🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

Plus: Feds probe fatal Florida crash tied to CDL failures, Trucking recession deeper than 2008 for some, Truckstop.com scoops up Denim for AI payments, and more.

Happy Hump Day. A big U.S. freight player is pulling out of Mexico, just as nearshoring trade hits new highs. We unpack what Landstar’s exit really means for cross-border strategy in today's feature.

Plus,

🚨 Fatal U-Turn Florida Crash Triggers Federal CDL Probe. The Florida Turnpike crash that killed three is now the subject of a federal investigation into CDL licensing failures. USDOT said driver Harjinder Singh “failed the [English proficiency] assessment, providing correct responses to just 2 of 12 verbal questions.” Despite lacking legal status, Singh received CDLs in Washington and California. Transportation Secretary Sean P. Duffy called the crash “a preventable tragedy directly caused by reckless decisions and compounded by despicable failures.” OOIDA urged USDOT to suspend non-domiciled CDL programs and conduct a nationwide audit, citing risks from weak vetting, “chameleon carriers,” and gaps in state compliance.

📉 FreightWaves: Trucking Recession Deepens, Worse Than 2008 for Some. FreightWaves reports the “Great Trucking Recession” may be more severe than 2008, with spot rates down to $2.27/mile and tender rejections near 5%. “Carriers don’t need SONAR data to know we’re in a recession,” wrote analyst Adam Wingfield, citing bankruptcies and repossessions. The downturn stems from pandemic-era overexpansion, high costs, and excess capacity. New pressures, tariff uncertainty, stricter English proficiency enforcement, and a weakened spot market are compounding the slump. Though CEO Craig Fuller declared recovery in 2024, Wingfield says the recession “never truly ended.” Small carriers, he warns, face unprecedented financial strain.

🤝 Truckstop.com Acquires Denim to Boost AI Payment Solutions. Truckstop.com has acquired fintech firm Denim to expand automated invoicing and factoring services for brokers and carriers. “Carriers and brokers today are demanding tools to help them work more profitably, more efficiently, and more securely,” said Truckstop.com CEO Scott Moscrip. Denim CEO Bharath Krishnamoorthy added, “We innovated a best-in-class tool … and we’re excited to bring this value to the industry at scale.” The deal strengthens Truckstop.com’s role in freight fintech as faster payments become vital in a tight market.

CtrlChain helps carriers do more with less.

Automated systems let you scale freight volume without adding headcount. Smarter route planning slashes deadhead miles, while real-time dashboards catch performance issues early.

Back-office automation eliminates paperwork, freeing your time to book and move loads. And with our Conversations feature, customer updates are seamless, faster, and more transparent—keeping clients loyal. Every tool works together to make your operation leaner, smarter, and more profitable.

Let’s build a future where freight moves efficiently and carriers thrive.

Mexico remains America’s top trade partner, with cross-border traffic pushing $73 billion in June alone. But in puzzling contrast, Landstar System just announced it’s considering selling its Mexico-based Metro unit, attributing the move to underperformance and “tariff-fueled uncertainties.”

Are they seeing a slowdown that others are ignoring?

Landstar filed for a strategic review of Landstar Metro, flagging that the unit wasn’t meeting expectations and cited “risks and tariff-fueled uncertainties” as primary reasons. Landstar is taking a $13–$17 million write-down this quarter to reflect the reduced value of its Metro unit.

Basically, this is an accounting move that signals the unit's value has dropped significantly.

“Our decision to pursue a disposition of Landstar Metro follows a comprehensive review... and is in line with our commitment to focus on our core asset-light model... while managing risk.” – James P. Todd, VP & CFO at Landstar System, Inc.

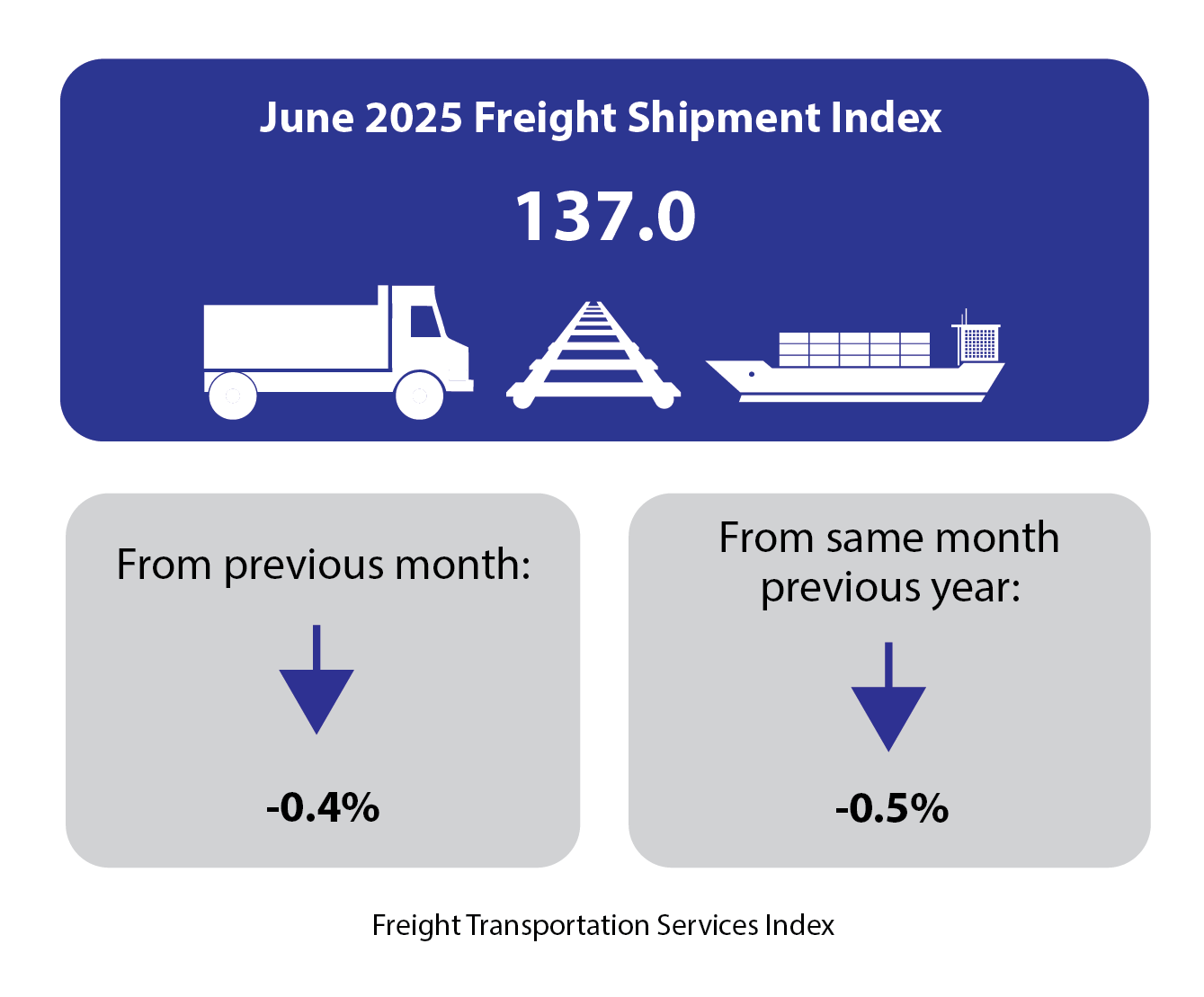

Mexico trade is up, but overall freight movement isn’t. The latest U.S. Freight Transportation Services Index (TSI) dropped 0.4% in June, following a 0.2% rise in May. Compared to June 2024, the index is down 0.5%, reflecting a soft freight environment across modes.

Landstar’s move exposes a strategic split among logistics players on how to handle U.S.–Mexico freight in an era of political risk.

Landstar was unusually blunt about tariff risk. While USMCA shields most trade, tools like Section 232 and national security exemptions still loom. July’s expanded metal tariffs and a new Republican tariff bill targeting China have only added to the uncertainty.

As Rice University’s Baker Institute put it:

“U.S. tariff uncertainty undermines Mexico’s investment climate, slowing supply chain integration and weakening long-term nearshoring gains.”

For companies deciding whether to go all-in south of the border or play it safe stateside, the warning signs are getting louder.

If trade continues climbing and tariffs remain restrained, Landstar’s exit could look like a missed opportunity on billions in cross-border opportunity.

But if policies shift, volatility spikes, or inventories destabilize, Landstar may emerge as the genius in the room.

Either way, it means the nearshoring boom is turning into more of a complex story, and may no longer be such a safe bet.

Utilize funding options that fit your unique brokerage needs with OTR Solutions.

Take advantage of OTR Solutions’ industry-leading working capital solutions now made available within the Epay Manager platform. Leverage OTR’s flexible offerings directly inside your TMS.

🎴 Credit Card Theft. Iowa truck driver Mitch William Gross, 34, was sentenced to 4 years in federal prison for charging $140,000 in Pokémon cards, gaming items, and gift cards to Ruan Transportation’s company credit card. He must repay $146,590.15 in restitution.

🛠️ Metal Tariff Shock. President Trump expanded tariffs on over 400 steel and aluminum products, imposing a 50% duty on items like HVAC systems, transformers, knives, and aluminum wire. Goods in transit prior to Aug 18 were not excluded, frustrating “small importers.”

💥 Baltimore Port Blast. A cargo ship explosion (which was laden with coal) halted truck traffic at the Port of Baltimore Aug 18, forcing emergency evacuations and container yard closures. Officials are investigating the cause. No property damage beyond the ship was reported.

🥩 Ribeye Fire Loss. A semi hauling 40,000 pounds of ribeye steak caught fire on I-24 near Paducah, Kentucky. The blaze destroyed the entire load, which responders labeled a “total loss.”

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).