🎣 Schneider's Weak Q4

Plus: AGX Freight suspends operations, Gatik goes fully driverless, Werner buys FirstFleet

Plus: a cyberattack rattles UNFI’s Whole Foods supply chain, an Illinois carrier files Chapter 11, a surge in new MCs masks ghost fleets and fraud, and more.

Happy Hump Day. When a freight brokerage fights to keep documents sealed, it usually means there’s something in there they don’t want you to see. But now, GlobalTranz and WWEX’s unredacted filings are public, seemingly by accident. Find out what they revealed in today's feature.

Plus:

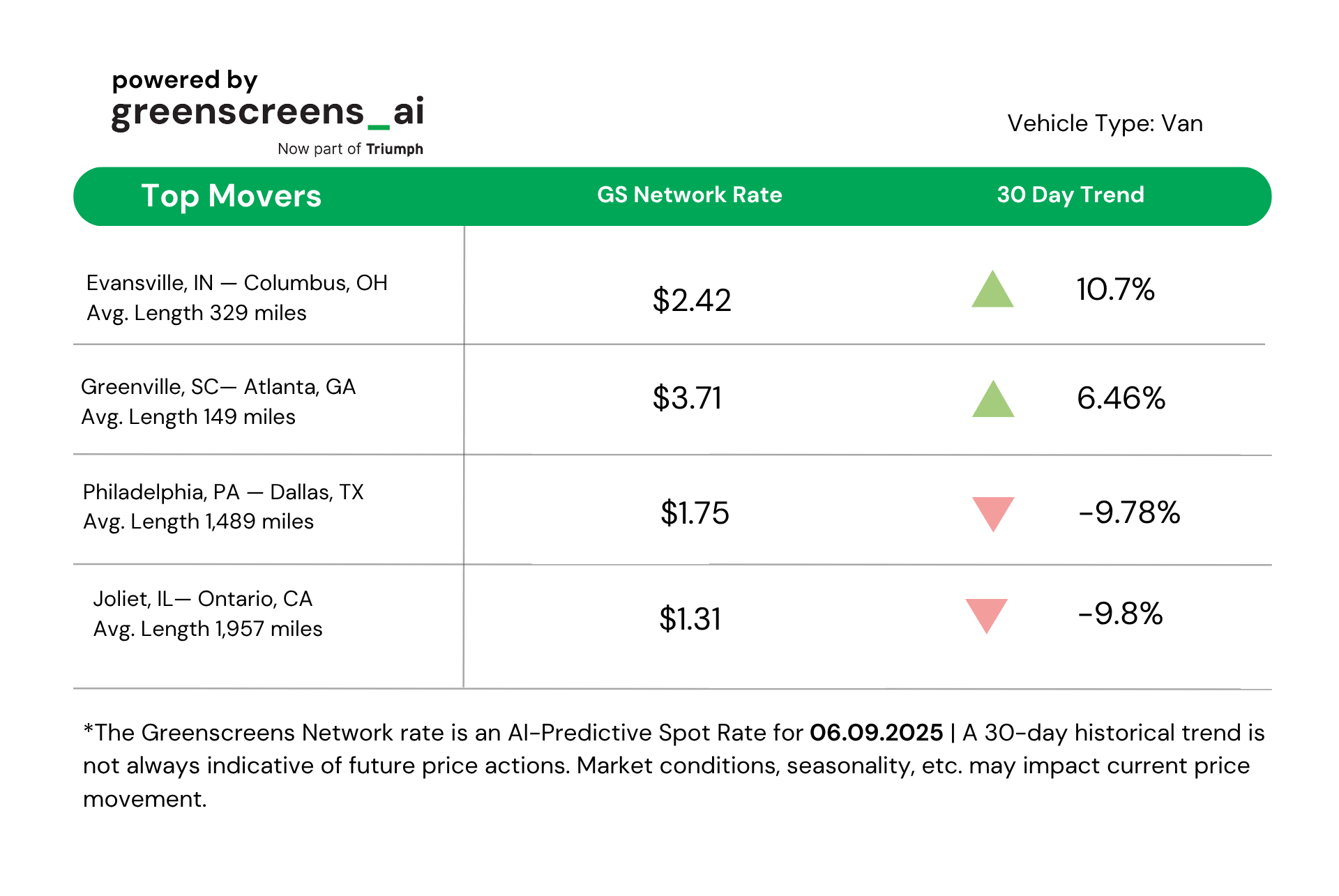

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

🍳 WHAT’S COOKIN’ IN FREIGHT

🛡️ Cyberattack Disrupts UNFI Operations, Affects Whole Foods Supply Chain. United Natural Foods Inc. (UNFI), the primary distributor for Amazon’s Whole Foods, is facing order disruptions following a cyberattack discovered on June 5. In a June 9 SEC filing, the Rhode Island-based company disclosed it had taken key systems offline and engaged forensic experts to investigate the breach. The incident has affected customer fulfillment operations and prompted coordination with law enforcement and external cybersecurity teams. UNFI, which operates 53 warehouses and distributes over 250,000 products, is not alone in facing such threats. Companies like FedEx, Maersk, Martin, and Truckstop have also been targeted, according to Craig Fuller. The fallout can be severe; Marks & Spencer Group, for example, expects a $403 million hit to operating profit this fiscal year due to similar cybersecurity challenges.

😔 Illinois Carrier AZA Transportation Files for Chapter 11. Chicagoland-based AZA Transportation has filed for Chapter 11 bankruptcy, citing over $826,000 in liabilities. The company, which operated 70 power units as of October, aims to reorganize and remain operational. Major creditors include Keystone Equipment Finance and Transportation Alliance Bank, tied to truck and trailer financing. The filing comes amid persistent freight market contraction and rising equipment costs. The carrier also owes the SBA for a COVID-era disaster loan. AZA joins a growing list of firms squeezed by weak demand and trade-related uncertainty.

🚨 New Carrier Boom Conceals Troubling Trends in U.S. Trucking. While Texas and California still top new MC authority totals (with California leading the nation), ZIP code-level data reveals deeper issues. Contributing to FreightWaves, Adam Wingfield uncovered that Fresno and Laredo lead the way in new entries for May 2025. However, many are linked to short-lived LLCs or regulatory loopholes. Alleged misuse of B-1 visa drivers in Laredo and reemerging fraud rings in Fresno point to a shaky foundation. Add in fraudulent CDL schemes, labor substitution, and delayed FMCSA audits, and you’ve got a regulatory powder keg. While CarrierOK’s earlier analysis shows FMCSA is flagging and blocking more suspect applications, the volume remains high, with 26,000+ new MCs in 2025 and a growing share linked to questionable activity. Fraudulent CDL pipelines, labor substitution, and delayed audits all raise the same concern: Is enforcement keeping pace with expansion?

Our customers are accomplishing what used to take them a month to do in one hour!!!

How? AI workers are assigned a task & can complete thousands of those tasks at once - vetting inbound interest, calling outbound for capacity, confirming appointments, collecting PODs.

Put the time-consuming, grunt work on autopilot & get back to the fun stuff.

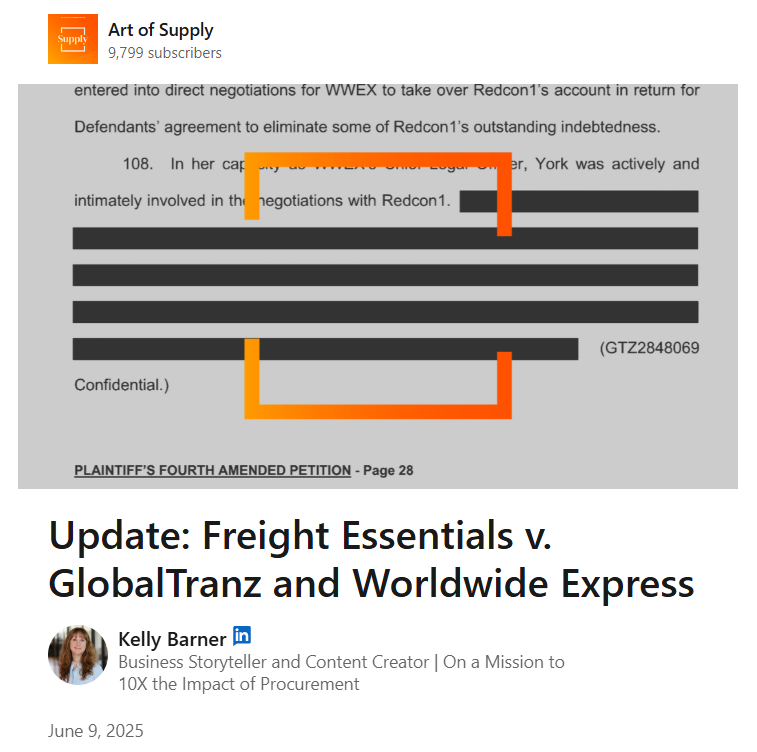

Freight Essentials’ RICO lawsuit against GlobalTranz and Worldwide Express has entered a new phase.

The defendants' efforts to seal key documents were met with resistance, and the resulting unredacted filings are now laying bare internal tactics of hidden fees, customer poaching, and data manipulation.

In December 2024, Freight Essentials CEO Dylan Admire accused GlobalTranz/WWEX of fraud, claiming they used anticompetitive tactics to steal clients, withhold payments, and inflate costs, essentially racketeering behavior.

A hearing on February 7 aimed to determine redaction levels in the filings, but many details remained sealed.

Thanks to sharp-eyed Kelly Barner of Art of Supply, we now know that many of the claims GlobalTranz fought to keep hidden were accidentally exposed in a later, unredacted court document filed in May, all 226 pages.

Barner noted:

"I started comparing the two documents and what I believe I have found is that many of the redactions GlobalTranz and Worldwide Express fought for seem to have been forgotten? Ignored? Disregarded? in the Appendix In Support Of Defendants’ Second Motion To Compel."

Here’s what’s now out in the open:

Barner’s takeaway? These weren’t minor redactions, but critical claims that now offer a much clearer picture of how Freight Essentials says they were undercut, overbilled, and misrepresented.

At the core, this case is about who owns the relationship between carrier, agent, and broker. As one commentator put it:

“Freight Essentials uncovered hidden charges…and GTZ’s effort to seal court filings shows exactly what they didn’t want us to see.”

Now that the redacted content is exposed, brokers must rethink: What are you not seeing in your own fee structures?

Summer 2025 – Discovery and Pre-Trial Motions

Late 2025 (Estimated) – Trial or Settlement Window

With the redacted content out, freight agencies should ask: What’s missing in your own fee structure?

Take control, centralize your claims process for:

✅ Faster resolutions

✅ Automated tracking & updates

✅ Simplified carrier communication

🌎 AROUND THE FREIGHT WEB

📢 Trump: “Deal with China Is Done." Trump says a U.S.–China trade deal is finalized, pending Xi’s signoff. China will supply rare earths; U.S. grants student access. Tariffs? U.S. 55%, China 10%. Relationship status: “excellent.”

💰 PepsiCo’s $1M EV Charging Win. PepsiCo anticipates saving nearly $1 million in fuel expenses by charging its fleet of 50 electric semitrucks at its Fresno, California bottling plant.

🤝 Tariff Truce Holds For Now. The U.S. and China struck a framework deal to ease export curbs and keep the Geneva tariff truce alive—for now. Rare earth restrictions may be lifted, but details are vague, and full tariff snapbacks loom by August 10 if no comprehensive deal is reached.

🎥 Trevor Milton Documentary Debuts. The new documentary by Trevor Milton, founder of Nikola, was released on YouTube. He shares his side of the story on Nikola's rise and fall, his fraud charges, and more.

📉 May Container Imports Fall. U.S. container import volumes declined in May 2025 as early-year frontloading eased and tariff-related impacts took hold. Job losses at the Port of Los Angeles are an example of the effects of this slowdown.

❌ CDL Veto on AV Bill. Colorado’s governor vetoed a bill requiring CDL holders in autonomous trucks (which would have been the first in the nation), siding with advocates who argue such mandates could stall innovation and commercial deployment.

🚔 Cocaine Smuggling Uncovered. Nine individuals were arrested in a cross-border cocaine smuggling scheme that used U.S.-Canada commercial trucking routes. This is the largest drug seizure in Peel Regional Police’s history, with nearly $50 million worth of cocaine seized.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).