🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

Plus: NY Novelis aluminum plant on fire again, FMCSA’s 2026 bond crackdown, USPS shipping prices hike

Happy Friday. Is the freight market stabilizing, or simply holding its breath? Mixed predictions from ACT Research and RXO reveal a recovery that may be slower and more fragile than it appears.

Plus:

🔥 Novelis Fire Raises Fresh Concerns for Ford’s Restart Timeline. A second fire at the Novelis plant has created new uncertainty for Ford just as the automaker was preparing for production to resume. Novelis declined to say whether the latest incident will affect its restart schedule, leaving suppliers and OEMs waiting for clarity. Ford said on Nov. 20 that it is “working with Novelis to learn more” and is still assessing the operational impact. The timing is significant: one day earlier, CFO Sherry House told investors the restart was “on track” for Thanksgiving or early December. With another setback now in play, Ford shares fell nearly 4% midday Tuesday as concerns over material flow and production timing resurfaced.

🚨 FMCSA’s 2026 Bond Crackdown Is About to Squeeze Brokers. FMCSA’s new broker rules hit Jan. 16, 2026, turning the $75,000 bond into a strict, real-time requirement. If a broker’s bond dips below the threshold, FMCSA will suspend operating authority within 7 business days. No grace period, no quiet fixes. BMC-85 trusts now must be 100% cash-backed, pushing many brokers to scramble for new coverage or pay higher premiums. The timing couldn’t be worse: brokers are already battling thin margins, rising spot costs, and slow contract resets. One big unpaid claim could shut a brokerage down overnight. Carriers are getting stronger protections, but many brokers may not be able to survive the eventual shift.

🛰️ New Cognosos Cargo Security Index Reveals Rising Theft Rings & Fraud Hotspots. Cognosos has released its first Cargo Security Index under the new brand, offering a real-time view into U.S. cargo theft patterns using IoT tracking data and field intelligence. The latest report flags a $4.5 million theft ring in California and a $1 million+ freight-fraud case tied to double-brokering, clear signs that organized crime is exploiting industry gaps as key FMCSA safety rules remain delayed until 2026. The Index shows where shippers face the highest risk and how tools like geofenced tracking, automated incident reporting, and always-on visibility can turn regulatory lag into proactive protection.

Your Road Operations, Finally Running in One Place

Most logistics teams juggle planning, carrier emails, spreadsheets, and status calls. A unified TMS solves most of these issues by pulling everything into one clean workflow.

Orders flow in automatically. Contracted lanes assign the right carrier without human input. Spot quotes run through a quick, structured quote flow.

Every milestone updates in real time, every document lands in the right place, and every stakeholder sees the same truth.

With user roles, compliance checks, and secure carrier-customer setups, even sensitive shipments move with confidence.

It is the control layer that road logistics has always needed: less noise, fewer steps, and full transparency from booking to delivery.

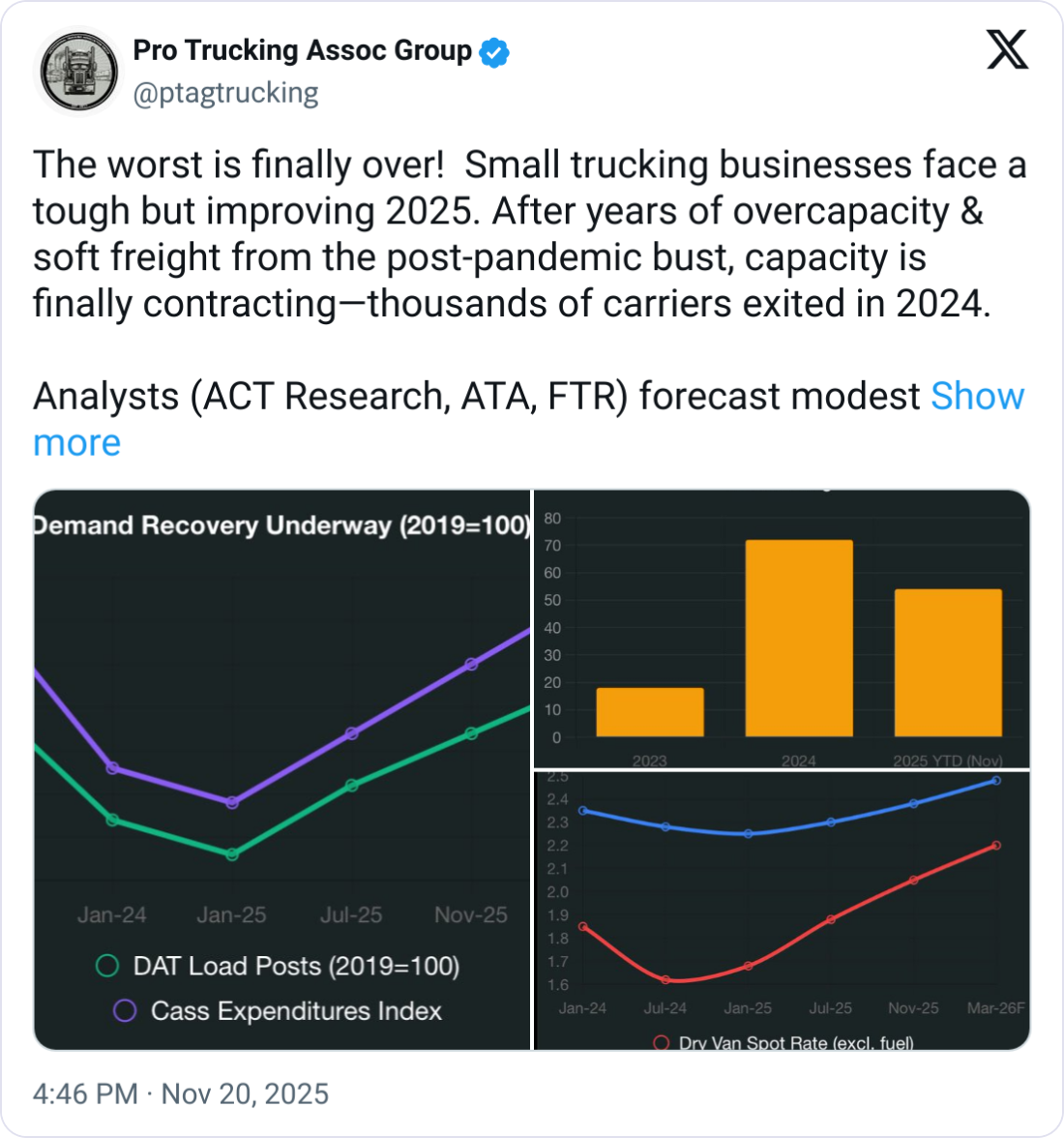

Freight analysts are signaling the end of the recession, but the data isn’t uniform. New forecasts from ACT Research point to stabilization in 2025, while RXO warns that the industry is heading toward 2026 with one of the most fragile capacity environments in years. The contradiction leaves brokers, carriers, and shippers reading mixed signals at a moment when stability matters most.

ACT Research, DAT, and Freight Transportation Research expect 2025 to deliver a modest recovery: roughly 2% GDP growth, stabilizing or rising contract rates, and slightly stronger tonnage. Capacity is finally contracting after two years of exits, and private fleets are slowing their insourcing efforts.

Tim Denoyer of ACT summed up the shift:

“The market is very close to balance… the for-hire rate recession is finally over.”

Key drivers behind the forecasted improvement:

For ACT, these points align with their opinions: gradual stabilization, not acceleration.

RXO’s Curve report tells a more cautious story. Spot rates were only up 1.8% year over year in Q3, marking the third straight quarter of cooling rate gains. Volumes remain muted, carrier costs remain elevated, and seasonal inflections have been too weak to break the market out of its range-bound pattern.

Corey Klujsza of RXO characterized the situation bluntly:

“Muted freight volumes, waning carrier capacity, and low spot rates that haven’t been able to sustain momentum.”

RXO flags several risks that could make 2026 volatile rather than stable:

Jared Weisfeld, RXO’s chief strategy officer, warns the industry is entering 2026 with:

“The most fragile capacity environment in two years.”

RXO expects rates to remain inflationary but not strong enough to meaningfully shift shipper behavior, unless demand spikes or regulatory exits accelerate.

ACT sees a balanced market emerging. RXO sees a structurally fragile supply side.

Both can be true:

The result is a market that is improving statistically, yet remains vulnerable to shocks.

Today’s conflicting forecasts a recurring industry theme: recovery without confidence.

The 2025 State of the Supply Chain report from Infios finds a widening gap between what companies believe about their resilience and what customers actually trust. Technology investment is accelerating, but consumer skepticism is rising. Resilience alone is no longer enough.

To understand how these tensions will define 2026, the full Infios report breaks down the trust gap shaping every supply chain decision this year.

You can read the report here.

Cash flow 101: Know your DSO and DTI. Then cut them both down with Epay Manager.

Epay is your back-office automation and payments partner that is an expert in helping you run a smooth back-office and maintain healthy cash flow with a proactive, streamlined, and connected invoicing workflow.

Real automation, real results.

🔋 Battery Meth. Authorities found $2.6 million worth of meth hidden inside a commercial truck’s load of batteries during an inspection, seizing the cargo and detaining the driver.

🦎 Multi-State Licenses. Border Patrol arrested a 29-year-old Uzbek truck driver after an I-10 crash in Arizona and found he carried five licenses from various states. Officials say he reentered the U.S. after a 2023 removal order.

🤝 Kodiak–ZF Growth. Kodiak bought 100 ZF ReAX redundant steering systems as it ramps production for 2026. The ReAX units are integrated into Driver-equipped trucks and upfitted by Roush in Michigan, providing fail-safe steering for autonomous operations.

🔐 Cyber Risk Rising. A new survey found seven in ten companies view supply chain cyber threats as a major concern, citing vulnerabilities in vendors, logistics tech, and third-party data access.

🦃 Turkey Spill. Dozens of live turkeys wandered across I-77 in Charlotte, NC after a semi-truck crash, forcing traffic closures while crews worked to recover the birds and clear the roadway.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).