🎣 C.H. Robinson

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

DAT faces criticism over contract terms. Plus, DAT acquires Trucker Tools, RBX declares bankruptcy, and Cargado hits $1M milestone.

Is your freight rate data really yours? FreightWaves CEO Craig Fuller critiques DAT's contract terms causing a heated industry debate.

Plus:

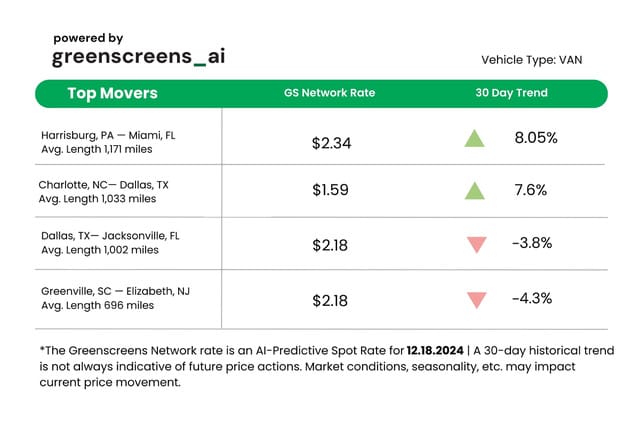

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

🐔 WHAT’S COOKIN’ IN FREIGHT

🤝 DAT Strengthens Tech Suite with Trucker Tools Acquisition. DAT Freight & Analytics has acquired Trucker Tools to bolster its carrier engagement, load optimization, and fraud prevention capabilities. Founded in 2013, Trucker Tools will keep its brand intact, with Kary Jablonski stepping into the role of VP and GM at DAT. Boasting 750 brokers and 350,000 drivers on its platform, Trucker Tools enhances DAT’s freight matching and tracking services. Both companies emphasize customer-centric innovation, scalability, and combating industry fraud. DAT plans to integrate AI and biometric tools, aiming to optimize broker workflows and modernize its platform for market growth in 2025.

🚀 Cargado Reaches $1M ARR in 8 Months. Cross-border freight marketplace Cargado hit $1 million in annual recurring revenue just 8 months and 4 days after its April 1st launch. Founder Matt Silver texted, "We hit $1M in ARR recently faster than almost any other company, ever." The platform has scaled to nearly 140 customers, including 7 of the top 10 and 40 of the top 100 brokers. Driven by Silver's network and a fast-moving, focused team, Cargado is already making waves. Looking ahead to 2025, the company plans to roll out new features and expand into more markets. Silver may share more about the journey and growth strategies in a blog series—stay tuned to his socials for details.

📄 Missouri Trucking Firm RBX Inc. Files for Bankruptcy. RBX Inc., a family-owned Missouri trucking company with 265 trucks and 255 drivers, has filed for Chapter 11 bankruptcy protection. Operating since 1983, the company hauls freight in the Midwest and Southeast. The filing lists assets under $50,000 and liabilities between $10 million and $50 million, citing 199 creditors. Despite operational challenges, including a 25% truck out-of-service rate (above the national average of 22.3%), driver safety metrics exceeded industry standards. The company seeks reorganization, with a court-ordered deadline of December 27 to disclose financial details.

TOGETHER WITH HIGHWAY

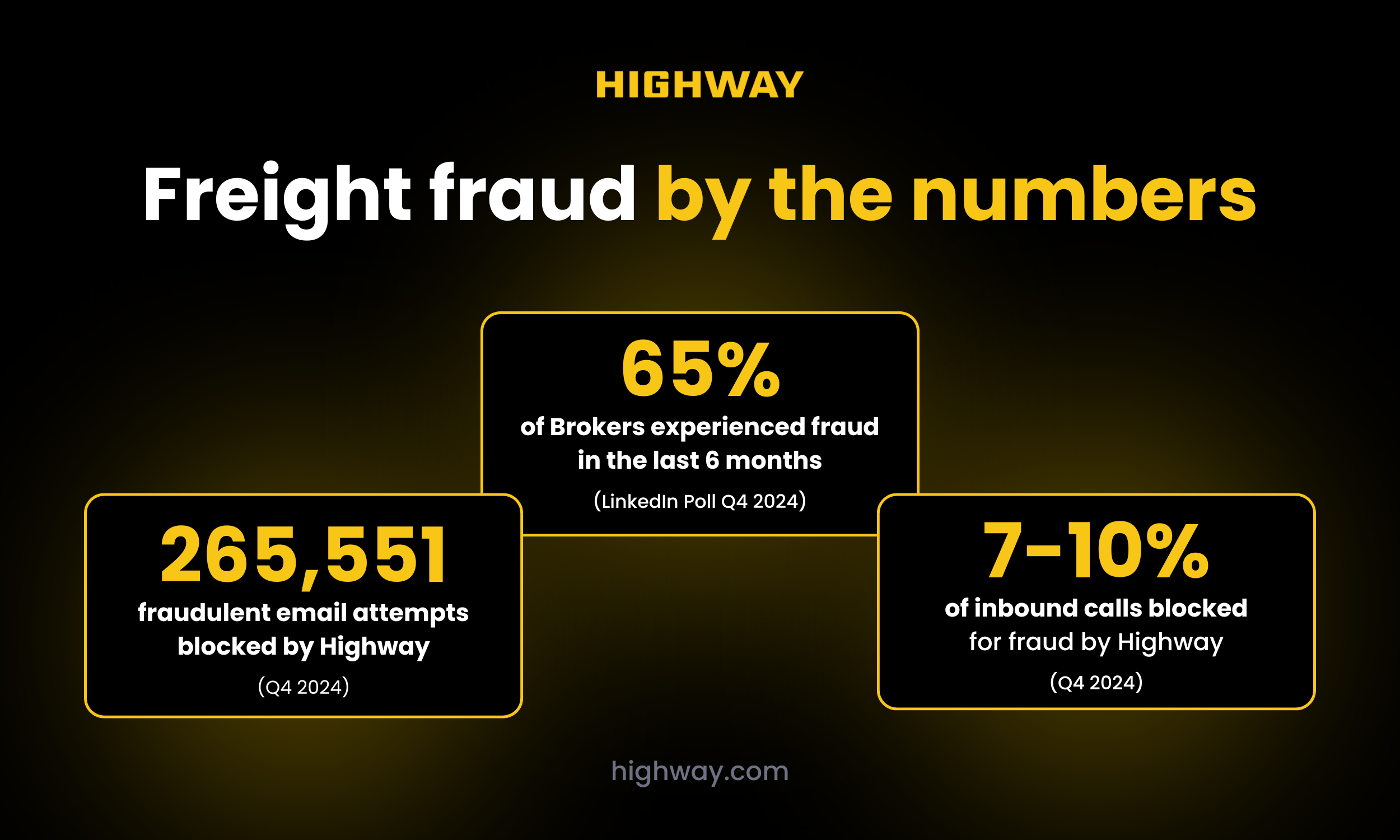

The freight industry is shifting focus from capacity challenges to safeguarding revenue and reputations against fraud. In a recent survey of freight brokers, 48% identified cargo theft and fraud as the most significant challenge of 2024.

Fraud trends show a concerning spike:

Highway empowers freight brokers to take control of their network, stopping fraud at the first point of contact.

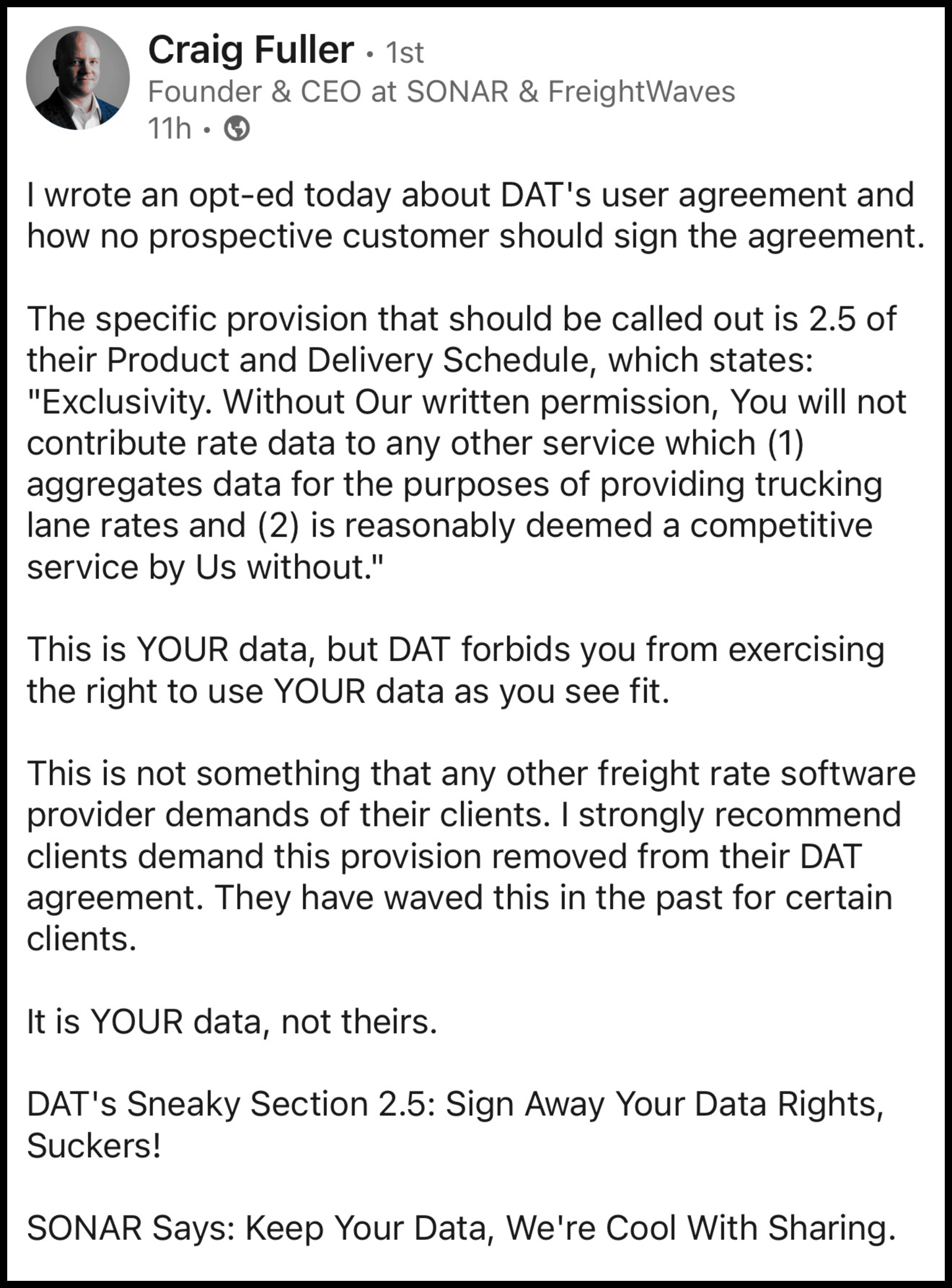

After DAT announced its acquisition of Trucker Tools, the conversation shifted. FreightWaves CEO Craig Fuller criticized DAT’s contract terms, highlighting a clause that limits customers from sharing their rate data with competitors. This raised questions about data ownership, competition, and what it means for freight tech.

He expresses that DAT's contract terms come with a catch: your data might not be yours to share.

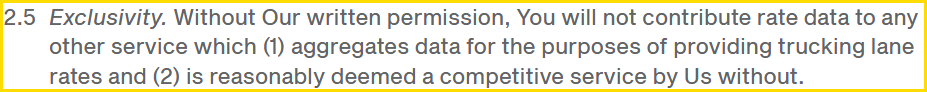

At the center of the controversy is Section 2.5 of DAT’s agreement. The clause restricts customers from sharing their rate data with any company DAT deems a competitor—raising red flags about data ownership and anti-competitive behavior.

FreightWaves CEO and Founder Craig Fuller, who also leads DAT competitor SONAR, didn’t hold back, writing:

“You are telling clients they cannot share their own data with another vendor that you deem to be a competitor... This is YOUR data, not theirs.”

Freight tech leaders weighed in, with Matt Silver, CEO of Cargado, saying:

“Wow, this is wild! That seems so obscene for them to do this. It’s greedy.”

Investor Benjamin Gordon added his reaction on 𝕏, saying:

But while Fuller’s take is spicy, some questioned the messenger. Just hours after DAT announced its acquisition, FreightWaves published its sharp critique. Former MoLo Solutions CEO Andrew Silver raised an eyebrow:

"My concern is the idea that the CEO of Freightwaves is also the CEO of a large DAT competitor and wrote this article aggressively attacking DAT hours after they announced the transaction… that kind of feels off."

It’s a fair point: DAT dominates the load board game, and any pushback comes with its own baggage. Still, the bigger question remains: Who really has ownership of the rate data?

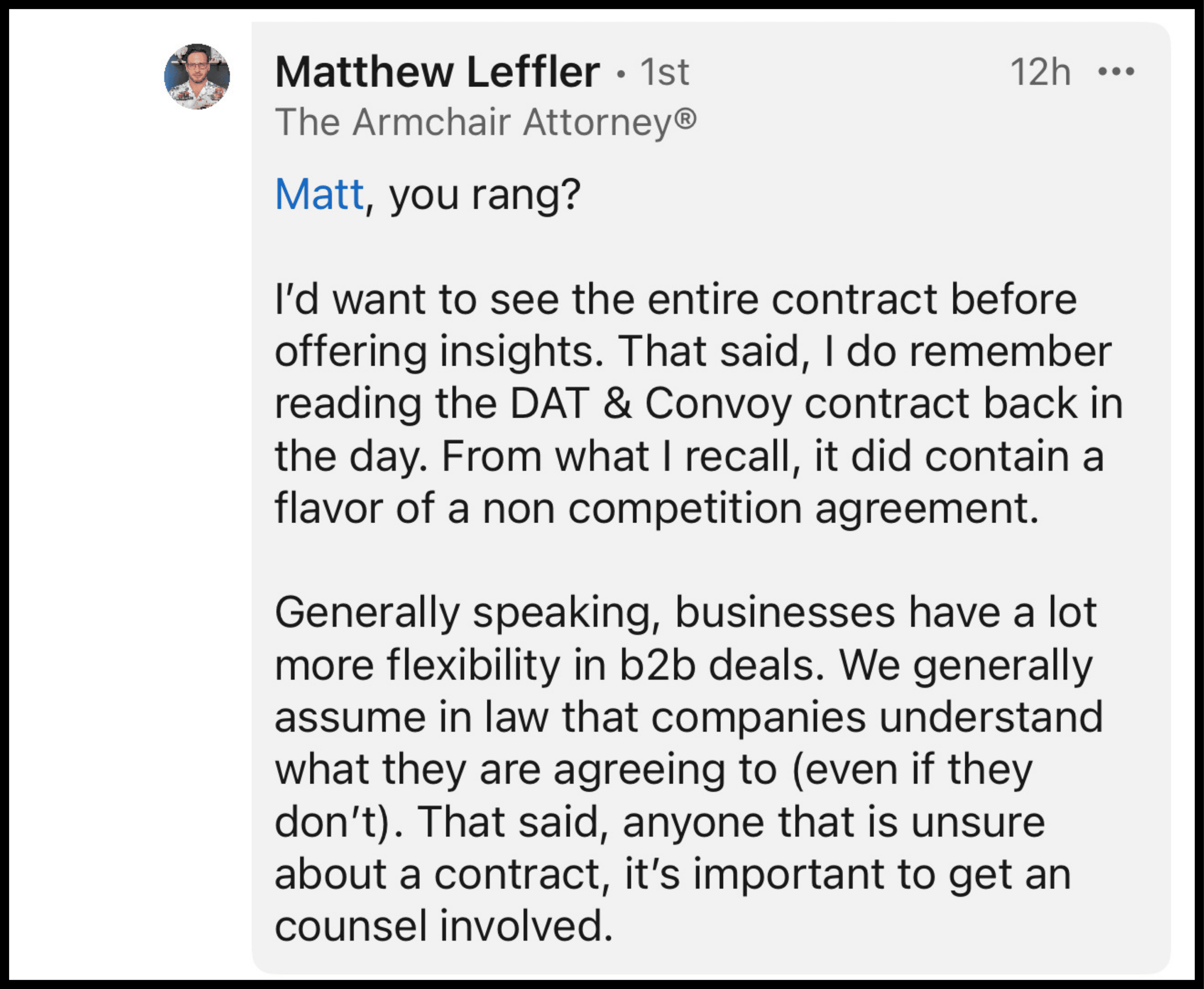

"The Armchair Attorney" Matthew Leffler says he'll offer his opinion after a deeper analysis of the docs but chimed in with this:

With DAT snapping up Trucker Tools, its influence is only growing. For freight brokers, smaller players, and emerging tech, this raises some concerns:

TOGETHER WITH CTRL CHAIN

CtrlChain is a cost-effective solution that helps carriers secure more contract freight with reliable shipper companies. The company emphasizes stable income for carriers by fostering long-term, mutually beneficial partnerships between carriers and shippers.

CtrlChain system simplifies the day-to-day tasks of fleet owners and operators by digitizing and automating manual tasks such as managing delivery information, updating customers, and providing PODs. It replaces spreadsheets, emails, phone calls, and post-it notes by offering a single platform for planning, executing, and receiving payments for deliveries.

🌎 AROUND THE FREIGHT WEB

📬 Trump’s USPS Plan. President-elect Trump is considering privatizing USPS. In addition, Trump’s transitional team is considering canceling a contract for a new fleet of electric mail trucks.

⚖️ TQL Seeks SCOTUS Ruling. Despite winning lower court decisions, TQL is asking the Supreme Court to clarify broker liability under F4A to resolve conflicting rulings across circuits.

📦 Tariff Stockpiling Surge. North American manufacturers are stockpiling materials at the highest levels since July, bracing for potential tariff hikes under the incoming Trump administration.

🚛 2024 Freight Market Recap. The trucking industry faced its longest freight market downturn in 34 months but shows minor recovery signs, with tonnage inching up since January 2024 lows and industry players anticipating gradual improvement into 2025.

🎁 Holiday Heist Unwrapped. Thieves pulled off a $1 million toy heist, rerouting three of Flycatcher’s Atlanta-bound shipments. Two trucks were diverted to Los Angeles, while the third remains unaccounted for.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT MEME OF THE DAY

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).