🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

FreightCaviar Weekly Recap. As federal scrutiny deepens over licensing failures tied to the Florida Turnpike crash, the push for road safety gains momentum. Here are this week’s most talked-about freight stories.

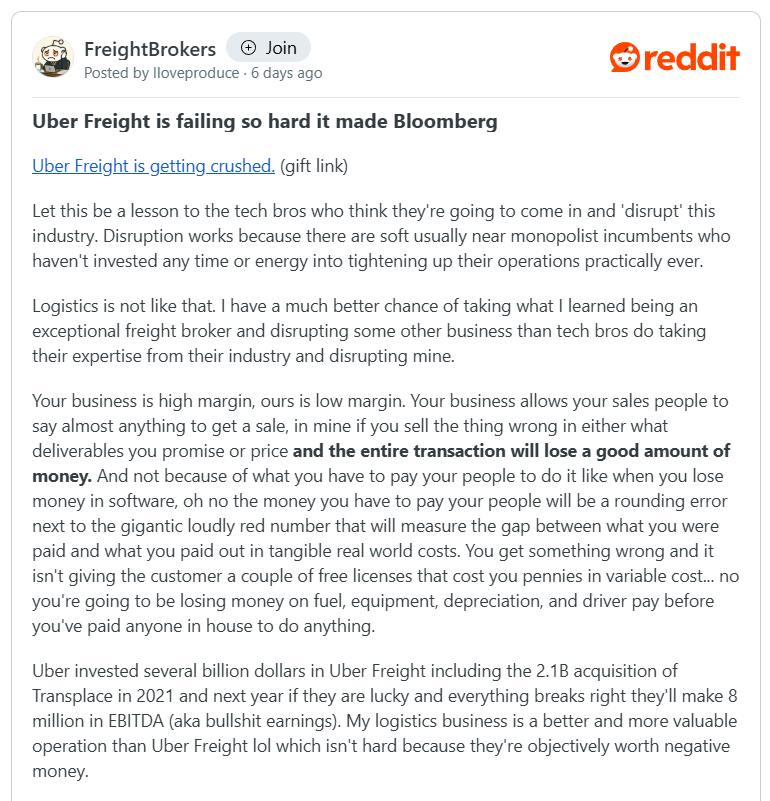

A Redditor on r/FreightBrokers reacted to Bloomberg’s recent report on Uber Freight’s financial performance, offering a pointed reflection on the disconnect between tech-driven disruption and the operational demands of freight. The post sparked renewed discussion around the challenges of scaling in a low-margin, execution-heavy industry.

The Redditor’s core argument: software alone isn’t enough to transform freight. Unlike tech sectors that scale rapidly with minimal cost per user, brokerage missteps carry real, immediate expenses—fuel, equipment, insurance, and driver pay. Freight, the post suggested, is far less forgiving of mistakes than digital-native businesses.

Recent reporting supports the broader point. As Bloomberg noted, Uber Freight has operated at a loss every year since 2017, with a single break-even year in 2022. Its $2.25 billion acquisition of Transplace in 2021 failed to push the business into profitability. Analysts expect only $8 million in EBITDA by 2026, a small return relative to Uber’s other divisions. In contrast, legacy brokers have digitized their operations while maintaining profitability, and many digital-first competitors, like Convoy and NEXT, have exited the space altogether.

We also reported on Lior Ron’s transition from Uber Freight CEO to COO at Waabi, an autonomous trucking startup. Ron will remain chairman of Uber Freight while helping Waabi scale its driverless freight platform across the U.S. Southwest by year’s end. This move signals Uber’s longer-term interest in autonomy over brokerage.

While Uber Freight is known for its tech, the company had to grind it out the traditional way at the start. In our recent FreightCaviar podcast, Uber Freight Co-Founder Bill Driegert, now helping lead the Convoy tech integration at DAT, reflected on those early days:

“When we started [entering brokerage] we didn’t have the tech. We just had to sling freight. So like we started calling plastics companies in Texas and just scrubbing the DAT to cover freight... we had a TMS built in Google Sheets.”

It’s a reminder that even for tech disruptors, logistics starts with grit, not just code.

As the industry recalibrates post-boom, the convergence of tech and trucking continues, but so does the reality check.

HappyRobot's AI workers handle the manual work, surfacing important information, insights, & recommendations along the way.

Your team leverages insight & recommendations for strategies to differentiate & grow.

Then right back to HappyRobot to execute.

Move faster, operate smarter, & stay ahead with HappyRobot.

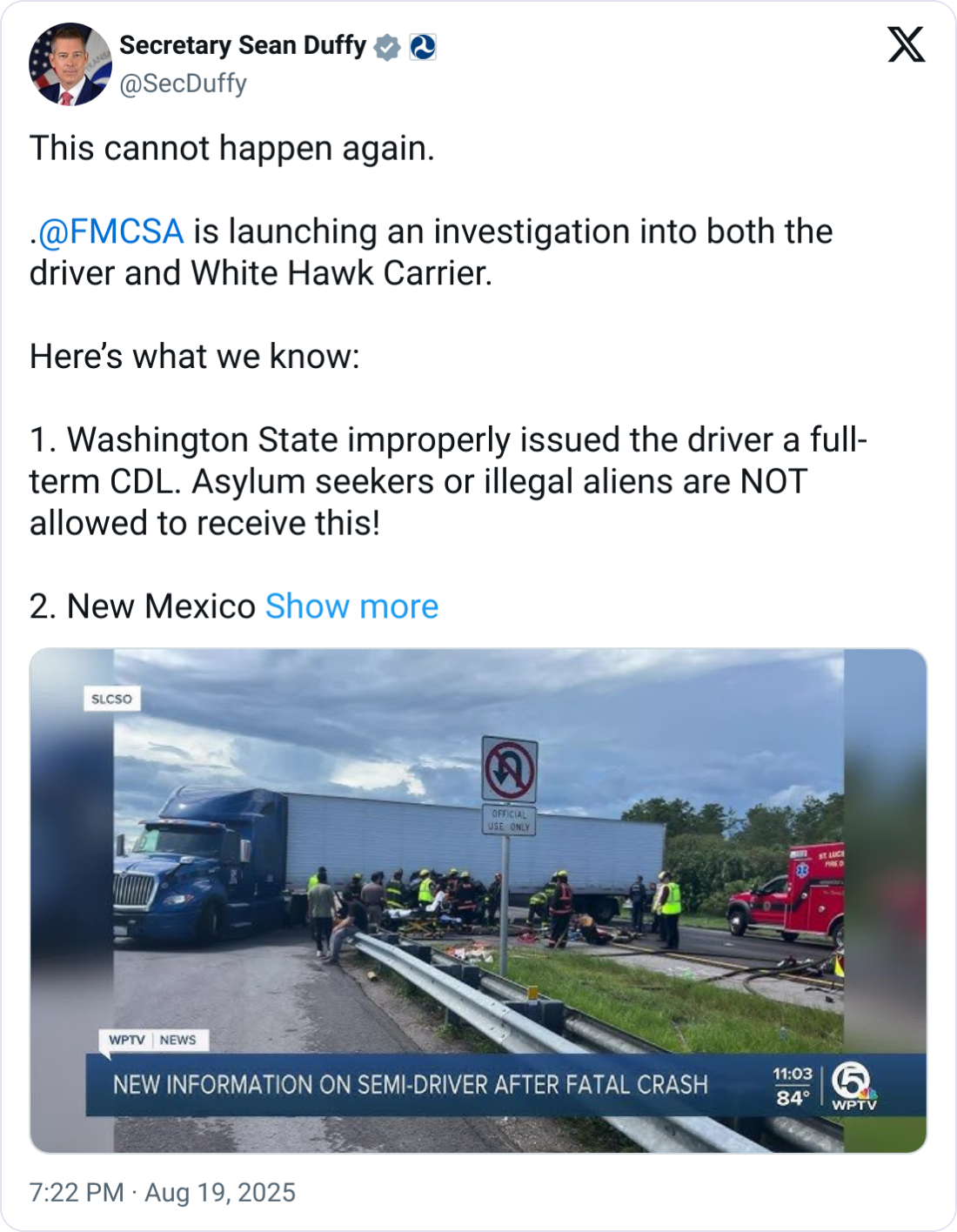

Secretary Sean Duffy is going viral after he confirmed the FMCSA is launching an investigation into White Hawk Carriers and its driver, Harjinder Singh, who is now charged with vehicular homicide after a fatal crash that killed three people on the Florida Turnpike.

The X post cited multiple state-level licensing failures, calling them “despicable” and a direct cause of the tragedy. Duffy stated that if states had followed federal rules, “this driver would NEVER have been behind the wheel and three precious lives would still be with us.”

The federal probe revealed serious gaps in CDL oversight:

FMCSA confirmed Singh failed the ELP test, correctly answering only 2 of 12 verbal questions and identifying just 1 of 4 traffic signs.

The Owner-Operator Independent Drivers Association (OOIDA) responded quickly, sending a letter to Secretary Duffy demanding a full nationwide audit of non-domiciled CDL issuance. Among their key recommendations:

Duffy confirmed a full-scale audit is now underway and emphasized that “this is just the tip of the iceberg.”

We will do a deeper dive on this issue tomorrow, so stay tuned.

A recent midyear survey from Truckstop.com and Bloomberg Intelligence captured a freight market moving in two directions. Brokers reported stable margins and growing optimism, while carriers showed signs of deepening strain amid weak spot rates and declining load volumes.

The data pointed to a clear split:

Carrier sentiment also worsened around tariffs, economic policy, and job satisfaction, with fewer planning to invest in equipment or workforce growth this year.

The story painted a picture of a market in two speeds: brokers navigating the downturn with flexibility, and carriers absorbing most of the impact.

Read the full feature to explore what’s driving this split and what it could signal for the rest of the year.

Over on LinkedIn, we highlighted Total Quality Logistics’ move to petition the U.S. Supreme Court following its loss in the Sixth Circuit. The question at the center: Can freight brokers be held liable when a carrier they hire causes a crash?

As we noted in a previous newsletter, this marks the second major case, alongside Montgomery v. Caribe II, asking the Court to resolve the growing split between federal circuit courts. With insurance markets already reacting and liability exposure rising, the pressure for legal clarity is mounting. You can take a look at the newsletter to get a deeper dive on this topic.

Furthermore, read our retrospective to understand what’s at stake and where the legal fight heads next.

Ever chased down a payment, juggled multiple claims or dealt with a silent back end?

At Trinity, we take the stress out of the backend with fast, transparent support you can count on.

From billings to claims, our team is responsive and ready to help!

🎣 THE FREIGHT CAVIAR CORNER

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).