🎣 Reading Between the Lines

Plus: UPS to cut 30,000 jobs, ATA pushes to extend under-21 driver program, and cargo thieves targeted bigger paydays in 2025.

Plus, a Texas-based trucking company abruptly shuts down, leaving 2000 jobless. The Southeast is heating up, and more.

Good Monday morning. Major M&A activity takes over headlines this morning: RXO to acquire Coyote Logistics from UPS in $1 billion deal. Meanwhile, an abrupt closure leaves around 2,000 logistics employees blindsided and jobless.

🤔 Question of the Day: With this $1.025 billion offer, UPS is taking an $___ million* loss on its Coyote Logistics investment. Find the answer in today's feature story.

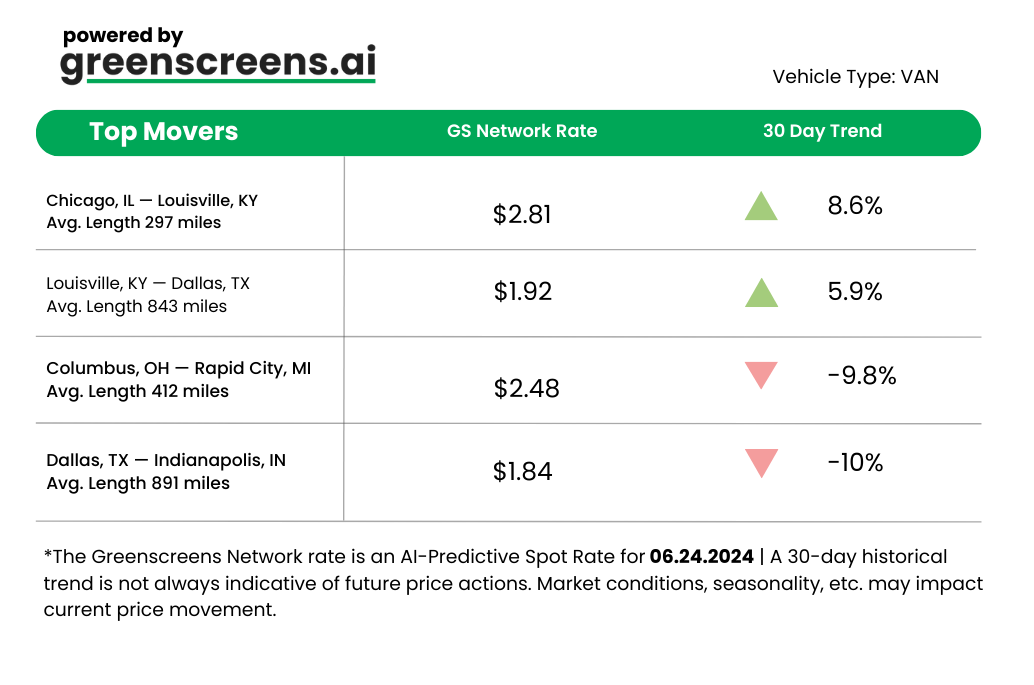

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

*Greenscreens.ai, forecasts real-time truckload buy prices that are suited to each freight brokerage's purchasing power using AI and machine learning. Its engine takes into account over 130 attributes and data points in each rate forecast.

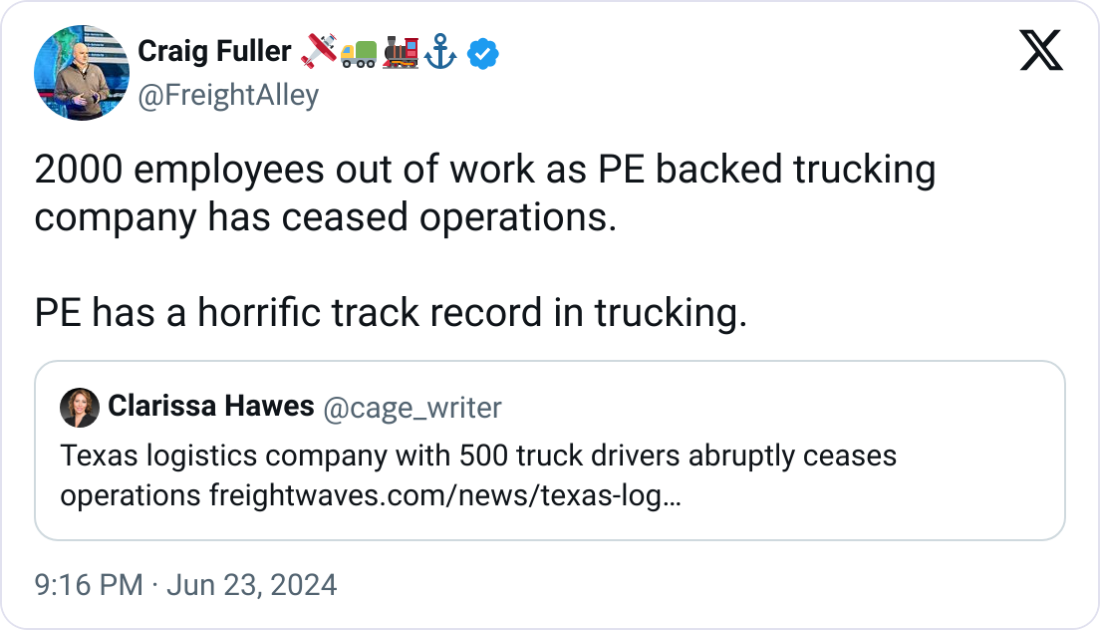

🐔 WHAT’S COOKIN’ IN FREIGHT

💼 USLS Leaves 2,000 Workers Stranded. U.S. Logistics Solutions abruptly ceased operations on Thursday night, leaving over 2,000 employees jobless and freight abandoned nationwide. The Texas-based company, owned by Ten Oaks Group (a private equity group), notified workers via text at 10 PM not to return to work. The message read, "Effective immediately, US Logistics Solutions is shutting down, and all employment is terminated. No routes should be run tonight, and all operations should be terminated immediately." With 500 drivers and 732 trucks suddenly idled, it's a logistics nightmare in the making. No paychecks were issued on Friday, and Ten Oaks remains silent.

🚨 Trucking Capacity Cracks in the South. According to FreightWaves, dry van rejection rates have hit a 2-year high, surpassing 7.5%. The issue isn't increased demand but rather a capacity mismatch. Trucks are being pulled to the West Coast, leaving the Southeast struggling. Zach Strickland of FreightWaves explains, "Carriers tend to prioritize covering loads originating in Southern California because they are the most disruptive and provide the most revenue." Atlanta is particularly affected, with rejection rates doubling since last summer. As we approach the July 4th peak, we might see bidding wars for trucks.

🚓 Tennessee Trucking Owner Indicted. Adam Brock, owner of several Tennessee trucking companies, including Reliable Transportation LLC and Active Transport LLC, was indicted on June 10, 2024, for multiple charges such as forgery, identity theft, computer crimes, and theft. The Franklin Police are seeking information from the public as they investigate these charges further.

TOGETHER WITH LEVITY

Levity helps fast-moving 3PLs and freight brokers to do more with less by automating the most time-consuming and repetitive email tasks.

Whether it's spot quoting, load building, or answering track-and-trace requests, Levity connects to your inbox, TMS and other tools like rating engines, extracting the right information no matter the language or format. It performs tasks on your behalf automatically in the background so you can save time and focus on building shipper relationships instead of data entry. Learn more on Levity.ai today.

"This acquisition will provide RXO with both immediate and long-term opportunities for revenue and earnings growth." - Drew Wilkerson, RXO CEO

Remember when UPS thought Coyote was their golden ticket to the truckload market? Well, that didn't quite pan out.

A former Coyote Logistics employee breaks down the potential reasoning behind the deal.

As a former Coyote employee explains: Carol Tomé (UPS CEO) wanted to focus on consolidating UPS to what they do best: Parcel Delivery.

This former employee offers an interesting sports analogy for this sale:

"This sale can be viewed a lot like the Khalil Mack Bears trade. Let's look at the Chicago Bears as UPS and Khalil Mack as Coyote, Ryan Poles as Carol Tomé, and RXO as Los Angeles Chargers..."

In other words: New leadership often reassesses and offloads expensive assets that don't fit their vision, even at a loss.

As for what this means for the market?: "No one [is] paying $1billion cash for a brokerage if not bullish on market."

Industry experts are split on what this means for Coyote's tech capabilities.

Yes, this deal means a lot for RXO's growth, but it also looks like UPS admitting defeat on its biggest acquisition ever.

The big questions now: Can RXO succeed where UPS failed in integrating Coyote? Will we see a mass exodus of Coyote talent? And who might be the next acquisition target in this newly energized M&A landscape?

The freight brokerage space just got a lot more interesting. We'll keep you updated as things play out.

Sources: Bloomberg | RXO Press Release

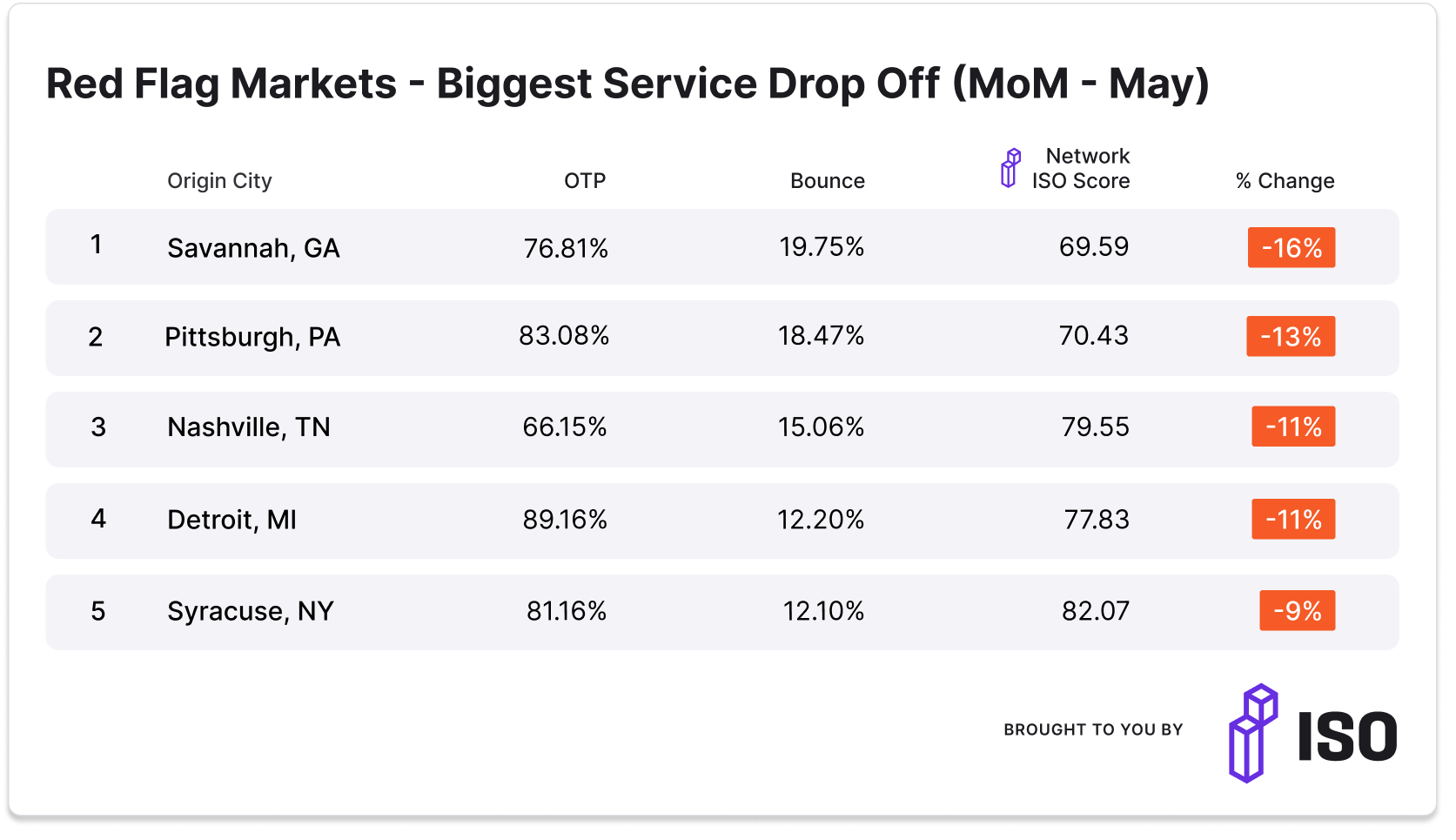

TOGETHER WITH ISO

Unpredictable service erodes margins. ISO gives brokers access to a network of thoroughly vetted, high-performing carriers, complete with historical performance data for lanes, consignees, facilities and more. Book a demo now.

🌎 AROUND THE FREIGHT WEB

🚨 NFI CEO Indicted in New Jersey Political Scandal. NFI CEO Sidney Brown has been indicted in a major New Jersey political case involving alleged corruption and tax credit manipulation centered around the Camden waterfront redevelopment.

⛽ Diesel Theft Crackdown. Texas man gets 50-year sentence for massive fuel theft scheme involving fraudulent cards and pump tampering, resulting in over 9,312 gallons of stolen diesel fuel.

💰 Mexico Investment Booming. Foreign direct investment reaches $39B in 2024's first five months, with U.S. leading at $20B.

🚛 Mountain Mishap. Truck gets stuck on Virginia's Cliff Mountain Roadway.

🌿 Truckers Support Pot Reclassification. Drivers advocate for marijuana rescheduling, citing off-duty use and pain management benefits.

🎣 THE FREIGHT CAVIAR PODCAST

In this week’s episode, we sat down with Dynamic Logistix leaders Billie Rodriguez, Director of Carrier Solutions, and George Schergen, Vice President of Carrier Services.

They discussed the importance of realistic pricing, transparency, and building strong client relationships. Billie and George also emphasize the importance of the human element in the industry and having a great team.

Catch the full episode on YouTube, Spotify, or Apple Podcasts.

FREIGHT MEME OF THE DAY

Also, check out:

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).