The Tab Count Is Killing Brokerage Margins

A practical look at how freight AI is evolving from simple automation to operational decision support, and what it means for broker productivity, tribal knowledge capture, and more.

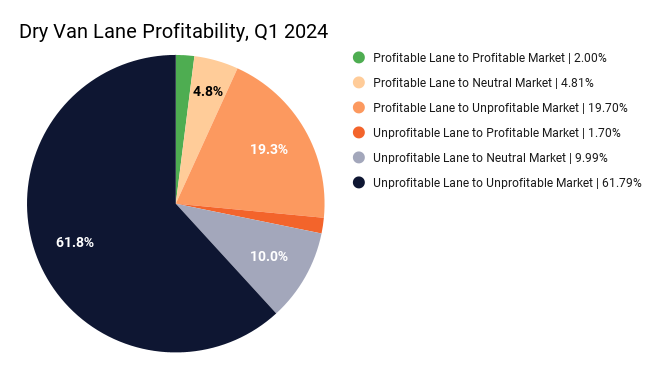

SmartHop data shows that in Q1 2024, nearly 62% of dry van loads were hauled on an unprofitable lane into an unprofitable market.

The latest SmartHop Profitability Report for Q1 2024 is out, shedding light on recent shifts in freight and profitability.

SmartHop takes a look at inbound and outbound freight across thousands of lanes. Here's a breakdown of what's been happening on the roads.

Looking at the pie chart for the entire Q1, 61.79% of the lanes fall under the not-so-great category of unprofitable lane to unprofitable market.

Only a slim 2.00% of the lanes were profitable to profitable markets.

Lanes leading from a profitable to a neutral market made up 4.81%, which isn't huge but could be considered a strategic move to keep the wheels turning and the business steady.

Lanes leading from profitable to unprofitable markets accounted for 19.70%. These are tricky since they can potentially lead carriers into less favorable market conditions for their next load.

Meanwhile, unprofitable to neutral markets accounted for 9.99%. These might help avoid further losses, acting as a buffer in tough times.

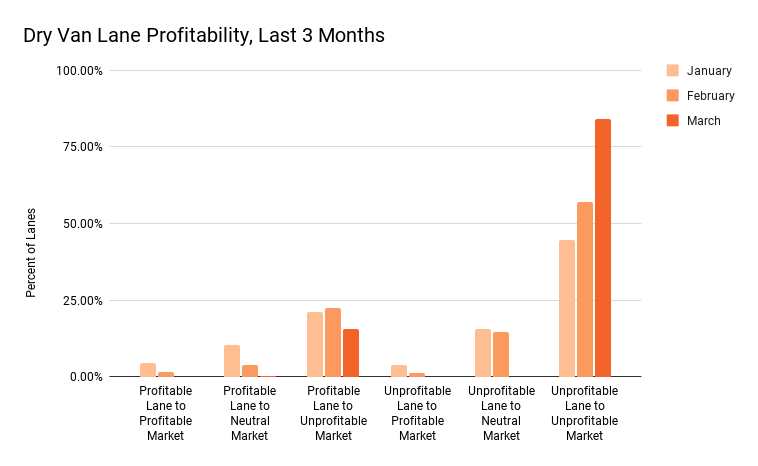

From the data in the above chart showing Dry Van Lane Profitability over the last three months, there's a distinct pattern in March that's hard to miss. In March, the percentage of unprofitable lanes to unprofitable markets shot up to over 75%.

The SmartHop Profitability Report has sparked some interesting conversations among industry experts.

CEO of AscendTMS, Tim Higham, questions the logic behind carriers opting into unprofitable lanes. He says to avoid the financial sinkhole and choose profitability – or try to at least break even.

"WHY send your truck from an unprofitable market into another unprofitable market when you CLEARLY can send them into a PROFITABLE (or neutral) market?" – Tim Higham, CEO of AscendTMS

Pavel Botev, President of Logiflex, raises important questions about data context and the definition of profitability, stressing that while the report zeroes in on lane profitability, the bigger picture of monthly combined lanes and company-specific factors like driver pay and fuel costs should be considered for a comprehensive view.

Guillermo Garcia, Co-Founder and CEO of SmartHop agrees, highlighting the importance of their data to inform and guide decisions, despite the complexities and unique nature of each operation. The data, while not exhaustive, gives a bird's-eye view of trends that could be critical for strategic decision-making.

Source: SmartHop

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).