🎣 C.H. Robinson

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

Good Wednesday Morning. Today, we're covering the tragic collapse of Baltimore's Francis Scott Key Bridge and its ripple effect across the supply chain. Also, FreightCaviar is taking on Berlin, February numbers are in for key ports, and a California trucking company filed for bankruptcy.

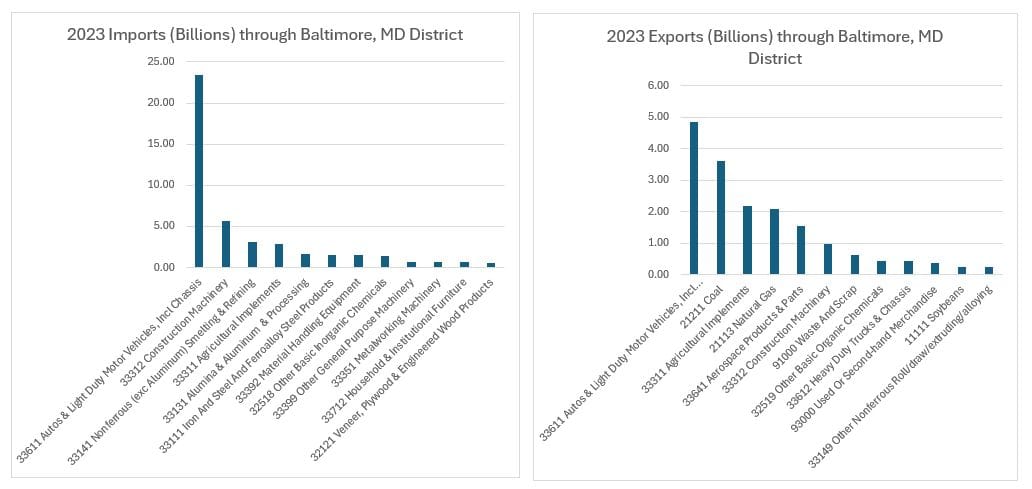

🤔 Question of the Day: In 2023, the Port of Baltimore handled $___ billion worth of imports. Scroll to the main story to find out.

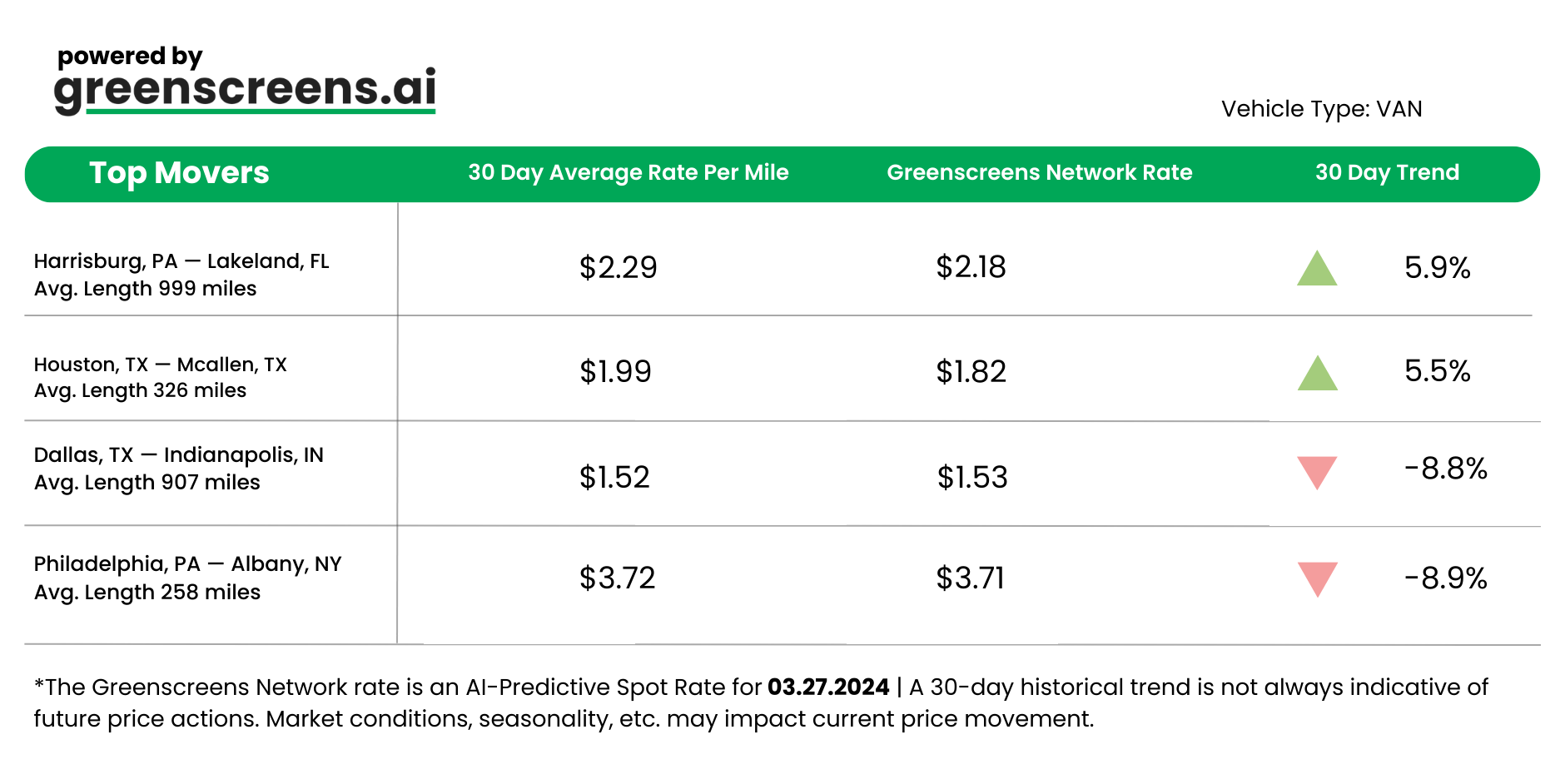

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

*Greenscreens.ai, forecasts real-time truckload buy prices that are suited to each freight brokerage's purchasing power using AI and machine learning. Its engine takes into account over 130 attributes and data points in each rate forecast.

🐔 WHAT’S COOKIN’ IN FREIGHT

🇩🇪 Berlin, Germany: A Freight Tech Hub? We are writing today's newsletter from Berlin, Germany. Yesterday, we arrived in the city to visit the latest freight tech company (& FreightCaviar sponsor), Levity.ai. We had the privilege of interviewing Levity.ai's co-founders for an episode of The FreightCaviar Podcast, diving into how Levity.ai helps you maintain a clean inbox while responding to quotes, tracking updates, and other tasks in record time. On top of that, we learned of a couple of other freight tech startups in Berlin. Find out which freight tech companies are operating from the "Silicon Valley" of the EU here.

🚢 Ports Post Positive February Figures. February brought on a flow of freight within the San Pedro Bay Port Complex and the Port of Houston. Los Angeles and Long Beach boasted a 60% and 24.1% spike in TEUs, respectively, while Port Houston wasn't far behind, with general cargo imports up by 49%. The is likely linked to improved labor relations and recent infrastructure investments. For context, solid economic indicators mean the ports are poised for an even more promising Q2.

🚚 Drayage Company Dries Up. Central California Cartage (CCC), a drayage company out of Goshen, CA, has filed for Chapter 7 bankruptcy. Founded in 2019, the company shut down operations in November 2023, post-authority revocation by the FMCSA. With assets barely touching $50,000 against a $1-10 million in liabilities, the company's revenues dropped from $9.6 million revenues in 2022 to nearly half that in 2023. Ryder is listed as a creditor, with CCC owing them over $2.5 million.

TOGETHER WITH TRUCKER TOOLS

Catch Trucker Tools at TIA Capital Events

The Trucker Tools team is heading to TIA Capital Events from April 10th to April 13th. We'd love the opportunity to connect - here’s where to catch us:

CTA: Grab a Drink With Us

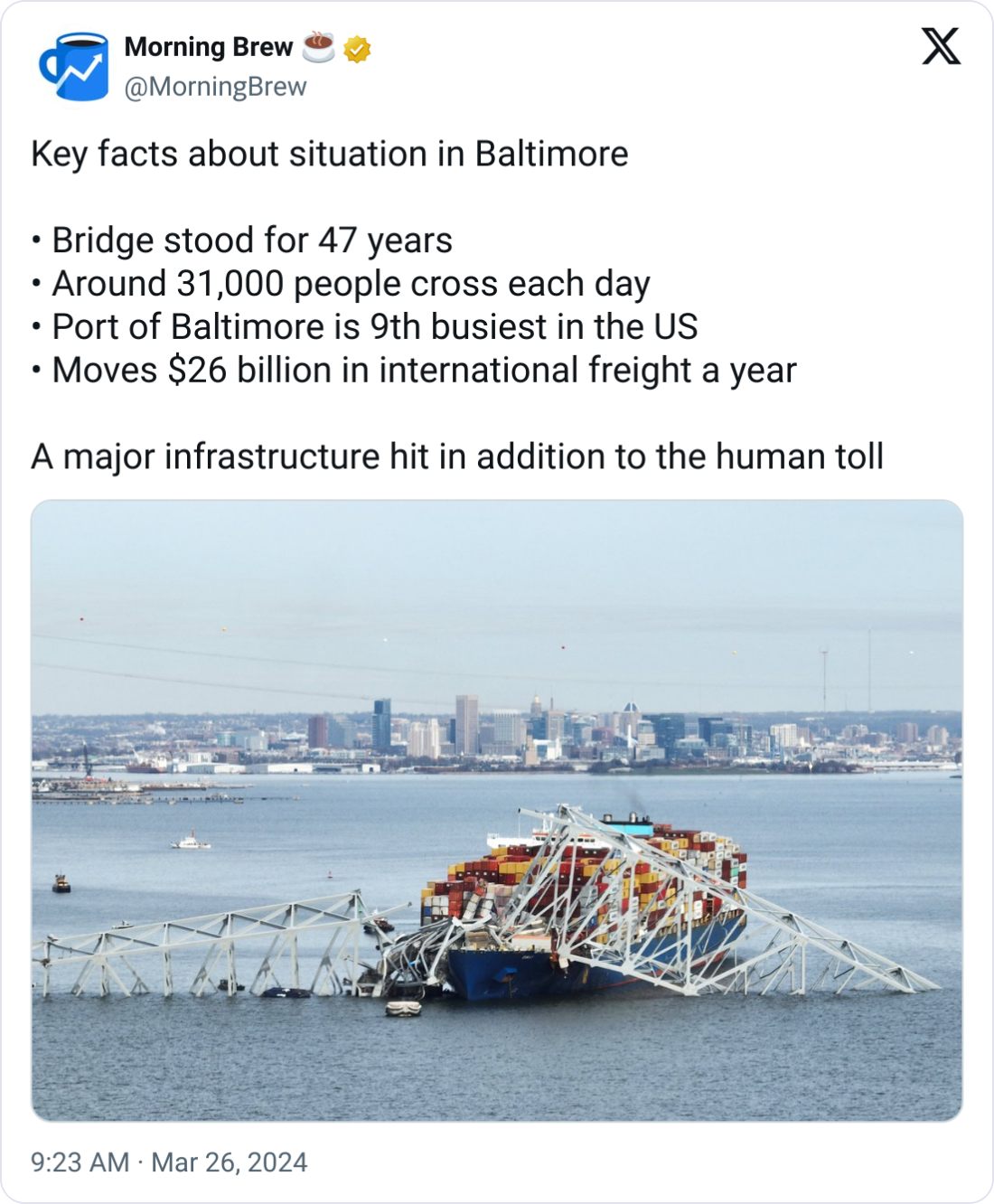

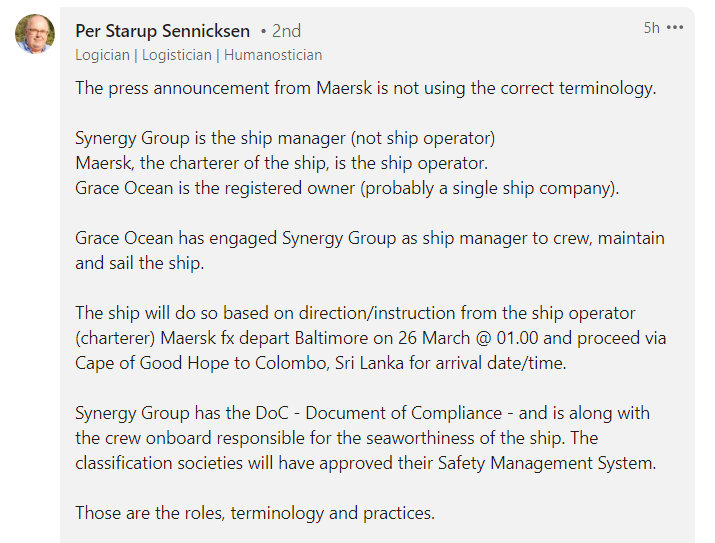

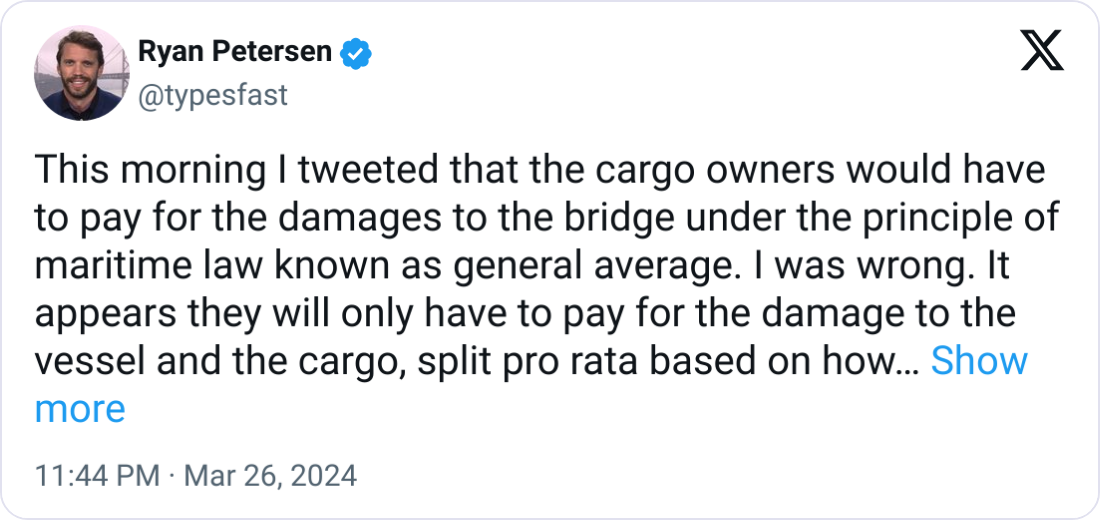

Early on March 26, the Francis Scott Key Bridge, a critical part of Baltimore's infrastructure, suffered a catastrophic collapse following a collision with the container vessel Dali. Eight road repair workers fell from the bridge into the water. As of the latest report, two workers were rescued, and six are still missing and presumed deceased.

Additionally, this incident has halted all vessel traffic in and out of the Port of Baltimore. Here's what you need to know.

Sources: Washington Post | The Wall Street Journal | NBC

TOGETHER WITH LEVITY

Levity helps fast-moving 3PLs and freight brokers to do more with less by automating the most time-consuming and repetitive email tasks.

Whether it is spot quoting, load building or answering track and trace requests. Levity connects to your inbox, TMS and other tools like rating engines, extracting the right information no matter the language or format. It performs tasks on your behalf automatically in the background so you can save time and focus on building shipper relationships instead of data entry. Learn more on Levity.ai today.

AROUND THE FREIGHT WEB

🍩 The Partnership We Didn't Know We Needed. McDonald's & Krispy Kreme are teaming up. What does this story have to do with freight, you might ask? Well, when you think about it, everything revolves around freight & logistics.

🚫 End to MC Numbers. The FMCSA announces plans to overhaul its registration system, phasing out MC numbers for USDOT numbers only to combat fraud and improve operations.

🎥 TIA 2024 Media Day Lineup. TIA announces the lineup for its inaugural Media Day at the 2024 Capital Ideas Conference, spotlighting logistics industry innovators.

🚚 Yellow vs. Teamsters. A Kansas court has dismissed Yellow Corp.'s $137M lawsuit against the Teamsters for not following grievance procedures. This development could signal important implications for freight contract negotiations.

🎣 FREIGHT CAVIAR TECHNOLOGIES

FreightCaviar Technologies is launching a shipper database & CRM for freight brokers called ShipperCRM. We've been relatively quiet about the project since October 2022, but are now ready to share with you something truly special.

Join us on April 9th as we unveil ShipperCRM 2.0. Head over to ShipperCRM.com to learn more.

FREIGHT MEME OF THE DAY

Also, check out:

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).