Cargo Theft: Why Drivers Aren’t the Weak Link – The System Is

For a long time, secure parking lived in the “nice-to-have” bucket. That framing no longer works. In today’s environment, secure parking functions as a preventative security layer.

The largest cargo railroad company in the United States generated $25.9 billion in operating revenue in 2022 and is a subsidiary of Berkshire Hathaway.

Good Monday Morning & Happy Labor Day. Today, we spotlight the immense impact of U.S. railways, where a few dominant names have reshaped our nation's transportation tapestry. We also explore the dynamics between OTR Solutions and Convoy in recent credit concerns, observe Coyote Logistics as they manage financial challenges, and understand the rising lawsuit verdicts shaking the trucking industry. Meanwhile, data shows shifting freight market dynamics with shippers showing preference towards asset-based carriers.

Question of the Day: What is the largest cargo railroad company in the U.S. that reported a $25.9 billion operating revenue in 2022 and is a subsidiary of Berkshire Hathaway?

In today's email:

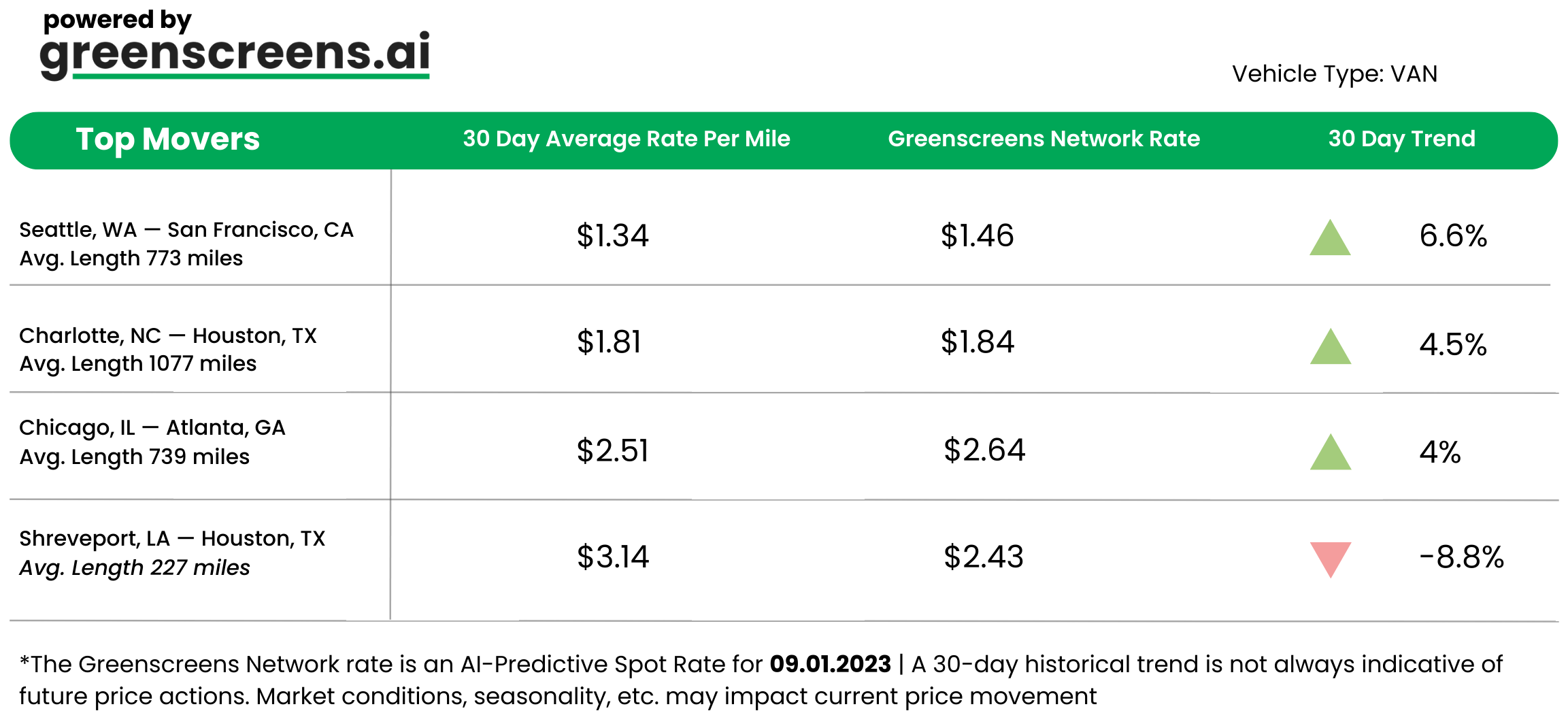

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

*Greenscreens.ai, forecasts real-time truckload buy prices that are suited to each freight brokerage's purchasing power using AI and machine learning. Its engine takes into account over 130 attributes and data points in each rate forecast.

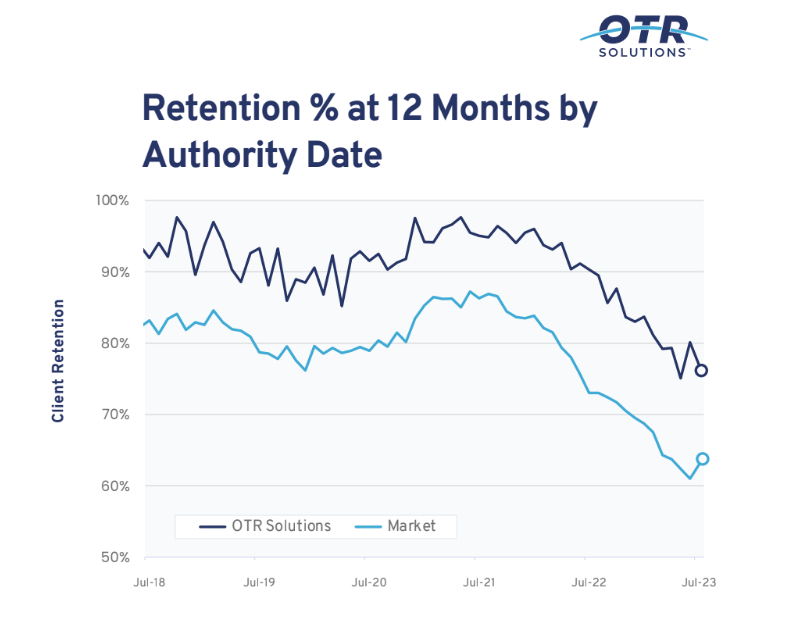

🐔 WHAT’S COOKIN’ IN FREIGHT

🤝 OTR Solutions and Convoy Clear the Air. In a recent industry stir, OTR Solutions temporarily placed digital freight broker, Convoy, on its "Do Not Buy" list, triggering concerns about their credit. While the industry buzzed, both companies quickly addressed the misunderstanding, with Convoy confirming up-to-date payments. In other news about OTR Solutions, we received data indicating that 78% of their 2022 factoring clients are still in business as of July 2023. For comparison, carriers not affiliated with OTR have a 15% lower operational rate over the same period.

💸 Money Woes Lead to Layoffs for Major Players. Coyote Logistics, having a revenue of $5.2 billion in 2023, confirmed recent layoffs, aiming for "long-term stability." This follows a post-COVID hiring spree and a 2022 market crash. Meanwhile, Knight-Swift, facing financial hiccups, initiated layoffs while executives took pay cuts. Rocket Shipping's CEO, Gabe Pankonin, observes a shifting investor landscape; profitability now trumps sheer growth. The lean, profit-focused startups may be the future industry leaders.

⚖️ Trucking Industry Faces Skyrocketing Verdicts. The U.S. trucking industry is grappling with surging lawsuit verdicts. Despite significant safety enhancements, verdict sizes are escalating, impacting especially the small trucking businesses at the industry's core. From 2010 to 2018, average verdicts against trucking firms rose by an alarming 867%. Yet, between 2000-2020, fatal crash rates dropped from 2.23 to 1.47 per hundred million truck miles. With recent settlements averaging $27.5 million, legal experts look for solutions.

TOGETHER WITH RAPIDO

Rapido is a top nearshore staffing company providing logistics and supply chain talent to companies in the United States. Based in Guadalajara, Mexico, Rapido offers a unique combination of cost savings and access to a skilled workforce, making it an attractive option for American logistics businesses.

See what makes nearshoring to Mexico an attractive option for scaling a logistics company and how partnering with Rapido Solutions Group simplifies the whole process.

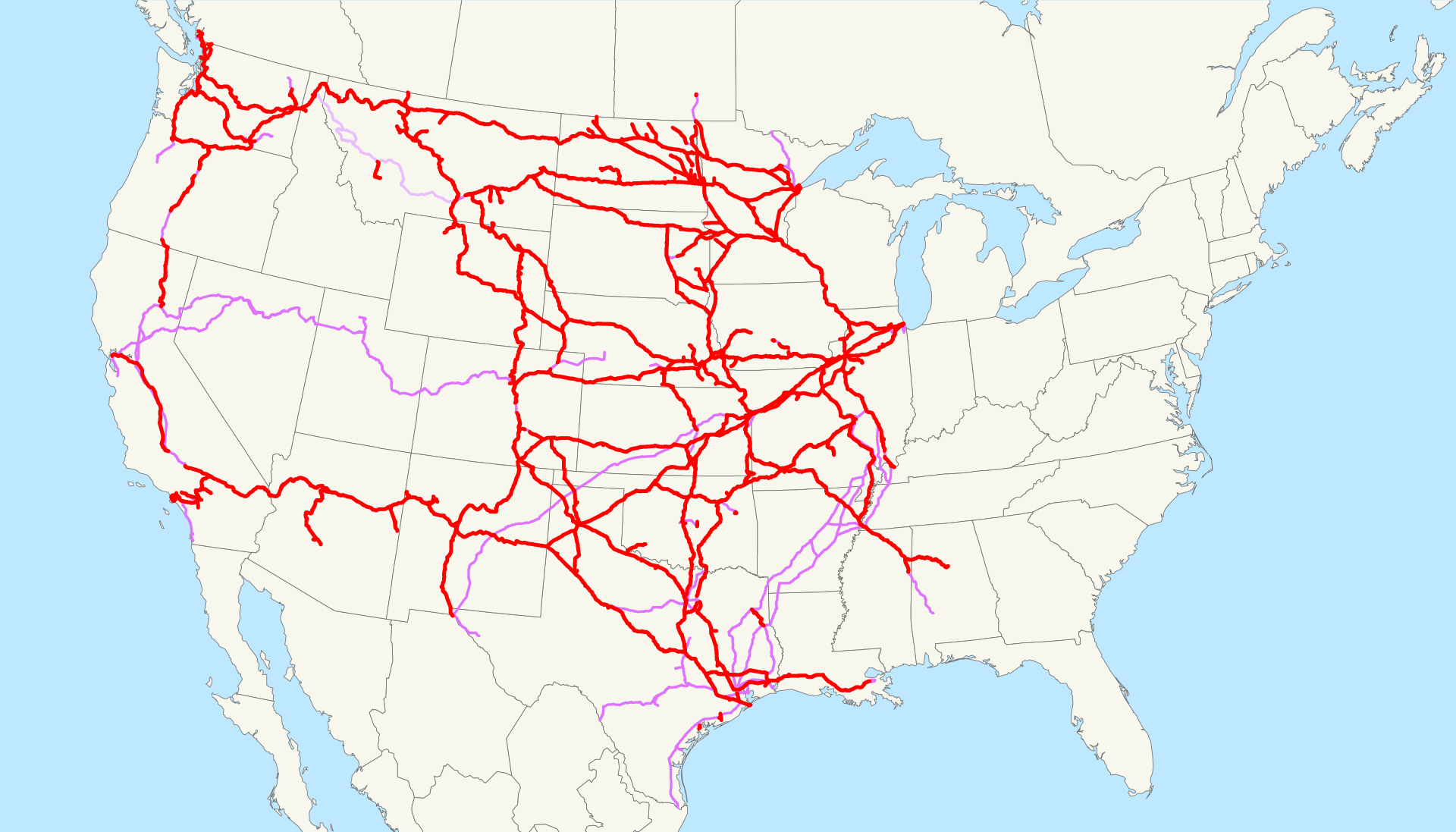

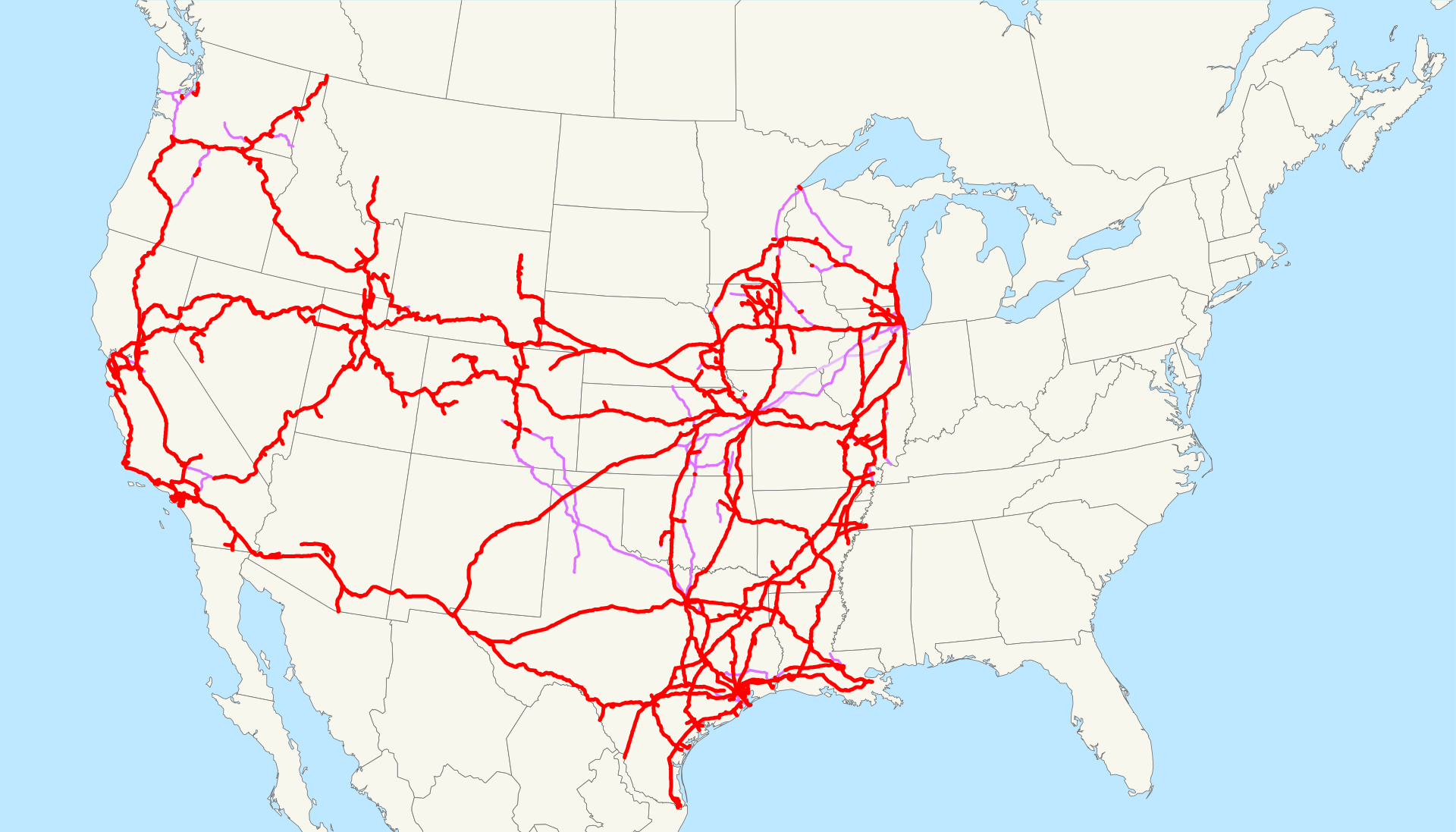

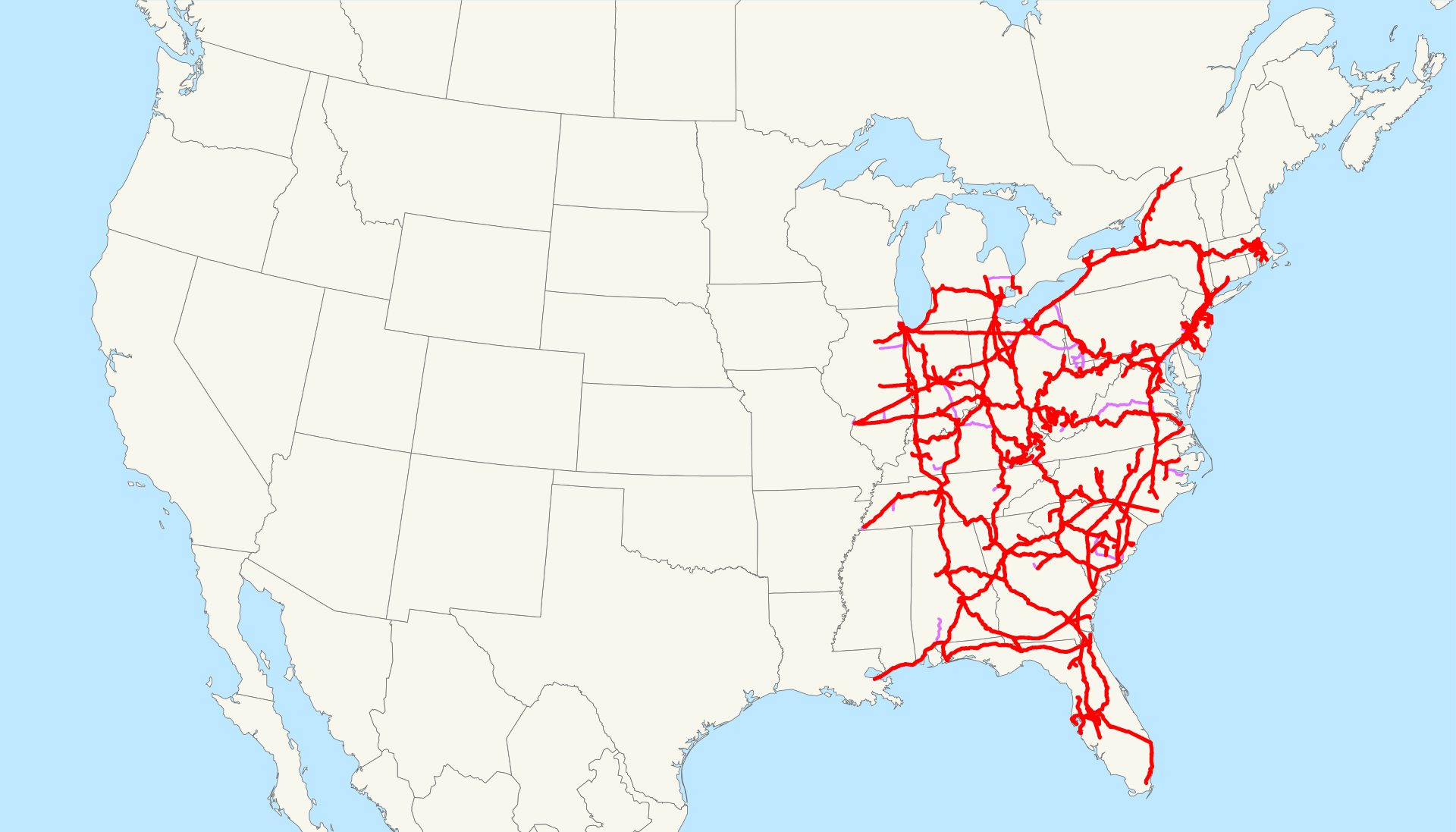

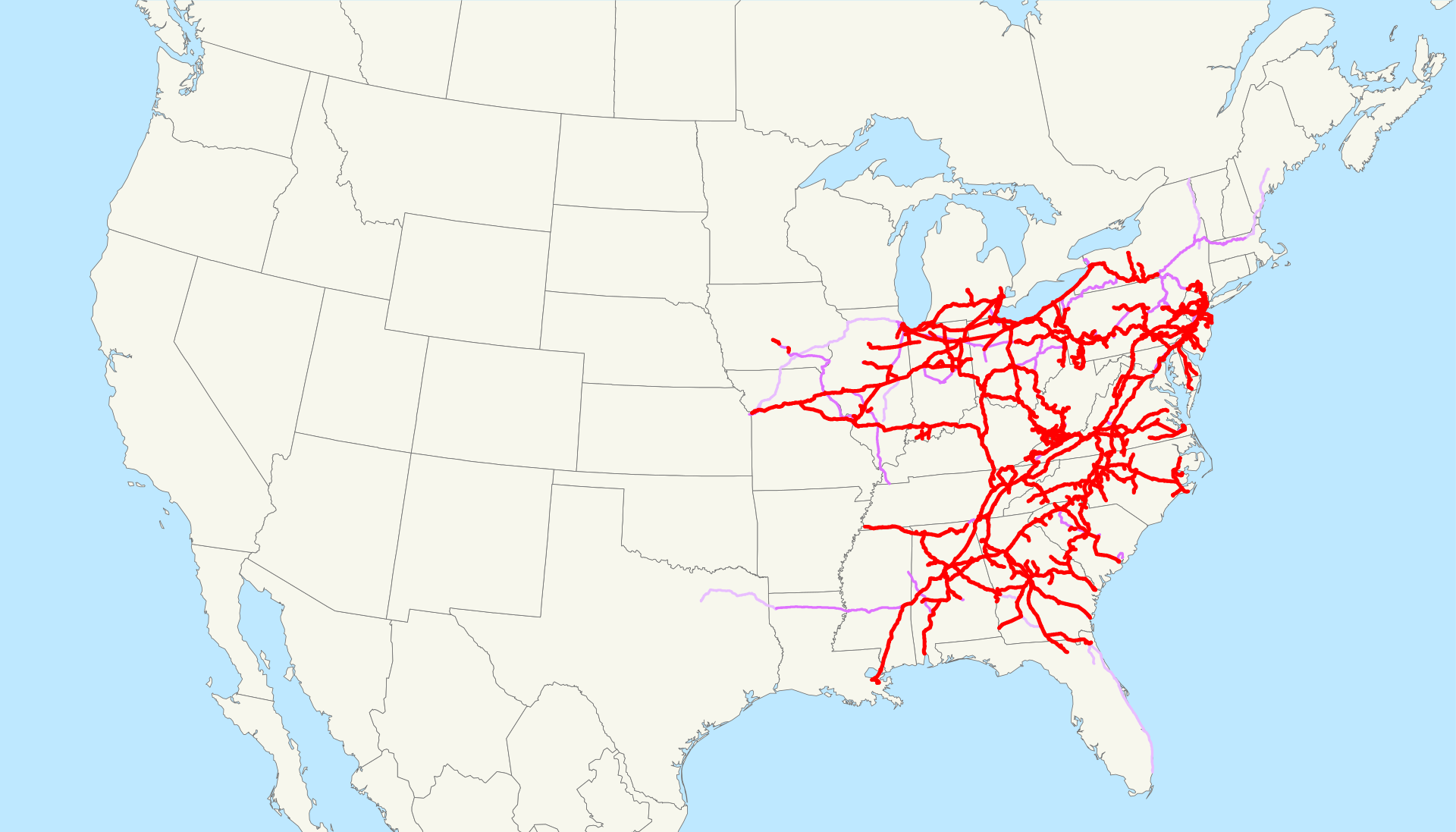

The world of U.S. cargo railways is dominated by a few powerful names that have left their marks across the vast expanse of the country and have quite literally altered the geographical tapestry of the nation. These powerhouses have shaped the freight transportation landscape and stood as towering testaments to American enterprise. Dominating the 2022 map are five mammoth entities, collectively shouldering a remarkable revenue total.

1. BNSF Railway: Reporting a staggering $25.9 Billion Revenue, this 32,500-route miles giant, under the banner of Berkshire Hathaway, proudly traces back its legacy to 170 years.

2. Union Pacific Railroad: Racing closely behind, it garnered $24.9 Billion from its 32,100 route miles.

3. CSX Transportation: Drawing $14.9 Billion, CSX spans 20,000 route miles.

4. Norfolk Southern Railway: This vast network, covering 21,300 route miles, revealed a robust $12.7 Billion revenue in 2022.

5. Canadian National Railway: Meandering through 20,000 route miles, it clocked in a substantial $12.4 Billion revenue.

It's important that Chicago, the U.S.' premier rail gateway, can't be overlooked. Key players like the Harbor Belt Railroad and Belt Railway provide seamless operations.

While rail revenues dipped from $93.3 billion in 2018 to $90.8 billion in 2022, these railways ensure a robust and rhythmic system.

Sources: Sounding Maps

LOGIFLEX: YOUR DRAYAGE & HAZMAT CARRIER

With a fleet of 100 trucks and 200+ chassis, Logiflex specializes in handling all container sizes, including overweight containers, hazardous loads, and special containers like ISO Tanks & Flat Rock. As a bonded carrier, Logiflex ensures secure transportation for even your most sensitive goods.

Though primarily based in Houston, Logiflex provides services throughout all 48 states, catering to clients' unique needs. Trust Logiflex with your drayage needs and experience unparalleled service. Get an instant quote or learn more about their offerings here.

AROUND THE FREIGHT WEB

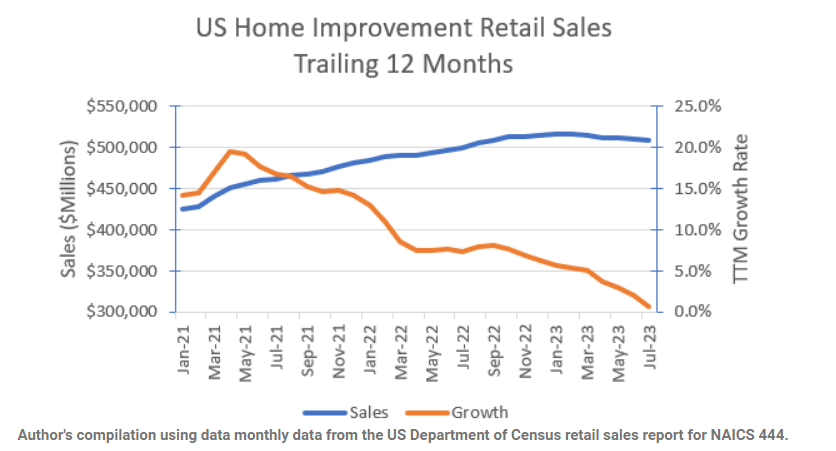

🛠️ Home Depot's Challenges. Despite Home Depot's strong fundamentals, higher treasury yields and lower economic growth expectations are creating a challenging macroeconomic environment, impacting the home improvement sector's near-term growth.

🚛 Freight Market Insights. Freight market dynamics change as shippers favor asset-based carriers.

🏜️ Arizona's Border Reparations. Arizona pays $2.1M for damages to federal and tribal lands from a shipping container wall at the Mexico border.

💊 Walgreens' Pivot. Walgreens CEO Roz Brewer steps down amid operational challenges. Company pivots to healthcare, hints of potential sales, with suggestions Amazon could be a prime suitor.

📦 Amazon's Raises Free Shipping Minimum. Amazon raises free shipping minimum to $35 for non-Prime members in select regions, nudging more towards Prime membership.

FREIGHT MEME OF THE DAY

The FreightCaviar Podcast: In our latest episode, Adam DeGroot shares the transformation of his family's legacy from humble farm stands to pioneering DeGroot Logistics, seamlessly integrating age-old produce wisdom with modern tech innovations.

Adam highlights the essential role of cultivating carrier relationships and the frequent challenges they face, like product rejections. Moreover, he introduces FreightSOS, DeGroot Logistics' innovative platform designed to address these common industry setbacks. Listen to this week’s podcast on Spotify & Apple Podcasts.

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).