🎣 From Speed Limiters to Stolen Loads: The Week in Freight

Happy 4th of July Week: Here's a round-up of the most engaging and talked-about freight content from around the web and from us.

Arrive Logistics provides a March Update to its 2024 Forecast: Prepare for continued loose market conditions with regional volatility as produce season approaches.

Arrive Logistics has released its March 2024 Freight Market Update, and we're breaking down the report for you.

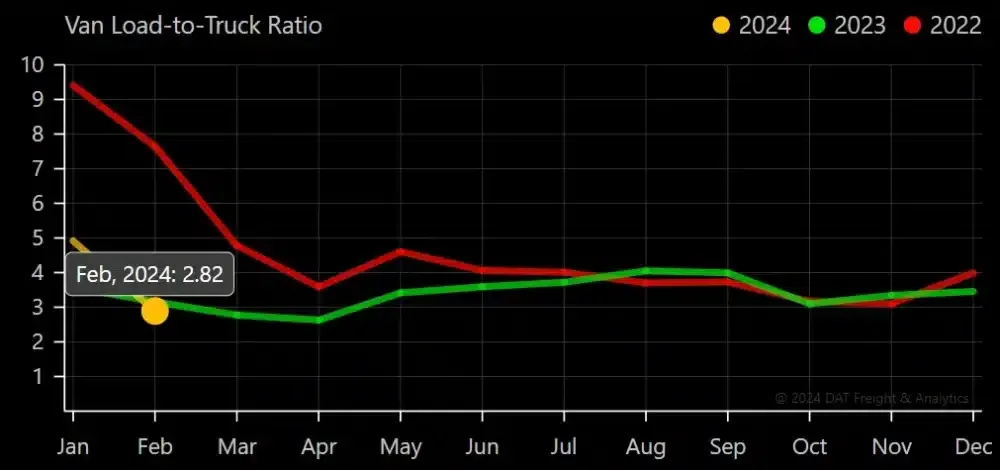

Spot load postings in February dropped 28% from January and were down nearly 12% YoY. Yet, this is an improvement over the 36% year-over-year plunge in January.

Moderating Exit Rates: There has been a slowdown in the rate at which carriers are leaving the market, coupled with an uptick in new entrants.

With dry van tender rejections dipping below 4%, there's a hint a steadiness. Reefer tender rejection rates are just below 5%, slightly higher YoY.

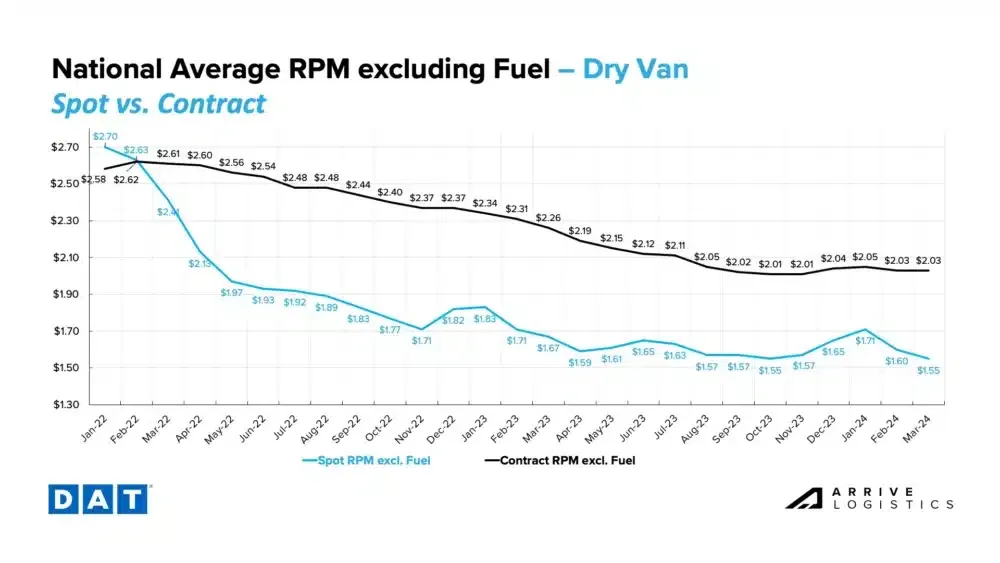

Spot Rates Take a Dip: Across the board, we're seeing a downward trend, with dry van spot rates hitting $1.55 per mile, a nod to the cycle lows observed in October 2023. Reefer rates aren't faring much better, with a notable slide to $1.84 per mile in March, marking a 12% decline from January.

Contract Rates Hold Steady: Despite the fluctuations in spot rates, contract rates have remained relatively stable. For dry vans, rates are at $2.03 per mile, while reefer rates have experienced a slight adjustment, now sitting at $2.60 per mile excluding fuel.

The spot-to-contract rate spread widening by $0.05 to $0.48 per mile

What’s Next?

The balance between supply and demand suggest a market headed toward stablization. With diesel prices steadying and the spot-to-contract rate spread offering insights, all roads lead to cautious optimism.

Our forecast still calls for loose market conditions to continue with periods of regional volatility as the produce season kicks off.

Source: Arrive Logistics

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).