🎣 Elk Grove Village Fraud

Plus, Arrive Logstics Q3 freight rates forecast, and a key highway pass collapse.

Happy National Iced Tea Day. Today, the infamous Elk Grove Village, Illinois, is in the spotlight. A local resident has been charged with cargo theft and fraud, resulting in the theft of approximately $9.5 million worth of goods. Read more about the story below.

🤔 Question of the Day: Class 8 semi truck orders are up __% year-over-year. Find the answer in today's main story.

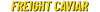

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

*Greenscreens.ai, forecasts real-time truckload buy prices that are suited to each freight brokerage's purchasing power using AI and machine learning. Its engine takes into account over 130 attributes and data points in each rate forecast.

🐔 WHAT’S COOKIN’ IN FREIGHT

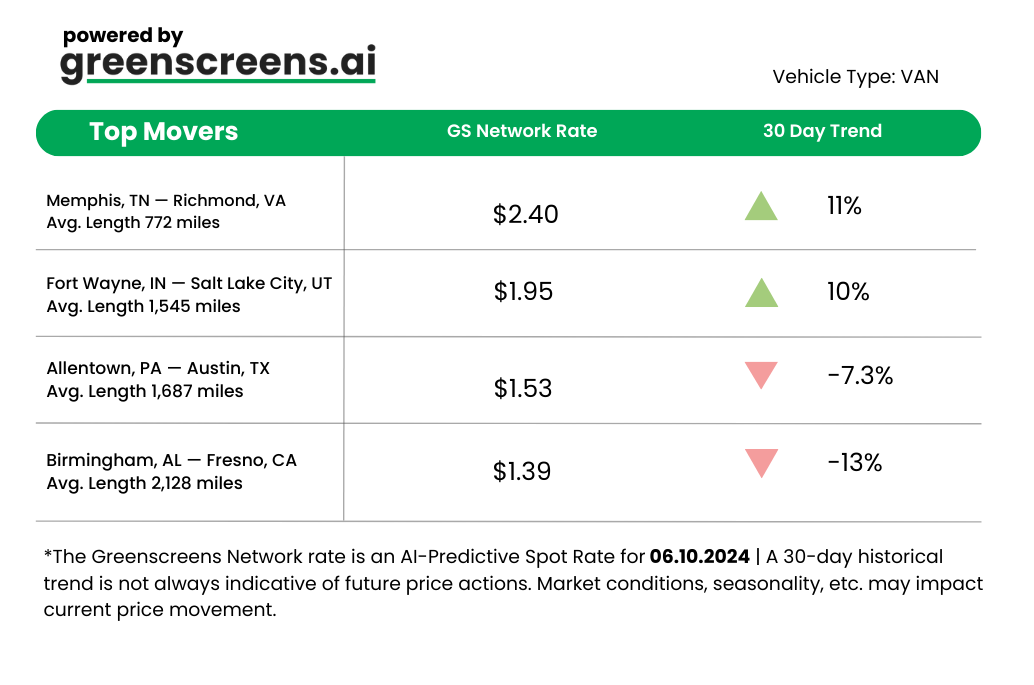

🚨 Elk Grove Village Man Nabbed for $9.5 Million Cargo Theft. Aivaras Zigmantas, a Lithuanian national from Elk Grove Village, is charged with wire fraud, theft of interstate shipments, and bank fraud. Between March 2020 and September 2023, Zigmantas used multiple aliases and created fictitious carrier and broker companies to fraudulently obtain shipments of goods across state lines, ultimately stealing over $9.5 million worth of goods. Fake entities included names like Best Global Express, Mato Trans, and Total Freight Broker. He also engaged in a bank fraud scheme from August 2017 to April 2018, using fraudulent identities to inflate bank account balances and withdraw funds, causing a loss of approximately $86,623 to financial institutions. Zigmantas faces significant forfeiture and legal penalties upon conviction.

🧐 Key Insights from the 2024 3PL Study. Penske, Penn State, and NTT Data's 2024 Third-Party Logistics Study offers a ton of strategic insights. Here are some great ones: 84% of shippers and 97% of 3PLs advocate for long-term agreements, indicating a trend towards stable, collaborative relationships. 92% of shippers and 96% of 3PLs prioritize collaboration and information sharing, stressing the need for advanced IT capabilities. Meanwhile, regionalization is in – 63% of shippers are open to working with smaller, specialized 3PLs, presenting new opportunities.

🚢 Container Rates Are High. Container rates are hitting new highs, causing major disruptions and anxiety among shippers. The SCFI (Shanghai Containerized Freight Index) is up to its highest level since August 2022, and nearly 70% of long-term ocean contracts are facing renegotiations or rollovers. FreightWaves CEO Craig Fuller predicts a recovery in trucking for 2H 2024, with tender rejections in LA at two-year highs. Meanwhile, other experts hint at a short-term boost due to anticipation of potential tariffs and port strikes.

TOGETHER WITH LEVITY

Levity helps fast-moving 3PLs and freight brokers to do more with less by automating the most time-consuming and repetitive email tasks.

Whether it's spot quoting, load building, or answering track-and-trace requests, Levity connects to your inbox, TMS and other tools like rating engines, extracting the right information no matter the language or format. It performs tasks on your behalf automatically in the background so you can save time and focus on building shipper relationships instead of data entry. Learn more on Levity.ai today.

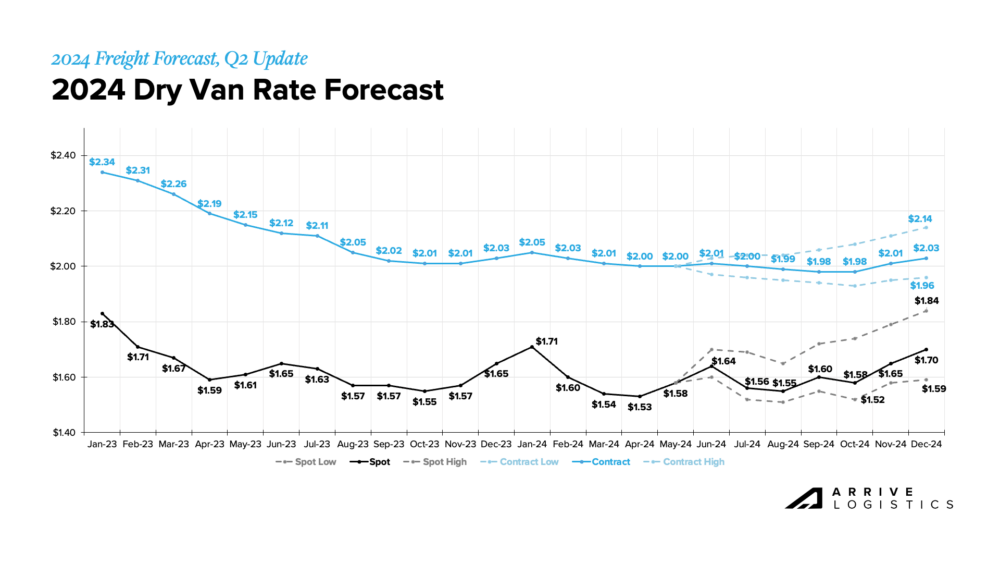

Truckload Freight Rates Forecast Q2 Update: Stability or Disruption?

Arrive Logistics recently dropped its Truckload Freight Rates Forecast Q2 2024 Update, and it's packed with insights. Here's what you need to know:

Key Takeaways from Arrive Logistics

- Spot Rates: Expect stability with typical seasonal ups and downs.

- Contract Rates: Slower normalization, hitting a floor by late Q3 or early Q4.

- Rate Gap: The gap between spot and contract rates will narrow, increasing market vulnerability.

- Capacity Issues: Pressure on asset carriers to provide lower rates may lead to shutdowns.

- Rate Peaks: Van spot rates peak at 5% YoY growth in Q4; reefer spot rates match YoY highs in Q4.

Demand and Supply Insights

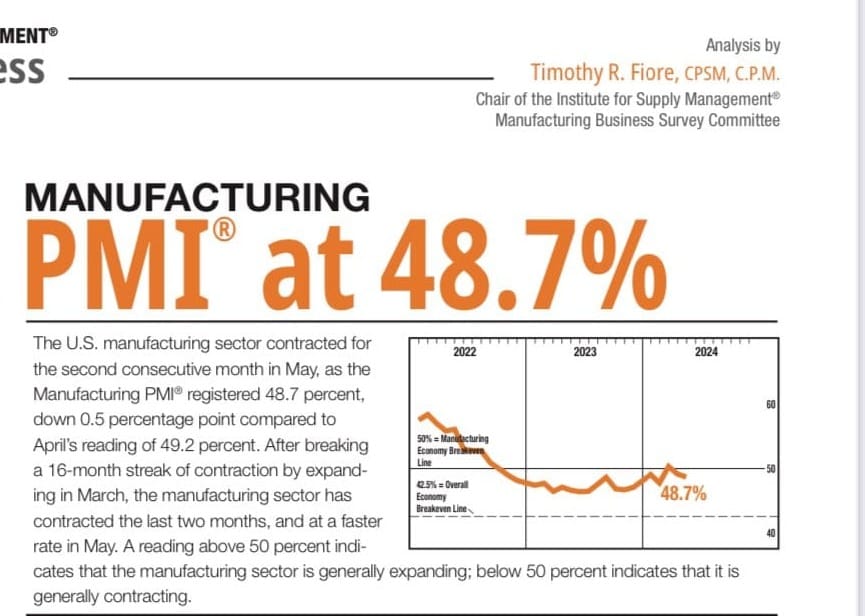

Demand faces risk due to reduced manufacturing activity. Get deeper insights here.

- Demand: Stable but at risk due to potential economic slowdown and reduced manufacturing activity.

- Supply: Market remains oversupplied, preventing major corrections.

- Capacity: Sufficient for current demand; reefer equipment more vulnerable to seasonal surges.

Risks and Considerations

- Global Tensions: Wars in Europe and the Middle East, and China-Taiwan tensions could impact trade.

- Economic Conditions: Inflation and interest rates might worsen trucking demand.

- Weather: Severe weather and hurricanes could disrupt the market.

- Carrier Profitability: Spot rates below operating costs may lead to market exits.

- Fuel Volatility: Rapid changes in fuel prices could impact forecast accuracy.

Latest Industry Insights

Intermodal Savings Index: Spot truckload rates up; domestic intermodal rates down.

Ari Ashe, Senior Editor at the Journal of Commerce, notes, "The May uptick in spot truckload rates combined with more reductions in spot domestic intermodal rates will generate the highest Intermodal Savings Index (Spot Market) since January 2022."

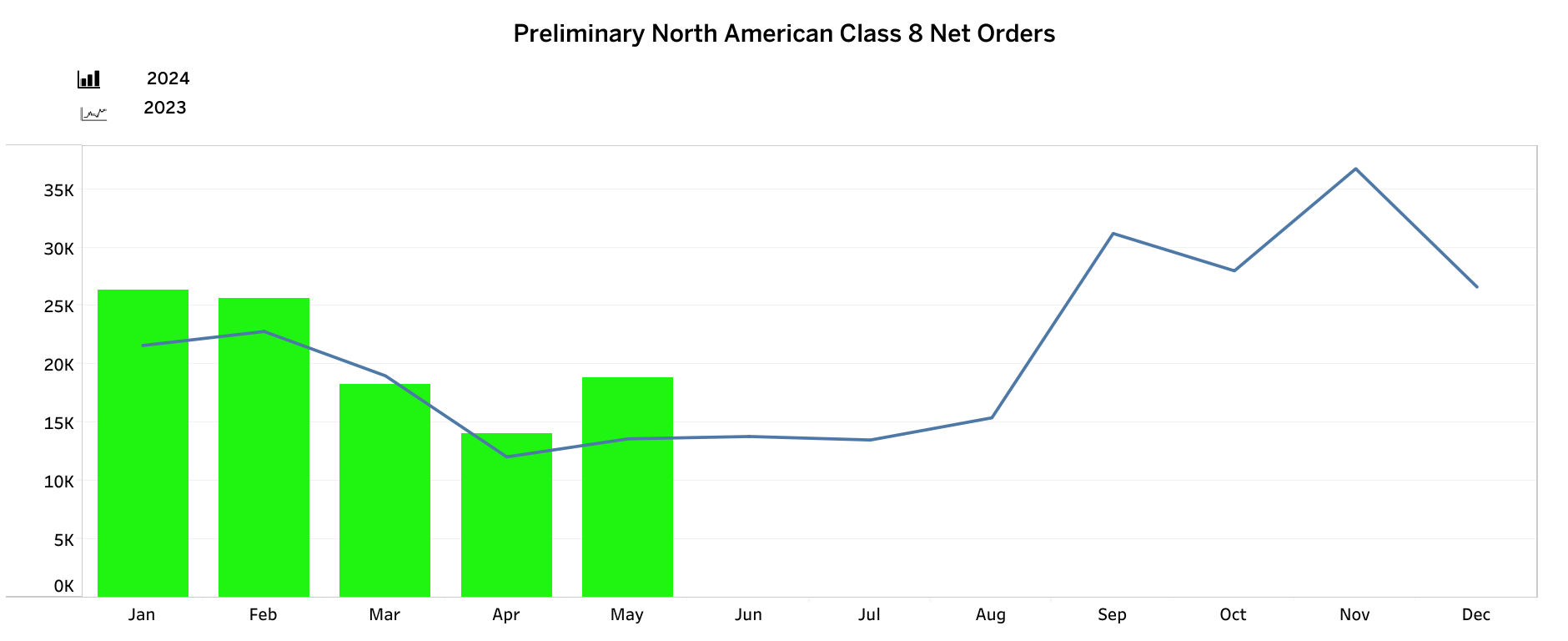

Class 8 Orders: May saw 18,900 units, up 25% MoM and 37% YoY. A healthy sign signaling trucking companies are increasingly buying new equipment.

Dan Moyer, Senior Analyst at FTR, says, "OEMs (original equipment manufacturers) are actively filling build slots at a steady pace. Along with the month-over-month increase, the fact that orders were up significantly from the May 2023 level indicates that the market remains on a solid footing despite near-term challenges."

Summer Shipping: Outbound tender volumes surged 7.1%, keeping spot rates elevated.

Truck Transportation Jobs: May jobs dipped by 5,400, reflecting pressure on asset carriers.

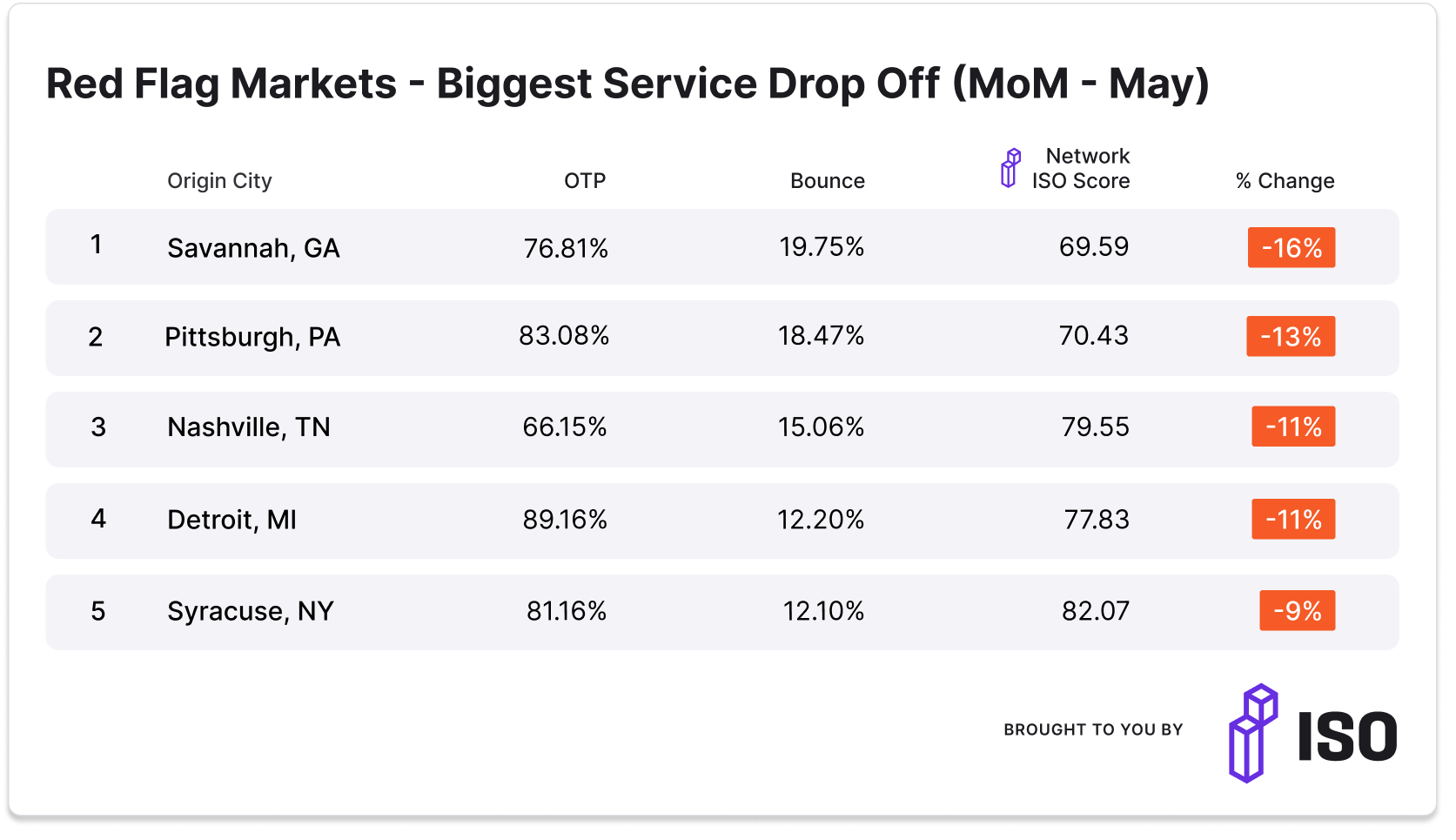

TOGETHER WITH ISO

Unpredictable service erodes margins. ISO gives brokers access to a network of thoroughly vetted, high-performing carriers, complete with historical performance data for lanes, consignees, facilities and more. Book a demo now.

🌎 AROUND THE FREIGHT WEB

🛣️ Teton Pass Collapse. A major section of Wyoming’s Teton Pass collapses, threatening a critical route for truck drivers.

🚛 Semi Burned Down. A video sent in by one of our followers shows a semi completely burned to the ground on I-75 in Pembroke Pines, Florida.

🚢 Baltimore Port Update. Following the collapse of Baltimore’s bridge, significant shifts in port traffic have been observed, with impacts visible at Newark and Virginia ports. Plus, the bridge's channel could be fully reopened as early as this weekend.

🚚 Digital Freight. Kristopher Glotzbach critiques digital freight matching providers, advocating for real-time network adjustments and strategic relationships over rate subsidization.

💼 Corporate Misstep. Forward Air’s board faces criticism for decisions that drastically reduced shareholder value, questioning the benefits of the Omni Logistics acquisition.

🌱 Sustainable Paper Transport. Paper Transport marks a milestone of 70 million miles using alternative fuels, emphasizing the environmental and operational benefits of RNG/CNG.

🎣 THE FREIGHT CAVIAR PODCAST

In this week’s episode, we sat down with Andrey Drotenko, President of Strategic Relations at Verified Carrier, a vetting platform. Andrey goes behind the scenes of fraud detection. He explains the role of Verified Carrier in preventing fraud, how scammers manipulate current systems, emphasizes the importance of inspections for freight brokers.

Listen on Apple Podcasts, Spotify, or YouTube.

FREIGHT MEME OF THE DAY

Also, check out:

- 🎧 The FreightCaviar Podcast. Listen to this week's podcast on Spotify & Apple Podcasts.

- Want to get your brand noticed by freight brokers? FreightCaviar can help. Work with us to get your services featured in our newsletter, podcast, and more. Plus, we write great articles about what you do. Get in touch with Paul at pbj@freightcaviar.com to learn more.