🎣 SAM Express Under Investigation

Plus, XPO and Hub Group Q4 2025 earnings, a trucking private-equity firm files bankruptcy, Mexico long-haul truckers win union rights, and more.

Plus: Tesla to build an electric semi-truck corridor, FMCSA approves TIA's petition for freight broker training, and Arrive Logistics releases a freight market update.

Happy Earth Day. We hope you're thinking green even though a bunch of trucking stocks are seeing red. Today's feature takes a look at cooling stock prices as Q1 earnings reports from major carriers have sparked concerns.

🤔 Question of the Day: Which of these four publicly traded mega carriers has had the worst-performing share price in the last 30 days? Scroll to our main story to find out.

A. ArcBest

B. Forward Air

C. Knight-Swift

D. J.B. Hunt

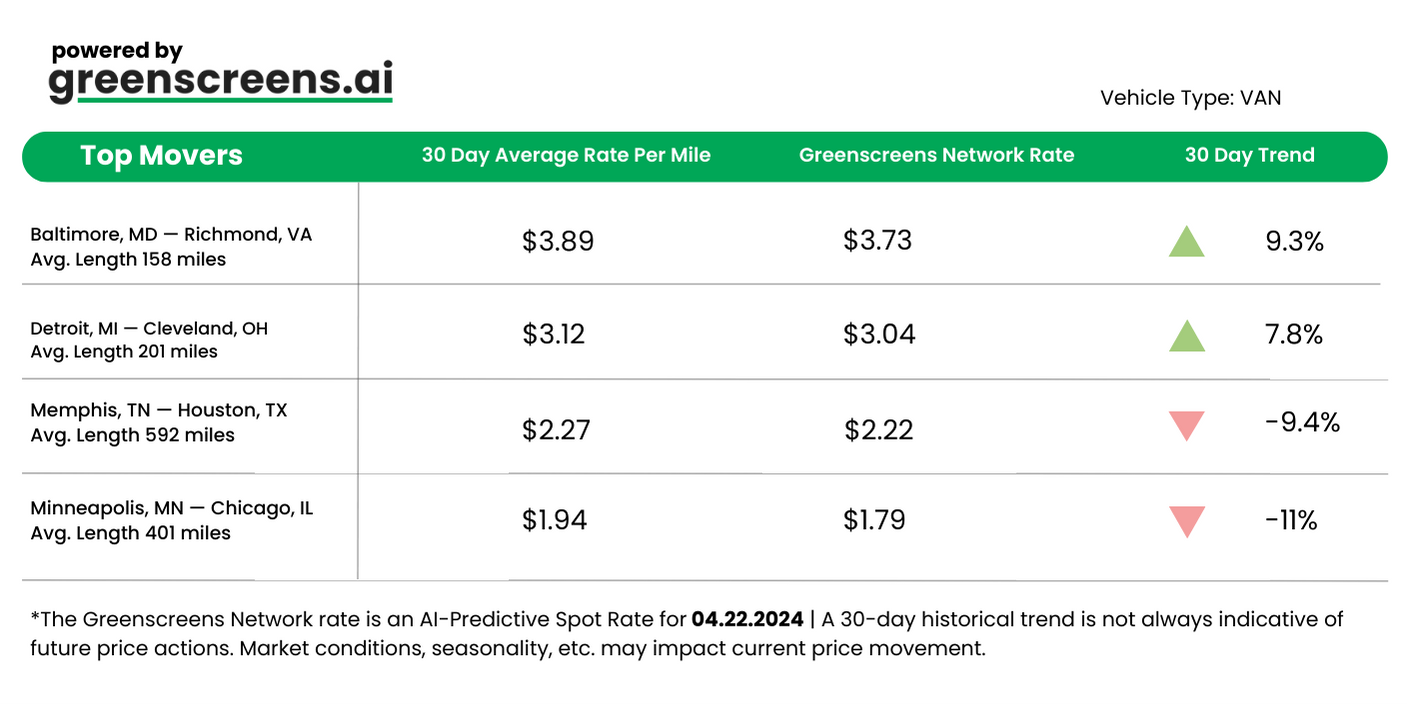

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

*Greenscreens.ai, forecasts real-time truckload buy prices that are suited to each freight brokerage's purchasing power using AI and machine learning. Its engine takes into account over 130 attributes and data points in each rate forecast.

🐔 WHAT’S COOKIN’ IN FREIGHT

⚡️Tesla Advances Electric Truck Corridor. Tesla continues to advance its plan to build an 1,800-mile electric truck charging corridor from Texas to California, named TESSERACT, despite not receiving federal funding under President Biden’s infrastructure plan. The project aims to link Tesla's North American factories and promote electric trucking, despite setbacks such as the company's recent restructuring and layoffs, and a focus shift towards autonomous driving and robotaxis. Tesla is exploring state funding and future federal opportunities to support the corridor, which could significantly impact long-distance and regional electric trucking.

🤝 FMCSA Approves Freight Broker Training Requirements. The Federal Motor Carrier Safety Administration (FMCSA) has approved the Transportation Intermediaries Association's (TIA) petition to enforce training requirements for brokers and freight forwarders. Despite increased fraud in the sector, highlighted by TIA, these measures aim to improve safety and integrity in the marketplace by ensuring that brokers employ individuals with either relevant experience or adequate training. Additionally, FMCSA is moving towards a new registration system and enhancing broker transparency, although specific rulemaking is still pending.

💡 Factoring Data Insights. Triumph Financial's TriumphPay segment experienced a setback with a negative EBITDA in the first quarter of 2024, marking a shift from its brief positive EBITDA in the previous quarter, despite the company's long-term strategy showing promise with notable client additions like Werner Enterprises. The broader trucking market remains sluggish, evidenced by minimal changes in average invoice sizes and weak earnings across the sector. However, TriumphPay continues to grow its influence in the brokered freight market, aiming to cover 50% of it by year's end.

TOGETHER WITH CTRL CHAIN

Celebrate Earth Day with a greener supply chain. See how leading companies are embracing sustainable options with CtrlChain, like offsetting carbon emissions.

This latest article explores the environmental strides being made in the freight industry, driven by consumer demand and automated tech.

Ready to reduce your carbon footprint and optimize your operations? Read on for more insights and solutions that benefit both your business and the planet. Make a change this Earth Day with CtrlChain.

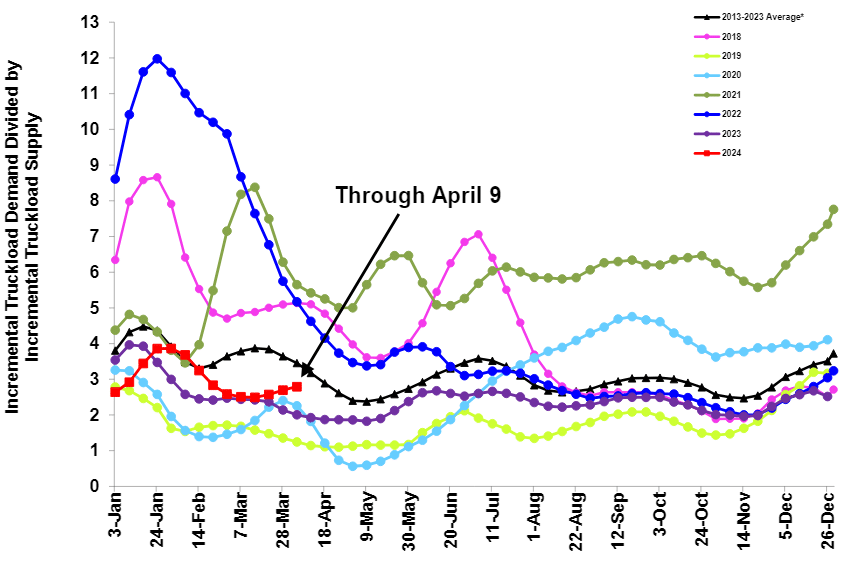

Although the freight market has been quite rough since mid-2022, that hasn't stopped investors from being bullish on trucking stocks. Many trucking stocks have enjoyed high prices, with several hitting share price records over the last couple of years. However, after last week's first-quarter reports from mega carriers, investor bullishness seems to be halting. Here is a one-month share price change of 12 publicly traded trucking companies:

*As of April 21, 2024, 21:29.

With the release of key earnings reports and sobering comments from J.B. Hunt President, Shelley Simpson, investor confidence wavered, hitting stock prices hard.

As we edge into Q2, the trucking industry still deals with the shadows of the freight recession.

These figures mirror investor worries about what lies ahead. Here's a closer look at the current state and what might be driving these trends.

Craig Fuller and Zach Strickland from FreightWaves provided some deeper insights:

The upcoming presidential election and ongoing economic conditions are also stirring the pot. Fuller warned, "Donald Trump winning the election could force a rapid adjustment in supply chain strategies due to anticipated tariff changes."

The graph above, originally posted by Felipe Capella, CEO of Loadsmart, tracks the number of active trucking carriers, peaking in 2022, with predictions divided on whether numbers will normalize by August 2024 or June 2025.

A few potential scenarios emerge:

While the immediate future might still hold some bumps, the trucking industry could be on its way to a slow but steady recovery. Keep an eye on how political developments and economic policies impact the sector in the upcoming quarters.

Sources: Yahoo Finance | FreightWaves | FreightWaves (2) | U.S. News | Investor's Business Daily

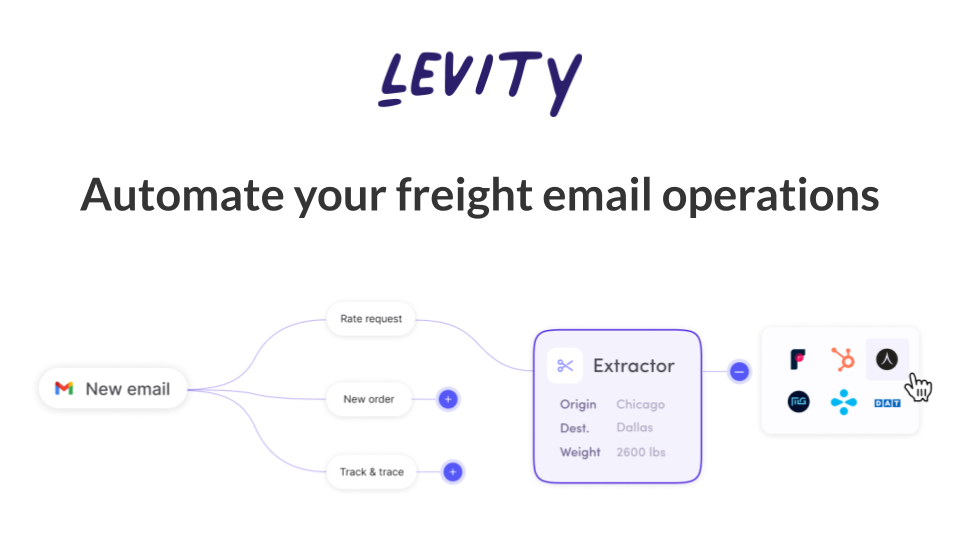

TOGETHER WITH LEVITY

Levity helps fast-moving 3PLs and freight brokers to do more with less by automating the most time-consuming and repetitive email tasks.

Whether it is spot quoting, load building or answering track and trace requests. Levity connects to your inbox, TMS and other tools like rating engines, extracting the right information no matter the language or format. It performs tasks on your behalf automatically in the background so you can save time and focus on building shipper relationships instead of data entry. Learn more on Levity.ai today.

AROUND THE FREIGHT WEB

📉 April 2024 Freight Market Update by Arrive Logistics. The April 2024 freight market report from Arrive Logistics highlights continued soft market conditions with low truckload demand and rate decreases, but anticipates regional volatility with the upcoming produce season.

💸 Freight Tech Startups Face 2024 Challenges. Felipe Capella, Founder & CEO of Loadsmart, warns that Freight Tech startups are facing shutdowns in 2024 due to sustained high interest rates and stagnant freight markets.

🚚 Maybach International Opens Huge Terminal. Maybach International Group LLC celebrates the opening of their new, advanced terminal in Elgin, IL, designed with extensive facilities for drivers and enhanced capacity for truck servicing and warehousing.

📦 Amazon Tops UPS in U.S. Parcel Volumes. In 2023, Amazon surpassed UPS in U.S. parcel volumes for the first time, highlighting a shift in market dynamics with Amazon and alternative carriers gaining ground.

⚖️ CDL School Owner Sentenced for Bribery. A Philadelphia CDL school owner was sentenced to nearly five years in prison for bribing an examiner to falsify student test results.

🚨 FMCSA Warns of Phishing Scam. The FMCSA has issued an alert about a phishing scam involving fraudulent emails that mimic safety audit communications to steal sensitive information from motor carriers.

🗣️Upcoming Freight Market Debate. DAT will debate SONAR about the freight market on June 4th in Atlanta at the Future of Supply Chain event.

🎣 FREIGHT CAVIAR TECHNOLOGIES

In this week's episode of The FreightCaviar Podcast, Paul and Krystian sit down to talk about how FreightCaviar came into existence and how they then partnered to launch ShipperCRM.

Listen on Apple Podcasts or Spotify.

Watch on YouTube.

FREIGHT MEME OF THE DAY

Also, check out:

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).