Clarifying the Serbia Data in Highway’s 2025 Freight Fraud Report

Last week, Highway released its Q4 2025 Freight Fraud Trends Report. The report outlined the countries outside the U.S.

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

FreightCaviar Weekly Recap. Japan strikes a deal with the U.S and the LTL shake up takes center stage in this week’s most talked-about freight stories.

Over on r/FreightBrokers, a reddit user highlighted the recurring issue of carriers marking their availability as "anywhere" but then rejecting specific destinations when offered. This can be quite annoying and a waste of time when it could have been much easier to say things like “no East Coast” or “no California" to avoid unnecessary back-and-forth.

Some responded to the thread, adding a bit of humor to how carriers may respond:

One detailed comment summed up the frustration: some carriers list “anywhere” to get more exposure but have clear preferences based on rate or lane. The user noted:

“If the broker pays the money we ask, we’ll go anywhere. No money = no. Pay us, and we’ll go wherever you want.”

So, is anywhere truly anywhere? Or is it anywhere...if the price is right?

Levity automates high-volume email and phone tasks like quoting, load building, and track & trace, without black-box agents or risky AI experiments.

Designed for teams that need control, transparency, and results they can trust.

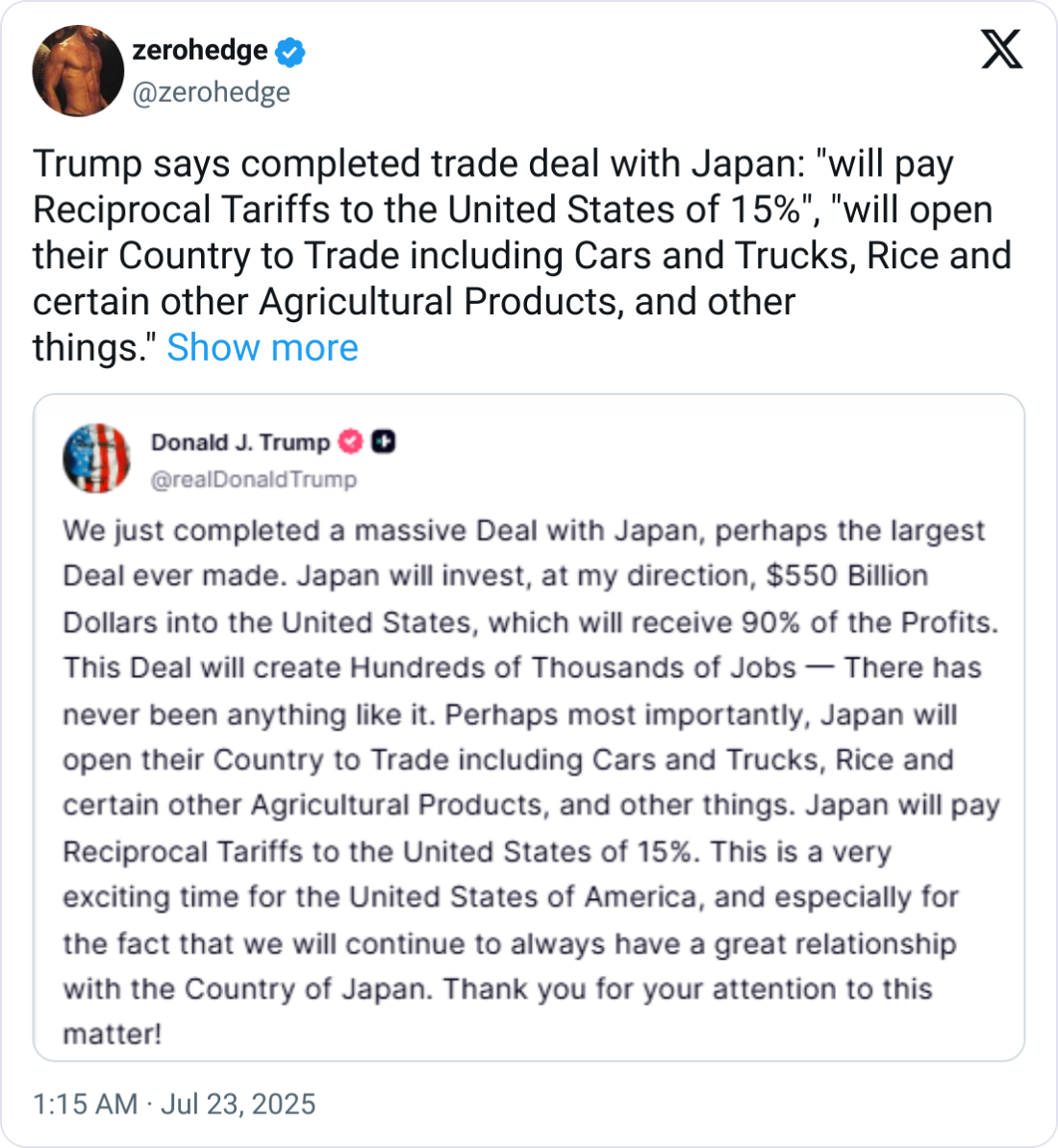

With the August 1 deadline approaching, countries are rushing to secure trade agreements with the U.S. to avoid a return to the steep April 2 tariff levels. President Trump had previously issued warnings to several nations, urging them to strike a deal or face higher duties.

Japan has now finalized its agreement, making it one of the most significant trade and investment deals in recent history. Here’s a quick breakdown of what’s included:

Key Points of the U.S.–Japan Trade and Investment Agreement:

$550 billion in Japanese investment into U.S. industries, directed by the U.S.

“The single largest foreign investment commitment ever secured by any country.” - The White House

One can wonder what other deals other countries will make before the deadline. If you want further details and contexts of Japan's deal, you can read it here:

In our latest Feature Story of the Week, we unpack the sweeping overhaul of the National Motor Freight Classification (NMFC) system that just went into effect on July 19. After decades of using a commodity-based model, the LTL industry has pivoted to a density-first approach that reshapes how freight is classified, priced, and ultimately moved across the country. With over 2,000 item codes eliminated or consolidated, this change is already sending shockwaves through logistics teams, carrier negotiations, and shipping margins.

Rates are rising, reclassification disputes are popping up, and only the most prepared players are staying ahead of the curve. Want to understand what’s really driving the chaos and how to navigate it?

👉 Read the full story to get the insights you don’t want to miss.

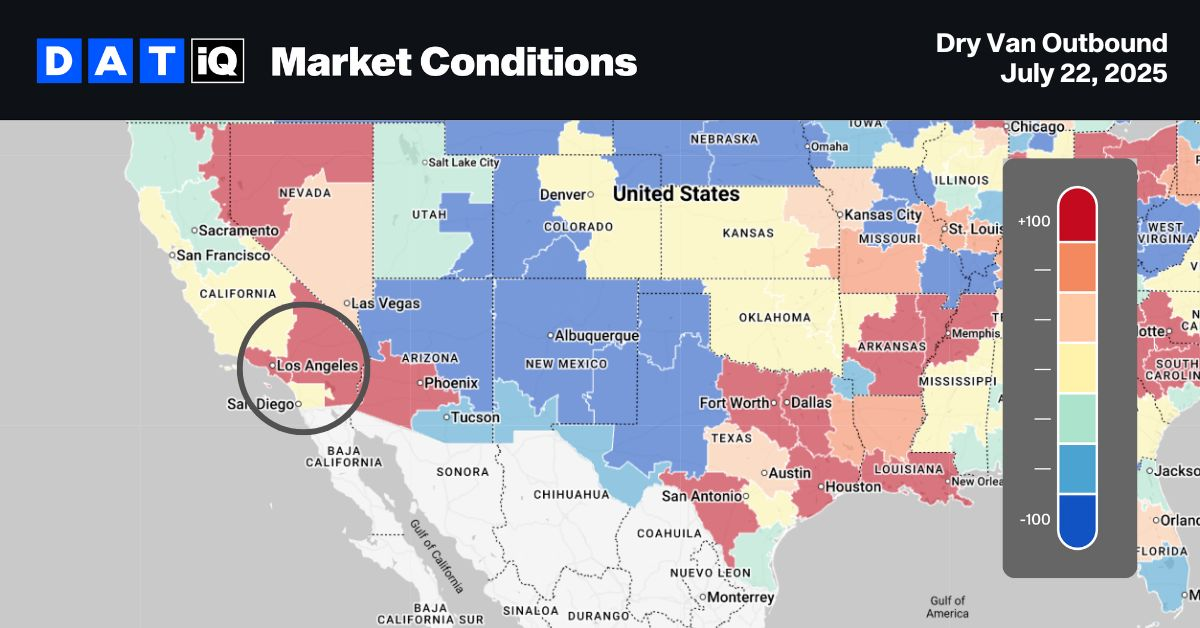

On LinkedIn, DAT shared the current trends in Dry Van outbound activity along the West Coast. According to their research, the Port of Los Angeles just experienced its busiest June in over a century, driven by importers accelerating shipments ahead of looming tariff increases on Chinese goods. With 30% of U.S. imports funneled through L.A. to inland distribution hubs, this surge reinforces California’s central role in national freight movement. Continued strength in West Coast drayage and truckload demand is expected as retailers prepare for the back-to-school and holiday seasons.

Take control of your future with Freight Flex!

Be your own boss without the corporate red tape. Build your business with our cutting-edge tech stack, including paid TMS, DAT, Sylectus, Highway, ZoomInfo, Macropoint, Allianz credit insurance, Triumph Pay, seamless onboarding, and 24/7 support.

Gain access to 10,000+ carriers with rapid customer setup. With 70% commission on margins—you’ll have the freedom to focus on your goals while we handle the rest.

Start your journey today!

As one commenter on X stated, His LinkedIn inbox must be flooooooooded!" 🌊

🎣 THE FREIGHT CAVIAR CORNER

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).