🎣 Warrants Served

Plus, a Chicago-based freight broker boasts about making $215k in one day, Lineage Logistics hits it big with an $18 billion IPO, the latest on the Ocean's 11-style freight heist, and more.

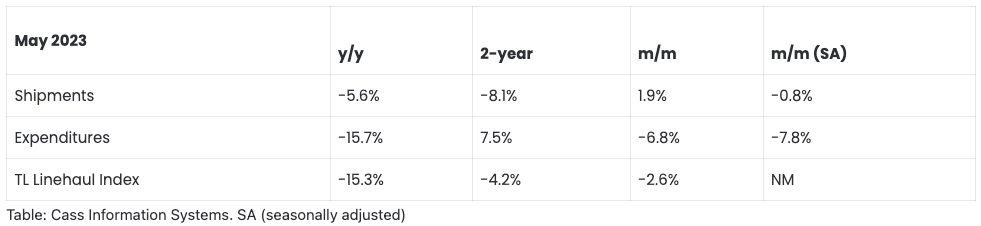

Comprehensive insights from the Cass Freight Index report for May 2023. Understand the latest trends in shipments, expenditures, freight rates, and the truckload linehaul index.

Freight Index and Shipments

The Cass Freight Index for shipments increased by 1.9% month-to-month (m/m) in May 2023, despite a year-on-year (y/y) decrease of 5.6%. The softer-than-normal seasonal increase points to a continuing freight market downcycle, driven by declining real retail sales trends and ongoing destocking. However, improving real incomes and the end of severe destocking hint at shifting dynamics.

Expenditures

The expenditure component of the Cass Freight Index fell by 6.8% m/m and 15.7% y/y in May 2023. Given the 1.9% m/m increase in shipments, inferred rates were down 8.5% m/m. The index, which considers changes in fuel, modal mix, intramodal mix, and accessorial charges, is projected to decline about 16% in 2023, indicating a possible ~20% decline in freight spending this year.

Inferred Freight Rates

May saw inferred freight rates embedded in the Cass Freight Index components drop 10.7% y/y, continuing from the 11.9% decline in April. Lower fuel prices and market pressures are significant contributing factors to the decline. The rates are expected to remain roughly stable month-to-month in June, but with an expected y/y decline of approximately 20%.

Truckload Linehaul Index

The Cass Truckload Linehaul Index fell 2.6% m/m in May to 142.8, representing a larger decline than the preceding five months. The Index, a broad indicator of the truckload market, dropped 15.3% y/y in May, suggesting that the larger contract market will continue adjusting downwards.

Freight Expectations

Despite the softness in freight volumes, the U.S. freight transportation industry is expected to transition into the early phase of a new cycle in the coming months. Excess capacity continues to be a concern, but capacity contraction at record pace should facilitate bottoming out. For more detailed forecasts, ACT Research's Freight Forecast provides comprehensive analysis and projections.

Source: Cass Info & FreightWaves

Shipments and expenditures plummeted year over year (y/y) in May at the fastest pace in nearly three years, according to data provided by Cass Information Systems. https://t.co/Knrq6DfVHq

— FreightWaves (@FreightWaves) June 13, 2023

Join over 10K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe now & be sure to check your inbox to confirm (and your spam folder just in case).