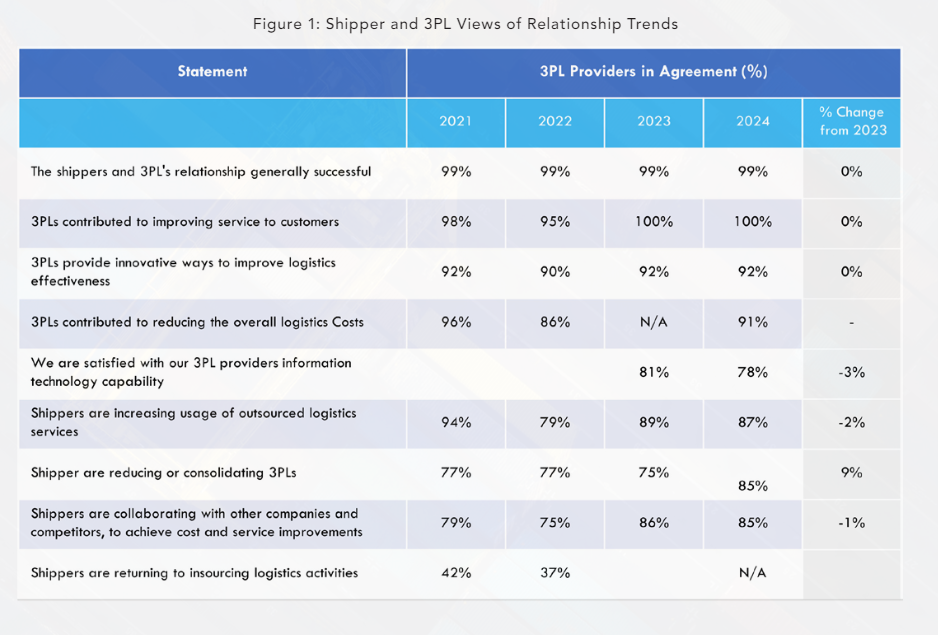

According to the study, 95% of shippers and 99% of 3PLs report their partnerships are successful. These relationships have led to significant benefits:

- Service Improvement: 89% of shippers say 3PLs improved their service.

- Cost Reduction: 80% of shippers report reduced logistics costs due to 3PLs.

Warehousing tops the list of outsourced activities, followed by domestic transportation, customs brokerage, and freight forwarding. However, IT services and customer service are less frequently outsourced, highlighting a focus on tactical over strategic tasks.

Outsourcing and Consolidation:

- Increased Outsourcing: 62% of shippers and 87% of 3PLs reported an increase in outsourced logistics services.

- Consolidation: The trend towards reducing or consolidating 3PLs grew, with 78% of shippers reporting this practice, up from 71%.

Shifting Power Dynamics

The past few years have seen a shift in power dynamics between shippers and 3PLs:

- Leverage Shift: 39% of shippers and 38% of 3PLs agree that shippers have gained leverage.

- Contract Negotiations: Cost savings are a top priority for 89% of shippers during negotiations. Service-level agreements (SLAs) and flexible termination terms are also critical.

The Importance of Data

Data sharing between shippers and 3PLs is crucial for optimizing supply chain performance. However, challenges remain:

- Data Quality Issues: 57% of shippers and 32% of 3PLs cite data quality as a major concern.

- IT Capabilities Satisfaction: Only 49% of shippers are satisfied with 3PL IT capabilities, indicating room for improvement.

- Integration Barriers: Integration and technology barriers, data standards, and costs are significant hurdles.

Smaller and Specialized 3PLs:

- Increased Willingness: 63% of shippers are open to working with smaller, more specialized, or regional 3PL suppliers.

- This suggests a growing niche market. Freight brokers can capitalize on this trend by offering specialized services that cater to specific industry needs.

This data equips freight brokers and 3PL professionals with an in-depth understanding of current market trends and shipper expectations. By leveraging these insights, industry players can make informed decisions, foster stronger partnerships, and drive innovation to stay competitive for the future.

Source: Third-Party Logistics Study from Penske/NTT Data/Penn State