🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

ATA and ACT Research report declines in U.S. truck tonnage and trailer orders in April, as economic uncertainty and tariff pressures stall recovery across freight and equipment markets.

U.S. trucking volumes and trailer orders both declined in April, highlighting persistent instability in freight markets early in the second quarter. New data from the American Trucking Associations (ATA) and ACT Research reflects growing hesitancy among carriers and equipment buyers amid trade tensions and economic headwinds.

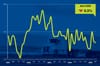

ATA’s For-Hire Truck Tonnage Index declined 0.3% in April, following a 1.5% drop in March. The index had surged 2.8% in February—its highest reading since May 2024—but has now fallen a combined 1.8% over the past two months.

“A recovery that was expected this year hasn’t transpired,” said ATA Chief Economist Bob Costello. “The industry is dealing with a freight market in flux from tariffs and softening economic indicators.”

The index reached a seasonally adjusted reading of 113.0 in April, marginally higher than April 2024 by 0.1%, marking the fourth straight year-over-year gain—but also the smallest over that stretch. The not seasonally adjusted tonnage index registered 112.0, down 2.2% from March’s 114.6.

ATA's index is based largely on contract freight and is widely regarded as a proxy for broader economic activity, as trucking moves 72.7% of U.S. domestic freight by tonnage.

April also brought a sharp contraction in trailer demand. Preliminary net orders totaled 9,400 units—down 32% year-over-year and 57% from March, according to ACT Research. The drop follows a surprising March spike, which analysts now believe was driven by early ordering ahead of anticipated tariffs.

“There’s a lot more hesitancy to place orders… customers are just waiting,” said Ron Jake, director of marketing at Stoughton Trailers.

Market participants point to a combination of soft freight demand, overcapacity, lower equipment resale values, and high borrowing costs. Manufacturers and dealers report slower quoting activity and more purchases from existing inventory rather than new builds.

Dan Taylor, director of sales at Western Trailer, said customers are reluctant to commit to long-term capital outlays amid the uncertain policy landscape.

“They’ve identified the need… but the economy is a little off. We’ve seen this before,” Taylor said. “It’s hard to make a long-term decision at this point.”

Recent tariff announcements have added a new layer of complexity. President Donald Trump’s administration has pushed a 10% baseline tariff on key trading partners, with higher rates proposed for certain Chinese imports. A temporary 90-day tariff truce with China announced in May has done little to fully calm market jitters.

“With all the announcements about tariffs and all that uncertainty… unfortunately, it’s made all the customers stay put,” Jake added.

ACT Research noted that seasonal adjustment placed April’s trailer order intake at 11,400 units—nearly half of March’s adjusted figure of 22,700.

Jake say the freight environment showed signs of improvement in late 2024 and early 2025, but momentum has been stalled by macroeconomic and policy concerns. Dealers and OEMs are keeping operations flexible to adapt to shifting demand.

“Q1 ended about as expected, with Q2 following quickly in its footsteps,” said Theresa Check, head of sales at Hyundai Translead. “Dealers and customers continue to show reluctance and uncertainty in this receding market.”

As the second quarter progresses, the freight sector remains in a state of caution, watching for clarity on trade, inflation, and consumer demand before making renewed investment decisions.

Source: ATA | Transport Topics

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).