🎣 Old Dominion's Thoughts

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

Plus: a Wyoming pipeline blast snarls a key freight corridor, brokers double down on U.S.–Mexico, truckload hauls shrink to record lows, and more in today’s newsletter.

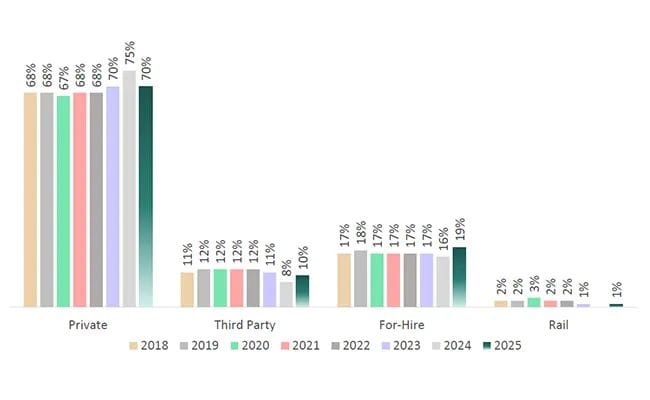

Good Monday morning. For-hire carriers just hit their highest share on record, now moving 19% of freight once kept in private fleets. Brokers still hold 10%, but the question is: will this shift stick when the market turns? Check it out in today's feature.

Plus,

🔥 Wyoming Pipeline Blast Halts Freight Corridor. A Kinder Morgan natural gas pipeline ruptured early Sunday near Cheyenne, Wyoming, igniting next to a Union Pacific freight train and charring several cars, including ones within 40 feet of hazmat shipments. No derailments or injuries were reported, but the fire disrupted one of the busiest east–west freight corridors. The National Transportation Safety Board has launched an investigation into the cause. With rail and truck routes heavily intertwined along I-80, even short-term inspections or repairs could slow traffic.

🇲🇽 Brokers Expand as Cross-Border Freight Surges. C.H. Robinson and Uber Freight are expanding U.S.–Mexico services to meet growing demand as tariffs and nearshoring reshape trade. Robinson launched a consolidation program that bundles freight from multiple suppliers, cutting costs by up to 40% while improving customs efficiency. Uber Freight is embedding compliance tools into its platform, promising visibility at traditionally opaque border crossings. With U.S.–Mexico trade up 21% year-to-date and Laredo processing $206 billion in shipments, brokers see opportunities in compliance, bonded warehousing, and LTL strength. As cross-border volumes grow, these moves position both companies to capture share in one of freight’s fastest-expanding markets.

📉 Truckload Hauls Shorten, Opening Door for EVs. FreightWaves data shows truckload average length of haul fell to 522 miles in August, a 13% year-over-year drop and the lowest level on record, before rebounding slightly. Long-haul freight has shifted to intermodal rail, where costs can be 15–30% lower, while shippers also front-loaded inventory earlier in the year to hedge tariff risks. Shorter hauls now dominate growth, creating tighter capacity cycles but also new opportunities. Electric Class 8 trucks, such as Tesla’s Semi, face challenges with long ranges but become more viable as networks shift to 500-mile averages. For brokers, modal competition and EV adoption are emerging strategy factors.

HappyRobot's AI workers handle the manual work, surfacing important information, insights, & recommendations along the way.

Your team leverages insight & recommendations for strategies to differentiate & grow.

Then right back to HappyRobot to execute.

Move faster, operate smarter, & stay ahead with HappyRobot.

New data shows private fleets are letting go of freight at a record pace.

According to the latest National Private Truck Council (NPTC) survey, for-hire carriers just grabbed 19% of outbound freight from private fleets, the biggest share ever recorded.

FreightWaves Analyst Thomas Wasson notes private fleets’ share slipped to 70% this year, while brokers and 3PLs held 10%. That’s a reversal from the post-COVID years when private fleets had been gaining ground, a trend that began in 2017.

America’s biggest private fleets easing off the gas. Transport Topics’ 2025 Top 100 Private Fleets shows who’s most exposed:

This is freight that’s historically been locked inside the tightest fortress fleets in the country.

Some brokers see opportunity. On Wasson’s LinkedIn post, a comment asked if this shift could trigger a bullwhip effect with brokers eventually gaining share once for-hire capacity gets absorbed.

Wasson’s response:

“… 3PLs may be more insulated, as they’re being used for more irregular routes and may be cheaper than for-hire carriers if the 3PL is sourcing extremely well.”

The real test will come in the next upswing. If brokers keep pandemic-era gains and strong carrier relationships, they could grow beyond 10%. If not, for-hire giants will tighten their grip.

As Wasson wrote on LinkedIn: “For-hire fleets had their best gain in outbound freight from companies with private fleets in the past 20 years.” That’s a bullish signal for big carriers hunting truckload demand and a warning shot for brokers.

Private fleets were meant to shield shippers from market swings. In 2025, we're seeing some freight leaking from cracks wider than they've been in decades.

Make carrier payments a strength of your back-office with OTR Solutions.

Nurture your broker-carrier relationship with best-in-class payments.

💊 Narcotics Seized. CBP officers at the World Trade Bridge in Laredo intercepted over $3.3 million in meth, cocaine, and heroin hidden in a tractor-trailer. The case is under Homeland Security investigation.

💼 Arkansas Driver Shortage. Arkansas reported 279 truck drivers removed from service under new visa and ELP enforcement. State officials say they are tightening hiring guidelines and recruiting more qualified drivers to fill the gap.

🚂 Trump Backs Merger. President Trump voiced support for the proposed Union Pacific–Norfolk Southern merger, saying it “sounds good to me.” The $85 billion deal would create a 52,000-mile rail network spanning 43 states.

📝 Watchdog Questions FMCSA. A federal watchdog raised concerns over FMCSA’s English proficiency testing, arguing inconsistent enforcement leaves gaps in safety oversight. The review comes as hundreds of drivers face out-of-service orders under stricter rules.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).