🎣 Warrants Served

Plus, a Chicago-based freight broker boasts about making $215k in one day, Lineage Logistics hits it big with an $18 billion IPO, the latest on the Ocean's 11-style freight heist, and more.

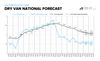

Comprehensive analysis of the Q2 2023 North American truckload freight rates, including van and reefer rates, along with future predictions based on market trends and predictive models.

This is a summary of Arrive's latest market update.

Recap of Previous Forecasts and Market Trends

The North American truckload freight rate forecast for November 2022 through December 2023 indicated a general alignment with previous projections. An ongoing trend of downward pressure on rates was observed, with expectations of this continuing as the economy and demand normalize towards pre-pandemic levels. Despite the dip in April 2023, typical seasonal patterns have returned to the market.

Rates and Supply Adjustments

Persistently soft spot market demand and robust truckload capacity kept rates within the forecasted range. Deviations for both van spot and reefer rates remained within acceptable margins, proving the accuracy of the predictive models. Spot rates are likely to stabilize, moving in line with typical seasonal expectations. Meanwhile, contract rates are predicted to normalize, gradually closing the gap with spot rates.

The Impact of Economic Factors and Global Tensions

The market experienced a significant influx of capacity during the last inflationary rate cycle, but recent data suggests trucking employment may have plateaued, pointing to a potential shift in the market. Rising interest rates and inflation continue to impact the demand, indicating a higher downside risk. The forecast also highlights potential market volatility due to global tensions, severe weather, and changes in carrier breakeven points and fuel volatility.

Read the entire update, here.

Join over 10K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe now & be sure to check your inbox to confirm (and your spam folder just in case).