🎣 Warrants Served

Plus, a Chicago-based freight broker boasts about making $215k in one day, Lineage Logistics hits it big with an $18 billion IPO, the latest on the Ocean's 11-style freight heist, and more.

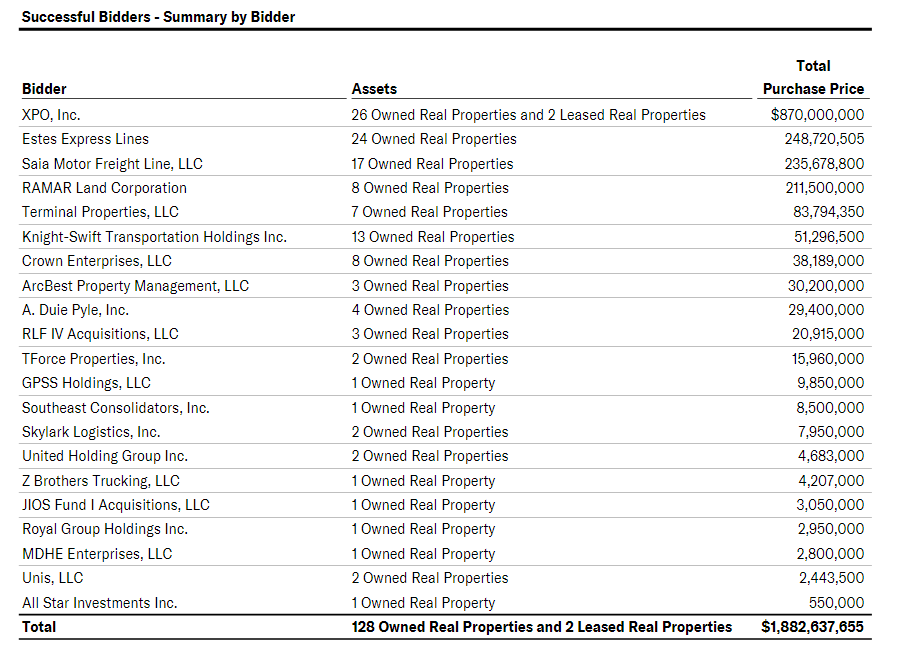

The auction, drawing interest from carriers and real estate investors alike, saw 130 of Yellow’s properties sold, with 46 owned and additional leased properties still on the market.

In a significant move, key players like XPO, Estes, and Saia have emerged victorious in the auction of Yellow’s defunct terminals. The high-stakes auction, supervised by a bankruptcy court, saw these logistics giants securing prime real estate assets totaling nearly $1.9 billion.

The auction involved large less-than-truckload carriers and also attracted real estate investors. With 130 of Yellow’s properties sold, the process is still underway for the remaining 46 owned and some leased properties.

This major real estate transaction is one for the books. The disbanded Yellow’s resources, including 12,000 tractors and 35,000 trailers, are also on sale, further reshuffling the industry.

The proceeds from this auction are set to cover Yellow's debts, including a $700 million COVID-19 relief loan from the federal government. The unwinding of Yellow's estate is a complex affair, with unsecured creditors, including pension funds, awaiting settlements.

HUGE news for Yellow Corporation shareholders. Auction results came in 400mm above stalking horse bid. By our calculations, shareholder recovery should be around 600mm, indicating more than 500% upside. $yellq

— Pernas Research (@pernasresearch) December 5, 2023

(either we totally missed something or the pop on open will be… pic.twitter.com/qySfZps2B6

Sources: Freight Waves | Trucking Dive

Join over 10K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe now & be sure to check your inbox to confirm (and your spam folder just in case).