🎣 Winter Has Come

Plus: Congress advances transportation funding bill, warehouse demand rebounds, December imports slide.

Are you paying attention to the issues unfolding with Forward Air & Omni Logistics merger deal? With legal battles and shareholder disputes, we've got the rundown.

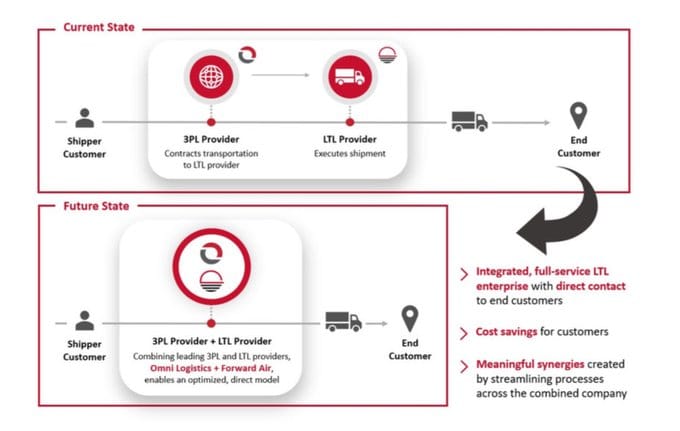

In the world of logistics mergers, a high-stakes drama is unfolding between Forward Air Corp. and Omni Logistics. The proposed merger, valued at $3.2 billion, is mired in controversy and legal disputes, casting shadows on its future.

The Merger's Rocky Road:

There was no middle ground for this deal to begin with - it was either going to go really well or not. The market didn’t like it. Look at Forward’s shares the day after the announcement. Plummeted. Several of Forward’s biggest clients didn’t like it either.

— Curtis Garrett 🦸♂️ (@spacetimerisk) November 20, 2023

Legal Tug-of-War:

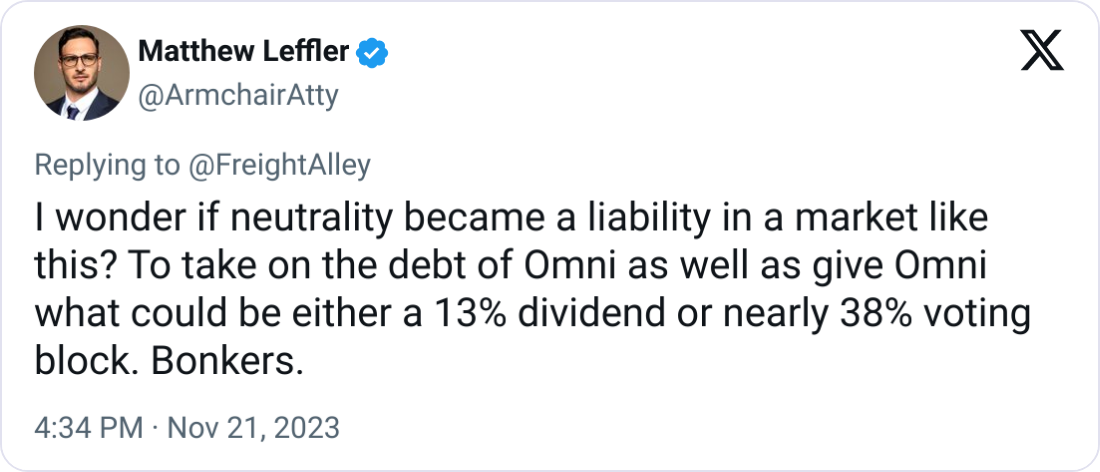

Omni categorically denies the claims made in Forward Air's counterclaim and believes the merger agreement is legally binding. The company says it has worked diligently and cooperatively with Forward throughout the merger process and intends to enforce the merger agreement and close the transaction as expeditiously as possible.

Forward Air believes that Omni has not followed through on the planned merger and has been delayed due to Omni's continuous delays and repeated misrepresentations. Forward Air no longer believes Omni is acting in good faith with respect to the merger agreement.

Inside the Dispute:

What's at Stake:

A Critical Decision Looms:

The Bigger Picture:

Sources: FreightWaves | Matthew Leffler | PR Newswire | Transport Topics

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).