The Tab Count Is Killing Brokerage Margins

A practical look at how freight AI is evolving from simple automation to operational decision support, and what it means for broker productivity, tribal knowledge capture, and more.

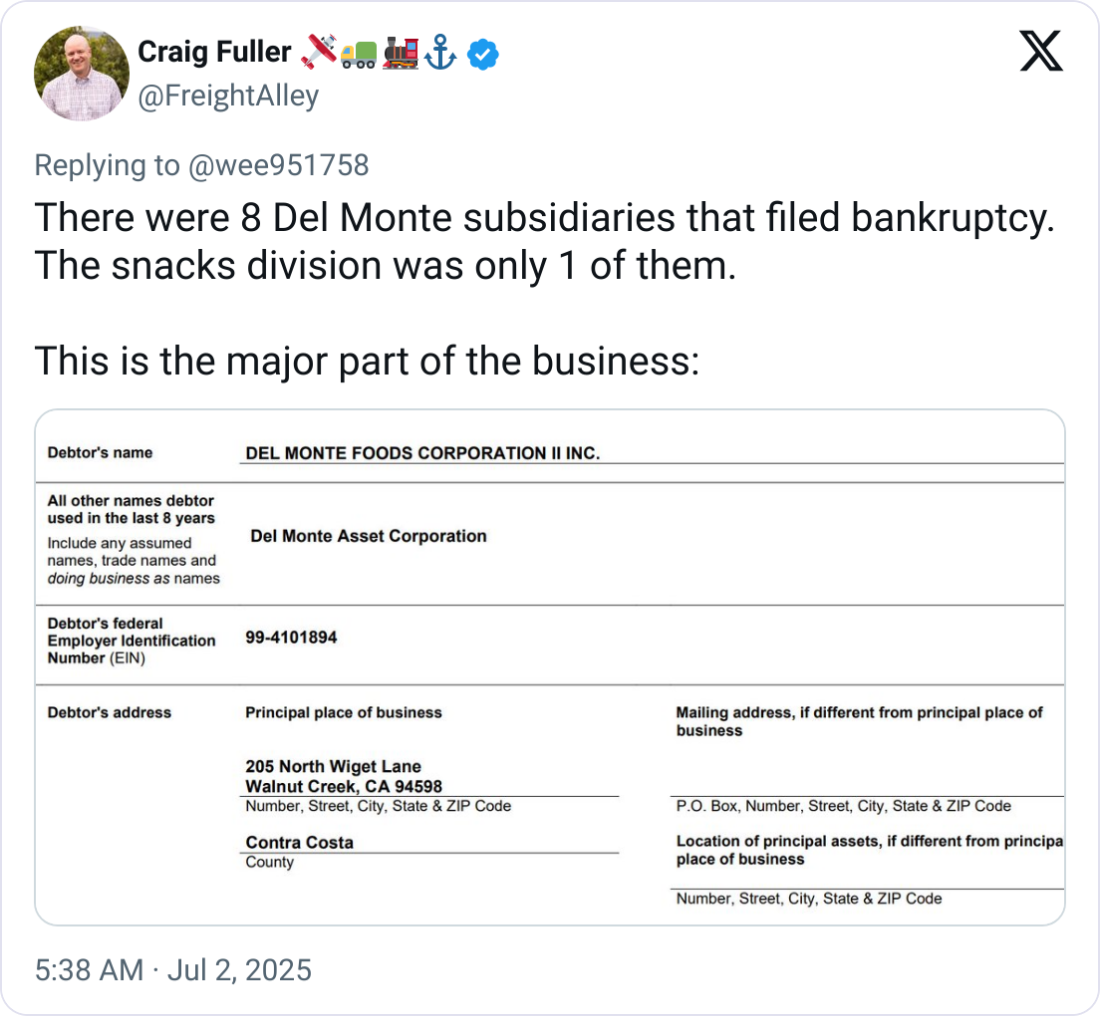

Del Monte’s bankruptcy exposes logistics firms like Uber Freight to major losses

Del Monte Foods Inc., U.S., has filed for Chapter 11 bankruptcy protection, citing over $1 billion in liabilities. The filing, made in the U.S. District Court of New Jersey, lists more than 10,000 creditors and marks one of the largest food shipper bankruptcies in recent years.

Among the companies affected is Uber Freight, listed under its acquired entity Transplace, which is owed over $9 million in unpaid transportation and brokerage services—making it Del Monte’s second-largest unsecured creditor. Other impacted logistics firms include:

These claims are unsecured, placing them lower in repayment priority behind lenders and administrative claims. In many Chapter 11 cases, unsecured creditors recover only a fraction of what they’re owed, if anything.

Del Monte Foods reported $1.7 billion in U.S. revenue in fiscal year 2024. Its brands, including Del Monte canned goods, Contadina tomato products, and College Inn broths are distributed through major grocery, retail, and club channels nationwide. That reach means its transportation and warehousing contracts are deeply integrated into supply chains across North America.

To maintain operations through bankruptcy, Del Monte secured $912.5 million in debtor-in-possession (DIP) financing from JPMorgan Chase and Wilmington Savings Fund Society. The financing supports continued business activity while the company pursues restructuring or a potential sale.

According to court documents, the board has authorized the sale of “all or substantially all” assets. This opens the possibility that logistics contracts could be assumed, renegotiated, or canceled, depending on buyers’ strategic plans.

“Pre-petition balances remain at risk, but post-filing services may qualify for administrative priority if approved by the court and funded under the DIP budget.”

While the bankruptcy casts uncertainty over unpaid invoices, logistics providers are still needed to keep Del Monte’s operations running. Transportation, warehousing, and pallet vendors may continue services under court-supervised contracts, though typically under stricter terms.

Source: FreightWaves

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).