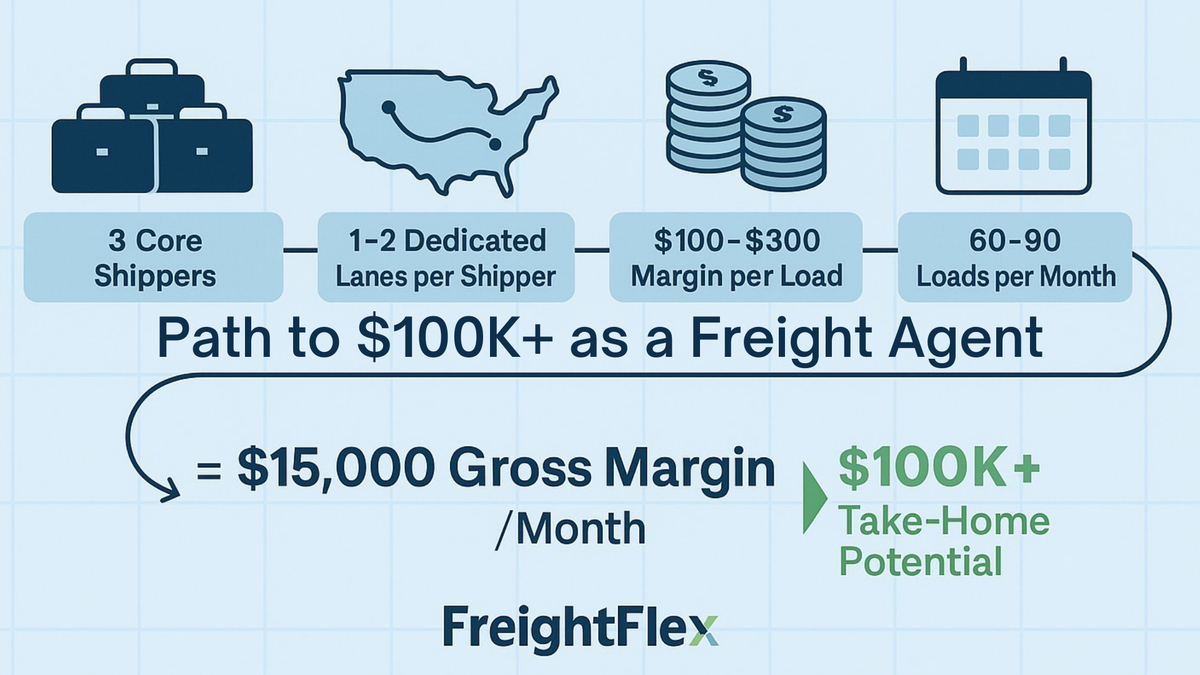

Before You Ask About the Freight Broker Agent - Agency Split

A high commission split means nothing without stability. Learn how credit exposure, factoring risk, and financial discipline impact freight agent income and why the right agency foundation matters most.