🎣 Freight-GPT

In just three years, we have moved from an industry that relied heavily on manual phone calls and emails to one where many of us use AI to some extent to support the above.

In just three years, we have moved from an industry that relied heavily on manual phone calls and emails to one where many of us use AI to some extent to support the above.

Happy Hump Day. Today’s feature highlights a new tool from freight AI companies that functions like ChatGPT for freight operations.

Plus:

🍳 What's Cookin' In Freight

💰 Freight Stocks Are Waking Up. According to Craig Fuller, Wall Street is starting to believe the Great Freight Recession may finally be ending. FedEx is up sharply over the past six months and just doubled down on that optimism by teaming up with Advent to acquire Polish parcel-locker giant InPost in a $9.2B deal, giving it direct access to one of Europe’s largest out-of-home delivery networks. The move gives FedEx direct access to one of Europe’s largest out-of-home delivery networks.

🚨 Crackdowns Are Here. Federal and state officials are turning up enforcement on multiple fronts. In Kentucky, five people were charged in a scheme that allegedly took illegal payments to fast-track driver’s licenses for legally present non-U.S. citizens, bypassing testing requirements and producing invalid CDLs. At the same time, the USDOT and FMCSA removed nearly 2,000 drivers and commercial vehicles from service nationwide during January’s Operation SafeDRIVE, citing unqualified drivers, unsafe equipment, and impaired driving.

📈 RXO’s 2025 Earnings. RXO reported a sharp jump in revenue in 2025, with sales up 26% to $5.7B, driven mainly by higher truck brokerage volumes following the Coyote Logistics acquisition and growth in last-mile services. Losses narrowed compared to last year, even as operating costs rose and integration expenses weighed on results. Truck brokerage remains RXO’s largest business, last-mile volumes grew double digits, and the company continued investing heavily in technology to support scale across North America and the U.K. RXO's stock is up 28% YTD.

Presented by FreightCaviar Print

The second print edition of FreightCaviar is almost here.

Our Spring 2026 issue focuses on one unlikely place: Chattanooga, Tennessee (Freight Alley). How a mid-size city became the most concentrated freight workforce in the United States, evolving from trucking giants to brokerage empires to today’s freight tech startups. We break down the history, the people, and what comes next.

If you subscribe today, you’ll also receive our inaugural Winter 2025/2026 edition for free.

No risk. If you're not satisfied with the magazine, email us, and we’ll issue a refund. No questions asked.

Every print edition includes a limited-edition FreightCaviar sticker set.

For teams, offices, or collectors, we also offer Caviar Club memberships (5+ copies of every issue). Interested in bulk copies or Caviar Club pricing?

Email pbj@freightcaviar.com for details.

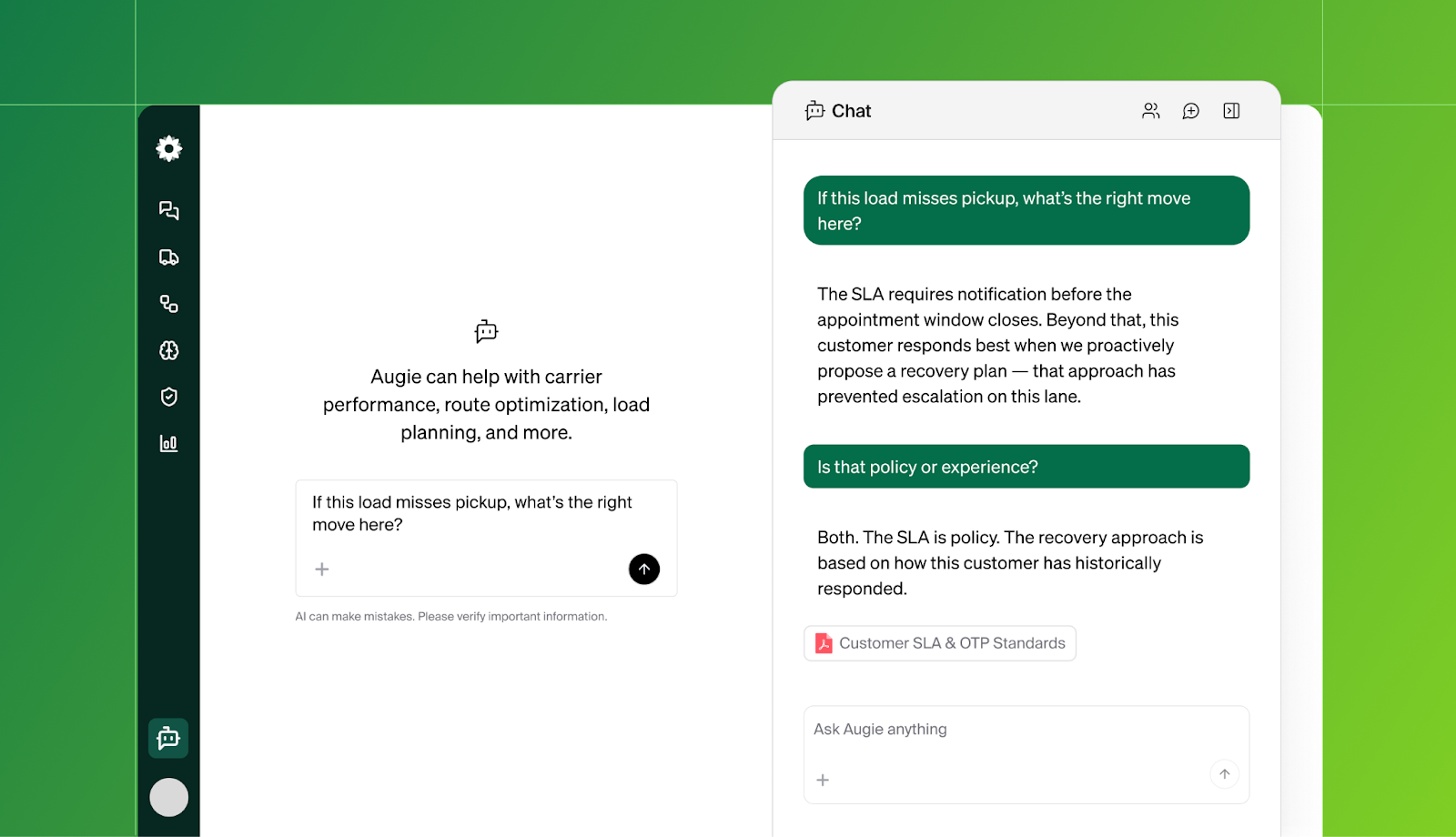

These days, a freight broker rep could hardly turn around without hearing AI.

The industry has been flooded with numerous AI companies promising to support operations with inbound and outbound calls, email responses, quoting, posting, and more.

It has been interesting to see firsthand how much venture capital has been invested in these companies since ChatGPT launched in October 2022.

In just three years, we have moved from an industry that relied heavily on manual phone calls and emails to one where many of us use AI to some extent to support the above.

With substantial capital being invested in the AI freight space, the space will continue to evolve rapidly.

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).