🎣 Honey, Hold My Beer

Here are the Top 500 fleets of 2026. Plus: Sierra snow shuts down I-80, rail targets truckload freight, and ocean rates fall.

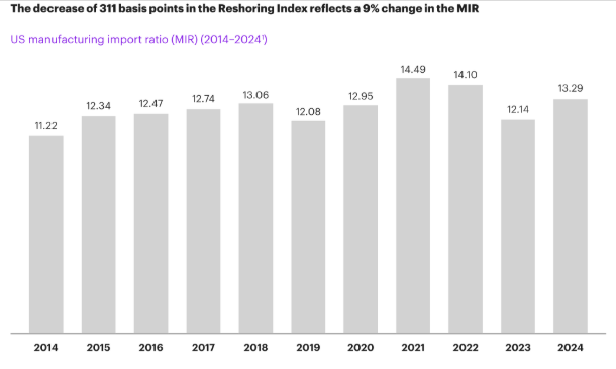

Kearney’s 2025 Reshoring Index shows reshoring momentum dips as firms confront costs, infrastructure, and market realities.

Despite political pressure and executive enthusiasm, reshoring momentum across North America has stumbled. Kearney’s just-released 2025 Reshoring Index reveals that while U.S. CEOs remain committed to bringing manufacturing home, real-world challenges — from labor costs to supply chain constraints — have forced companies to reassess their reshoring strategies.

“The 2025 Reshoring Index points to a reality check that exposes the gap between reshoring intention and facts,” said Patrick Van den Bossche, Kearney partner and study co-author. “Despite executives being more committed than ever, expectations for the strategy need to be tempered by market realities.”

The index shows a 311 basis point drop in the U.S. manufacturing import ratio for 2024, pulling reshoring momentum back into negative territory after two consecutive positive years.

Some key notes from Kearney’s report include:

While the data signals a pause, it doesn’t signal retreat.

“Even if the tariffs previously imposed on China were to ease… the preferential treatment of Mexico over China would remain significant, further fueling Mexico’s manufacturing momentum,” said Jorge Gonzalez Henrichsen, co-CEO of The Nearshore Co.

Despite setbacks, executives are not walking away. Instead, they are recalibrating:

As Omar Troncoso, Kearney partner and report co-author, put it:

“As U.S. demand outpaced what domestic production could supply, Mexico was not able to fill the gap. We saw manufacturers reverting to sourcing from those distant Asian low-cost countries and regions they had relied on in the past.”

The reshoring wave isn’t ending — it’s maturing, with firms realizing that scaling U.S. manufacturing requires more than good intentions; it demands hard choices, smart investments, and resilient supply chains.

Source: Kearney | FreightWaves

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).