🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

Plus: A Google Cloud outage disrupts key freight platforms, a new Trevor Milton doc takes aim at the fraud narrative, GenLogs ranks the top carrier activity leaders, and more.

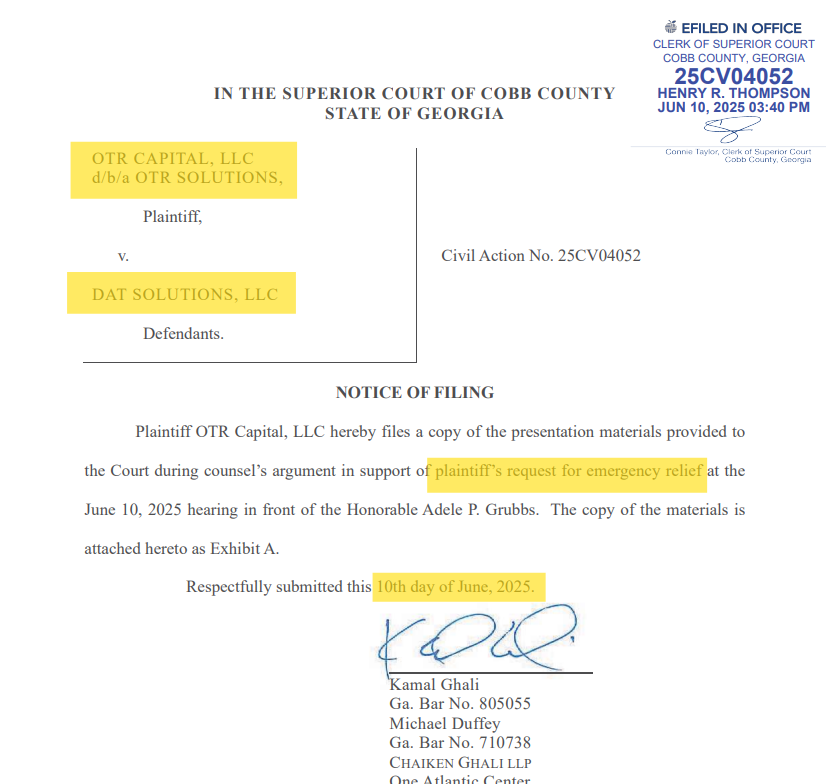

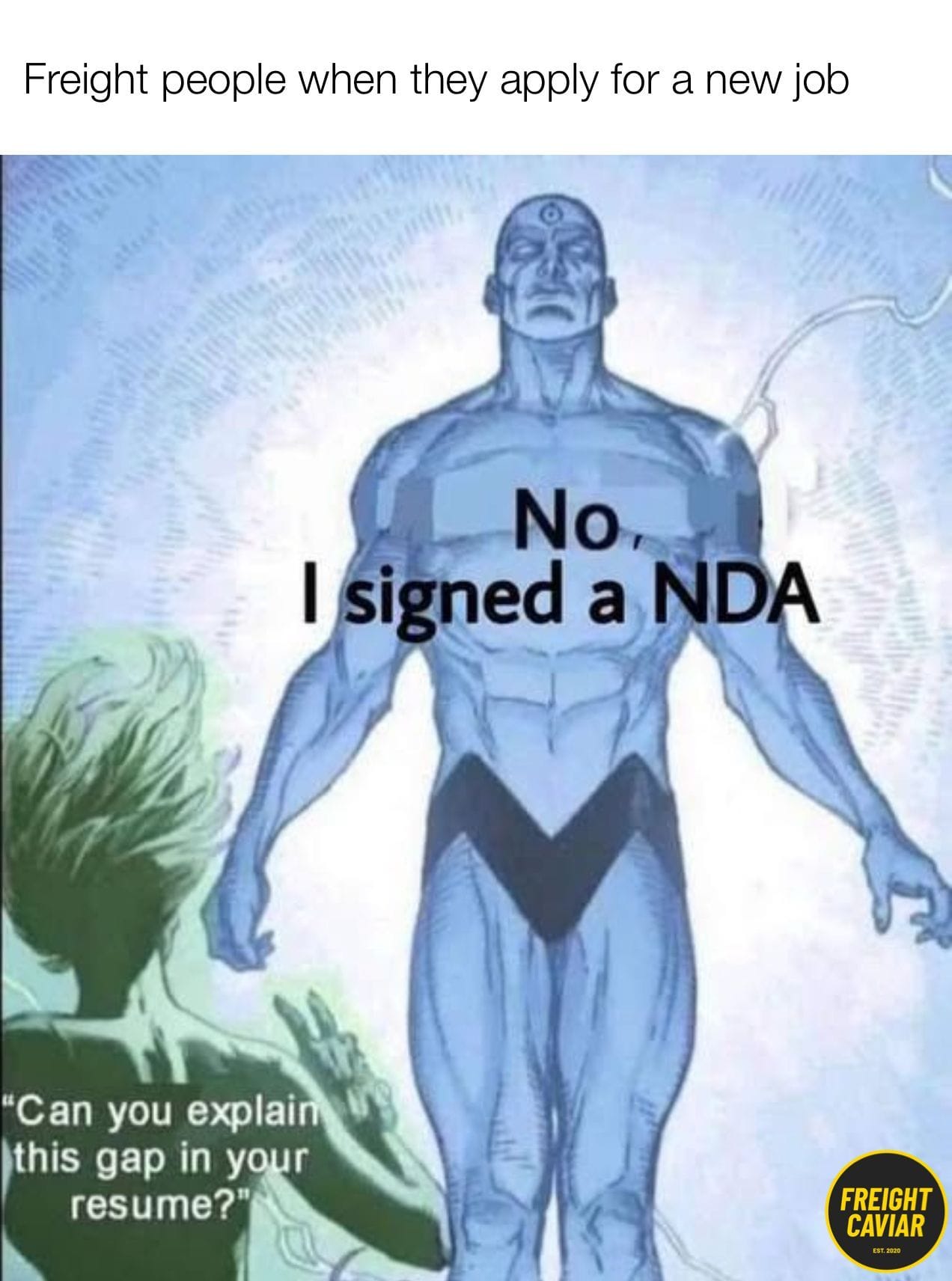

TGIF. A Georgia court just froze DAT’s Outgo factoring rollout. Today's feature story gives a first look at the lawsuit OTR filed against DAT for NDA and non-compete violations.

Plus:

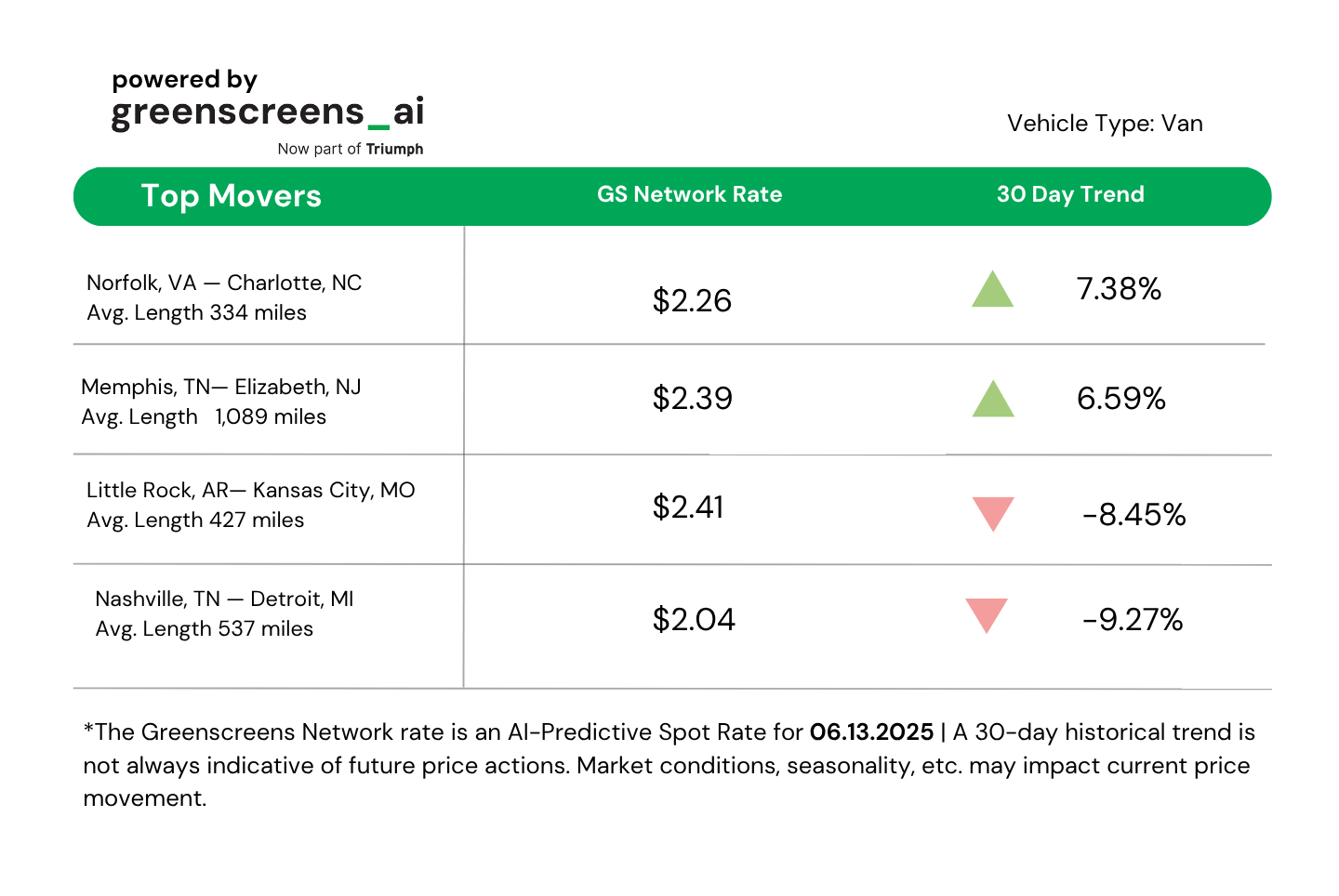

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

🍳 WHAT’S COOKIN’ IN FREIGHT

🌐 Widespread Internet Outage Tied to Google Cloud Disrupts Major Platforms. June 12’s outage linked to Google Cloud caused widespread internet disruptions across major platforms, including Project44, Truckstop, and other logistics companies. Downdetector recorded over 13,000 incident reports beginning around 11:30 a.m. PT. The root cause was traced to Google’s Identity & Access Management service. Though most systems were stabilized by 6 p.m. ET, some service issues lingered. Market reactions were immediate, with Google stock falling nearly 1%. At the time of this writing, signs of recovery have been reported for some users, but the damage companies have faced remains to be seen. Expect some potential delays with communication as companies start their Friday recalibrating their services.

🎥 Trevor Milton Documentary Pushes Back Against Fraud Narrative. The new documentary paints Nikola founder Trevor Milton not as a convicted fraudster but as the target of a coordinated takedown. Conviction or Conspiracy: The Trevor Milton Saga follows Milton’s rise from entrepreneur to billionaire, then to felon, arguing his downfall was fueled by short sellers, media pressure, and an unfair trial process. Milton disputes claims from the Hindenburg Research report and shares his views on the alleged bias during his trial. “This isn’t just my story—it’s a warning about how quickly our system can be weaponized,” Milton stated. “This film gives people the context and evidence that was left out of the headlines. I’m proud it’s finally out.” What is your take on the matter? Is he innocent? Guilty? Share your thoughts in our FreightCaviar Forum.

⭐ Walmart, UPS, and FedEx Dominate GenLogs’ Top Carrier Activity Rankings. GenLogs’ Q1 2025 rankings reveal the fleets most frequently observed by its nationwide sensor network. Walmart Transportation topped the list, followed by UPS, Swift, and J.B. Hunt. Notably, FedEx had two divisions in the top 10: FedEx Express (#6) and FedEx Freight (#10). The top five fleets alone accounted for roughly 30% of all observations, reflecting the outsized activity of retail and parcel giants. GenLogs notes these rankings measure network visibility, not fleet size or service. GenLogs plans to expand their sensory coverage by 30% next quarter, so more granular insights into carrier activity and regional trends are expected to be reported in due time.

Tenure means something in logistics. Anyone in this industry knows that the market changes like the wind, and everything that happens in this world, from natural disasters to tariffs to holidays, can change what it looks like day to day.

Experience in all types of markets is crucial to longevity in this business.

Success in all types of markets and industry changes shows true security in the industry.

Partnering with a company like Trinity Logistics, with 23 years on the Transport Topics Top Freight Broker list, brings the security that your Freight Agency needs to continue growing year after year.

OTR Solutions has quietly filed a lawsuit against DAT Solutions and has already won an injunction stopping DAT’s use of Outgo, a factoring company it acquired in May to serve as its in-house solution.

This is the first public release confirming both the legal complaint and the emergency court ruling. The filing, dated May 30, 2025, remained under wraps until now.

OTR alleges that DAT, once its trusted referral partner, used insider access to confidential data and then flipped the script by acquiring OTR rival Outgo, becoming a direct competitor.

DAT allegedly continued using OTR’s trademark blue checkmark to signal creditworthiness on Load Board listings, despite cutting ties. Brokers and carriers believed OTR still backed the loads.

“Clients were confused by the blue checkmark and believed that OTR had conducted the credit checks.” (p. 12, ¶66)

OTR claims DAT used this signal to mislead the market and capitalize on OTR’s reputation.

As of June 10, the court ordered DAT to:

The ruling came after OTR filed for emergency injunctive relief on June 3, citing "irreparable harm" from DAT’s conduct. The court agreed.

On June 10, Senior Judge Adele P. Grubbs ruled in favor of OTR, finding it faced “irreparable harm” and was “likely to prevail” on its claims. The injunction remains in place until a full hearing is held on the matter.

DAT provided FreightCaviar with the following statement:

We are aware of the legal action filed by OTR Solutions and believe the suit is without merit. We intend to defend ourselves vigorously. DAT and OTR Solutions had a successful partnership for more than three years. In May, DAT acquired Outgo to expand our offerings for carriers. In response, OTR chose to pursue litigation. As this is pending litigation, we have no further comment on the case itself at this time. We are concerned that OTR’s actions directly impact the cashflow of our carrier customers. Cashflow is the lifeblood of these small businesses, and any disruption to it can severely impede their operations. OTR’s actions are disappointing given our years of partnership and raise questions about OTR’s mission and ability to serve its customers. At DAT, our priority is the success and stability of our customers, and we remain dedicated to providing the services they depend upon.

This response shows DAT's intent to challenge the allegations and centers impact on carriers as a key concern.

OTR Solutions also provided a statement to FreightCaviar:

OTR is proud of the support we’ve provided carriers and brokers for more than a decade, and we remain focused on protecting their businesses and providing them with the support they need to succeed. DAT’s decision to acquire Outgo, with complete disregard for clear contractual obligations, exposed Outgo’s clients to a disruption of services. We remain committed to helping any carriers impacted by this situation.

This legal bombshell shows just how fast a partnership can turn into a turf war in freight tech.

DAT’s move to become a one-stop shop (platform and funder) backfired spectacularly when its former partner accused it of stealing the playbook. The case could also rattle brokers already uneasy about putting all their tools under one platform’s roof.

This is also a wake-up call for any vendor in a “strategic partnership”: when you share data, you share risk.

OTR is demanding a full trial. If it proceeds, expect discovery into how Outgo was built out, and how much of that came from OTR's own files.

[Disclaimer: The content of this article is for informational and editorial purposes only. FreightCaviar is not a party to the legal proceedings referenced and does not offer legal advice or definitive judgments on the matters discussed. All information is based on publicly available court filings as of June 13, 2025.]

Levity automates high-volume email and phone tasks like quoting, load building, and track & trace, without black-box agents or risky AI experiments.

Designed for teams that need control, transparency, and results they can trust.

🌎 AROUND THE FREIGHT WEB

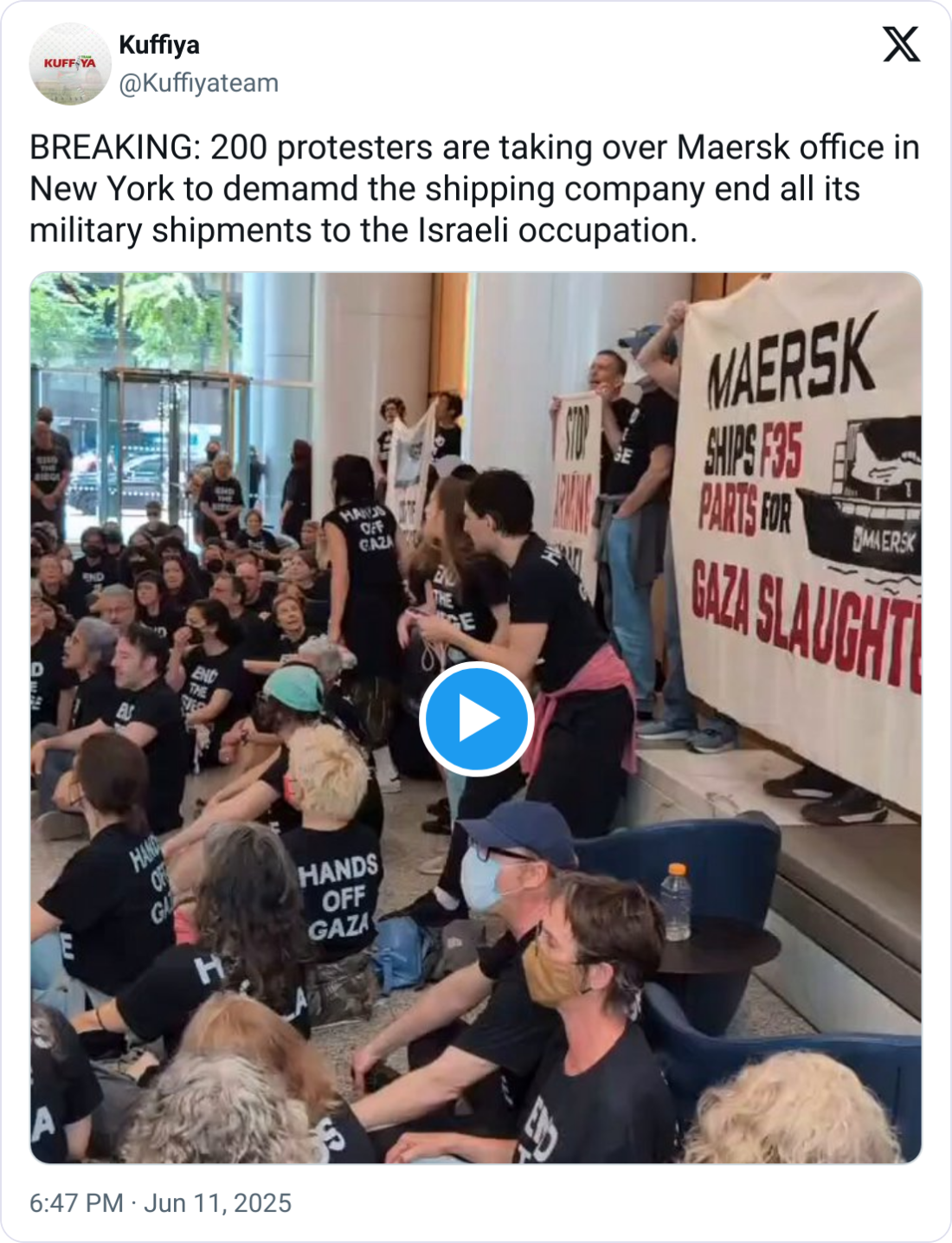

🙅♂️ Protesters Occupy Maersk Office. Roughly 200 protesters took over Maersk’s New York office, pressuring the company to end all of its military shipments to Israel.

🚓 Out-of-Service. During the recent Roadcheck operation, 43% of inspected trucks were taken out of service, according to DCSO. Some additional stats include 64 citations were given, and 670 warnings were issued.

❄️ Breaking the Ice. A proposed shipyard deal could support the construction of Arctic icebreakers backed by former President Trump. Canada’s Davie Shipbuilding wants to invest $1 billion into a Texas ship-repair facility, which would then produce Arctic-ready vessels for the US.

🏛️ Board Shakeup. Forward Air’s chairman, George Mayes, and two directors are stepping down following a shareholder vote. Named “unfit legacy directors” by Ancor Holdings Group, investors are hoping to regroup following the “disastrous acquisition of Omni Logistics.”

🏭 GM's Investment. General Motors will invest $4 billion across plants in Michigan, Kansas, and Tennessee. This investment will allow GM to build more than 2 million vehicles per year, upping its current 1.7 million goal.

📦 Import Surge Expected. Retailers are accelerating shipments through U.S. ports amid the temporary tariff reprieve, according to the NRF’s latest port tracker. An import surge is expected during the summer months.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).