🎣 Warrants Served

Plus, a Chicago-based freight broker boasts about making $215k in one day, Lineage Logistics hits it big with an $18 billion IPO, the latest on the Ocean's 11-style freight heist, and more.

Here's a glimpse at the latest Q1 results for major carriers, with key financial details and insights from company leaders.

The first quarter of 2024 has been rough sailing for major U.S. carriers, and here's a breakdown of the latest reports:

Startling Figures:

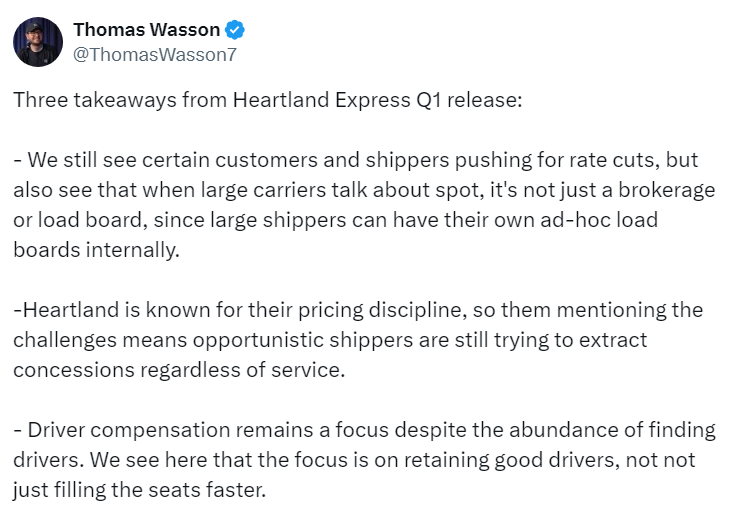

Heartland Express faced a tough Q1, wrestling with weak demand and rising costs. "We've seen extended periods of weak freight demand... and ongoing operating cost inflation," CEO Mike Gerdin stated. Despite a 105.3% operating ratio (the goal was 85% or lower), the company is optimistic, expecting improvement as market capacity adjusts.

Covenant Logistics also struggled, with profits taking a significant dive of 76% to faltering freight rates and volumes. "Although we believe freight market fundamentals are slowly improving... 2024 recovery looks dim," remarked CEO David Parker. Their truckload revenues did increase by 7.47%, but overall profits sharply declined.

Old Dominion Freight Line didn't meet expectations either, with a slight revenue increase but lower shipment volumes. "Challenges from the domestic economy have persisted," noted CEO Marty Freeman. Their operating ratio edged up to 73.5%, indicating rising inefficiencies.

Similarly, Hub Group's revenue dipped by 13%, with CEO Phil Yeager pointing to "excess truckload capacity" as a persistent issue. Although earnings per share slightly exceeded expectations, overall market conditions remain challenging.

Companies are adjusting strategies in hopes of weathering the current economic climate. As carriers tighten their belts and refine operations, the latter quarters of 2024 might just bring some stability back to the freight and logistics industry.

Sources: Trucking Dive | Transport Topics | Reuters/MSN | FreightWaves

Join over 10K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe now & be sure to check your inbox to confirm (and your spam folder just in case).