🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

Truck manufacturers face steep order declines as regulatory rules remain unclear and tariff policy shifts. Some signs of recovery emerge, but the outlook stays cautious.

The second quarter brought little relief to the trucking industry, and the situation for companies building and selling new heavy-duty trucks was even more challenging, FreightWaves reports. While some manufacturers and retailers, like Rush Enterprises and Cummins, reported stability in other business lines, most executives described a sluggish order environment marked by regulatory uncertainty and shifting demand.

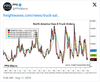

Industry data from FTR underscored the slowdown. Preliminary Class 8 order volumes for June totaled just 8,900 units, a 25% drop from May and down 36% year-over-year. July orders rebounded slightly to 12,700 units but still marked a 7% decline from the prior year. Over the last 12 months, orders fell 15% compared to the previous cycle.

Jennifer W. Rumsey, CEO of Cummins, said the company expects North America heavy- and medium-duty truck volumes to decline 25–30% in the third quarter.

“We have seen truck orders recently reach multiyear lows and OEMs have initiated reduced work weeks,” Rumsey told analysts. “The duration of this reduced demand… will largely depend on the trajectory of the broader economy, the evolution of trade and tariff policies, and the pace at which regulatory clarity emerges.”

Marvin Rush, CEO of Rush Enterprises, was even more blunt:

“New truck production will be drastically down across all OEMs, because there’s just not any demand out there because uncertainty is there.”

Much of the hesitation stems from unresolved federal and state emissions rules, alongside the shifting tariff landscape.

California’s truck market continues to struggle under withdrawn or blocked zero-emission vehicle mandates, adding to the uncertainty.

Despite the overall downturn, there were some positive indicators:

While tariff clarity could help stabilize demand, it may also raise equipment prices.

Brent Yeagy, CEO of Wabash National, warned that while the company sources 95% domestically, higher costs for key inputs could force price adjustments.

“We’ve been successful in holding off on price adjustments… However, based on the current trajectory, we expect that pricing for 2026 orders will need to be adjusted to reflect the rising cost environment.”

Source: FreightWaves

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).