🎣 “Chameleon Carrier”

Why chameleon carriers are suddenly everywhere. Plus a freight tech Super Bowl moment, Uber Freight breakeven, and more.

Out of these four retailers: Target, Walmart, TJ Maxx, and Home Depot, can you guess which one had the best Q2 performance? The answer might surprise you.

Good Friday Morning. Notable retailers like Target and Walmart have unveiled their Q2 results, offering a glimpse into the current state of the retail industry. In the transportation sector, Jim Cramer's mention of XPO Logistics as the "new king" of trucking might have XPO Executives worried, while the joint venture of CPKC, CSX, and G&W signals potential shifts in cross-border trade. On a cautionary note, Maybach & GLT Logistics, both significant players in the transportation sector, have reported identity thefts this week, underscoring that even industry giants are not immune to sophisticated fraud schemes.

Out of these four retailers: Target, Walmart, TJ Maxx, and Home Depot, can you guess which one had the best Q2 performance? The answer might surprise you.

In today's email:

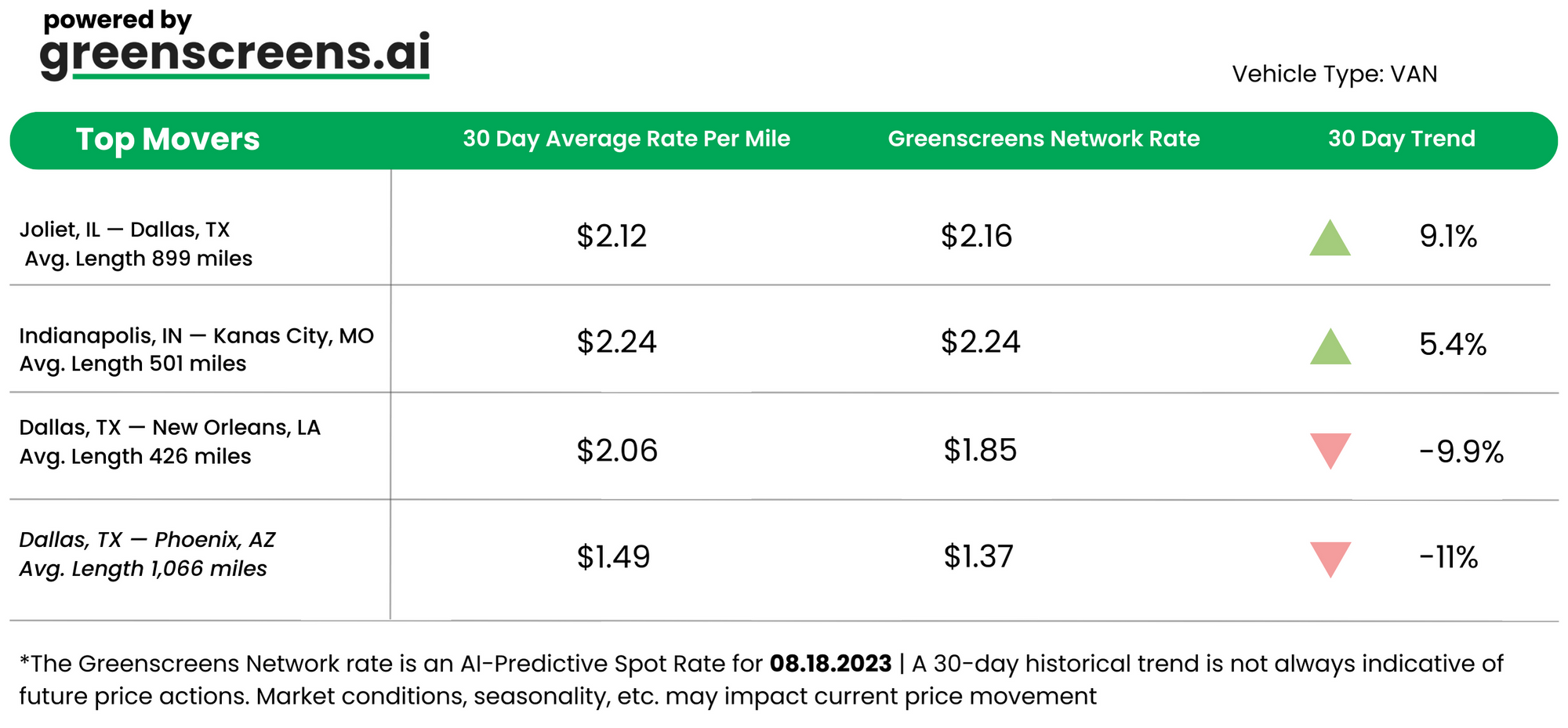

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

*Greenscreens.ai, forecasts real-time truckload buy prices that are suited to each freight brokerage's purchasing power using AI and machine learning. Its engine takes into account over 130 attributes and data points in each rate forecast.

🐔 WHAT’S COOKIN’ IN FREIGHT

🚚 Jim Cramer Dubs XPO Logistics The New King of Trucking. Jim Cramer, the often unpredictable stock market commentator, has named XPO Logistics the 'new king' of trucking, just as Morgan Stanley raises its price target for the company to $65. Despite this royal proclamation, XPO's stock has been trading slightly down, at around $72.80. Cramer, known for his bold and sometimes erratic predictions, has also recently spoken of a potential "golden age" for natural gas. Is XPO stock about to tank? We shall see...

🚢 Shipping’s Rising Costs & Blanked Sailings. Blanked sailings in Asia-Europe trade routes remain frequent, with 10.8% of major alliances' Central China-Europe loops voided in recent months. Meanwhile, U.S. importers face soaring costs, as the average spot rate for a 40-foot container from China to the U.S. West Coast surged 61% to $2,075. Despite a record addition of 1.2 million containers of capacity in 2023, carriers are pushing for peak-season surcharges in long-term contracts, while some experts anticipate a potential drop in spot rates due to the excess capacity.

🛤️ US-Mexico Rail: CPKC, CSX & G&W Unite. CPKC, CSX, and G&W are partnering to establish a transformative freight corridor connecting Mexico, Texas, and the U.S. Southeast. They're developing a new direct interchange in Alabama, a move that CSX CFO Sean Pelkey highlights as a game-changer in cross-border trade. As this project awaits approval from the Surface Transportation Board, Norfolk Southern is also strategically positioning itself with CPKC to enhance service and regain market share from trucking. Despite leadership changes at CSX, the team remains optimistic about breaking organizational silos and seizing this new opportunity.

SCALE YOUR FREIGHT BROKERAGE WITH OTR SOLUTIONS

Stop spending hours on carrier pay. With OTR Solutions Broker Services and Open API, you can pay all your carriers in a single transaction. Need help with cash float issues? OTR can help with that, too. You can even start offering quick pay and generate revenue from OTR, helping you stay competitive in the market.

OTR Solutions is focused on helping the everyday freight broker choose the services you need and OTR will handle the rest. Get started today by visiting their website at and see the difference they can make for your brokerage.

In a turbulent retail environment, Target, Home Depot, TJX, & Walmart recently reported their Q2 earnings, revealing a blend of disappointments and triumphs. Here's a snapshot of each retailer’s performance and expert insights.

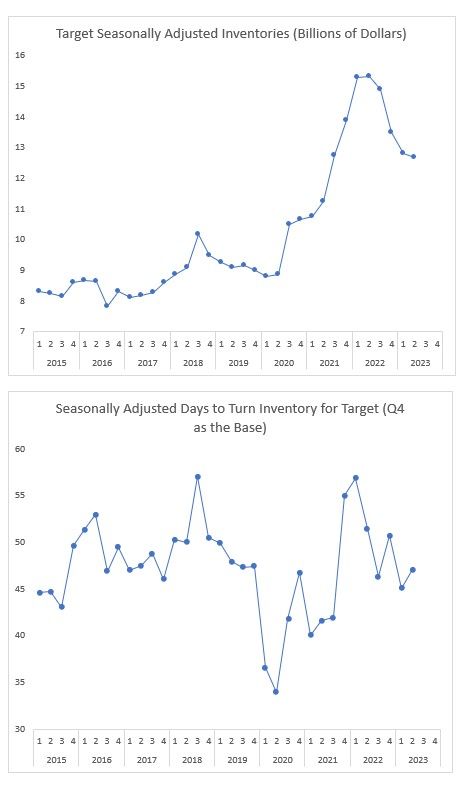

Target

Home Depot

TJX Cos.

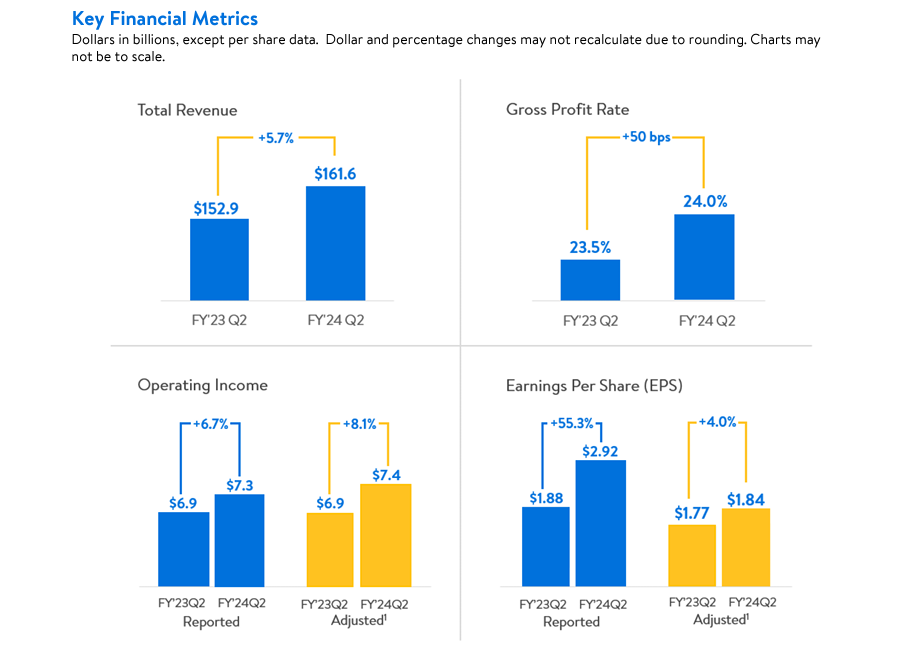

Walmart

What’s The Takeaway? As inflation and social values increasingly impact consumer behavior, retailers are navigating a complex landscape. Target is feeling the weight of social backlash and inflation, Home Depot is maintaining despite a slowdown, TJX Cos. is thriving as consumers hunt for deals, and Walmart is leveraging its low-price strategy and e-commerce growth to fuel higher sales.

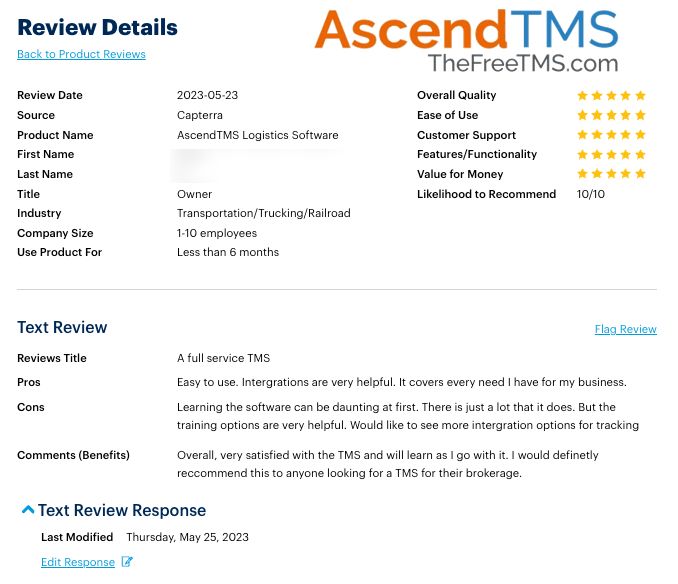

THE WORLD'S MOST POPULAR TMS

AscendTMS is the world's most popular & best-rated TMS. Use our referral code RA-FreightCaviar! to receive 3 months of AscendTMS Premium for free. It only takes 20 seconds to sign up and no credit card is required. Click here to learn more.

AROUND THE FREIGHT WEB

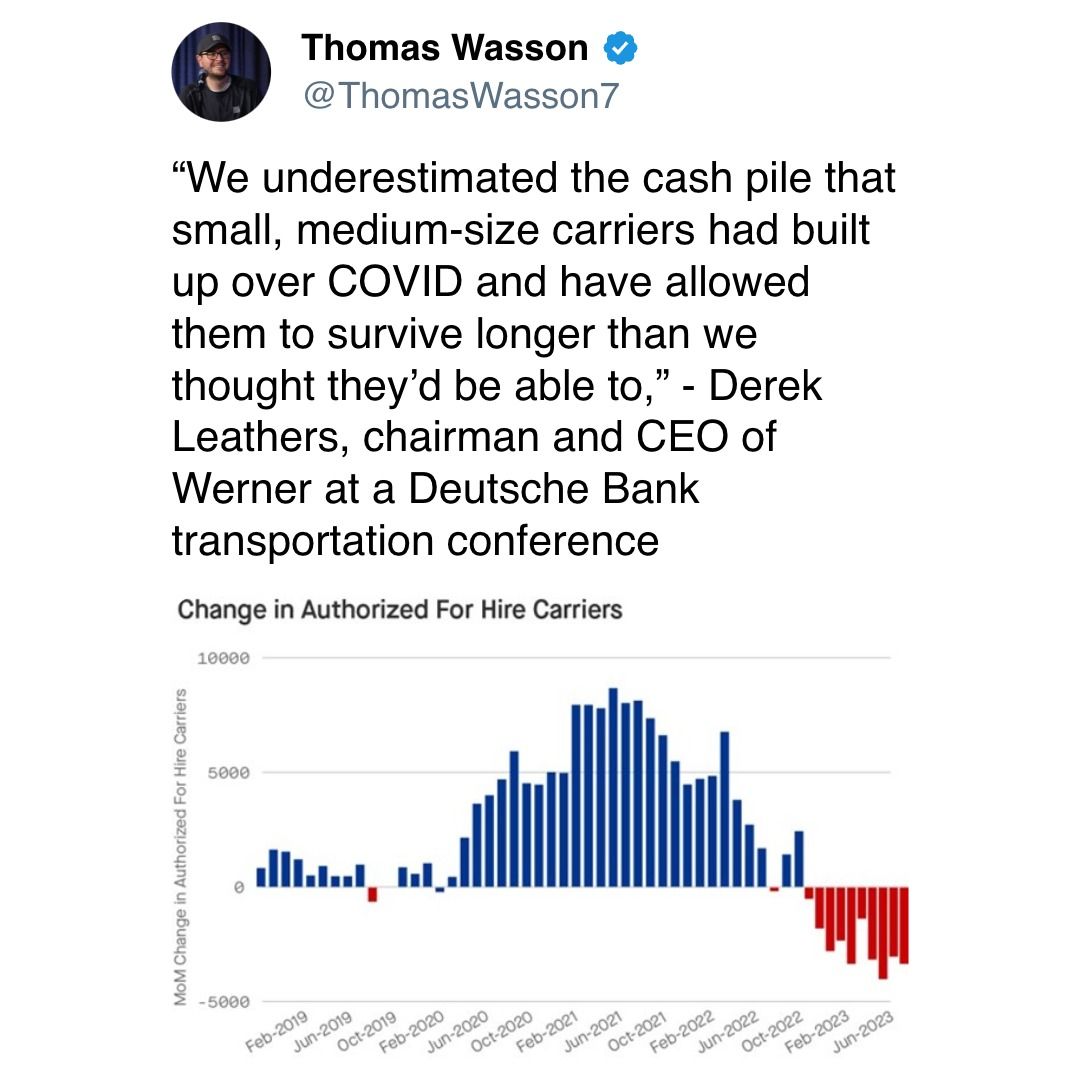

💰 Small Carriers' Surprising Financial Strength. Small and medium-sized carriers accumulated more cash during COVID than anticipated, enabling them to endure challenges longer than expected, according to Derek Leathers of Werner.

🚨 Scammers Target GLT & Maybach. GLT Logistics and Maybach warn of scammers using their credentials to exploit freight services.

💼 Estes Eyes Yellow’s Terminals in $1.3B Bid. Estes, the 4th largest LTL carrier in the nation, bid $1.3B for Yellow's terminals amid Yellow Corp.'s bankruptcy dealings with Citadel and MFN Partners.

🛫 Chicago to Maui Relief Effort. SEKO Logistics and partners send 24,000 pounds of essential supplies from Chicago to wildfire-stricken Maui. Learn how you can help.

⚖ Frances Hall's Legal Battle Continues. Frances Hall, a trucking company owner, and convicted murderer faces an ongoing Texas legal battle. She's now accused of evading $9 million in insurance premiums.

😂 Freightliner vs. Bentley. A hilarious comparison between a Freightliner & a Bentley.

FREIGHT FEST IN HOUSTON, TX

Don't miss the biggest transportation and logistics conference of the year: Freight Fest, taking place in Houston, TX from September 28th to October 1st. Join industry experts, network with peers, and discover the latest in transportation and logistics.

Use our code, FC15, to receive a 15% discount on your ticket today. Learn more by going to FreightFest.com.

FREIGHT MEME OF THE DAY

THE FREIGHT CAVIAR PODCAST

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).