🎣 Warrants Served

Plus, a Chicago-based freight broker boasts about making $215k in one day, Lineage Logistics hits it big with an $18 billion IPO, the latest on the Ocean's 11-style freight heist, and more.

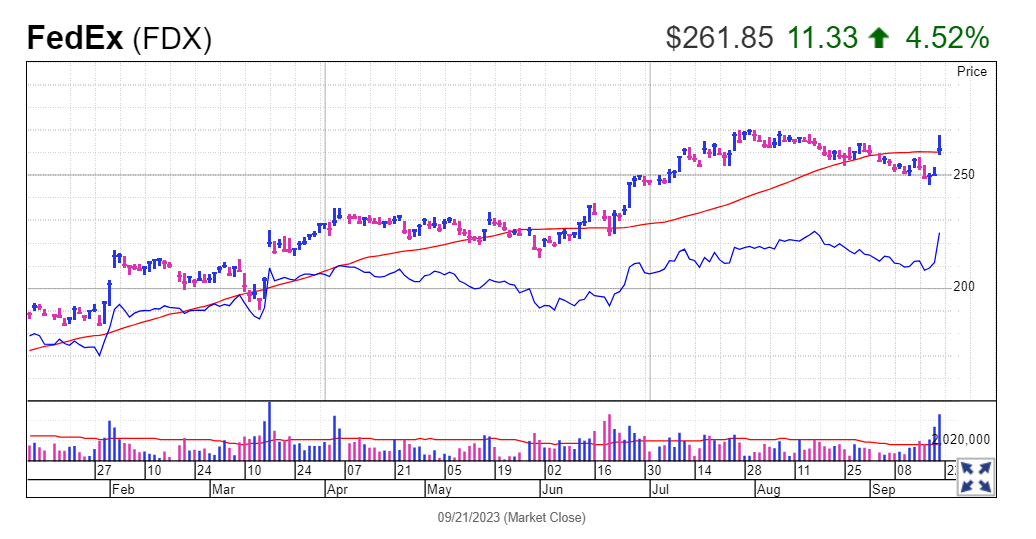

Analysis of TuSimple's challenges in the autonomous trucking industry and FedEx's impressive financial performance surpassing expectations.

FedEx, with its deeply entrenched network and financial robustness, showcases the strengths of a seasoned player, capitalizing on tried-and-true methods even amidst shifting market dynamics. On the other hand, TuSimple represents the promise of the future, venturing into the world of autonomous trucking, aiming to reshape the very fabric of the industry. It's worth taking a side-by-side look at these two big names in logistics.

TuSimple (TSP):

FedEx (FDX):

Sources: SeekingAlpha | Barron's

Join over 10K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe now & be sure to check your inbox to confirm (and your spam folder just in case).