🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

A round-up of the most engaging and talked-about freight content from around the web and from us.

FreightCaviar Weekly Recap. A round-up of the most engaging and talked-about freight content from around the web and from us.

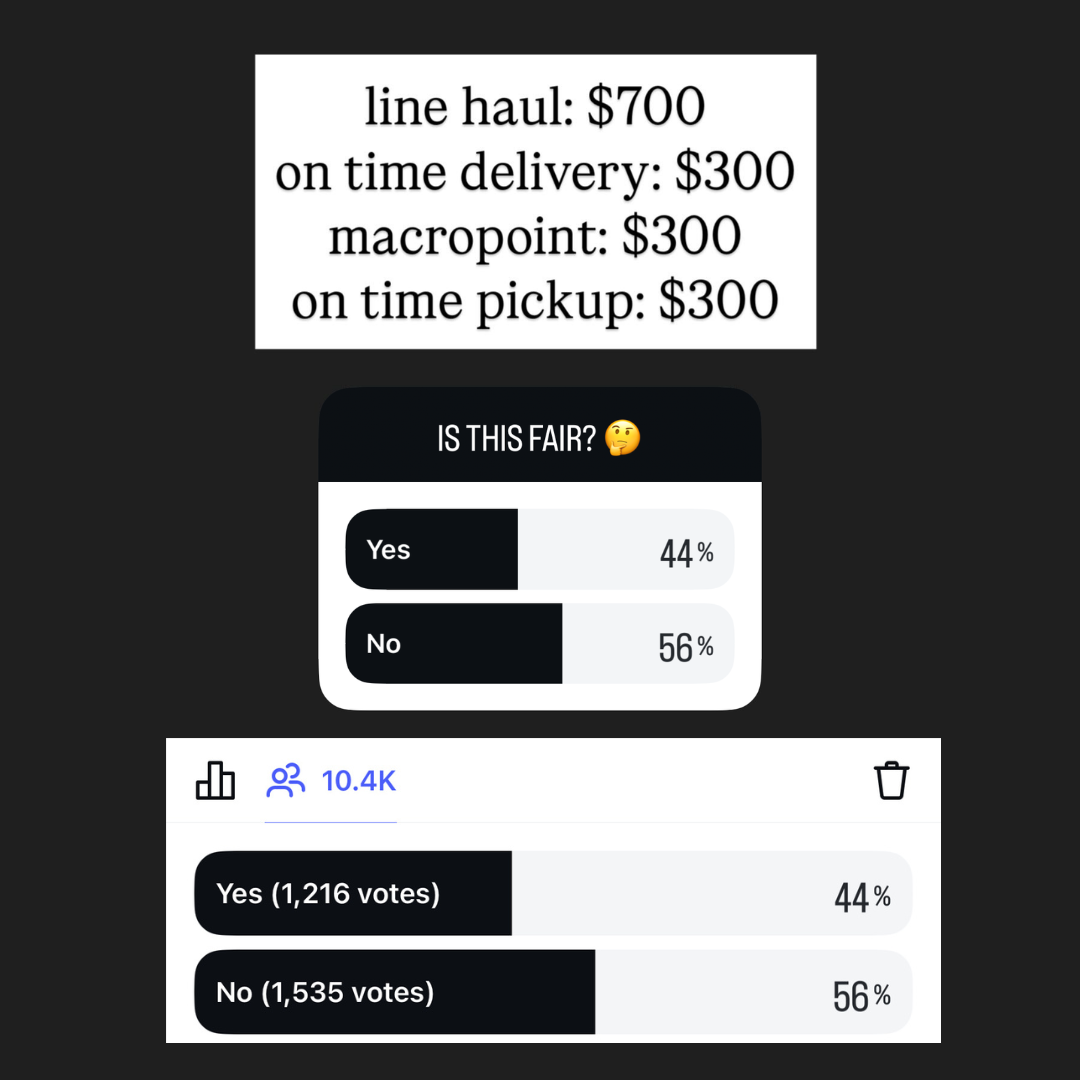

Would you accept this load breakdown?

Yesterday on our Instagram page, we shared a rate confirmation with this breakdown:

We asked if this setup was fair, and it sparked a debate.

Out of 2,700+ votes: 44% said yes, 56% said no.

Here’s what some of you had to say:

Let us know what you think by replying directly to this newsletter!

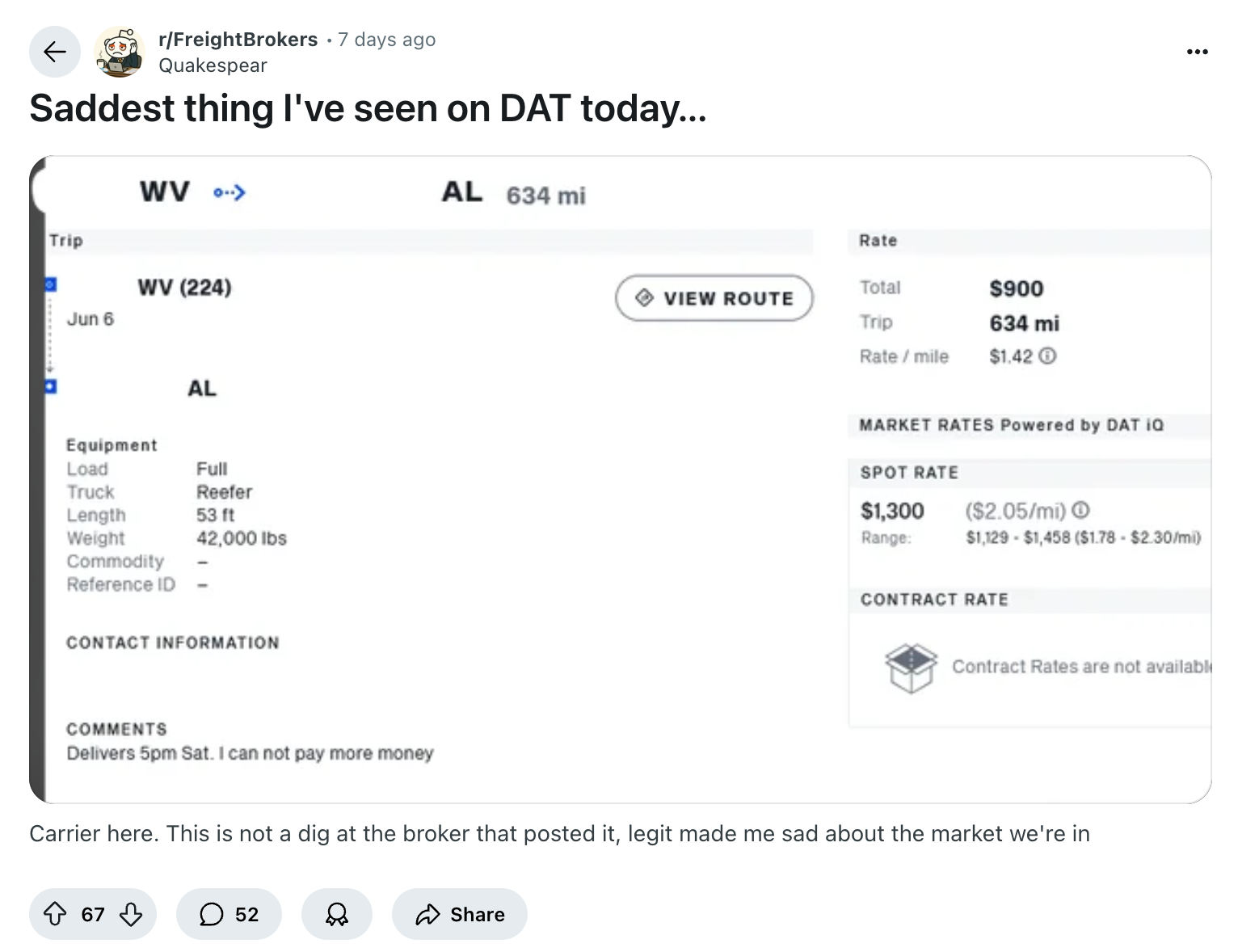

Over on r/FreightBrokers, Reddit user QuakeSpear (a carrier) shared a load from DAT with a rate so bad it had people calling it “disgusting.”

Some suspect it’s triple brokered, while one commenter summed it up:

“Broker: Greedy. Shipper: Stupid. Carrier: Not Taking This.”

But not everyone’s out. One user said they’d take the load, not for profit, but to hedge the market, reinvest, and out-service the big guys.

Would you haul it or walk away? Drop your take in the FreightCaviar Forum.

Take control, centralize your claims process for:

✅ Faster resolutions

✅ Automated tracking & updates

✅ Simplified carrier communication

Click here to see the entire tweet.

I mean, c’mon. Times are tough... but not that tough. Wes Harman called it the worst trucking photo he’s ever seen and honestly, I agree.

The carrier, ShipEX responded in a separate post, saying they’re aware of the photo and are working to verify if it’s legit. They added:

“It is unacceptable and not in line with ShipEX’s values, culture, or policies.”

So next time you're down on your luck, just remember:

At least you’re not that guy.

BONUS X POST:

Craig Fuller dropped this chart showing steep year-over-year declines in freight demand. The reactions? A mix of memes, market nihilism, and hard-to-argue takes like:

“Tariffs are uncertainty on steroids.”

“Input costs up, consumer confidence down, and growth stalls.”

When a freight brokerage pushes to keep documents sealed, there’s usually a reason. But now, unredacted court filings from GlobalTranz and WWEX have surfaced, seemingly by mistake. And they reveal more than either company probably wanted out there. We break it all down in this week’s most-clicked FreightCaviar feature.

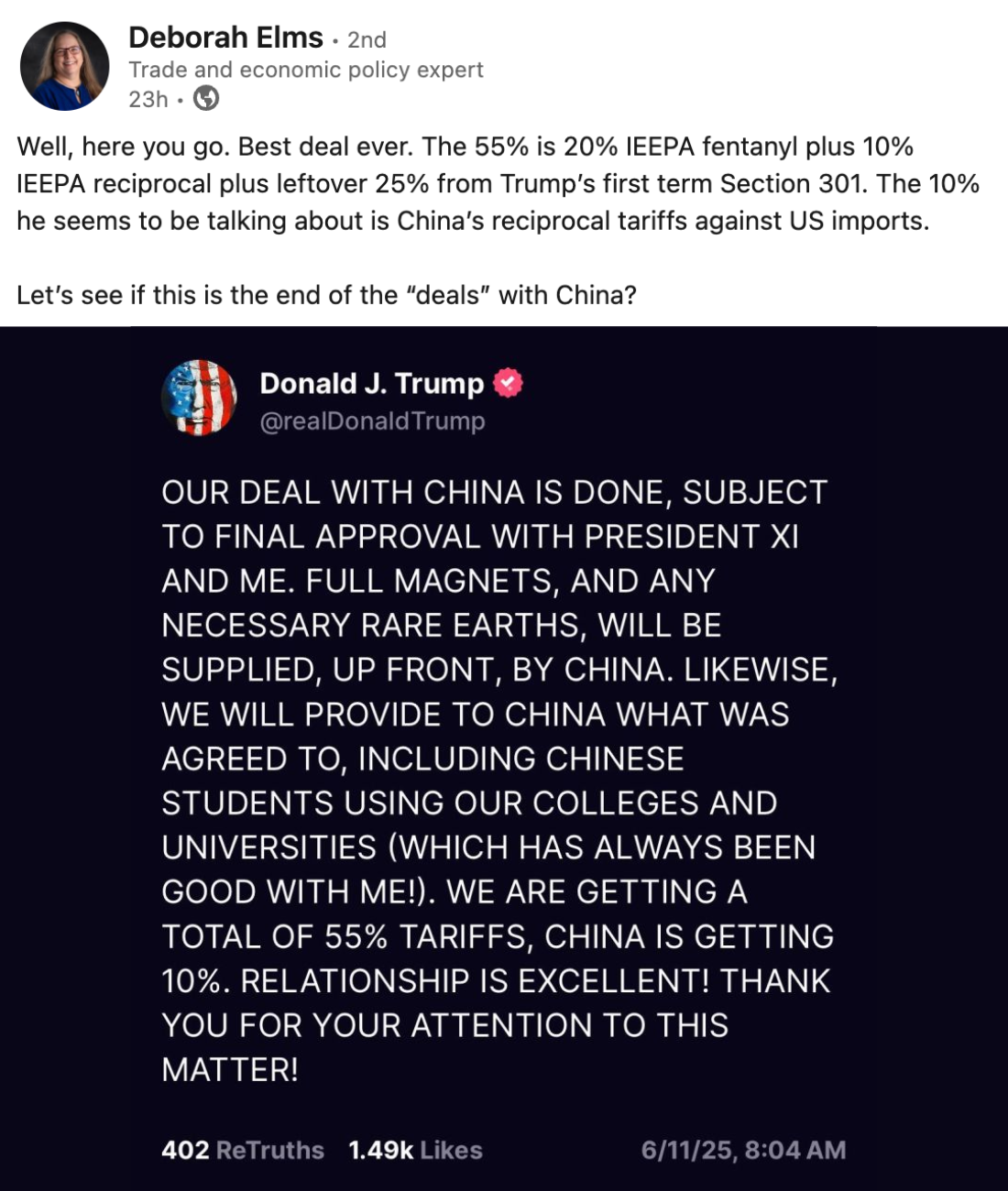

“The 55% is IEEPA fentanyl + reciprocal + Trump-era leftovers.”

Deborah Elms, trade policy expert, broke down Trump’s math in his latest China deal. Her post got a lot of engagement on LinkedIn, drawing in commentary from freight economists, professors, and supply chain leaders like Lars Jensen, who replied:

“We are paying 55% tariffs, not getting them. There, fixed it for you.”

Some commentators questioned whether the framework marks a turning point or just another round in a longer trade tug-of-war. Others noted the six-month rare earth export window as a sign of cautious progress rather than a breakthrough.

Our take: There’s still uncertainty ahead. Imports from Asia may face renewed pressure after August 10 if talks stall or enforcement tightens.

What's yours?

You’re in control of your back-office with Epay Manager.

For over 20 years, Epay has provided best-in-class automation, invoicing, and payments solutions to freight brokerages.

😅 Meme of the Week

Our most liked meme this week received over 1750 likes on Instagram.

🎣 THE FREIGHT CAVIAR CORNER

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).