🎣 Nightmare On the Boards!!

Plus: Landstar profits cut in half, Werner $18 million driver settlement, arsonist gets 10 years, and more.

Plus, freight shipments and expenditures mixed in March, China freezes rare earth export, TransLoop jumps the list, and more.

Happy Hump Day. America's roads just got graded, and it’s not pretty. A new report shows deteriorating conditions that impact the freight industry.

Plus:

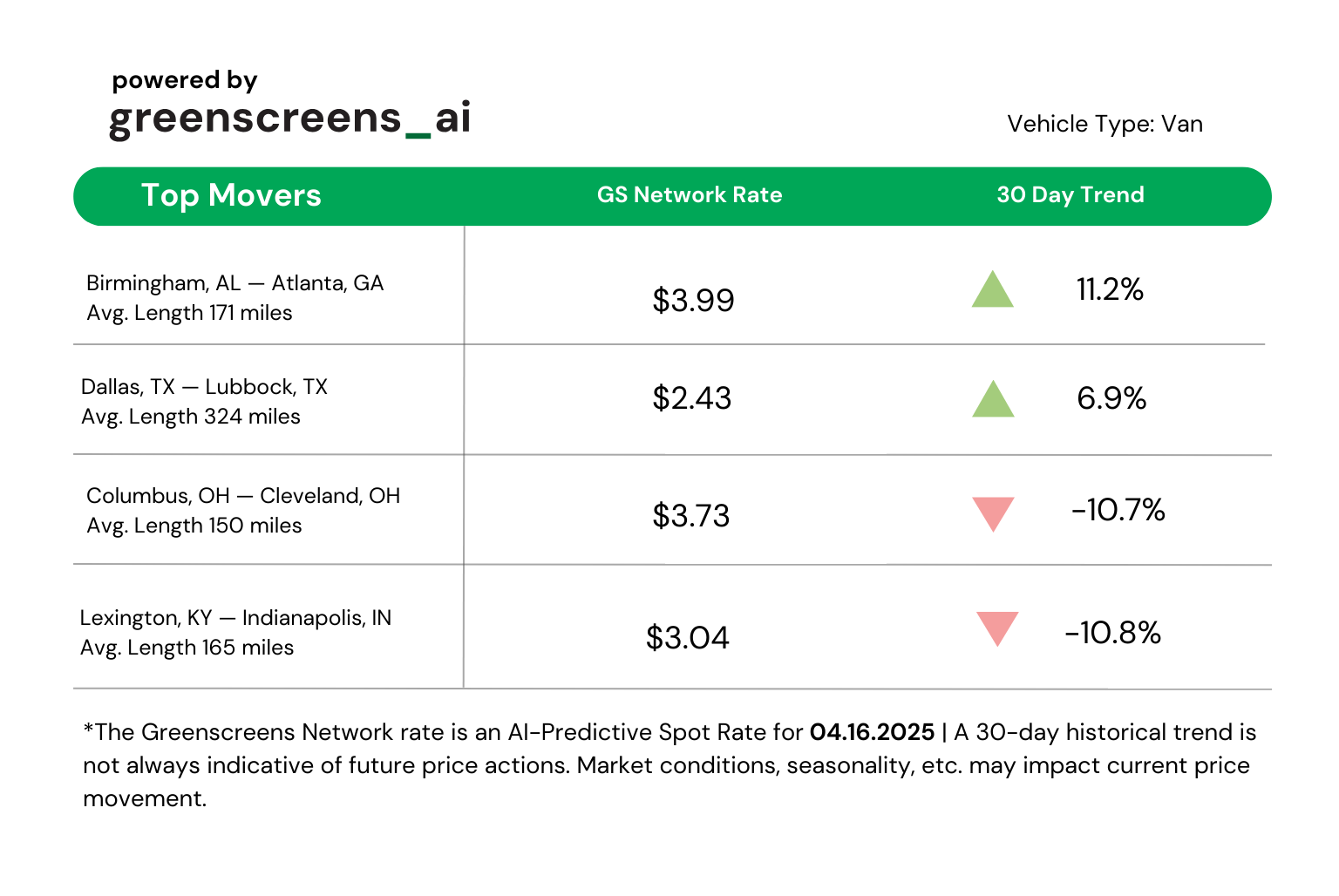

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

🐔 WHAT’S COOKIN’ IN FREIGHT

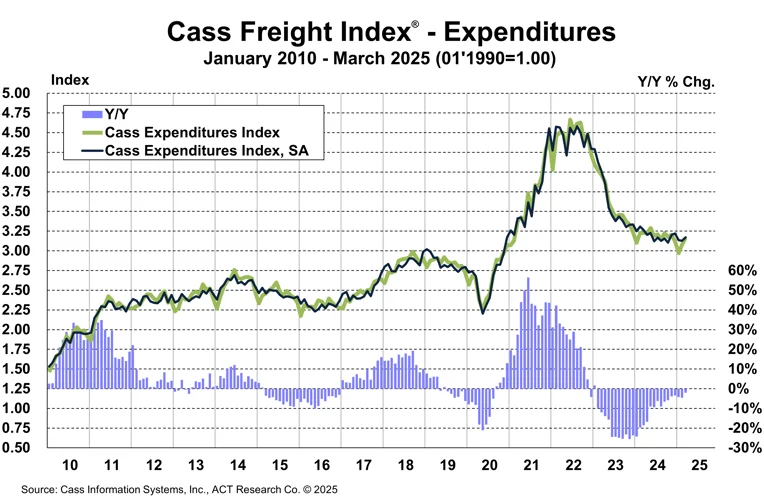

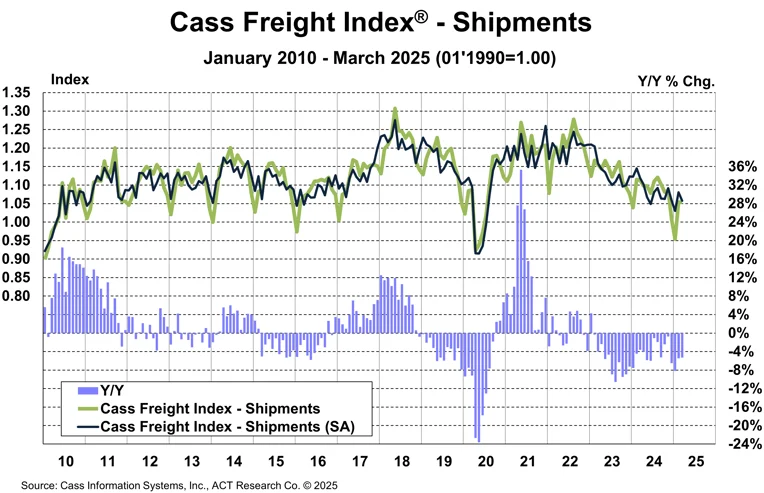

Image Source: Cass Information Systems

📊 Cass Freight Index Reveals Uneven March Trends. The Cass Freight Index reported mixed results for March, reflecting flat month-to-month shipment volume and a 3.5% year-over-year decline. Seasonally adjusted, shipments dropped 2.1% from February and 8.7% over two years. Despite a 2.8% monthly rise, freight expenditures fell 2.0% annually, tied to lower volumes and a 3.5% rise in inferred rates. Tim Denoyer, ACT Research Vice President and Senior Analyst, expects short-term volume boosts from pre-tariff activity, though ongoing trade tensions and tariff impacts may prolong the “for-hire freight recession.” Denoyer attributed the yearly decrease to reduced shipment volumes—evident in the 3.5% drop in annual shipments—as well as a 3.5% annual rise in inferred rates in March.

🇨🇳 China Freezes Rare Earth Exports. China just hit back at Trump’s new tariffs by cutting off exports of rare earth minerals and magnets—stuff that’s essential for EVs, drones, semiconductors, and military gear. These materials mostly come from China, and now they won’t ship without a special license. Problem is, there’s no real system in place yet to get those licenses. So ports are frozen, supply chains are scrambling, and U.S. factories (especially auto and defense) might be in trouble soon. It’s a clear sign: China’s not afraid to use its grip on critical materials to push back.

💪 TransLoop Rising Up The Ranks. TransLoop, a Chicago based freight brokerage, has jumped nine spots to #86 on Transport Topics’ 2025 Top 100 Freight Brokerage Firms list. Amid high-profile stumbles from peers like Convoy’s shutdown and Uber Freight’s ongoing profitability woes, TransLoop’s 51.5% sales growth and 36.1% shipment increase in Q1 magnify its momentum. Founded in 2019, the company emphasizes tech-driven transparency and strong partnerships, growing its team by 44% this year alone. CEO Nicholas Reasoner credits their rapid ascent to focused execution and a long-term vision: to become the #1 freight brokerage in the U.S.

Cross-Border Freight, Made Easy with Cargado

Cargado is the first invite-only load board built for US-Mexico freight. No fluff—just faster bookings, trusted carriers, and full transparency.

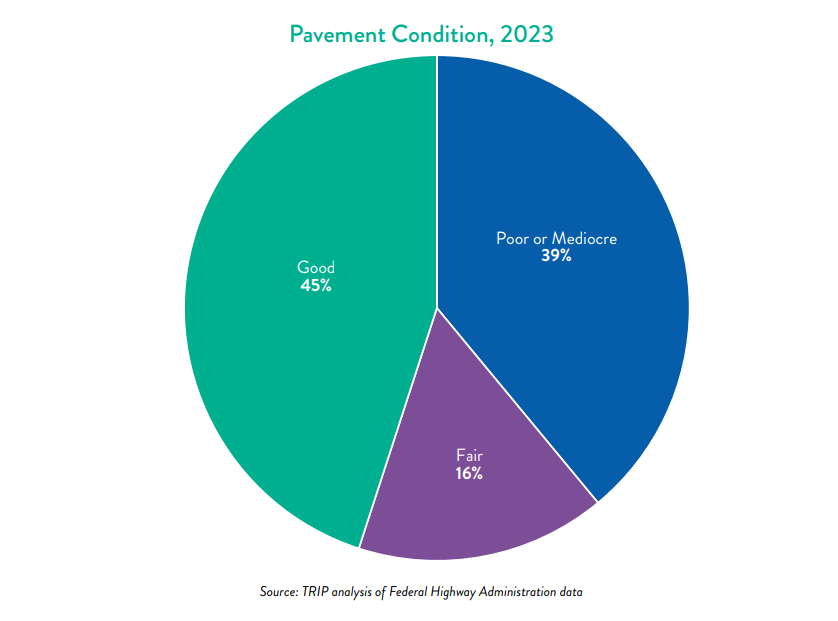

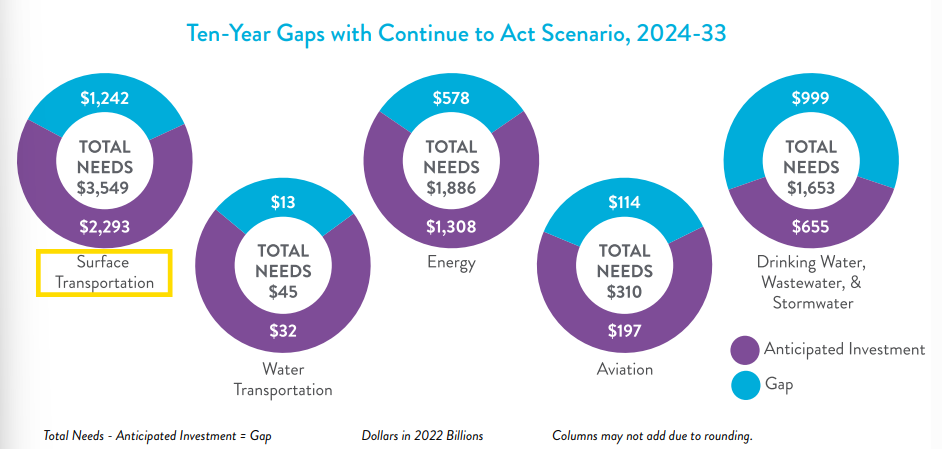

The 2025 Infrastructure Report Card is in: the American Society of Civil Engineers (ASCE) upgraded the U.S. road system from a D to a D+.

Even after billions in federal infrastructure funding, 39% of major U.S. roads remain in poor or mediocre condition, costing logistics billions a year.

“Our national roadways remain underfunded and under-maintained,” ASCE wrote. “Our system is stuck playing catch-up.”

America’s ports earned a B, up from a B– in 2021, thanks to targeted funding and improved throughput. But the inland journey? Still rough.

Better port capacity doesn’t always mean smoother freight flows—not when the inland infrastructure connecting those ports to warehouses, rail hubs, and final destinations is still lagging.

A container may leave the Port of Los Angeles efficiently, but still face hours of delay in the Central Valley due to road closures, congestion, or infrastructure issues that force detours.

"In 2022, 5,837 trucks were involved in a fatal crash, a 1.8% increase from 2021 and a 41.6% increase since 2012."

ASCE notes that “more than 207,000 miles of roads have been improved” since the 2021 infrastructure law passed. But a $1.242 trillion investment gap remains, and much of the improvement has yet to touch the truckload corridors brokers depend on.

Rail also held a strong B grade on the 2025 Report Card.

Even with robust investment and modernization, coordination between modes remains a sticking point.

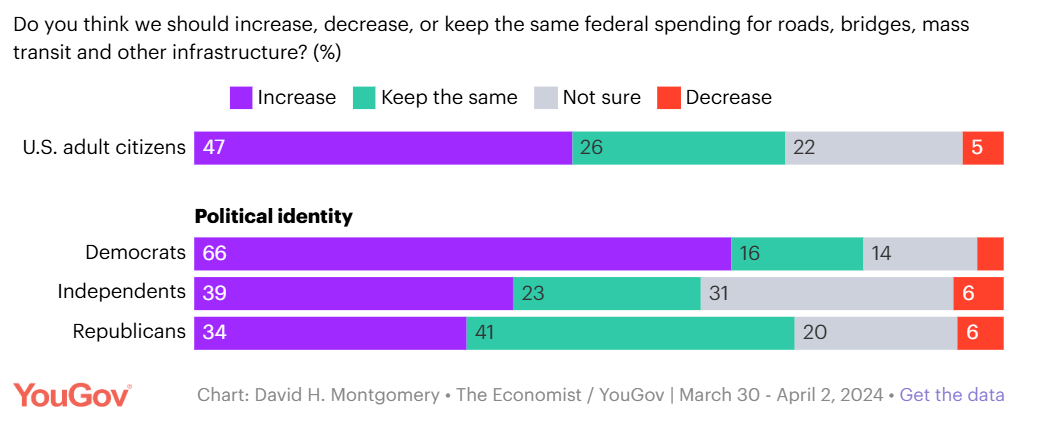

Since stepping into the role, U.S. Transportation Secretary Sean Duffy has made it clear: the focus is on traditional infrastructure and getting things built faster, particularly roads, bridges, and highways.

“We’re working to streamline the process for the states—to take off as much weight as possible so they can build faster and spend more time turning dirt and less time doing paperwork.” – Sean Duffy, U.S. Secretary of Transportation

Duffy's infrastructure priorities include:

At the end of the day, supply chains move at the speed of infrastructure. You can have the best tech and fastest network—but if the roads suck, so does your ETA.

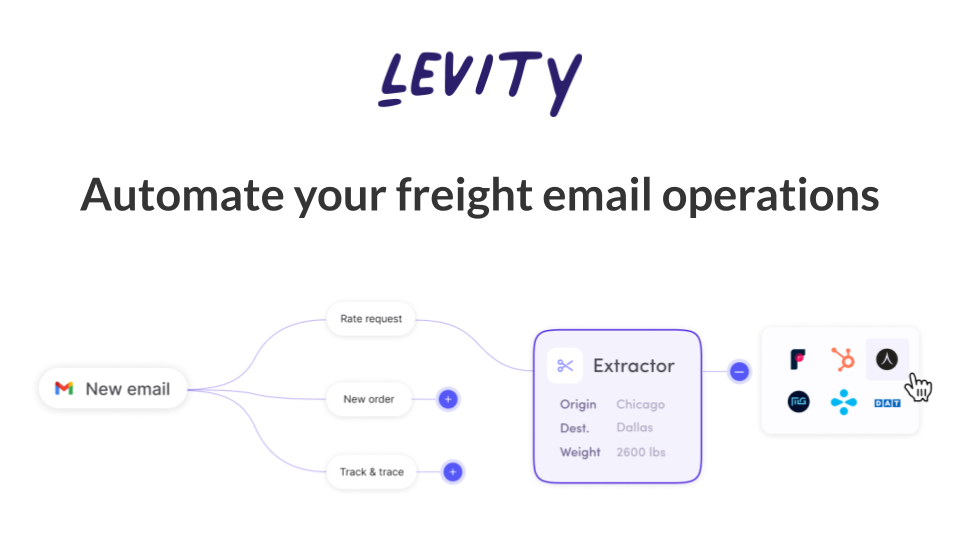

Levity helps fast-moving 3PLs and freight brokers do more with less by automating the most time-consuming email and phone tasks.

From spot quoting and load building to track & trace responses, Levity connects with your inbox, TMS, rating engines, and call systems to extract the right information, no matter the language, format, or channel.

It runs quietly in the background, performing tasks automatically and reliably, so your team can focus on building shipper relationships, not doing manual data entry.

🌎 AROUND THE FREIGHT WEB

🤝 Making Moves. Kodiak Robotics is going public through a $2.5 billion merger with Ares Acquisition Corp II, accelerating its go-to-market strategy with aim of being a publicly traded autonomous truck company soon.

🧾 Bookkeeper Stole $4M from NJ Trucking Company. A New Jersey bookkeeper admitted to stealing $4 million from West End Express over six years to fund a gambling habit.

🚫 Truck Parking Crackdown. San Antonio will limit legal truck parking in response to 311 complaints. Areas that were once legal are now banned for trucks based on residents' complaints to the city.

🍅 Tomato Tariffs. The White House is enforcing a 21% tariff on tomatoes from Mexico, starting July 14. The Commerce Department said, “This action will allow U.S. tomato growers to compete fairly in the marketplace.”

🛢️ Diesel Prices Dip. National diesel prices fell by 6 cents to $3.579 per gallon. A gallon of fuel now costs 43.6 cents less than it did around this time last year.

💰 Tariffs Boost Financing Talk. New tariffs could drive more businesses to explore financing options in supply chains, as businesses work to create capital while being faced with increasing costs, according to a Wells Fargo executive.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).