🎣 C.H. Robinson

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

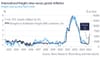

Sharp increase in freight rates early 2024 may signal an impending surge in goods inflation, according to data from Steno Research.

As we venture into 2024, a sharp spike in international container freight rates suggests an upcoming climb in U.S. goods inflation, potentially disrupting market forecasts. While a significant cutting cycle is anticipated, uncertainty over the inflation trajectory remains unreflected in current market pricing. Analyst Andreas Steno draws a direct line from current shipping costs to future price increases and questions the Fed's next steps.

Critical Observations:

Studies link shipping costs directly to inflation: a doubling in freight rates may boost CPI inflation by 0.7 points. The pandemic's freight cost surge, a 600% jump, eventually passed onto consumer prices, a pattern we may see again.

Not everyone agrees on this outlook. Debates on Twitter reflect a spectrum of opinions. While some urge the Fed to take quick action, others question the reliability of freight rates as an inflation indicator, especially in a market still stabilizing from recent shocks.

Just because there's short term correlation, it doesn't mean that historically this has been the case.

— George (@georgezii_) January 21, 2024

What's the R^2 between those two since 2013?

Spurious correlaction in my opinion. In 2021-2022 so many shocks tooked place at one time, that it is not right to connect inflation only to freight levels

— Paweł Mura, CFA (@Pawel_Mura) January 21, 2024

The conversation is buzzing with varied perspectives – some users see a strategic opportunity amid potential policy errors, while others doubt whether inflation will indeed follow suit. The uncertainty of the times adds to the complexity of predicting the Fed's response.

#policyerror

— Chris McAlister (@TheWineSwine) January 21, 2024

But, as you infer, need to determine what they will do, not what you think they will do in order to play checkers.

Chess players can use that policy error to their advantage so long as they don’t do it too early.

Source: Andreas Steno/X | Stenoresearch.com | CEPR.org

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).